What makes employee retention so buzzworthy?

Millennials are known for many things – their love of avocado toast, an inability to read a paper map, and, albeit stereotypically, job-hopping. Millennials [those born between 1981 – 1996 as defined by The Pew Research Center] already make up the largest segment in the workforce, and it’s anticipated this buzzworthy generation will account for 50% of U.S. employees in the next two years according to a 2018 Dynamic Force report. While some praise millennials for their innovative thinking and passion, others label them as privileged and unable to commit to an employer – a point of anxiety for any HR manager. With millennials at the forefront of many workplace trends and hiring decisions, the subject of employee retention and stability is a hot topic in today’s workplace.

In the [active] asset management industry, one would argue that stability is a characteristic of even greater importance. With all of the modern tools and quantitative models in the industry, the people who comprise an organization truly differentiates it. Individuals with years of niche industry expertise are able to utilize any reporting software or data-driven capabilities to their greatest potential.

Additionally, a consistent portfolio management team is able to learn the intricacies of a client’s business – their strengths, weaknesses, risk-appetite, state regulations, etc. With this knowledge, the portfolio management team is able to create a customized portfolio and best manage a client’s money in order to assist them in achieving their company-specific goals.

Investment managers should care about more than returns

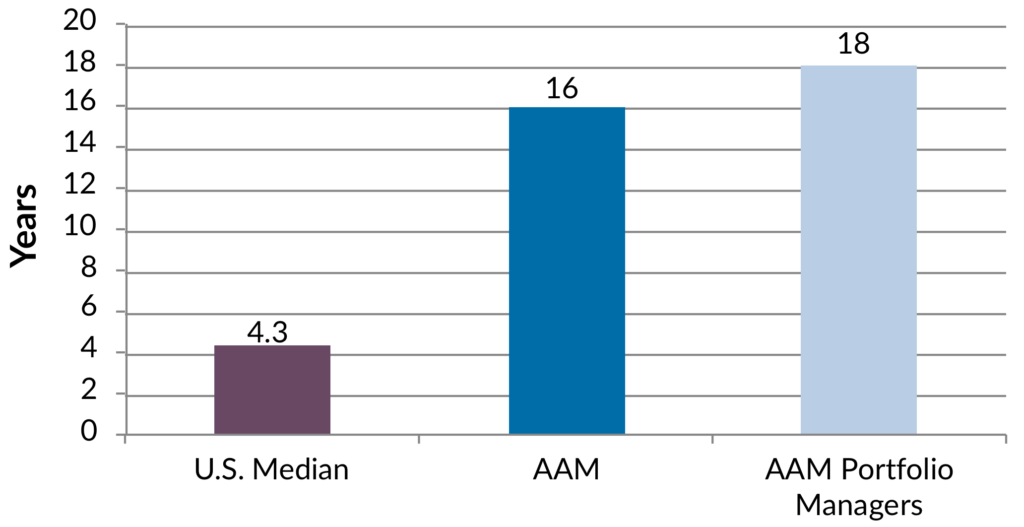

When discussing manager success, standard measures include statistics such as returns. However, as a key determinant of asset manager health and therefore client outcomes, stability needs to be included in the discussion. In January 2018, median employee tenure as stated by the U.S. Bureau of Labor Statistics was 4.3 years. Comparatively, AAM’s median investment professional tenure is an impressive 16 years, with AAM portfolio managers specifically boasting an 18 year median tenure.

Exhibit 1: Employee Tenure

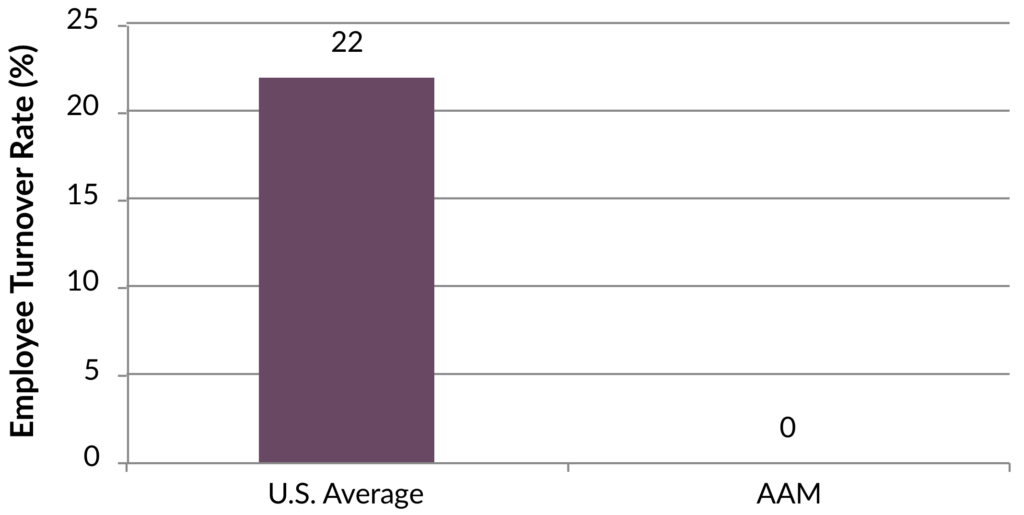

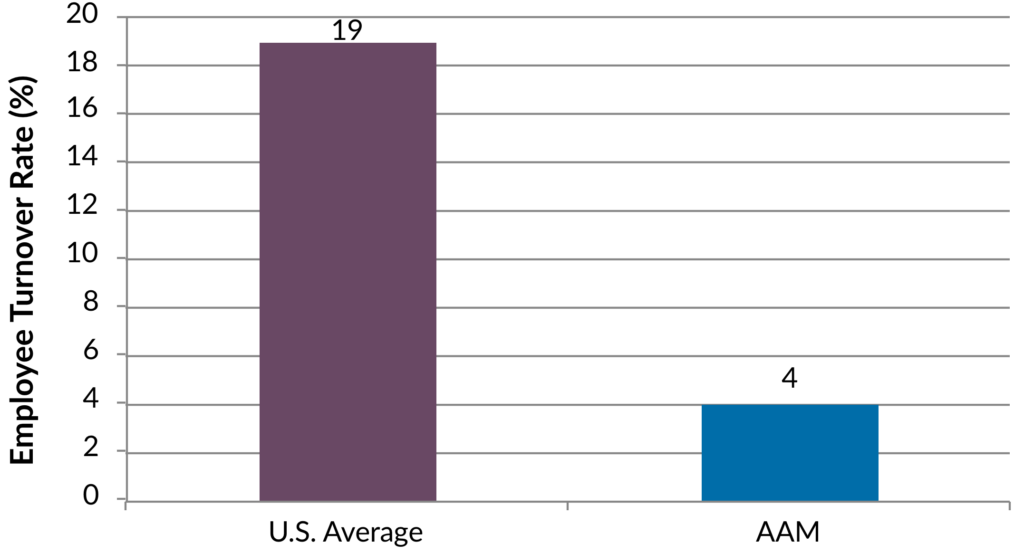

According to an article on North American employee turnover by Mercer LLC, the average turnover rate was 22% for 2018. It should be noted that this number accounts for total separations, including voluntary turnover, involuntary turnover, and retirement. By the same criteria, AAM’s turnover rate for investment professionals was 0% last year. Expanded to the range of 2015 – 2018, the turnover rate increased to a mere 4%.

Exhibit 2: Turnover Rate (2018)

Exhibit 3: Turnover Rate: (2015 – 2018)

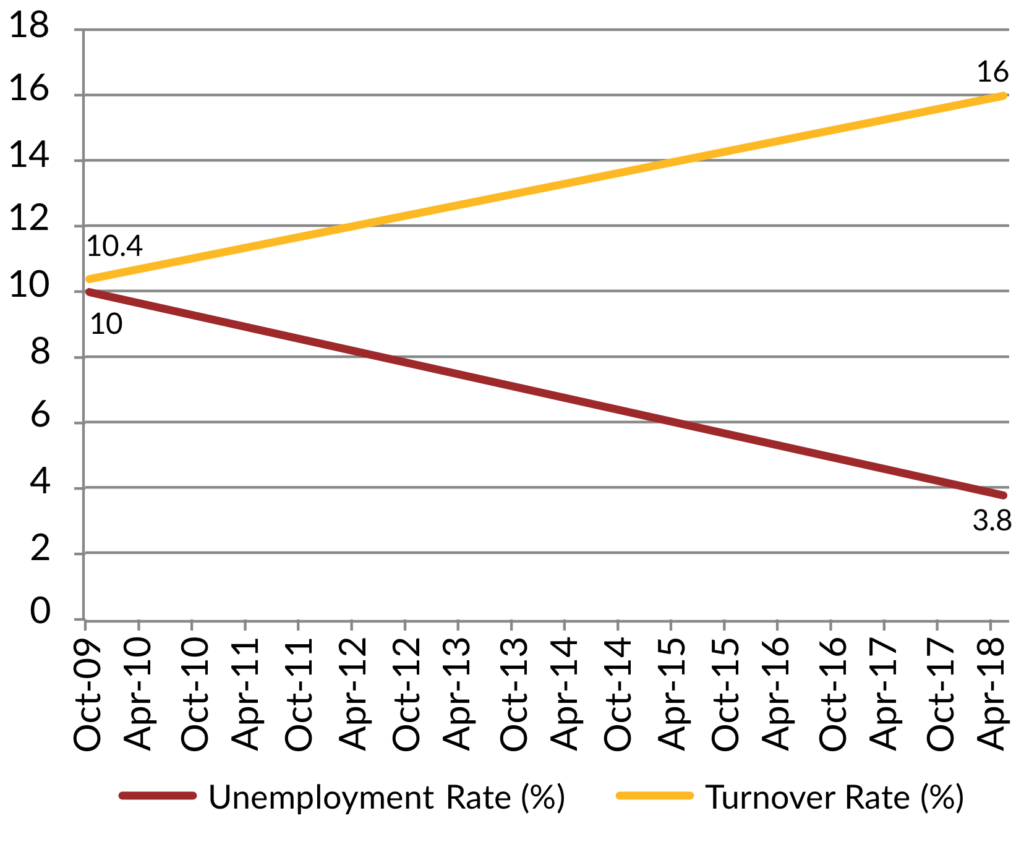

The high annual turnover rate last year is part of an overall trend – employee retention has been getting increasingly more difficult. While a number of causes can be attributed, according to a 2018 article from Decision Wise, primary reasons include the strong economy, a changing workforce, technology, and side incomes that for many have turned into full-time gigs. The most tangible example of these four reasons is the strength of the U.S. economy.

The relationship between unemployment and turnover

The past decade has seen a drastic turnaround for both employee retention and unemployment. As the U.S. Bureau of Labor Statistics reports, unemployment hit a whopping 10.0% in October 2009. Nearly a decade later, unemployment was reported at a steady 3.8% in May 2018, the lowest percentage the United States had seen since the 1960s. While the stock market crash of 2008 resulted in high turnover rates due to the inclusion of involuntary turnover, voluntary turnover rates dropped to 10.4% according to Compensation Force. Comparatively, as stated by the aforementioned Mercer article, voluntary turnover accounted for 16.0% of total separations in 2018.

Exhibit 4: Unemployment Rate vs. Turnover Rate (October 2009/May 2018)

The current employment climate has shifted the pressure from employees to employers. Combined with the previously discussed changing workforce and technology advances, many employers have been struggling to determine the most effective methods to retain employees.

The true cost of turnover

Off-the-shelf estimates are available, which might set the cost of an entry-level position turning over at 50 percent of salary; mid-level at 125 percent of salary; and senior executive over 200 percent of salary according to Forbes. While precise costs remain impossible to calculate, these numbers ought to be staggering to any manager or executive.

Making up these estimates is the obvious HR cost, the cost of training any new employees, and reduced new-employee productivity during their adjustment period. Additionally, other employees are unable to complete their standard responsibilities while training any new colleagues, not to mention the added tasks they may need to accomplish to an already set workload if there is a gap between a former employee departing and their replacement starting. It can be tempting to cut corners during this training period due to the hassle, stress, and cost, but if new employees are not properly transitioned, statistically they are more likely to leave sooner resulting in a vicious turnover cycle.

Stereotypically, millennials are attracted to companies with kegs in the breakroom and casual dress-codes – but studies and reports prove otherwise. While every employee desires fair and competitive compensation and culture fit certainly matters, things such as work-life balance, health and retirement benefits, and growth opportunities both through additional education and within the company are top priorities for today’s workforce for everyone from baby boomers to Gen-Zers. And in an environment where social issues have been integrated into every facet of life, diversity and environmental awareness should also remain on managers’ radars.

AAM understands insurance – and employee retention

AAM knows our strength begins with people that make up our organization, which is why we have built a culture of transparency, growth, and respect. With around 50 employees, we currently have 19 Principals who own approximately 30% of the equity of AAM. This ownership percentage has been virtually constant for over a decade. We are committed to expanding the number of owners while at the same time maintaining the performance and commitment requirements for becoming a Principal.

Growth at AAM stems from both internal advancement and education opportunities. Annual reviews focus on both employee performance and goals, and employee transfers between departments are a viable option should that fall in line with employee career aspirations. Most of AAM’s Portfolio Managers started as Assistant Portfolio Managers, allowing them to gain a deeper expertise of our process and philosophy as well as familiarity with clients. Additionally, education through CFA Charterholder designation as well as obtaining an MBA is encouraged at AAM. We currently employ 19 CFA Charterholders and 14 individuals who have earned MBAs, and we anticipate that number to increase in the near future.

Additional points of view and a diversity of experiences and backgrounds strengthen any organization, including AAM. Successful investing necessarily involves considering and evaluating differing ideas. By definition, some ideas are better than others and the evaluation of investment ideas is measured only with the benefit of hindsight. Our employees must be free to identify ideas and suggestions in an environment of mutual respect in order to keep the idea pipeline open and flowing freely.

In conclusion, stability matters, but, further than that, people matter. At AAM, we have held strong to this belief for years, resulting in numbers that showcase both high performance and high employee retention. We look forward to continued growth and excellent client service in the years to come.

Special thanks to Marketing and Business Development Analyst Sarah Bujold for contributions on this paper.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.