insight

Blue Cross Plans: Tax Efficient Investing

September 19, 2013

With the expiring 833(b) tax deduction, the issue of taxability has entered the equation as a key consideration in the asset allocation process for many Blue Cross plans. Optimizing the allocation between taxable and tax-exempt fixed income securities can lead to maximizing after-tax returns. This paper discusses key considerations in the tax modeling process, and advocates for a dynamic approach to tax modeling, which takes into account the variability of operating results.

Tax-exempt municipal bonds can be a valuable source of incremental yield and portfolio diversification for an insurance company, especially in the context of a well-executed taxable/tax-exempt crossover strategy. This depends, however, on the company’s ability to take advantage of the income tax exemption on these bonds, without which their returns are significantly less attractive under normal market conditions. Municipal bond income is typically only tax-exempt for ordinary Federal Income Tax (FIT) purposes, so companies that pay the Alternative Minimum Tax (AMT) must treat it like any other investment income and apply the AMT tax rate (typically 20%), reducing the appeal of municipal bonds for these companies relative to sectors with higher nominal yields.

It is therefore critical to carefully analyze a company’s capacity to benefit from tax-exempt income and calculate an appropriate allocation before investing in this sector. This is especially true of Blue Cross Blue Shield (BCBS) insurance plans due to the existence of the 833(b) tax deduction, which allows eligible BCBS plans to deduct 25% of their claims and claim adjustment expenses over a calculated threshold in their FIT calculation. This deduction can be quite substantial, and almost always results in eligible companies paying the AMT (and accumulating AMT credits) in the years they use it. However, the limiting threshold of the deduction grows over time for companies with positive net income, such that after a number of profitable years these companies will eventually be “limited out” and lose their eligibility to use it. At this point, they are likely to have accumulated significant AMT credits that will enable them to pay the AMT rate of 20% rather than the 35% Federal rate for a number of subsequent years.

As a result, for purposes of investing in tax-exempt municipals, there are three broad categories a BCBS plan might find itself in:

- Companies currently using the 833(b) deduction, and expecting to do so for the foreseeable future: these companies are likely already paying the AMT every year, and thus are not in a position to benefit from the deductibility of municipal bond income.

- Companies that have recently stopped using the 833(b) deduction, or expect to stop soon, but still have a material AMT credit: these companies may be able to benefit from tax-exempts, but the benefits will accrue at a delay and will only be fully realized as the AMT credit is consumed. Briefly, the tax-exempt income will reduce the FIT calculated each year, which will reduce the amount of AMT credit consumed and prolong the time the company is able to pay the 20% marginal AMT rate rather than the higher Federal rate. AMT credits do not expire, so this strategy can be viable for companies that expect to have adequate income to consume their AMT credits over a reasonable horizon.

- Companies that no longer use the 833(b) deduction, and no longer have any AMT credits: these companies may be good candidates to invest in tax-exempts, and should perform dynamic tax analysis to determine an appropriate allocation to the sector.

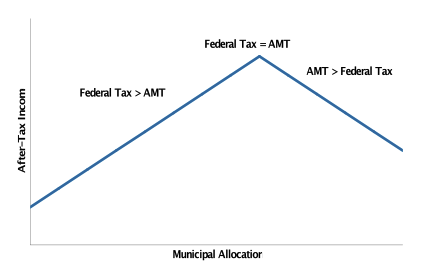

Exhibit 1

Source: AAM

For companies in the third category, we recommend dynamic tax analysis to determine their capacity to benefit from tax-exempt income. Holding too few tax-exempt municipals can result in lost income and sub-optimal diversification, but holding too many can tip a company into the AMT and thus reduce total after-tax income (Exhibit 1). Identifying the “sweet spot” between these scenarios is the goal of the analysis. This process incorporates underwriting, investment, and tax inputs to generate pro-forma income and tax statements for one or more forecast years and to determine an allocation to tax-exempt municipals that maximizes after-tax income while limiting the risk of paying the AMT.

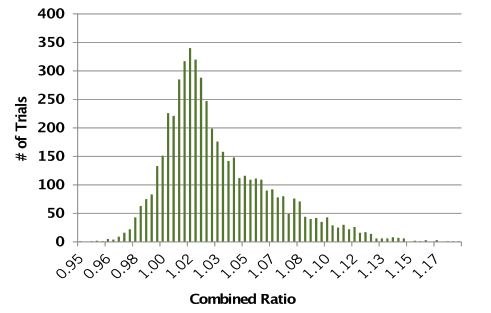

Exhibit 2: Sample Combined Ratio Distribution

Source: AAM

The first step of dynamic tax analysis is gathering inputs, and the first of these is company operating forecasts for one or more years (using just a single year can simplify the analysis, but may require more frequent follow-ups than using multiple forecast years). This makes a good starting point, but for a truly robust analysis it is necessary to expand this “base case” forecast into a range of possible scenarios for key components of combined ratio like Net Premiums Written (NPW), Claims and Claims Adjustment Expenses (CAE) incurred, and other underwriting expense (Exhibit 2). By using probability distributions to describe these inputs we can arrive at a tax-exempt allocation that takes into account the risk of the overall enterprise. Furthermore, these distributions can be asymmetric, which can be crucial to accurately representing variables like Claims that may have greater odds of coming in higher than expected than below.

Other inputs include current portfolio composition and book yield; current market yields for both taxable and tax-exempt bonds; and tax work papers showing composition of tax assets and liabilities and reconciling book and tax income. These make it possible to quantify the impact on investment income of adjusting the portfolio allocations and to estimate the necessary book-to-tax adjustments required to create pro-forma tax statements for the forecast years and identify the AMT “tipping point.”

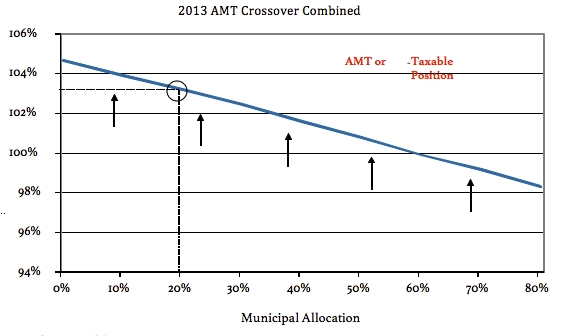

Exhibit 3

Source: AAM

Once all the necessary data is collected, we perform a 100,000-trial Monte Carlo simulation to test thousands of underwriting scenarios against 20 different taxable/tax-exempt allocations to identify the portfolio composition that maximizes expected after-tax income across the forecast horizon(Exhibit 3). The dynamic nature of the simulation also allows a variety of additional analyses to more fully develop a recommended tax-exempt allocation, including the probability of paying AMT at different allocations and the change in the optimal allocation if the combined ratio comes in above or below expectations.

A well structured tax-exempt municipal investment program can offer a variety of benefits to insurance companies: strong credit quality, high liquidity, stable cash flows, and attractive after-tax yields. Spreads for this sector have widened recently, making it especially appealing for new investments. Blue Cross Blue Shield plans that are not currently using the 833(b) deduction would be well advised to pursue dynamic tax analysis to identify an appropriate allocation to tax-exempts, and consider implementing a crossover municipal strategy to add diversification and after-tax yield to their portfolios.

Written by:

Peter Wirtala

Insurance Strategist

For more information, contact:

Colin Dowdall, CFADirector of Marketing and Business Development

John Olvany, Vice President of Business Development

Neelm Hameer, Vice President of Business Development

30 North LaSalle Street

Suite 3500

Chicago, IL 60602

312.263.2900

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.