insight

AAM Corporate Credit View: May 2012

May 30, 2012

A Negative Rating Forecast Adds to Pressure on Yield Starved Life Insurance Companies

Investment Grade Corporate Bond Spreads Increase

Spreads have widened to reflect the increased volatility and credit risk associated with the increased uncertainty in Europe and the implications of the JP Morgan trading loss. The corporate market underperformed Treasuries in April by 50 basis points (bps), as spreads widened 9 bps. Month-to-date as of May 21, the corporate market has underperformed Treasuries by 151 bps with spreads widening 22 bps. Importantly, we had a strong start to the year. Therefore, year-to-date as of May 21, the corporate market has outperformed Treasuries by 185 bps, generated mainly by Financials and BBB rated Industrials. This week, new deals are being priced with above average new issue concessions, a change from how the market has behaved since February. Our expectation is for this volatility to continue, with spreads likely to widen in the near term.

Earnings season is drawing to a close and results are largely better than expected (earnings 6% and sales 2% better than expected). Management’s tone on conference calls in regard to results for the year was more cautious given the uncertainties regarding Europe and the fiscal and economic conditions in the U.S.

Rating Forecast Turns Negative

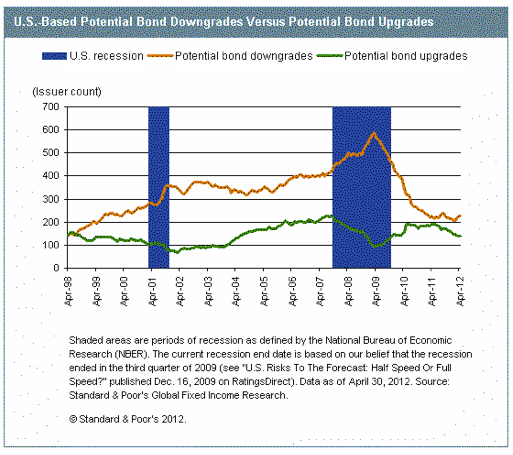

Standard & Poor’s (S&P) published its monthly Credit Trends report[1] on May 17, 2012 stating that the number of potential downgrades is at its highest since October 2010. Although as Exhibit 1 shows, this level remains below pre-recessionary periods and based largely on a methodology change in the bank sector. We have been anticipating rating downgrades for the bank sector, with S&P and Moody’s changing their methodologies. The new S&P methodology explicitly anchors bank ratings off of the sovereign and bank regulation score of that bank’s primary domicile. Similarly, Moody’s is changing its rating methodology to reflect its view that banks and brokerage firms are undergoing secular changes. Factors that Moody’s is considering for domestic banks include: a heavy reliance on wholesale funding, opacity of risk profiles and interconnectedness, and evolving regulation and business models. For European banks, the review is being driven by a difficult operating environment, weakening sovereign creditworthiness, and challenges from capital market activities. For both European and domestic banks, we expect rating downgrades to be one-to-three notches. Moody’s started by downgrading Italian banks last week, and we expect the actions to be completed by July 2012. S&P’s negative outlooks for the banks reflect the sovereign outlooks as well as counterparty risk if liquidity and funding stresses in Europe spread to the U.S.

Exhibit 1

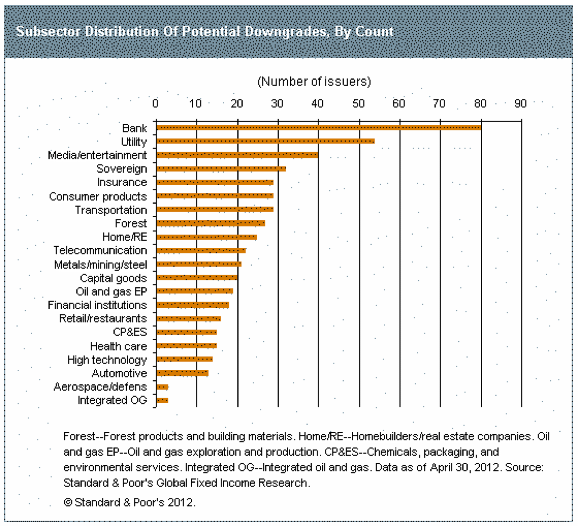

Exhibit 2

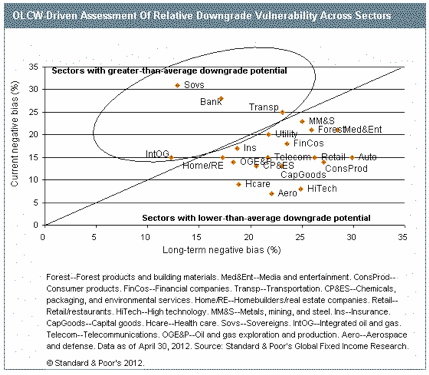

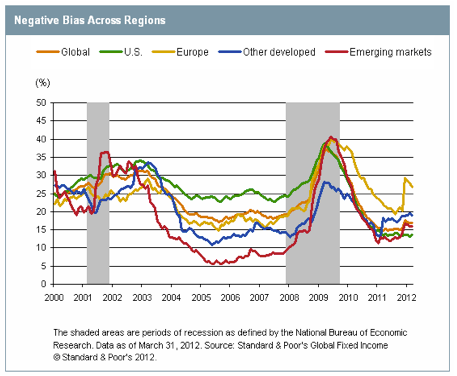

Exhibit 2 shows that not only are Banks pressured from a ratings perspective but also Utilities and Media companies. Utility rating outlooks are negative due largely to the negative outlook/watch assigned to the respective sovereign (mainly in Europe and Japan) or low natural gas prices. The vast majority of the Media credits that are on Negative Watch/Outlook are below investment grade, and Media is a sector that suffers from a high degree of negative rating bias (Exhibit 3). Of the 32 sovereigns on the potential downgrade list, 75% are in Europe. Clearly, the ratings bias is more negative for Europe than the U.S. (Exhibit 4).

Implications for the Life Industry

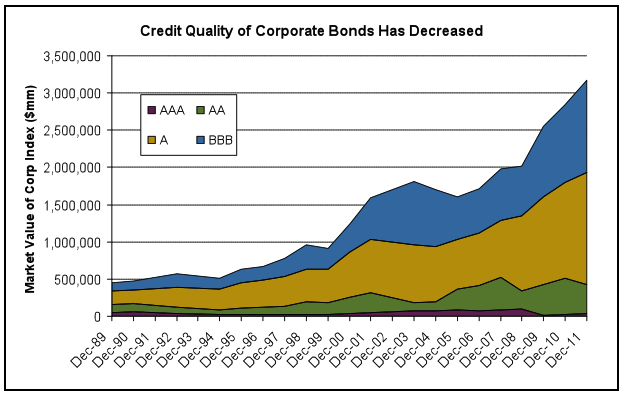

The quality of the investment grade corporate bond market has fallen dramatically over the last decade (Exhibit 5). We would expect this trend to continue as long as funding costs remain so low. This places added pressure on life insurance companies that manage to an average credit quality while searching for more yield. S&P entered the year with the expectation that Treasury rates would rise (10-year Treasuries: 2.3% in 2012, 2.8% in 2013) partly driving the Stable Outlook for the industry[2].

Exhibit 5

Source: Barclays Capital

According to S&P, the average statutory net investment yield declined to about 5.20% in 2010 from about 5.75% in 2007, and we would expect that to be lower in 2012. Low interest rates continue to hamper life insurers’ efforts to obtain attractive yields on new investments. Some companies continue to marginally lower their asset quality by stretching for yield and, on the margin, investing in more risky/less liquid assets (i.e., commercial mortgages, private placements and high yield bonds).

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

[1] Vazza, Diane, “Bond Downgrade Potential in Emerging and Developed Markets, Including the U.S. and Europe: Stress in Europe Widens The Gap Between Potential Downgrades and Upgrades,” Standard & Poor’s Credit Trends,May 17, 2012

[2] Carroll, Matthew; “Solid Capital And Liquidity Support A Stable Outlook In The Face Of Macroeconomic Headwinds,” Standard & Poor’s U.S. Life Insurance 2012 Outlook,November 30, 2011

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.