insight

AAM Corporate Credit View: November 2011

November 9, 2011

Sovereign Risk Decreased But Not Diminished

Results were Favorable for Corporate Bonds in October

After months of debate, European leaders finalized their plan, and investors didn’t wait to see the details. The tail risk resulting from a disorderly Greek default appears to have been reduced in the near term, and the domestic economy performed better than the markets expected. Hence, the increased appetite for risk by the markets. Corporate credit spreads tightened 36 basis points (bps) in October, generating 273 bps of excess return per Barclays Corporate Bond Index. Despite outperforming in October, the Finance sector has underperformed year-to-date, 93 bps wider compared to the Industrial and Utility sectors that are 27 and 22 bps wider, respectively. New issue supply has picked up in both investment grade and high yield, and new issue spread concessions have begun to normalize as deals are oversubscribed. Dealer inventories remain very low historically, a technical that should support spread tightening based on current demand.

AAM’s Corporate Investment Outlook Remains Constructive Yet Selective

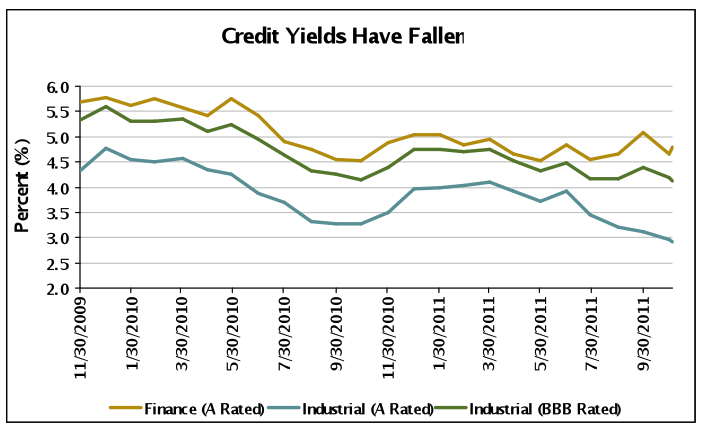

Because we were more optimistic about the domestic economy and did not believe a tail event would occur in Europe, we did not feel it was appropriate to reduce our Corporate positions meaningfully, as it becomes a strategy of market timing, which is dangerous given volatile Treasury yields and poor liquidity (Exhibit 1). Instead, we have reduced credits vulnerable to weakening economies and sovereigns or funding needs, believing the right security selection over time in this low growth environment will lead to outperformance. The reality that rates will remain low for some time should result in spread compression between higher and lower rated credits, as seen earlier this year. Unfortunately, for 2011, we are no longer expecting to exit with positive excess returns for the market given the risk premiums that will remain in various sectors to compensate for the volatility and uncertainties.

Exhibit 1

Source: AAM, Credit Suisse LUCI Index (7-10 year maturities)

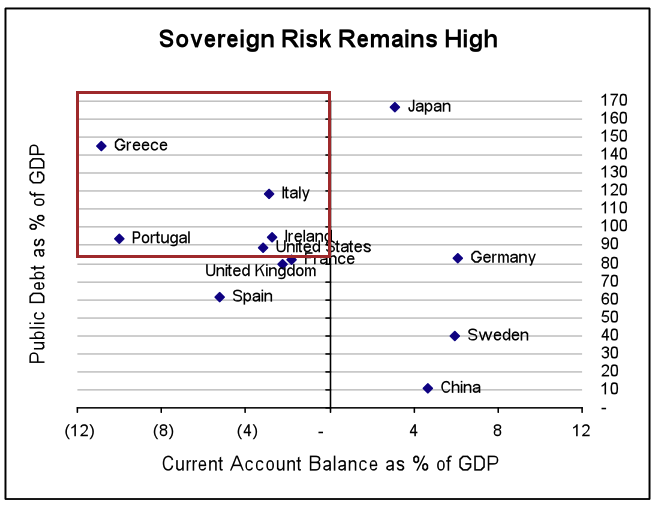

Fundamentals remain very strong for U.S. domiciled investment grade companies. Case in point, third quarter earnings reports have been better than expected with most industries surprising to the upside and reporting both earnings and revenue growth. That said, sovereign risk remains elevated in the U.S., as we face our own fiscal challenges (Exhibit 2).

In Europe, the environment from both a sovereign and an economic perspective is more concerning. While the European banks reported better than expected loan growth and credit costs in the third quarter 2011, bank balance sheets are likely to contract over the near term due to the requirement for capital improvement and the austerity measures will take hold, both dampening economic growth. Moreover, according to a recent Goldman Sachs study, European company fundamental improvement is lagging, providing less of a cushion for creditors. Whereas, the U.S. nonfinancial corporate sector’s credit quality is close to its highest level in decades, European firms have only reverted about two thirds back to pre-crisis strength[note]Himmelberg, Charles P., “European credit fundamentals: Not so good,” Goldman Sachs Global Investment Research, Page 1, November 7, 2011[/note].

Exhibit 2

Source: AAM, Bloomberg, International Monetary Fund

Sovereign Risk Remains in the Forefront

This month, we thought it worthwhile to review the European plan, and provide our thoughts on the details. Our investment strategy in the region remains unchanged: avoiding European financial, infrastructure, and economically sensitive companies. We expect continued volatility until we see greater economic and fiscal stabilization in Italy and Spain.

Greek Debt Restructuring

Private investors (i.e., banks/insurance companies) agreed in principal to a 50% reduction in their holdings of Greek sovereign bonds. This haircut would apply to the approximately €210 billion of privately held debt but not to the €150 billion International Monetary Fund (IMF) or European Central Bank(ECB) held debt. The IMF estimates that this would result in a debt/GDP ratio of 120% as of 2020 (vs. currently projected 180%). This strikes us as a half measure, but it avoids, for the moment, a disorderly default in Greece. We await details of the new government, recognizing the elevated uncertainty and thus risk, but are reassured that despite angst over austerity measures and their national sovereignty, more than seven of ten voters said they favored Greece remaining in the Eurozone per a poll two weeks ago in the To Vima newspaper.

Bank Recapitalization/Liquidity

European banks will be required to achieve a 9% “core” Tier 1 capital ratio no later than June 2012 after a mark-to-market of all sovereign holdings (using sovereign prices and exposure as of September 2011). The European Banking Authority (EBA – engineers of the Euro Stress Tests) estimate a Eurozone capital deficit of €106 billion based on the figures and marks as of September 30, 2011. The recapitalization plan calls for banks found to require capital to first attempt to tap private markets (for common equity or “strictly underwritten contingent capital instruments”), followed by withholding of dividends and bonuses, reduction of high risk weighted assets, and only if these measures are insufficient, capital injections from the national governments or the European Financial Stability Facility (EFSF) if the national governments do not have the means (i.e., Greece, and possibly Spain and Italy). The banks must submit a capital raising plan to their national regulators and the EBA no later than December 25, 2011. The bulk of the €106 billion recap falls on Greece (€30 billion), Spain (€26 billion) and Italy (€15 billion). It should be noted that the €106 billion capital shortfall estimate is based on the July 2011 EBA stress test base case (which already appears somewhat optimistic), and does not take into account the prospect of further GDP slowdowns in either broader Europe or those countries most affected by fiscal consolidation measures (i.e., Greece, Italy, Spain).

The Eurogroup announcement also contemplated a sovereign guarantee scheme for bank term funding from 2012 on in order to prevent either a buyers’ strike or “excessive deleveraging” by banks that are trying to achieve the Tier 1 targets through balance sheet reduction. This would be separate from the ECB liquidity provision efforts (and likely would aim to replace it ultimately). Details of this program are completely to be determined, but should be supportive of Euro area bank spreads as it further reinforces bank access to term funding over an intermediate period and reduces fears of a liquidity squeeze.

“Upsized” EFSF

While there is explicitly no increase to the €440 billion contribution of the Aaa/AAA countries (Germany, France, Netherlands, Finland), the Eurogroup will continue to explore two options for leveraging the structure in order to facilitate approximately €1 trillion of new sovereign issuance:

- Insurance Option – This would see the EFSF offering a partial wrap on new sovereign issuance (20% first loss absorption has been the amount rumored). This would effectively allow a €200 billion commitment from the EFSF to backstop the contemplated €1 trillion of issuance (roughly equivalent to the issuance needs of Spain and Italy over the next 18 months). The Eurogroup contemplates such insurance being discretionary (i.e., provided only if investors explicitly request it) and there has been no discussion of pricing.

- Special Purpose Vehicle – This would see the EFSF fund a Special Purpose Vehicle (SPV) with a first-loss equity piece that would then purchase new issue sovereign debt and sell a senior tranche of bonds to private investors. This is the closest structure yet to a “common Eurobond” issuance and is the structure that market participants seem most enthusiastic about. A good way to think of this approach conceptually is that it is using cash Collateralized Debt Obligation (CDO) architecture.

The Eurogroup has promised details on both of these options in November 2011 and may use either or both approaches. Still to be determined is the market’s receptivity to a 20% first-loss protection (on assets that had previously been treated as 100% risk-free/0% risk weighted). Additionally, we note that the EFSF has raised less than €20 billion of the contemplated €440 billion funding capacity. The latest €3 billion 10-year bond was downsized from the originally planned €5 billion 15-year after demand was tepid. It was sold today at a spread of 177 bps over German bunds with Central Banks accounting for 35%, Banks 30%, Insurance companies 20% and Fund Managers 15%.

Our Thoughts on the Credit Implications

This plan appears to nominally address many of the outstanding issues (i.e., Greek restructuring, bank capitalization, EFSF mechanism for supporting sovereign liquidity), but the key to resolving the Eurozone crisis is the ability of Italy and Spain to achieve a more stable fiscal trajectory (Exhibit 3). In that respect, the actions announced by the Eurogroup are really just treatments of the symptoms, rather than curing the underlying ailment. Ultimate resolution of the crisis depends on Spain’s, and especially Italy’s ability to implement their fiscal consolidation plans (without backsliding) and to achieve the projected (or at least reasonable) levels of GDP growth in the face of fiscal austerity and considerable domestic political resistance. Their success or failure in these efforts will likely not become apparent for another twelve-to-twenty four months. Until we see clear evidence that Italy and Spain are demonstrating political commitment to fiscal consolidation and clear economic and fiscal progress, we will remain very cautious of the continental European sector.

Exhibit 3

Source: AAM, Bloomberg, as of November 7, 2011

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Sebastian Bacchus, CFA

Vice President

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.