insight

AAM Corporate Credit View: October 2011

October 3, 2011

Where to Invest in a Low Yield Environment

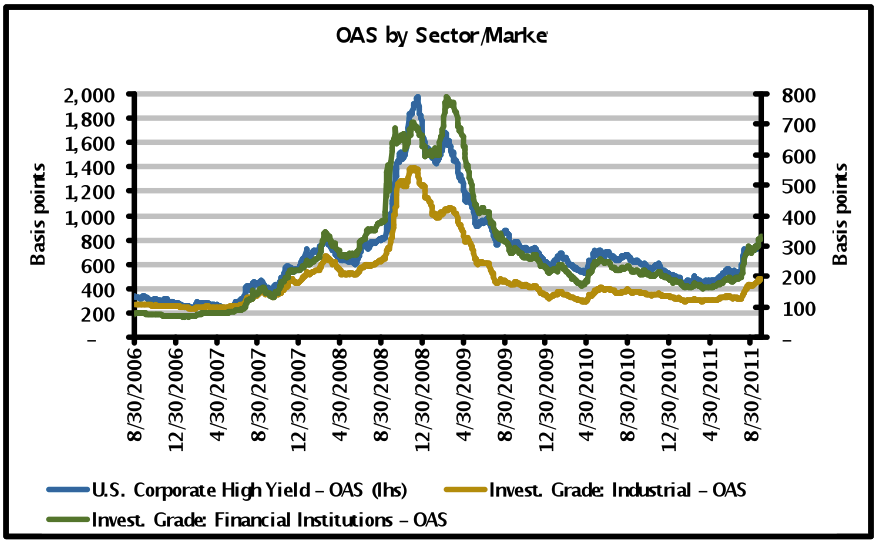

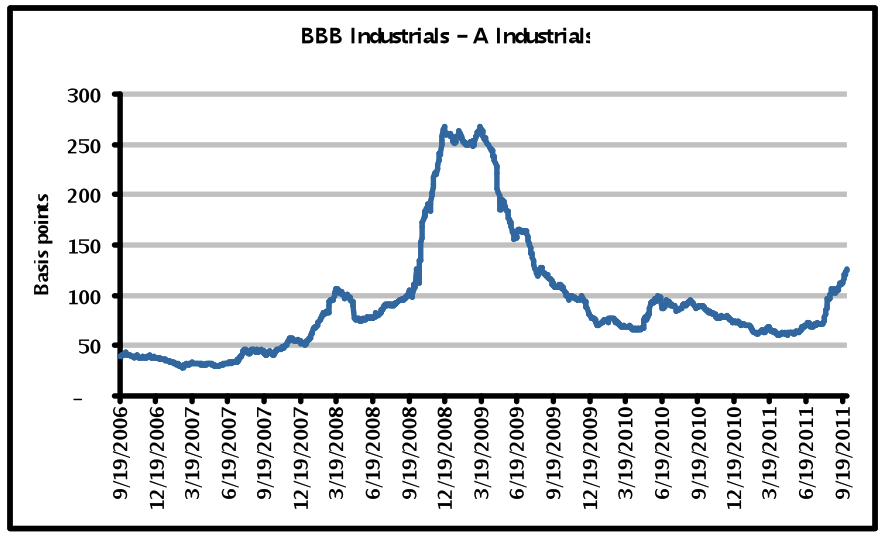

The late rally in September for both equities and Corporate bond spreads was not sufficient to exit the month in the black. In September, Corporate spreads widened 30 basis points (bps), generating -192 bps of excess return vs. Treasuries per the Barclays Capital U.S. Corporate Index. All industries posted negative excess returns with financial and economically sensitive sectors underperforming once again. From a total return standpoint, the Corporate market effectively broke even (0.26%) given the Treasury rally. Financial and high yield spreads have widened to levels pre-Lehman bankruptcy (Exhibit 1), reflecting the heightened systemic risk of the debt crisis in Europe and recession risk for developed economies around the globe. Accordingly, risk premiums have increased as reflected in the differential between BBB and A rated credits (Exhibit 2). Assuming a recession like 2002 (as opposed to 2008-2009), investment grade credit spreads are compensating investors for roughly a one-third probability of such risk.

Exhibit 1

Source: AAM, Barclays Capital (data as of 9/28/11)

Exhibit 2

Source: Barclays Capital (data as of 9/28/11)

The economic data released in late September has given investors reason for optimism. Although creeping GDP rates may not solve the woes of indebted sovereigns and high unemployment rates, they are adequate for many investment grade companies. These companies are benefiting from low interest rates, productivity enhancements, and emerging market growth as well as taking advantage of consumers who are spending despite the overall lack of confidence. Management commentary at conferences over the last couple of weeks seems to indicate that the economy is slowing not contracting, as demand continues for advertising, technology, autos, and energy. Admittedly, this will not last if Europe is not able to address its issues and a financial crisis in Europe ensues, pushing economies, including ours, back into a recession. As each month goes by with no solution, we get closer to that outcome. We are encouraged by the German vote for the European Financial Stability Fund (EFSF), but realize the underlying problem is not simply liquidity but solvency for various banks and sovereigns.

Understanding that risk is higher and investors need to be compensated, we have been investing conservatively – even more so over the last several months. We do not believe this is the time to shed all Corporate risk because we do not believe a “Lehman type event” will occur in Europe and/or we are in/entering another recession. That said, given the outstanding risks, we believe that investors need to be avoiding: (1) financials in the Euro zone, (2) infrastructure companies in the European periphery, (3) companies with material refinancing needs over the near term, weaker market positions or management and/or a reliance on lower income consumers or housing, and/or (4) smaller, less diversified companies in cyclical industries. Also, we have favored the new issue as opposed to the secondary market since new issue concessions are once again attractive especially in this low yield environment.

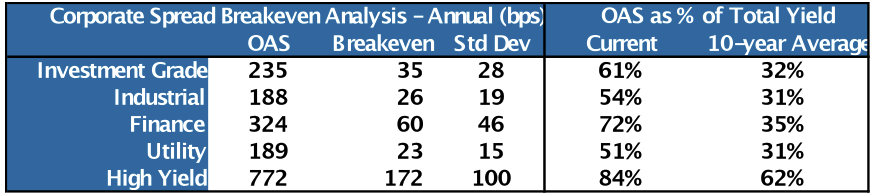

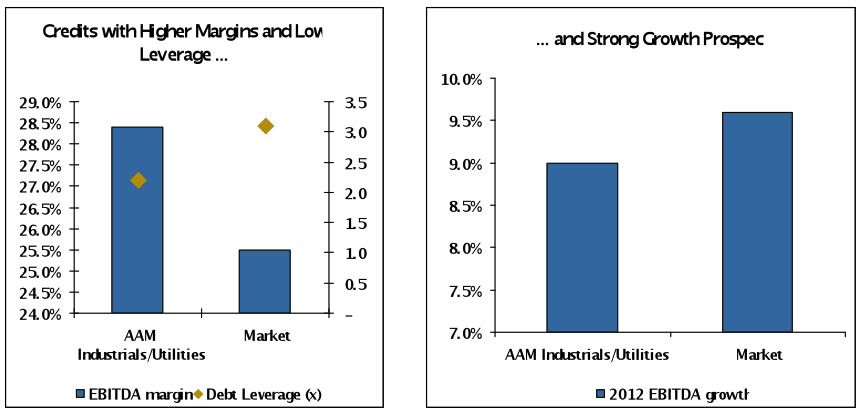

Yields will only rise when there is more optimism about growth that is not fed by leverage, private or public. Even though this may take a while, we appreciate the lack of risk adjusted income opportunities for all investors especially those that need income to run their businesses or in the case of retirees, lives. Hence, we expect increased demand, in particular for credits that will continue to perform well operationally (Exhibit 4). For the sector, we expect risk taking will ensue after the systemic risk associated with Europe peaks, and even though we are unable to pinpoint when that will be, we are comforted by the more attractive credit spreads and break-evens today (especially for Financials, namely banks) for investors with a longer term investment horizon (Exhibit 3).

Exhibit 3

Source: Barclays Capital (data as of 9/28/11)

Exhibit 4

AAM is taking a more defensive investment stance, recommending:

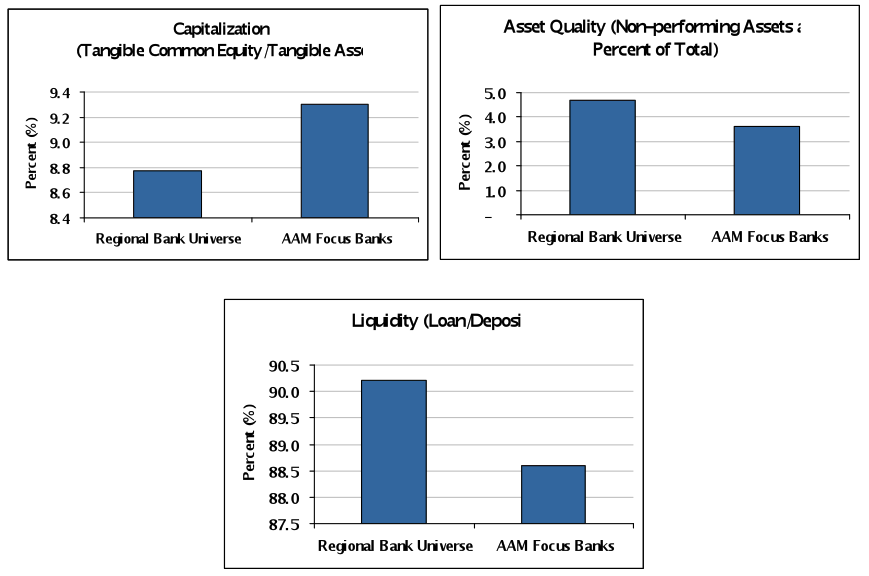

And, within the Banking sector, we prefer strong, well capitalized banks within the U.S.:

Source: AAM, Capital IQ (Note, Non-Financial “Market” as represented by approximately 500 credits largely in the Barclays Capital U.S. Corporate Index), SNL

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.