insight

Is a Mortgage Like Meltdown Brewing in Subprime Auto ABS?

May 8, 2017

Structured Products Strategy and Trading

Subprime Auto ABS has been a prominent headline recently with multiple articles suggesting that increased delinquencies are a sign of a bubble getting ready to burst, similar to the mortgage crisis of several years ago. So AAM took a look behind the headlines.

What does a Subprime Borrower Look Like?

Obviously, a borrower who falls into the subprime category is someone who is considered a higher-than-normal risk. Very often individuals find themselves in the subprime category due to one significant occurrence or due to a series of unfortunate events. Bad investments, a failed business, debilitating student loans, loss of employment, catastrophic medical bills and many other circumstances can quickly force people into precarious financial situations.

So what is the profile of a subprime borrower? They may have a history of late or missed payments, default debt, excessive debt, and personal bankruptcy or have few or no assets. As a result, they can only qualify for higher interest rate consumer debt and consequently, pay more in interest for mortgages, credit cards, car loans and car leases. In the United States subprime borrowers are typically categorized as individuals with FICO scores of below 640.

In 2008, subprime lending to people who may not otherwise have qualified lead to the mortgage crisis. Per JP Morgan, roughly 70%-80% of subprime borrowers were issued adjustable rate mortgages and when those loans adjusted to higher interest rates, refinancing was difficult due to declining home values. This resulted in a widespread domino crisis beginning with mortgage defaults which lead to foreclosures and eventually resulted in the declining value of mortgage-backed securities and a meltdown of the entire system.

Is that same trend happening today in Auto ABS?

In AAM’s review of data and information from multiple sources, the good news is that a mortgage-like meltdown does not seem imminent in the Auto ABS sector. According to JP Morgan:

- Subprime and deep subprime loans are a relatively small portion of new sales;

- Delinquency increases have been modest outside of subprime;

- Loan duration has seen no recent inflection;

- Premiums to US Treasuries that auto finance companies must pay have moderated.

JP Morgan goes on to state:

“Auto ABS collateral performance shows signs of deterioration in aggregate with the belief based on history that there will likely be a shakeout and/or consolidation of lenders. However, the feeling is that Auto ABS structures remain sound in spite of potentially higher losses.”

According to Deutsche Bank, the number of cars registered per household is as high as ever at 2.25 and most auto loans are issued to super-prime borrowers. Also, per JP Morgan, new car loan FICO scores remain flat at 711 going back to 2015, and while delinquencies have risen, they have not done so sharply. Although loan durations reached an average of 68 months in 2016 this increase is the result of longer average length of ownership and vehicle durability. It appears that it is well qualified buyers who are driving up loan durations due to continuously increasing new car prices.

So Why the Headlines?

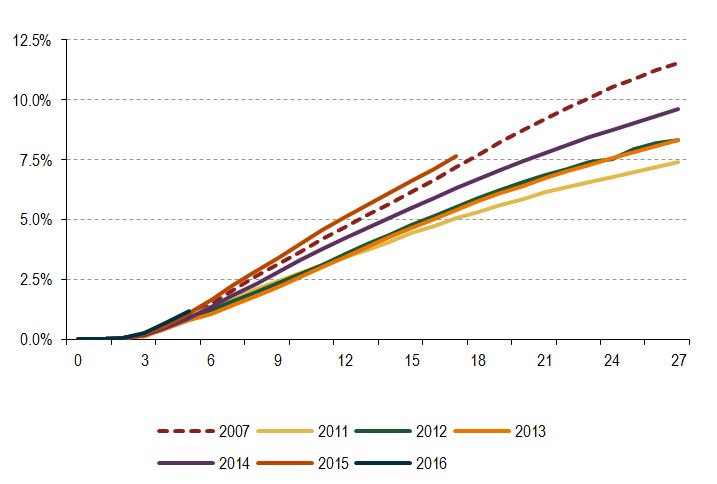

The reason for the worrisome headlines is because subprime Auto ABS cumulative net losses appear to continue to climb. According to Merrill Lynch, cumulative net losses for the 2014-2015 vintages are higher than the 2011-2013 vintages for sub prime issuers in aggregate. And, the 2015 vintage is tracking higher than those for the 2007 vintage.

| Non-prime auto loan ABS – Cumulative Net Losses |

|

Source: Intex, BofA Merrill Lynch Global Research

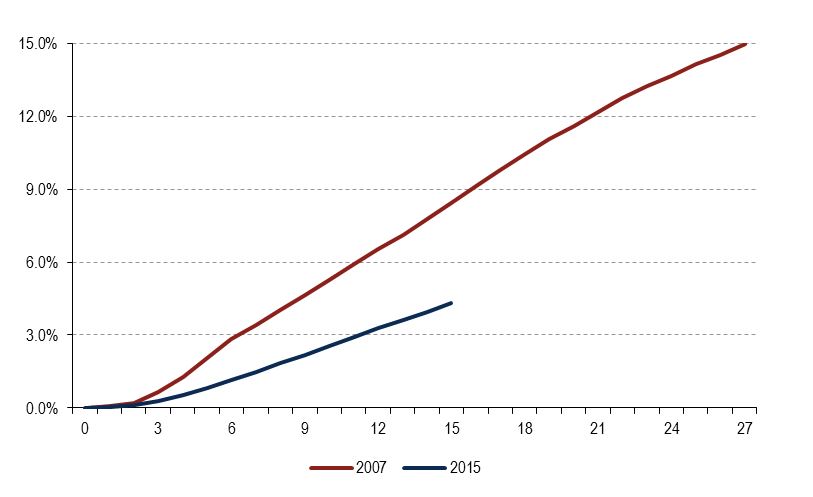

However, it must be noted that in comparing 2007 vintages to 2015 vintages, the latter includes additional and new lenders who focus on the deep subprime market, thereby skewing the results. When the data is normalized to compare similar types of lenders between periods, the 2015 vintage performs much better than 2007. According to Merrill Lynch, “Specifically, at 15 months of seasoning, the 2015 vintage has CNL of 4.3% while the 2007 vintage has CNL of 8.4%. Unadjusted, the CNL would be 6.6% for the 2015 vintage and 6.2% for the 2007 vintage.” So, as JP Morgan states, the sky is not falling on the automotive finance industry.

| Non-prime Auto Loan ABS – Cumulative Net Losses – Normalized 2007 v. 2015 |

|

Source: Intex, BofA Merrill Lynch Global Research

But there are some negative trends that warrant attention in the future, including:

- Car dealer inventories are rising as more vehicles come off leases;

- Lease penetration has risen to new highs as consumers search for ways to offset higher new vehicle prices;

- Even more vehicles will come off lease in the next three years;

- Overall auto loan delinquency rate has moved slightly higher due to uptick in subprime delinquencies

What Does This Mean for AAM Clients?

At AAM, we believe that subprime auto loan performance will continue to deteriorate in 2017 and 2018, although at a slow rate. Similar to earlier cycles, credit expansion in deep subprime auto lending is moving credit performance to weaker levels. The make up of more recent subprime lenders accessing the ABS market has dramatically changed since the 2008 recession. Lender and product mix and weaker vehicle prices could drive losses higher. The current level of enhancement for most auto ABS should limit the downside risk for these subprime deals.

Auto headlines will continue to hit news wires. Used car supply has close to doubled since 2011 and 2012. Higher than usual lease sales will continue to put pressure on supply in the future considering that 30% of all sales are now leases, which is up from 20% a few years back. Close to four million cars annually will be coming off lease in 2017 thru 2019 up from two million annually just a few years ago. AAM structures and light exposure to benchmark subprime ABS autos is nominal and we look to use any widening as an opportunity to add to senior bonds.

At AAM, we still view benchmark ABS issuers in prime auto loans, high quality credit cards, rate reduction, rail car and equipment ABS as a safe haven in structured products. The auto market is seeing tiering in the weaker and new sponsor names but we don’t see a systematic subprime auto breakdown ahead. The market will see spread separation in the usual benchmark subprime issuers versus the deep subprime entrants the market has recently seen.

Despite the subprime credit deterioration news, economic expansion and respectable wage growth is supportive for a majority of the ABS market. While we do see worse credit performance ahead in the student loan market place, consumer lending and deep subprime auto, we believe ABS investors will be well protected by their structures and credit support.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.