insight

AAM Corporate Credit View: April 2012

April 20, 2012

Is This Time Different?

After Strong Performance in the First Quarter, Corporate Bond Spreads are Widening in April Due to European and U.S. Growth Concerns

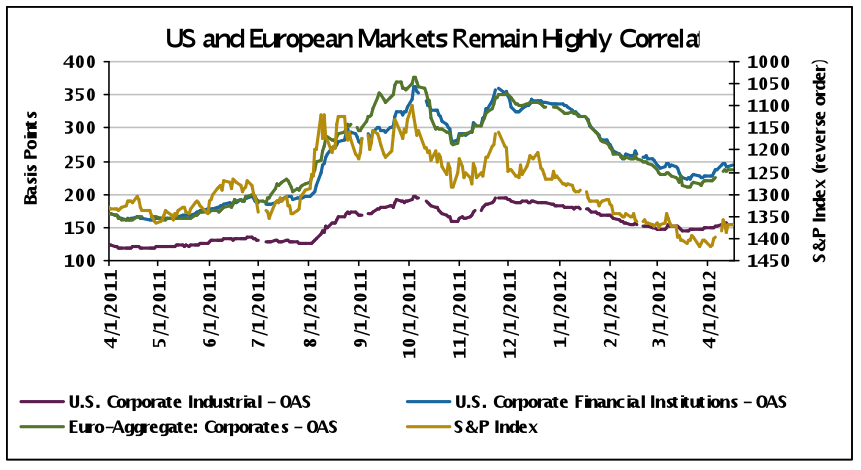

The Corporate bond market posted 34 basis points (bps) of positive excess returns vs. U.S. Treasuries in March, generated mainly by the Finance sector as well as short-to-intermediate Industrial and Utility credits. At month-end, Spain released its budget and shortly thereafter, the disappointing U.S. jobs data was released. Hence, spreads have widened this month, Finance and European credits bearing the brunt of the widening. As evidenced by the reaction from both the equity and bond markets, Europe remains on investors’ minds as well as the vigor of U.S. growth.

Exhibit 1

Source: AAM, Barclays Capital, Bloomberg as of 4/16/12

European Headlines Will Persist

We detailed the challenges Spain faces fiscally and politically in our recent white paper (“The Pain in Spain Falls Mainly on the…”). We believe that Spain will likely need to request formal support from the Troika sometime during 2012 or 2013 (and potentially much sooner). The increase in TARGET2 balances (bank borrowings from the Eurosystem) for Italy as well as Spain is also concerning. This, in addition to the debt issuance needs of Portugal in late summer or early fall 2012, Italy’s recent backsliding on its budget deficit, the French election, among others, are likely to keep spreads volatile in the near term. The consideration being given to direct capitalization of Spanish banks by the European Fiscal Stability Fund (EFSF) is encouraging. We have long believed that Europe needs its own form of TARP (Troubled Asset Relief Program).

The Micro Picture is More Favorable Albeit Tepid

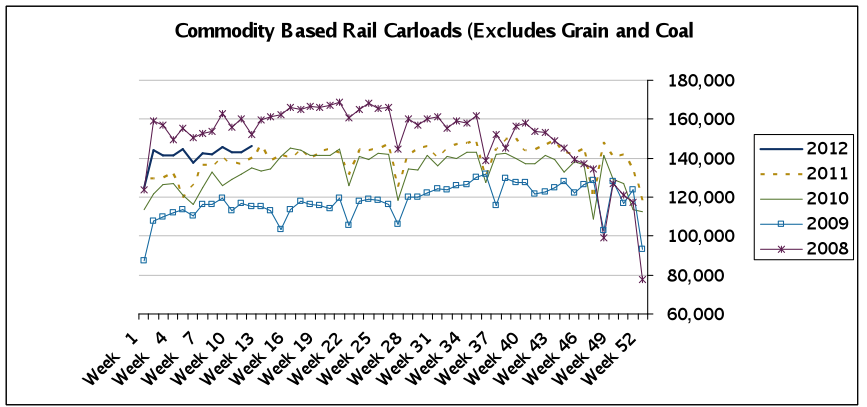

Earnings estimates for the first quarter of 2012 were revised down over the second half of 2011, and most companies are poised to beat in our opinion. Our credit and industry level cues point to a domestic economy that is on track for low single digit growth in 2012. The level and trend of commodity based railroad carloads is one example of improving economic activity (Exhibit 2) where carloads continue to trend above 2011 levels. Additionally, initial bank results have been modestly positive. Headline numbers were highlighted by strong capital markets results, but a deeper look shows modest loan growth to both companies and individuals, including strong mortgage lending results. Asset quality continued its improving trend and organic capital generation was also a positive highlight despite increased dividends and share buy-backs by most banks under coverage.

Exhibit 2

Source: AAM, Association of American Railroads

Source: AAM, Association of American Railroads

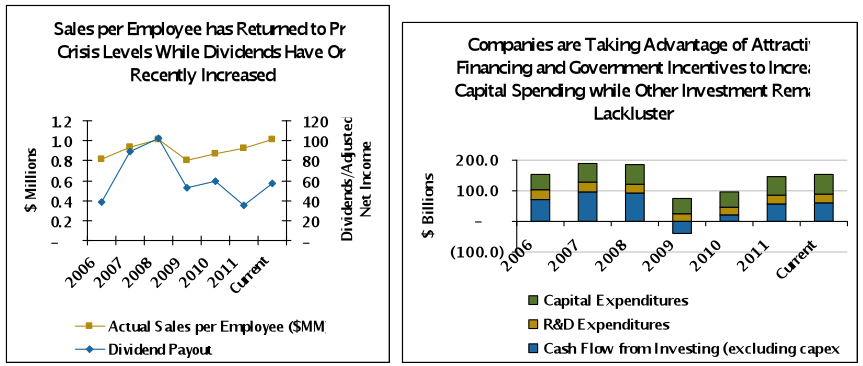

With profits recovering and cash coffers full, companies are increasing dividends and share repurchases. While this is not welcome from a bondholder perspective, it possibly does point to a turn in the cycle and increasing management confidence in the political and economic outlook domestically and abroad. We would have more confidence if we saw companies investing in their businesses by hiring, spending more on research and development (R&D) and/or making other investments. (Exhibit 3)

Exhibit 3

Source: AAM, Bloomberg (S&P 500 Index member data used)

Source: AAM, Bloomberg (S&P 500 Index member data used)

Invest Cautiously to Maximize Risk Adjusted Income

Our base case is that corporate market spread volatility will be high but not exceed the level in 2011 (Exhibit 4), since investors and companies have had time to contemplate and reposition, spreads have widened especially for sectors directly exposed to the crisis, company balance sheets remain strong, liquidity has improved with companies accessing the markets (high yield, investment grade, domestic and European) this quarter, and the U.S. 10-year Treasury yield is 141 basis points lower than one year ago or 1.95%.

Exhibit 4

Source: AAM, Barclays Capital – Change in Standard Deviation of OAS YTD 4/16/12 vs. 2011

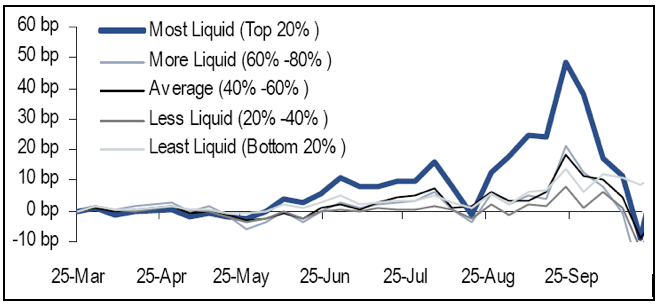

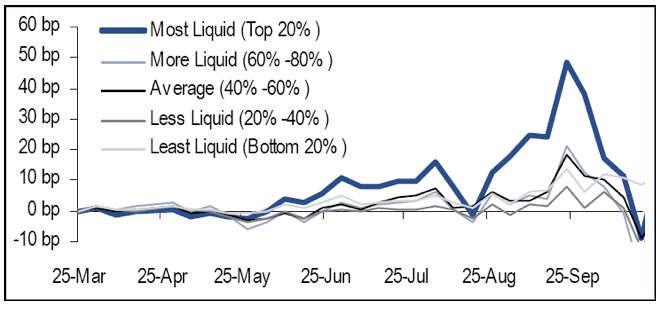

That said, we recognize all corporate bond spreads will widen dramatically if tail risk manifests itself. Regardless, portfolios must be managed to compensate investors for expected volatility. We entered the year positioned with bonds that we believed would be less volatile due to favorable structures, technicals, or fundamentals. As shown in Exhibit 5, technicals alone are significant drivers of volatility in this more illiquid market environment, which we believe is not changing in the near-to-intermediate term.

Exhibit 5: Liquidity Bucketed Non-Market HG Spread Moves

Source: Citi Investment Research and Analysis (CIRA, Bloomberg)

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.