insight

How Do You Watch TV?

December 8, 2016

how do you watch tv?

By Elizabeth Henderson, CFA

Director of Corporate Credit

Last week, AT&T launched its long awaited video product, DirecTV Now. This service allows people in the U.S. to watch network television anywhere, anytime using an internet or mobile connection vs. traditional cable or satellite service. The promotion is very attractive, offering over 60 channels for $35/month. If you pre-pay for three months, AT&T will send you a 4th generation Apple TV box ($139 value), allowing you to watch the service on your television. It includes all the popular channels except for CBS and NFL Sunday Ticket (however, we expect both to be available next year). The user interface is easy to use, the picture quality is very good, and from our initial testing (using an iPhone), the latency and reliability is similar if not better than other over-the-top services (NFLX, MLB Network). Not only is the price attractive versus traditional cable offerings as well as competing products such as Sling, AT&T is allowing its mobile customers to stream the video without counting against their monthly data allowance.

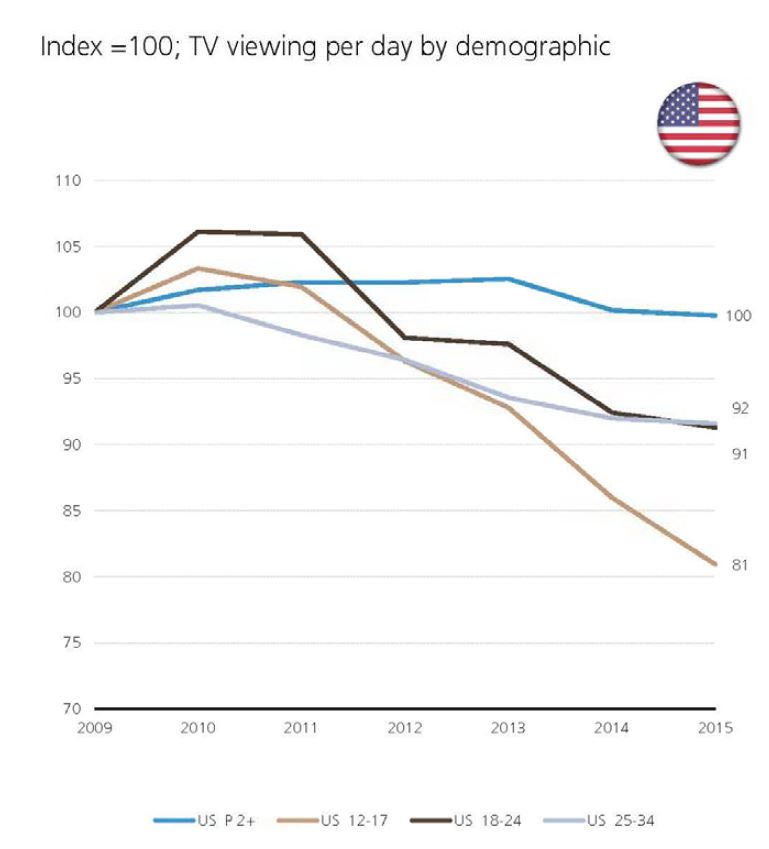

This is the first potential real disruptor to the traditional video bundle. While it is not at the same quality as traditional video service, it is considerably cheaper and mobile. We are reminded of the quality of service differences of mobile phones and landlines years ago, with mobile subscribers sacrificing quality for flexibility . AT&T believes video is moving to mobile just like voice did decades ago. As mobile networks get better, the quality of service should improve. Verizon and AT&T are aggressively working to upgrade to 5G wireless networks so that mobile customers have access to 1 gigabit per second (Gbps) speeds, which is similar to fiber network speeds today. This will also enable connected cars and other devices. That said, AT&T is not waiting for a better network to launch this product. They realize that younger audiences are not watching as much traditional television, as viewing options and habits are changing, and many believe that trend will continue.

Exhibit 1: Generational TV Viewing

Source: Barb, Nielsen

What are the implications to the industry? We believe there is a movement away from traditional cable/satellite television and believe in the merits of a mobile, internet based product.

The “winners” are:

- Wireless providers such as AT&T and Verizon that have the financial capacity to be a first mover in 5G as well as having the scale (operating and financial) to offer mobile video to consumers. Verizon has the ability to craft a similar package as DirecTV Now since it has relationships with media companies given its FiOS product. Verizon has also been acquiring firms to offer a more unique video solution. Will this push Comcast to buy a mobile company or spectrum? We think so.

- Media companies with solid programming such as Time Warner, 21st Century Fox, Disney and most likely CBS. Their distribution could increase after falling over the last three years. They should have access to a larger number of subscribers, given that a lower price point may entice younger viewers to pay for something other than just Netflix, for example. Over 20 million US consumers do not pay or pay very little for cable television today. According to a survey by UBS1, over 70% stated they would be interested in an internet pay TV service. The primary reasons were cost (cheaper than traditional cable) and mobility. With Netflix, Amazon and other subscription based providers creating their own programming, creating content for television has gotten more competitive. We believe this creates a barrier to entry, as larger firms especially those with studios can compete while smaller ones cannot.

The “losers” are:

- Smaller wireless providers including Sprint, T-Mobile and perhaps resellers like TracFone that lack the ability to offer mobile video either because of financial constraints (i.e., AT&T is likely losing money on its low priced DirecTV Now offering) or the lack of operating scale (no relationships with media companies, fewer subscribers which make it more expensive). As well, this removes the advantage Sprint and T-Mobile had by offering unlimited data. This was attractive to users that wanted to stream video, and now, with DirecTV Now streaming for free and Netflix allowing subscribers to download programming, this advantage is minimized.

- Cable operators which have earned economic rents for years under the traditional bundle. We are concerned for pure-play cable companies because they will need to upgrade their networks to be competitive in a 5G world, have a first class user interface (no more clunky cable box!), and lower the pricing on their products. While they should be able to demand a higher price because of the quality of service, they will need to pay media companies for the right to offer the same level of service to their customers using mobile devices. While some analysts are positive on the prospect of cable companies only providing the broadband connection vs. cable television, we would highlight the different capital structure that should accompany that business model. With a smaller, cash generative business, we would not expect management teams to prioritize investment grade ratings. Companies in this category include Time Warner Cable, Cox Communications, Dish Network, and Comcast but to a lesser extent given its ownership of NBC and its X1 platform.

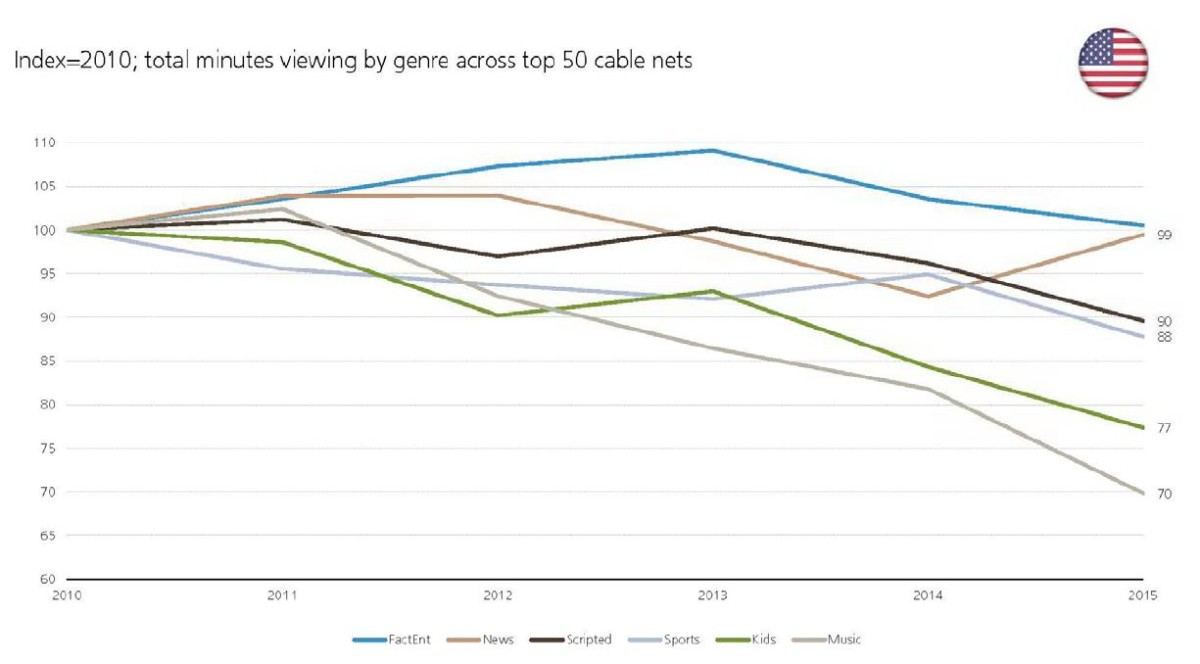

- Media networks that lack the scale of their larger peers will find it more difficult to maintain the same level of economics given the shift from linear to binge watching. This affects the demand for their programming and then the money they receive from cable/satellite providers and advertisers. These cable networks include Scripps, Discovery, AMC Networks and Viacom (see graph below that shows the steep decline in traditional kids programming) as well as much smaller ones such as Hallmark Channel. The new user interface will help direct the viewer to programming or offer the opportunity to watch an entire season over a shorter period of time instead of a guide that limits one to what is available at that particular time. This has been the trend, and we expect it to accelerate.

Exhibit 2: Linear Programming Source: UBS, Nielsen; Top 50 channels includes 12 factual entertainment networks (e.g., Discovery, History); 18 scripted networks (e.g., AMC, FX, USA, TBS); 7 kids networks (e.g., Nickelodeon, Disney Channel); 4 news networks; 3 sports networks; 2 music networks.

Source: UBS, Nielsen; Top 50 channels includes 12 factual entertainment networks (e.g., Discovery, History); 18 scripted networks (e.g., AMC, FX, USA, TBS); 7 kids networks (e.g., Nickelodeon, Disney Channel); 4 news networks; 3 sports networks; 2 music networks.

It’s harder to produce great programming because of the cost associated with it, as demand has increased by Netflix, Amazon and others for original programming. As fewer people watch programming that is “mediocre,” the premium paid by advertisers as well as cable/satellite providers to carry the network should decrease. Advertisers will have the ability to target a person instead of a group of people. In other words, advertising is moving from being able to target a group of individuals like those that watch Food Network to an individual based on the location and activity on one’s mobile device (Exhibit 3). This allows advertising to become more successful in a mobile environment. Will this advertising dollar be taken from the media networks or at least shared by the platform or mobile provider? Will this direct relationship with the customer push Disney to buy Netflix? We believe the burgeoning importance of the platform will be the catalyst for major acquisitions in 2017.

Exhibit 3: The Lifecycle of Targeted Advertising

Source: AAM

Source: AAM

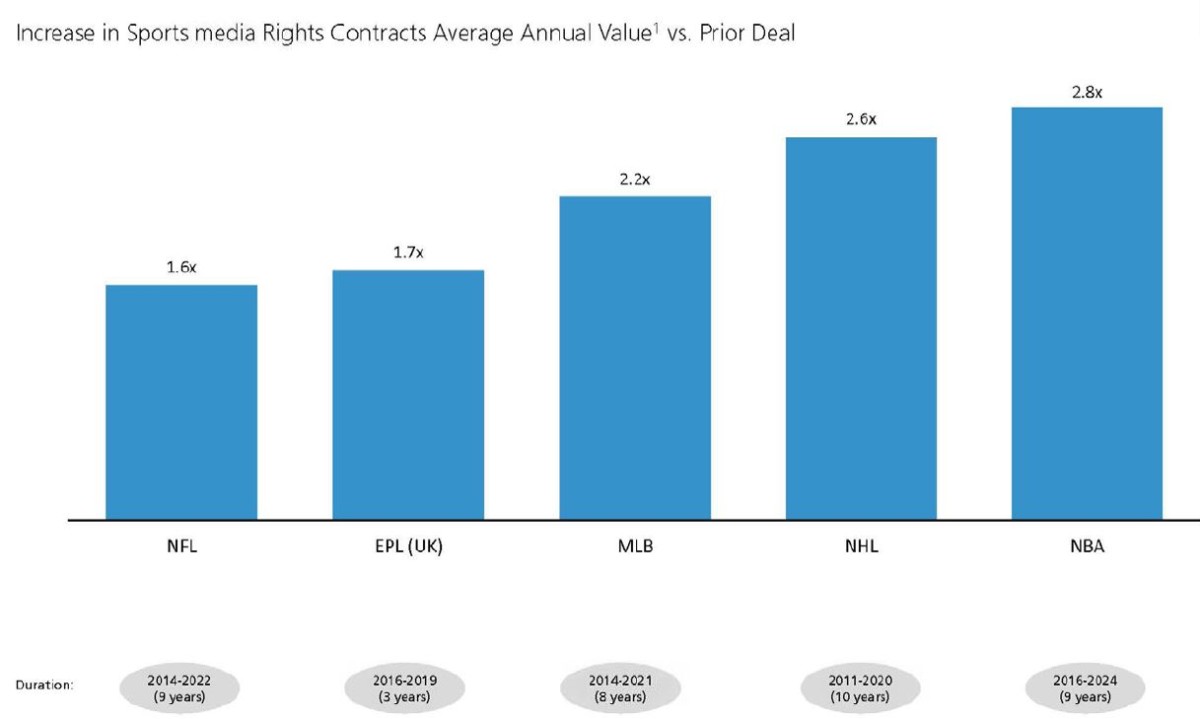

- Sports teams and networks have benefited from skyrocketing sports rights values. The rights to view sports programming have increased in value at a 2-3 times multiple in the past ten years. This was because of the increased use of time shifted programming (e.g., DVRs), causing commercial skipping. Since most people watch sports live, it increased the value of the advertising slots. However, this programming is the most expensive to carry, and if we start to see a real shift towards packages that allow people to customize, and/or cable/satellite providers get more selective with what they want to carry, it should negatively affect the distribution and overall value of this programming. Networks with long term rights agreements that are unable to change the economics of the agreements will likely be losers. However, we believe if the value of sports programming materially falls, the major networks like Fox will seek to renegotiate so they pay fair value. The teams may have no choice but to negotiate in order to avoid the risk of the network defaulting on the agreements.

Exhibit 4: Sports Rights Values

Source: Liberty Media

Source: Liberty Media

1 Excludes values of international media rights contracts, 2 Excludes value of Thursday Night Football and Sunday Ticket

We are just beginning to see real change in this sector, and expect investors will start to differentiate between the winners and losers in 2017.

Written By:

Elizabeth Henderson, CFA

1UBS, Doug Mitchelson, “Will 2017 be the year of Internet Pay TV? UBS Evidence Lab survey indicates robust demand”, 9/20/2016

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.