insight

AAM Corporate Credit View: March 2010

March 2, 2010

The Barclays Corporate Bond Index modestly underperformed Treasuries in February (-5 basis points (bps) of excess return), leaving the Option Adjusted Spread (OAS) 1 basis point wider than where it ended in 2009, and the yield 26 bps lower. The year of mixed sentiment certainly continued in February. Sovereign related fears dominated discussions and the media but did not affect spreads, as they had in January (correlation between Barclays Corporate Index OAS and Greece 5-yr Credit Default Swaps (CDS) dropped from 0.6 in January to 0.2 in February). Companies continued to report improved earnings and sales while management voiced

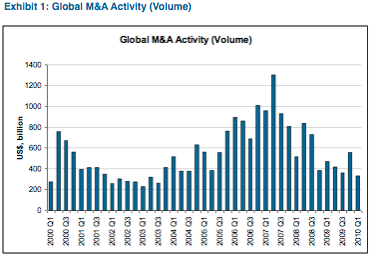

caution regarding the strength of the economic recovery. Moreover, domestic economic data was mixed, M&A activity remained low (Exhibit 1), cash continued to build at the corporate level, and of course, political and regulatory issues remained unresolved. Regarding technicals, the new issue calendar has been slow, new issue concessions lack- luster, and most accounts are long credit, including the primary dealers, which finally stopped adding to positions in mid-January. In short, this is what we expect in 2010 – a year driven by economic data and idiosyncratic events. Therefore, unlike the broad based spread tightening in 2009, we continue to expect 2010 to be a year where sector and credit selection and curve positioning are paramount for outperformance.

The much anticipated Greek bond issue continues to get delayed, but it’s a matter of time since €23 billion is due by the end of May. The capital markets expect assistance from either France, Germany, the European Union (EU) and/or International Monetary Fund (IMF) in order to not only prevent a Greek default, but to decrease funding costs and implement conditions that will force structural reforms and tougher fiscal policies. This does not necessarily apply only to Greece, as other countries in the region and outside the region face the same challenges. Therefore, we expect sovereign and municipal related headlines to continue throughout 2010, periodically affecting spreads especially for those institutions directly exposed (e.g., local banks in Southern Europe as opposed to large, diverse European utilities or telecoms). We took advantage of the contagion in early/mid February and recommended buying two strong, diverse credits based in Spain, Telefonica and Iberdrola. Specifically, the Telefonica 2019 bonds were purchased at +165 to the 10-year Treasury (+165/10) and are offered today at +139/10. We also recommended selling select highly rated Industrials, as the spreads are lackluster relative to other risk-adjusted investment alternatives. We expect others may do the same if sovereign issuance is attractive and mortgage spreads widen after the Fed terminates its Mortgage Backed Securities (MBS) purchase program.

Regarding economic data, February was a difficult month to analyze given the severe weather in many parts of the country and other unexpected events (e.g., Toyota scandal resulted in plant shut downs). On the negative side, consumer confidence was lower than expected and initial jobless claims were higher than expected. At this point, we believe such noneconomic factors caused the miss and may further influence other reports in the near term (e.g., government’s monthly employment report released on March 5). That said, if initial claims do not begin to improve over the next several weeks, it would potentially indicate layoffs are beginning to accelerate and the recovery is stalling. Positively in February, manufacturing related data was strong according to the two regional manufacturing surveys and robust industrial production growth, although we expect the pace will slow in coming months as goods production settles into a more sustainable growth path. Pricing pressures remained low, and with the surplus of production capacity and slack in the labor market, should remain low this year at a minimum. In addition, credit costs seemed to have stabilized in the fourth quarter, Mortgage Bankers Association mortgage delinquency rates edged lower, retail sales were up albeit modestly, temp hiring continued, and employment related advertising spending increased. We believe economic data will be the ultimate driver of spreads in 2010. Our forecast is muted GDP growth, hampered by a weak consumer and housing market and the lack of credit for consumers and small businesses. Banks, especially smaller community and regional banks, are still fragile, and governments are not in a position to continue subsidizing growth.

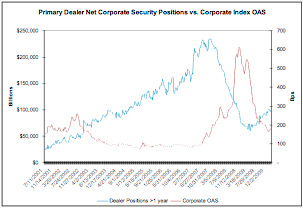

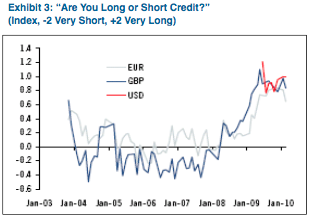

Lastly, the technical back-drop entering 2010 was not as positive as a year ago. In the second half of 2009, investors’ risk appetite returned. This is best shown in the regression results of primary dealer net Corporate security positions and Corporate Index OAS. Historically, dealer positions have explained very little (R squared 6% since 2001), but over the last six months (November and December in particular), they have explained 80% of the variability in spreads (Exhibit 2). Also, dealer surveys are showing investors are long credit and the flow into investment grade mutual funds, while still positive, has slowed (Exhibit 3). While new issuance has been slow year-to-date, we expect it to pick-up especially as M&A activity increases. That said, we expect new issue concessions and issuance from Industrials will be lower in 2010 versus 2009. We believe the current level of uncertainty regarding political, regulatory, economic and sovereign related issues does not bode well for a big change in these positions, keeping investors cautious and expecting coupon income to be the predominant source of return in 2010.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.