insight

Improving Investment Income Within the Medical Professional Liability Industry

May 14, 2019

Download PDFIndustry transitions

The medical professional liability (MPL) industry has been going through a period of tightening margins, soft pricing, and decreasing investment yields as detailed in AAM Insurance Strategist Peter Wirtala’s AAM Insight published in February 2019. As these factors are pressuring profitability throughout the industry, there are ways to improve the investment income generated from the fixed income portfolio that could benefit MPL insurers. The industry owns an allocation to tax exempt municipal bonds that have become unattractive versus other taxable sectors after the tax law change in 2018.

Tax law change

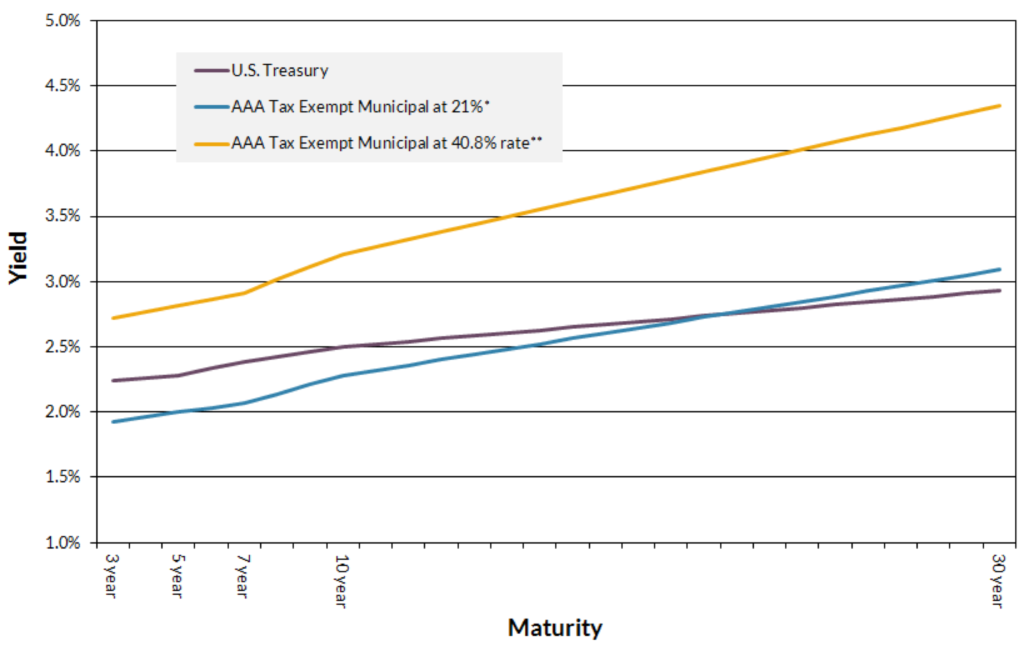

As part of the Tax Cuts and Jobs Act that was passed at the end of 2017, the tax rate for corporations was lowered from 35% to 21%. This change reduced the after tax yield on tax exempt municipal securities, making them unattractive for insurance companies in relation to other taxable fixed income sectors. The largest buyers of the tax exempt municipal debt are retail investors. Since individual tax payers have a higher tax rate relative to corporations, they receive a larger tax advantage for owning tax exempt securities. Exhibit 1 shows the difference in tax adjusted yields for AAA rated tax exempt municipals for individuals and corporations.

Exhibit 1: Market Yield – Individuals vs. Corporations

The new tax rate for corporations translates to tax adjusted yields that are lower than U.S. Treasury securities for maturities that are 20 years and shorter while the tax benefit at the highest tax bracket for individuals makes the sector attractive across the curve.

MPL fixed income allocations

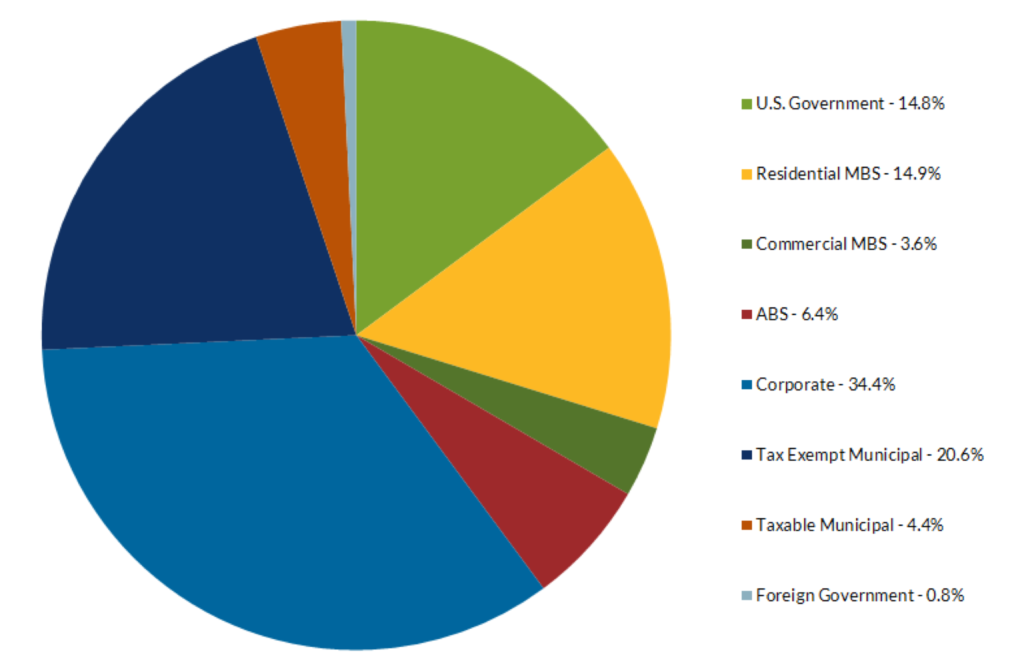

At the end of 2018, the MPL industry had an allocation of 20.6% to tax exempt municipal securities in their fixed income portfolios. Exhibit 2 details the investment grade fixed income allocations of the industry according to their year end statutory filings.

Exhibit 2: MPL Sector Breakdown

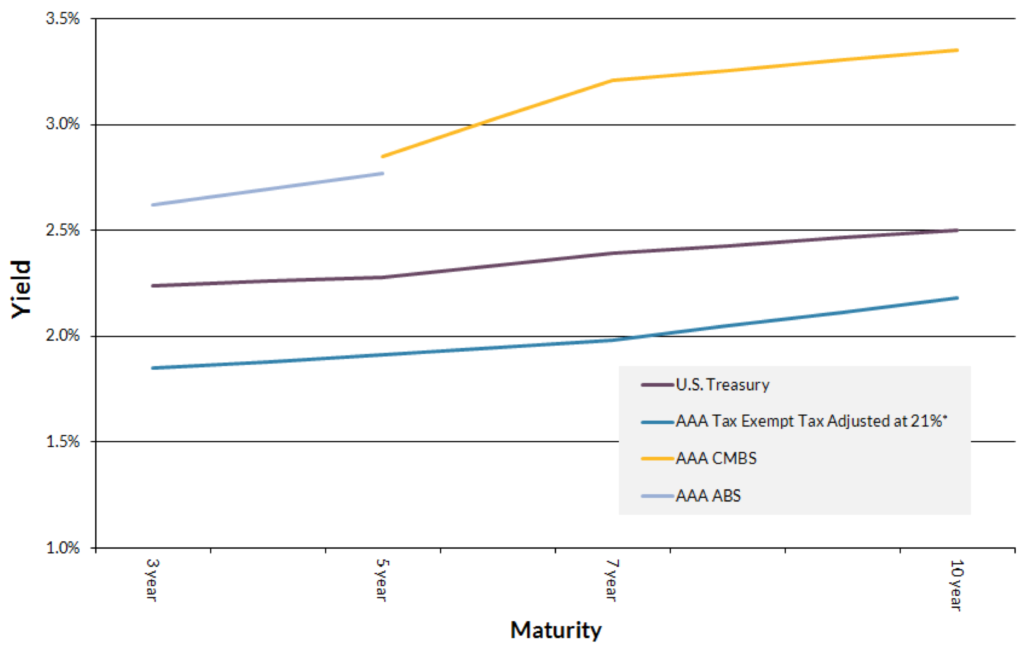

Given the current unattractive yields in tax exempt municipal bonds, the MPL industry would benefit by redeploying assets into high quality taxable sectors such as Asset Backed Securities (ABS), Commercial Mortgage Backed Securities (CMBS), and Corporate bonds, which provide a substantial yield advantage versus tax exempt securities today. If you dissect the tax exempt allocation of the MPL industry further, there is 4.5% of the fixed income portfolio that is under yielding U.S. Treasuries as of 04/30/2019. Exhibit 3 illustrates the yield advantage of 3-5 year AAA rated ABS and 5-10 year AAA rated CMBS versus similar tenor tax exempt securities.

Exhibit 3: Market Yield – ABS/CMBS vs. Tax Exempt Securities

ABS and CMBS are high quality sectors that are under allocated in the MPL industry. Their yield advantage over tax exempt municipals offers a way to improve the income profile of the fixed income portfolio. As of 4/30/19, 3-5 year AAA rated ABS securities provide an additional 75-100 bps and 7-10 year CMBS provides 100+ bps of additional yield versus AAA tax exempt securities. There are other factors to consider, such as each company’s tax situation and the effect of realizing gains/losses from sales, but the MPL industry should be reviewing their tax exempt holdings due the unattractive nature of the sector today.

Conclusion

Lower corporate tax rates have reduced the benefit of tax exempt municipal bonds for insurance companies. With the challenging underwriting environment, MPL insurers can increase investment income by reviewing their allocation to tax exempt municipal bonds and reallocating to higher yielding taxable sectors.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.