In the Fall of 2007, a new neighbor asked me what I do for a living. When I told him that I manage portfolios for insurance companies primarily consisting of investment grade bonds, he replied, “That has to be the most boring thing I have ever heard.”

His view point is one that is shared by many. Investment grade bonds are considered the “boring” part of your portfolio intended to be a safe haven asset class. Bonds generally represent the vast majority of investment holdings on risk pool balance sheets; they are there primarily to support the liabilities of the organization. Further, stability in the asset class and consistent income can support the risk pool mission of serving members through efforts such as grant programs, rate stability, wellness programs and other avenues. Over time, it can be easy to become complacent with the risks inherent in bonds, especially given the solid returns from investment grade fixed income since the global financial crisis of 2007-2008.

In this article we briefly review the two principal risks in risk pool bond portfolios: interest rate risk and credit risk. As we are late in the economic cycle, there is an increased likelihood that these risks will manifest themselves in a significant way, leading to heightened price volatility. Being aware of these risks is critical for all insurance entities, but especially for risk pools. The commercial market carries most bonds at amortized cost, so changing market values in their bond portfolios do not directly impact surplus or net position. However, since most pools are subject to GASB accounting standards, they carry bonds at fair market value. Thus, changes in value directly impact pools’ capital position.

Interest Rate Risk

With the substantial drop in US Treasury yields this year through September 30, 2019, fixed income returns have been tremendous, especially for long maturity assets. The magnitude of the impact from changing interest rates is measured by duration.

Setting the duration of a portfolio can have a significant impact on portfolio returns over time. If it is too short, pools sacrifice long term investment income. If duration is too long interest rate volatility may create more price volatility than pools are comfortable with or can financially support. In setting your portfolio duration target, AAM recommends reviewing your claims payment patterns, member contributions, and cash flows to support member services. These factors not only impact cash flows but also the stability and growth of net position. The ultimate goal is to budget an amount of interest rate risk that allows you to comfortably meet the obligations of your pool while maximizing investment income.

Credit Risk

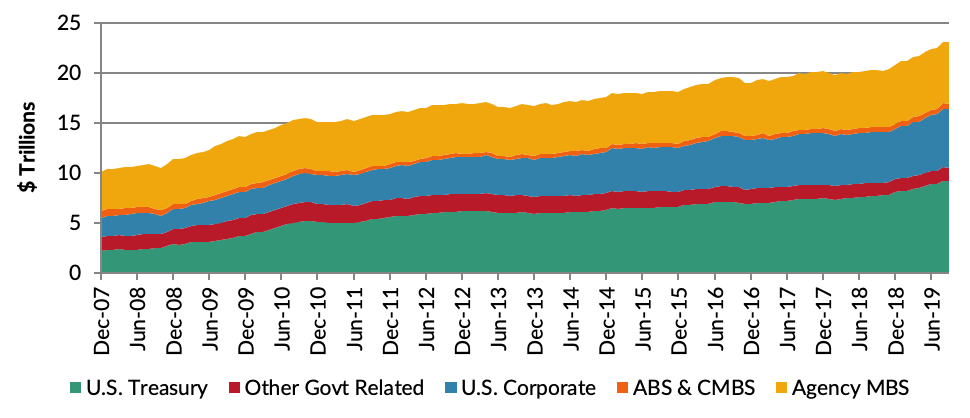

The other meaningful risk for bond investors is credit risk. Investors vividly remember the global financial crisis of 2007-2008 and the concomitant volatility in the bond market. Recently, headlines are plentiful about the potential risks in the corporate bond market. With persistently low interest rates, companies have been willing to borrow and add leverage to their balance sheet. This has contributed to dramatic growth of the investment grade bond market since the last downturn.

Figure 1: Size of Investment Grade Bond Market

Since the end of 2007, total investment grade debt outstanding has increased from $10 trillion to $23 trillion. A significant portion of that is due to US Treasury borrowing, but corporate debt has also grown significantly from $2 trillion to $6 trillion outstanding. Not only has the bond market grown, it has generally migrated down in credit ratings. Now over 50% of the US Investment Grade Corporate bond market is rated in the BBB category, the lowest investment grade level. This is up from 35% at the end of 2007.

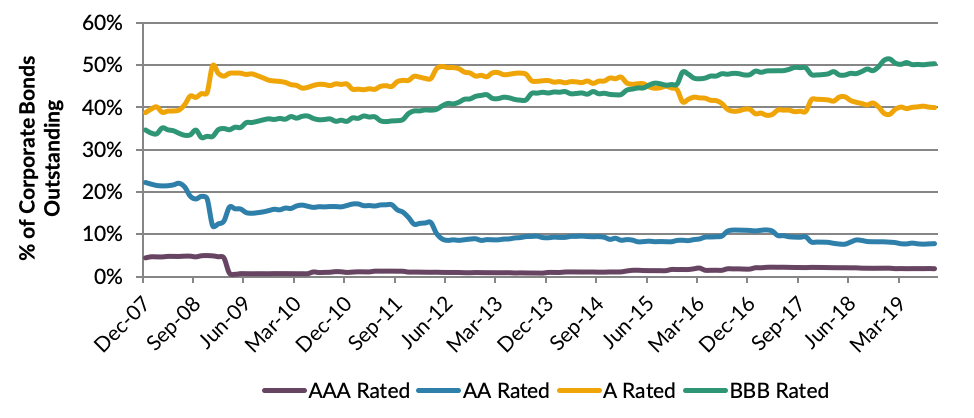

Figure 2: Corporate Bond Ratings

For an investor who maintains even a market weight to corporate bonds, their allocation to lower quality bonds has grown over the last decade. As a result, it’s highly likely that most pools are holding more corporate bonds, and more bonds with weaker credit ratings today than before the financial crisis.

With more debt outstanding, and debt that is lower rated, many investors are concerned about significant credit volatility in the next downturn. While defaults in investment grade bonds are rare, market valuations can become volatile when the economy slows as the market reprices the risk of downgrade to below investment grade or eventual default. This volatility would negatively impact the income and surplus of most risk pools. Further, ratings downgrades to below investment grade may have implications for compliance with a pool’s investment policy statement.

Action Items

Despite concerns about heightened risk in the corporate bond market, and an uncertain economic outlook, valuations in the market are not offering significant value today. Against this backdrop, what steps should your pool consider?

- At AAM, we are reducing risk in pool portfolios. We have been reducing our exposure to the corporate bond sector and redeploying cash in other high quality sectors such as Agency MBS, US Treasury obligations and senior Asset Backed and Commercial Mortgage Backed Securities. We have also reduced risk by transitioning holdings within the corporate bond sector to higher quality, more defensive companies and industries.

- We are also cautioning our pool clients that rating volatility may increase in the near term. Through prudent portfolio management downgrades should be infrequent, however it is possible that securities may fall below a minimum rating threshold. As a result, it is important to understand the steps mandated by your Investment Policy if a security is downgraded below investment grade. Clear Investment Policy language allows all parties to make decisions that are in the best long term interest of the pool and its members. One pool we work with took an interesting approach following the downgrades of the 2008-2009 period. The policy allows the lower of 2% of total invested assets or 5% of surplus in downgraded securities. This language allows a manager to be flexible in an effort to maximize value with regard to holding or selling securities in a downgrade situation. However, at these small sizes, it does not put undo stress on the balance sheet of the pool, and provides a clear avenue to maximizing value over time.

- Regarding portfolio duration, review your pool’s projected cash needs, contributions and current net position to be sure the duration target set in the past is still appropriate. Often duration targets are set and are not consistently reviewed. This is a good time to undertake that review.

At this stage in the economic cycle, it’s critical to prepare for a downturn or recession. While reviewing the entire investment portfolio, pools will benefit from considering the risks in both their allocations to stocks and bonds. With bond prices at or near historic highs, many holdings can likely be sold at attractive prices. Ensure you and your board are cognizant of the risk profile for your pool’s investment portfolio and consider its suitability for your specific circumstances.

AAM works with 11 of Risk Pooling clients. Dan is the lead portfolio manger for our pooling clients.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.