insight

AAM Corporate Credit View: February 2010

February 4, 2010

Volatility re-emerged in January. It started strong with Corporate intermediate spreads tightening 10 basis points (bps) and long spreads 6 bps by January 11. On January 12, they reversed course and widened 5 bps and 18 bps respectively over the remaining days of January. This pressure on the long end caused the Corporate Index (Barclays) to post negative excess returns for January (-11 bps overall, +16 bps intermediate, -92 bps long). All three broad sectors (Finance, Industrials, Utilities) exhibited this type of performance (positive 1-7 years, negative 8+ years) and BBBs and AAAs outperformed AAs and As. The drivers were diverse: sovereign, political and economic.

Sovereign risk was front and center this month. China increased its reserve requirement for banks by 50 bps from 15.5% to 16%. The market viewed this as the Central Bank taking action to cool potential asset price inflation, namely in the property and equity markets. In short, we believe China’s structural changes bring organic growth opportunities, and view the largely symbolic action as supportive of that outlook.

The other sovereign issue was and remains in Europe, namely Portugal, Ireland, Greece and Spain, and the potential systemic effects they could have economically and technically given their fiscal issues. Regarding technicals in particular, one reason for concern is the correlation between the Sovereign and Corporate sectors of the Index. It has historically been high (0.92 over 10 years per the Barclays Index data), but has ranged from 0.24 to 0.98, which shows decoupling does take place. The European Commission recognizes the downside risks of letting countries like Greece fail, and while we acknowledge the risk of sovereign weakness over the longer term for market returns, we do not view that as a material driver of spreads in 2010. We do expect spreads to remain vulnerable to this news until uncertainties are addressed.

Second, President Obama’s speech regarding his support of the Volcker Rule disrupted the financial markets due to both the direct and indirect consequences of a more aggressive regulatory approach. The public’s outrage toward large banks increases the uncertainty regarding the reform of the financial system, and the possibility that the issue will become more political. We had believed that financial reform would decrease the risk in the system (good for creditors), but the shift in tone was worrisome from the standpoint that too much regulation can be harmful to economic growth, potentially slowing down the velocity of funds and destroying value. This risk continues to be front and center in our minds, but we are optimistic after time has passed since the President’s speech and the rhetoric has not increased but has been assuaged.

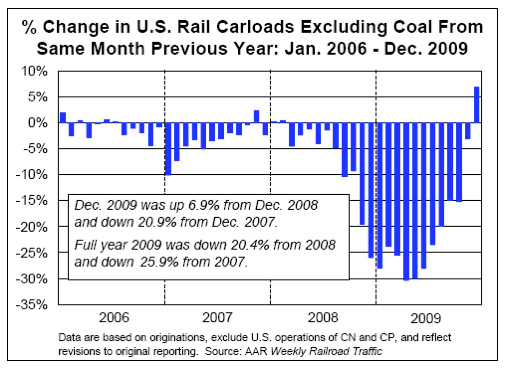

Lastly, fears emerged once again that the economy was not as strong as it seemed at the end of 2009. We have communicated our expectation for muted domestic GDP growth, which we believe is supportive for Corporate bonds. Our tracking of the data, including but not limited to: specific industry related data (see Exhibit 1) that serves as leading economic indicators, the improvement in 30 and 90 day delinquencies at the banks, the improvement in consumer confidence and spending, temporary hiring, not to mention the positive results this earnings season especially at the revenue level, is encouraging. Moreover, the Administration’s focus on job growth we view positively for the economy, as these stimulus efforts should help to support GDP growth in 2010 and reduce the risk of a “double dip.”

Exhibit 1:

In summary, we believe January is reflective of what Corporate bond investors can expect this year. Investors are wary that spreads are not compensating them for downside scenarios that can easily be painted due to all of the uncertainty that exists, politically, economically, financially, globally. That being said, after nearly 12 months of supportive behavior and actions at many different levels (private and public sectors), our outlook is not skewed to the downside based on higher probabilities assigned to more draconian scenarios. We are taking an objective approach, analyzing and tracking the data, and continue to believe that a portfolio that is invested in particular industries and credits will outperform Treasuries in 2010.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.