Recap

During the third quarter, yields on fixed income assets continued to plunge. The move by the Federal Reserve to cut interest rates twice during the quarter on concerns related to a tariff-driven economic slowdown and volatile swings in the stock market created extremely strong risk-off demand for Treasury assets. Treasury rates fell by 34 and 42 basis points in 10 yr and 30 yr maturities, respectively, during the quarter. Tax-exempt yields followed suit, but as has been the case since mid-May, the municipal market underperformed. Municipal Market Data (MMD) ‘AAA’ nominal yield spread relationships to Treasuries widened out by 13 bps and 12 bps in 10 yrs and 30 yrs, respectively.

The principal reasons for the underperformance during the quarter have generally been tied to the unattractive relative valuation levels for the sector and a softening of technicals during August and September. As we highlighted in the prior quarter’s commentary, new issue supply during the first half of the year and into July has largely been underwhelming, while the demand for tax-exempts has been incredibly strong. The record level of refundings/refinancings that occurred between 2015 and 2017 created a healthy stream of calls and maturities related to that refinancing activity, and retail investors remain firmly entrenched in reinvesting these flows in the tax-exempt market. That’s been especially true for wealthy investors in high tax states. The tax-reform related cap on state and local taxes or SALT deductions has resulted in increased federal liabilities for these investors, making the after-tax yield profile of tax-exempt assets look very compelling relative to taxable investments. This robust demand profile resulted in relative valuation metrics like 10 yr muni-to-Treasury yield ratios to move to over a 25 yr low of 70.9% during May. The average for this metric is 92% over the last 10 yrs.

Advance Refundings are Attractive Again

On the supply side, 2019’s new issuance, as reported by the Bond Buyer, has been running at anemic levels for most of the year. Monthly supply exceeded $30 billion only once during the first 7 months, with an average of $27.7 billion per month. The most significant factor driving the low supply is the dramatic slowdown of refinancings since the passage of the Tax Cut and Jobs Act (TCJA) that eliminated the use of tax-exempt advance refundings. Prior to tax reform, this process allowed for the issuance of tax-exempt debt to refinance outstanding tax-exempt debt more than 90 days before its call date. However, under the new rules, the refinancing can now only be executed in the taxable municipal market. For 2019, the net result of the tax-reform over the first 7 months was a 59% decline in refinancings relative to the same time period in 2017, the last year that the pre-tax reform rules were in effect.

In general, with taxable rates at much higher levels than nominal tax-exempt levels, pushing advance refundings to the taxable municipal market created a significant impediment to the execution of refinancings utilizing taxable debt. Based on data compiled by AAM and MMD, over the last 15 yrs, 10 yr ‘AAA’ taxable muni yields were higher by an average of 113 bps relative to ‘AAA’ tax-exempt nominal yields, and at the beginning of 2019, this spread relationship stood at 111 bps. However, as rates have plummeted and tax-exempts have underperformed taxables during the third quarter, there’s been a significant shift in this spread relationship during 2019. From the beginning of the year through the beginning of September, 10 yr Treasury rates have fallen by 123 bps, and taxable muni spreads to tax-exempts in 10 yrs have tightened by 32 bps to a spread of 79 bps. The combination of these moves has produced taxable muni yields that are now low enough to prod issuers to become actively engaged in taxable advance refundings. Over the last two months of the third quarter, average monthly refinancing activity has increased by 178% relative to the average monthly issuance over the first 7 months of the year. Similarly, over the same time period comparison, average monthly taxable muni issuance has increased by 232%.

Outlook

Looking forward, broker/dealer estimates call for an additional $5 to $10 billion per month of increased new issuance supply over the balance of the year, with a large proportion expected to be taxable issuance from advance refundings. With this expected increase, overall taxable muni supply for 2019 is expected to come in at between $50 and $60 billion, which would be the highest level of issuance since the expiration of the Build America Bond program in 2010. The last year of that program helped produce $152 billion in taxable muni issuance, as reported by the Bond Buyer.

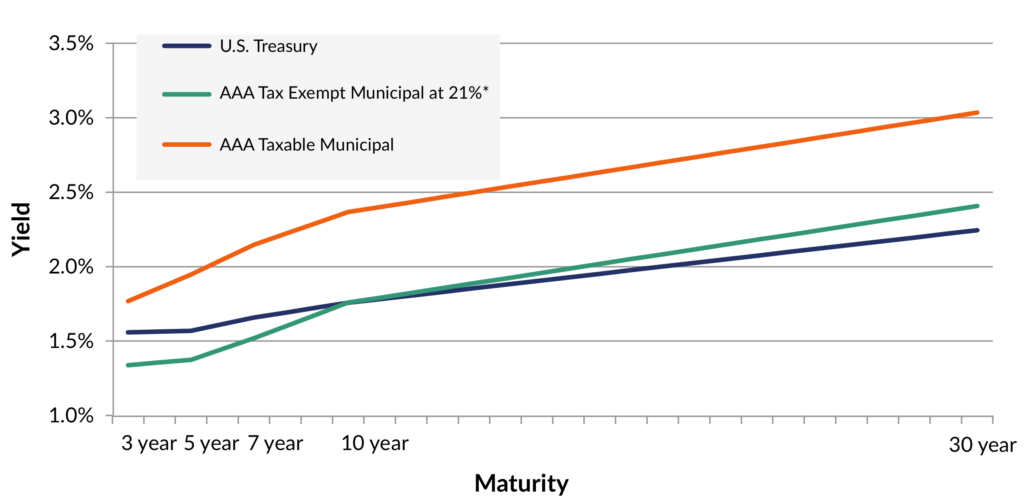

In our opinion, we do not expect this supply surge to have a meaningful impact on taxable muni spreads versus Treasuries. The demand for taxable munis has been healthy all year, with foreign investors finding the yields available in the sector attractive relative to the negative yield environment overseas. Additionally, institutional investors taxed at 21% still find that taxable munis provide a compelling yield advantage relative to similarly rated tax-exempt bonds. As of this writing, ‘AAA’ taxable municipals out-yield tax-adjusted tax-exempt bonds by 59 bps and 55 bps in 10 yr and 30 yr maturities, respectively.

Market Yield as of 10/21/2019

Consequently, we are maintaining our negative bias towards the tax-exempt market and continue to advocate a sector rotation trade out of the sector and into taxable alternatives with a more compelling after-tax return outlook. We view one of the favorable sectors to be taxable municipals, and as long as rates remain low, there should be ample opportunities to add to the basis over the balance of the current year and into 2020.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.