insight

AAM Corporate Credit View: October and November 2012

November 6, 2012

Strong Performance from Investment Grade Corporates

- QE3 has Increased Demand for Investment Grade Corporates

- Company Earnings and Outlooks have been Weaker than Expected

- Spreads are Fully Valued but Technicals Remain Supportive

- Rating Migration to BBB is Expected to Continue within Investment Grade Industrials

- A/AA Rated Industrial Credit Spreads Do Not Reflect Increased Credit Risk

Investment Grade Corporate Bond Spreads Reacted Positively to QE3

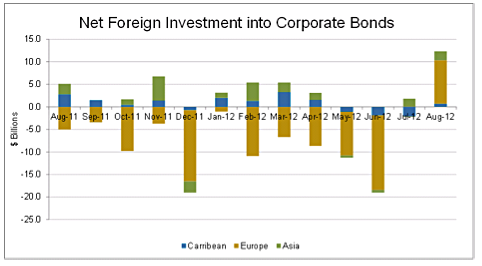

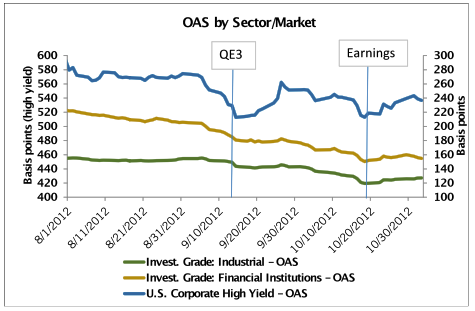

The Investment Grade Corporate market rallied, propelled by more quantitative easing (QE) than expected, benign European headlines (including Moody’s affirmation of Spain), and better than expected economic data. While the equity, high yield and credit default swap (CDS) markets reacted negatively to weak earnings reports, investment grade spreads remain largely unchanged (Exhibit 1). We believe spreads are benefitting from the increased demand due to QE3, as the supply of mortgage backed securities has contracted. This is likely to become more pronounced when/if the European Central Bank (ECB) starts its Outright Monetary Transactions (OMT) program. European investors returned to the Corporate market in August, and we expect this continued in September (Exhibit 2).

The Investment Grade Corporate market earned 1.17% over Treasuries in September and 1.47% in October, increasing the year-to-date excess return to 7.63% per Barclays. The Finance sector continued to outperform as did BBB rated securities and long maturities. From an industry perspective, those more levered to the economy outperformed the more defensive, higher quality sectors. New issuance in all markets remains healthy and new issue concessions nonexistent except for the lower yielding, higher quality deals. Since September, credit curves have flattened more than expected with the short and long ends benefitting from the increased demand due to QE3. We expect this technical support to continue over the next twelve months, softening the volatility that we expect from macroeconomic headlines (including fiscal cliff related discussions), weaker company level results and increased shareholder friendly actions.

Exhibit 1

Source: Barclays Capital, AAM

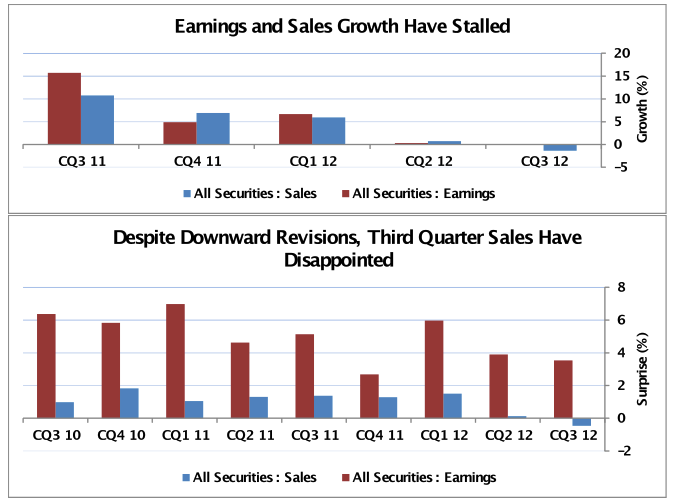

Third Quarter Earnings Have Been Lackluster

This earnings season has been fairly negative, not only from a reporting standpoint for the third calendar quarter, but also from an outlook perspective (Exhibit 3). On earnings calls, management teams have talked about the uncertainties in the marketplace due to upcoming fiscal decisions in the U.S., China and Europe, causing companies to invest more cautiously. This is the second quarter we have seen sales and earnings growth plateau, reflecting the low growth rate of the domestic economy and slowing growth outside the U.S. The only sector that has positively surprised with higher than expected Sales is Finance.

Exhibit 2

Exhibit 3

Source: Bloomberg, AAM (S&P 500 constituents)

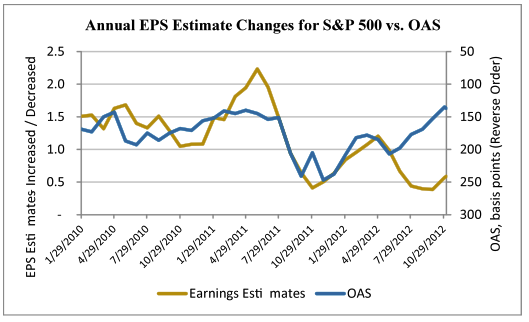

We had expected spreads to widen in the second half of 2012 due to our expectation of softening fundamentals, not to mention the potential economic and European related event risk. Historically, there has been a strong relationship between earnings estimates and spreads. As shown in Exhibit 4, since May 2012, this relationship reversed. We believe this reflects the increased demand for Corporate credit, as investors look to earn a higher risk adjusted return over risk free rates in a more uncertain environment.

Exhibit 4

Source: Bloomberg, AAM

How Has AAM Been Investing in Corporates?

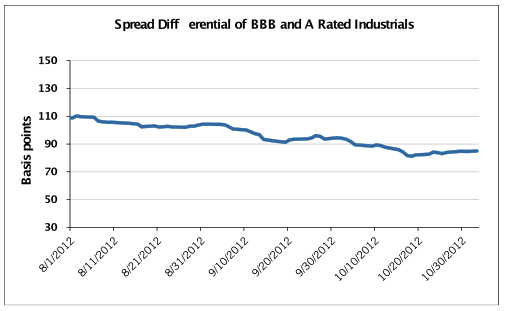

After the strong rally, the corporate market is at the tight end of our fair value range. The spread compression between Finance and Industrials is largely over after strong performance from Financial credits this year, but the basis between A and BBB rated Industrials remains too wide (Exhibit 5). We expect continued performance from BBB rated securities, and generally believe A/better rated Industrials are rich.

Exhibit 5

Source: Barclays Capital, AAM

Tactically, we remain defensively positioned in regard to Europe, avoiding European financial and infrastructure credits and hold fewer low quality credits, which we believe are more likely to fall to high yield. We are replacing that yield with a greater percentage of higher quality BBB rated credits and less liquid securities (e.g., private placements) while preserving overall portfolio yield and liquidity. Our security analysis has proven that in Investment Grade, the spread for “reaching for yield” is inadequate to compensate insurance companies for the increase default risk and risk based capital (RBC) charges associated with the credit rating downgrades.

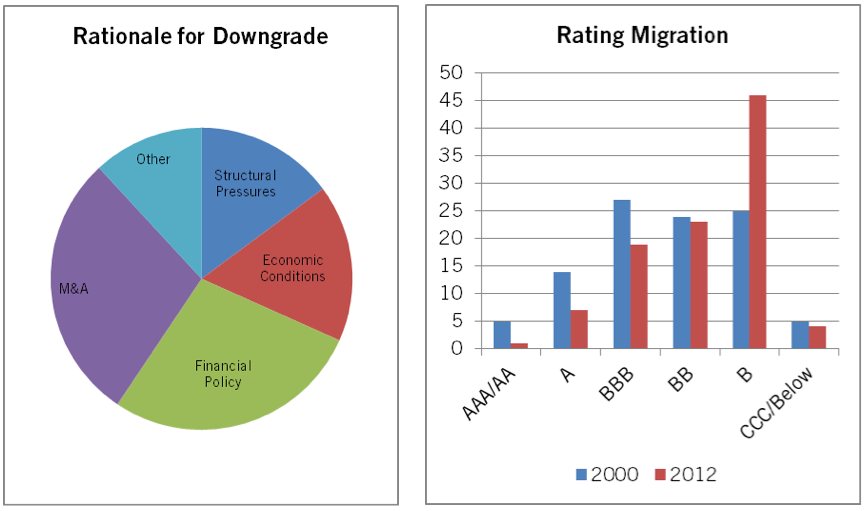

The risk of increased leverage is rising, as the forecast for low rates lengthens and volatility has subsided due to increased support from the Federal Reserve and the ECB. We expect ratings migration to continue from the A to the BBB category.

In a recently published S&P report titled, “The Credit Overhang – 101 Lost ‘As’ – A Dozen Years of Decline for U.S. Industrial Ratings,” the authors detail the migration, including the rationale (Exhibit 6). The authors end the report by stating that “S&P believes that the number of ‘A’ companies will continue to decline. The low cost of debt (especially for investment-grade issuers), the tax advantages of issuing debt, and the pressure to return money to shareholders suggest that other considerations can outweigh the benefit of having an ‘A’ category rating. Under such conditions, S&P believes that companies will be more inclined to take on increased financial risk, even if it means carrying lower credit ratings.”

Exhibit 6

Source: Standard & Poor’s

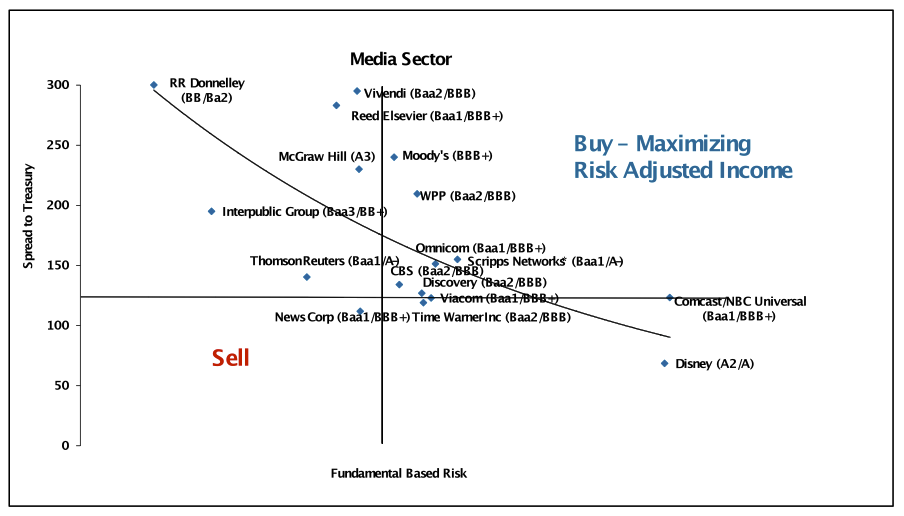

We generally agree with S&P, which is why we believe it is imperative that one measures credit risk on a forward looking basis, assigning internal credit ratings. We measure returns based on these internal risk assessments, and look to maximize risk adjusted income. An example in the Media sector is in Exhibit 7, showing the differences of our risk assessment vs. the agencies. Spreads for A/AA rated Industrials are historically very tight; therefore, we generally believe investors are not being compensated appropriately for the expectation of increased credit risk.

Exhibit 7

Source AAM, Capital IQ, Bloomberg, broker runs.

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.