insight

A.M. Best Releases Draft of BCAR Reforms for P&C Insurer

March 17, 2016

A.M. Best recently released its long-awaited draft guidelines for the major reforms they are making to the Best’s Capital Adequacy Ratio. In this paper, AAM Insurance Strategist Pete Wirtala summarizes the biggest changes, and offers resources for those wanting a more detailed review. AAM will continue to monitor this project as it proceeds and provide periodic updates.

A.M. Best has recently been evaluating a suite of changes to their Best’s Capital Rating Methodology for insurers, most particularly affecting how the Best’s Capital Adequacy Ratio (“BCAR”) score will be calculated. It released presentations in April and October of 2015 outlining these changes and the reasons for making them. More recently on March 10, 2016 it released a draft document describing the new process entitled “Understanding Best’s Capital Adequacy Ratio For P&C insurers” for a comment period, and will shortly start sending rated companies sample calculations of it’s BCAR scores under the new system using 2014 data (Life/Health insurers should expect similar releases later in 2016). Key changes to the BCAR formulas include:

- While BCAR has historically been calculated as Adjusted Surplus divided by Net Required Capital (i.e., the estimated capital required to support the company’s risk profile), the new proposed calculation takes the difference between Available Capital and Net Required Capital, and divides the result by Available Capital. This simplifies the interpretation of the score, as a score above zero indicates a surplus of available capital over the calculated requirement, while a negative score suggests a deficit.

- In addition to the seven factors traditionally used to calculate Net Required Capital for P&C insurers, an eighth factor for Catastrophe Risk has been added. This factor is not included in the covariance adjustment (which has also undergone some changes), reflecting Best’s view that an insurer must be able to absorb catastrophe losses independently of all other risks they face.

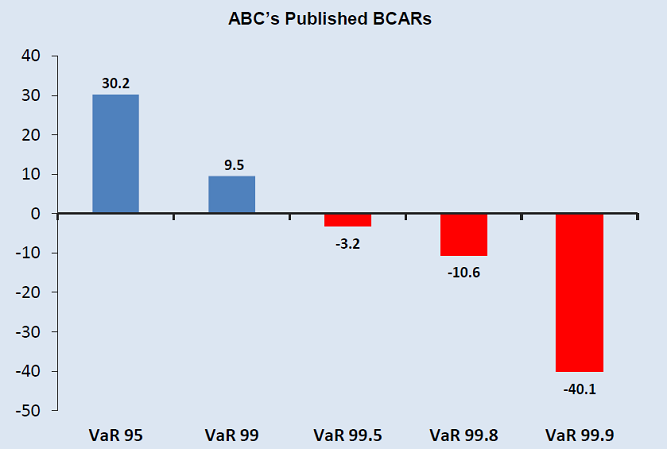

- Companies will no longer receive a single BCAR score, but rather a table of five scores representing five different statistical confidence intervals. Relatedly, a number of the specific risk factors will now use statistical modeling techniques to generate distributions of capital requirements rather than single point estimates. This will allow BCAR to illustrate tail risk exposure, and increase the utility and transparency of the analysis. The following graph was included in the latest materials to illustrate how scores could be presented going forward:

Source: A.M. Best’s Credit Rating Methodology (March 10, 2016)

- Given the above changes, overall BCAR scores will be significantly lower under the new system. This does not mean ratings will necessarily change (Best has announced that it “does not expect sweeping ratings changes” and that its “assumption is that current ratings are appropriate”). However, Best also plans to phase out their guidance regarding the relationship between BCAR scores and financial strength ratings; it previously published a graph with indicative scores for each rating, but have now decided that this is no longer appropriate given the numerous other factors outside the BCAR score that affect ratings decisions. In addition to balance sheet strength (of which BCAR is just one measure), Best also cite operating performance, business profile, enterprise risk management, and rating enhancement/drag from affiliated companies as other critical factors in assigning a rating.

The above is just a short overview of some of the largest changes being proposed. We encourage all P&C insurers to obtain the draft materials and review them closely, and to provide A.M. Best with their feedback and suggestions. All the materials mentioned above are available on the A.M. Best website www.ambest.com, or you can also contact AAM and we will forward them along. Additionally, A.M. Best is holding free webinars to review the draft materials on March 18, 2016 and on March 21, 2016 for all interested parties. Life and Health insurers may also be interested in reviewing the materials as a preview of the kinds of changes they can expect to see in their own BCAR calculations when that information is released later this year.

Written by:

Peter Wirtala, CFA

Insurance Strategist

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.