insight

AAM Corporate Credit View: July 2009

July 13, 2009

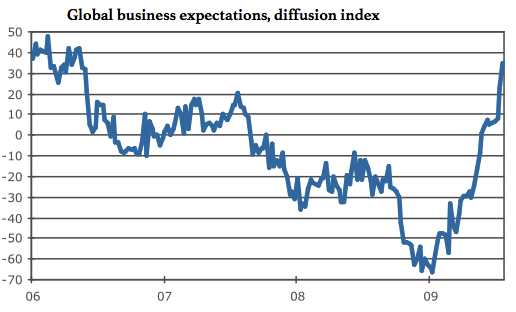

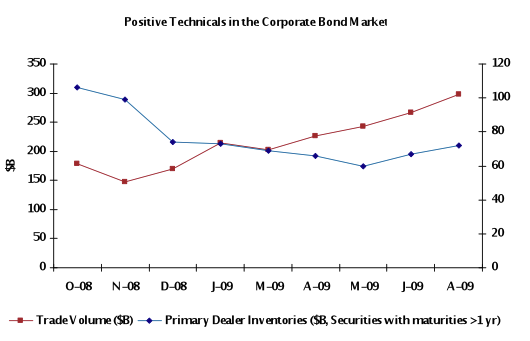

AAM continues to be cautiously optimistic about Corporate bonds. Corporate credit spreads have tightened materially this year, generating 13.49% excess returns year to date as of July 10, 2009. The tightening has been broad based across industries, all benefiting from the improvement in confidence in the financial sector and economy. Except for financials and most deep cyclical industries, spreads have returned to their 3 year average in the intermediate to long end of the curve. New issue concessions have tightened over the year as demand for Corporate bonds, especially those that are higher quality, has increased. Therefore, unlike in 2007-2008 when the technical driver was an exodus from Corporates to safe-haven Treasuries, the technical driver has been positive this year.

Source: Moody’s Economy.com

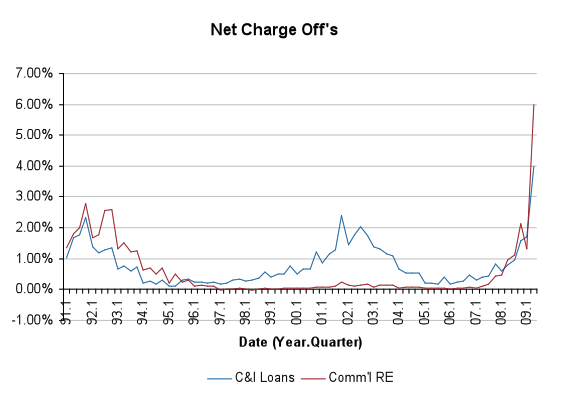

We enter the earnings season with spreads over 200 basis points tighter and signs of stabilization from an economic standpoint. Our expectation for unemployment to peak between 10-11% in the first half of next year is consistent with the markets’ and should allow Industrial and Utility companies to maintain their second half forecasts for 2009. Financial firms are expected to report dismal earnings the remainder of the year due to the elevated provision costs as late stage loans such as commercial & industrial and commercial real estate become a bigger problem. We are watching three main areas in the bank sector over the near term: (1) the trajectory and magnitude of loan losses (2) foreclosure mitigation (3) rate of change in loan balances. As long as these track within expectations, bank spreads should remain range bound with technicals possibly placing pressure on them in the latter part of the year as the Fed’s Temporary Liquidity Guarantee Program (TLGP) expires and banks resume funding in the unsecured market.

Since late 2008, AAM has been buying Corporate bonds from issuers that will withstand a period of prolonged single-digit economic growth. We need more than “green shoots” and “stress tests” to get more bullish and invest in the broader financial and deep cyclical sectors. We remain cautiously optimistic as we enter this very important earnings season.

Source: AAM, FDIC, Federal Reserve

Note: 4Q’09 reflects SCAP stressed case assumptions

AAM refers to Asset Allocation & Management Company, LLC, an SEC registered investment advisor specializing in insurance investment management. This report does not constitute an offer to any person to provide investment management services in any jurisdiction where unlawful or unauthorized. AAM only provides products or services to qualified investors.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.