insight

Will It Be a “Merry Christmas” or “Bah Humbug” for U.S. Retailers This Year?

November 18, 2011

This is an important time of year for the retail industry. We make our prediction for holiday sales using a variety of indicators, trends, and statistical analysis. This will be an interesting holiday given all of the volatility in the capital markets. The results could ultimately set the tone for consumers in the new year.

With Thanksgiving approaching, we thought it prudent to release our outlook for holiday retail sales. This is an especially important time of year for retailers as holiday sales account for 25% to 40% of annual sales. The economic rollercoaster of 2011 is sure to make this year’s forecast a difficult one. Various retail trade associations and Wall Street analysts predict retail sales will be up 2% to 5%. We expect holiday sales will be slower than the 5.2% growth we saw in 2010 and closer to the ten year average of 2.6%. In this report, we touch on important retail trends and explore some of the most influential drivers of retail sales.

Economic Backdrop is an Important Factor for Consideration

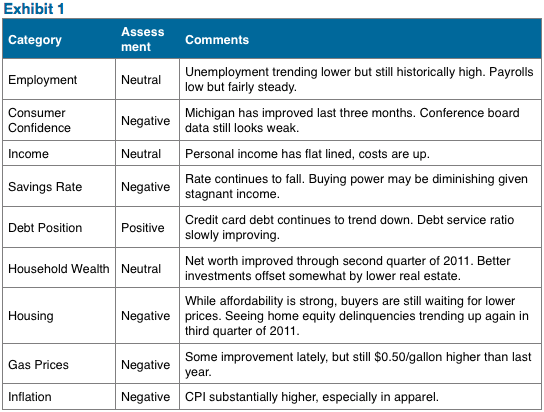

Perhaps the most important driver of retail sales is the willingness of the consumer to spend. To do this, we focused on nine categories which help us gauge the overall health of the consumer. We analyzed the most recent economic data points for each category and made a simple assessment for each category relative to data posted in November/December of last year (Exhibit 1).

An average of all the categories returned a score that was halfway between “Neutral” and “Negative”. Looking forward, we think household wealth could turn negative when third quarter data is released from the Federal Reserve given the significant drop in the stock market. An offset might be more favorable gasoline prices if the trend towards cheaper gas continues through the end of the year. In summary, we believe that the consumer is in a slightly weaker position today versus the holiday months of 2010. Recently, better economic data resulted in third quarter GDP of 2.5% coming in better than expected thus reducing the risk of a double-dip recession. However, we acknowledge this was largely as a result of consumers spending more, but using savings to do so.

Statistical Analysis Indicates a Stronger Season

Looking back on data over the last fifteen years reveals a strong relationship between “Back to School” retail sales (August and September) and “Holiday” sales (November and December). Strong “back to school” sales tend to lead to strong “holiday” sales and vice versa. To complete this analysis, we used the Bloomberg Same Store Sales Composite Index which includes a variety of retailers in the department store, discounter, and specialty subsectors. The regression model returned an R-squared statistic of 64% which means that “Back to School” sales explain 64% of the variability in “Holiday” sales. The model predicts “Holiday” sales of 5.0% when using 5.4% for the “Back to School” sales observed in 2011. This would be significantly better than the average which was 2.7% over those fifteen years. We recognize that this is strictly a mathematical analysis and does not include any qualitative data as inputs.

Seasonal Hiring is Weaker than Last Year

The National Retail Federation (NRF) predicts the retail industry will hire between 480,000 and 500,000 seasonal workers this holiday. That compares to 496,000 workers hired in 2010. In addition, Challenger, Gray, & Christmas thinks seasonal hiring will be about flat to slightly lower than last year. The Hay Group reported that about two-thirds of retailers expect to bring the same amount of workers back this holiday season while about 25% said they will bring back fewer workers. All of these various estimates reflect a muted tone from retailers for this holiday season.

Price Increases are Necessary for Sales Growth

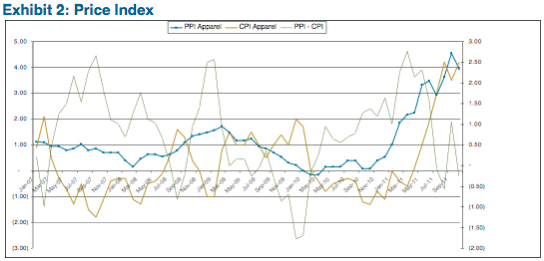

Historically, retailers have not been able to pass on the full effect of rising costs on to the consumer for fear of losing volumes and market share. This is illustrated in Exhibit 2 as the positive difference between apparel Producer Price Index (PPI) or producer costs and Consumer Price Index (CPI) or consumer costs. We expect price increases to be the main driver of sales for retailers this holiday season. CPI has been above 3% for the last six months. CPI is estimated to be up 3.4% year over year in the fourth quarter of 2011.

Retailers are always trying to balance lower margins and higher sales. This will be a bigger problem for those retailers that focus on basic items as opposed to those that have more fashion forward (inelastic) products. Going into the holidays, department stores and discounters are expected to be running inventories at relatively conservative levels. This should help to keep margins in check. In addition, we expect promotions to pick up as we haven’t heard much about “must have” new gift items. In the past, those kind of items have included TVs, cell phones, e-tablets. We don’t believe price increases will follow an increase in costs this holiday season. In addition, retailers are expected to increase promotions in an attempt to avoid lower volumes. In summary, there’s limited ability for retailers to drive same-store-sales with increased prices above what we expect from inflation.

Cyber Shopping is Expected to be Strong

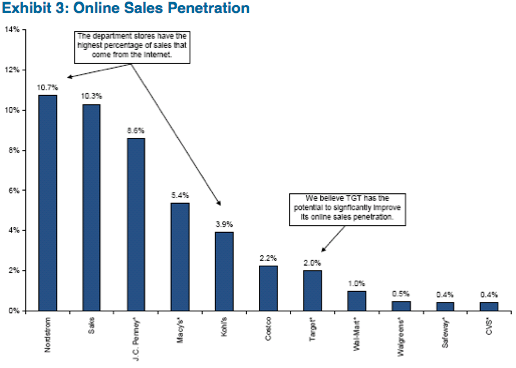

Online shopping has become so popular that the industry has coined the Monday following Thanksgiving as “Cyber Monday.” Most retailers have recognized the importance of online commerce as more than two thirds expect sales to be up 15% or more compared to last year. Many retailers have enhanced their web sites and have already starting promoting the holiday season on social platforms such as Facebook and Twitter. Ease of use, convenience, ability to compare prices, and free shipping offers are some of the main reasons why consumers shop online. A survey by the NRF showed that the average shopper plans to do about 36% of his or her shopping online in 2011, compared to 33% last year. While this trend is positive for the industry, there are still a lot of other important factors to consider as online sales typically represent only about 5% of total retail sales. As shown in Exhibit 3, some retailers are more focused on e-commerce than others. In particular, the department stores have done a better job penetrating this market than others. We expect the growing popularity of e-commerce to help sales this holiday season.

Inventory Management has Improved the Sales Process

Another important trend for the retail industry has been the improvement in inventory management. Controlling inventory is one of the most critical operating activities for a retailer. It is a delicate balance between having enough inventory, so sales aren’t lost and having too much, so the product doesn’t have to get discounted. Since the last economic recession, companies have invested a lot of capital into technology that integrates inventory across all channels, including the entire store base and central warehouses, which support the online business. Inventory has become more transparent to the shopper and the sales associate who is trying to win a sale. A customer who is searching for a product on a retailer’s web site can either order the product online to be shipped to the home or to a local store. A very convenient feature for the customer is the ability to see if a particular product is in stock at a nearby store. Behind the scenes, inventory moves from store-to-store, from warehouse-to-store, or directly to the customer’s home. Also, retailers have become more localized in their merchandise decision making process. With better inventory systems, retailers have the ability to more closely monitor inventory so product that is not selling well in a particular region can be moved to a different location. Some retailers have equipped their sales associates with mobile devices with real-time access to inventories and the ability to complete a sale on the spot. At the end of the day, inventory management has become more productive and the customer receives a better service experience. We expect these improvements to improve sales and margins as fresh product reaches shelves more quickly and markdowns are reduced. In addition, retailers are also investing in their supply chain. Shorter cycle times and improved reorder capabilities are resulting in better product success and more conservative inventory positions.

Survey Results Indicate Consumers will Spend Prudently

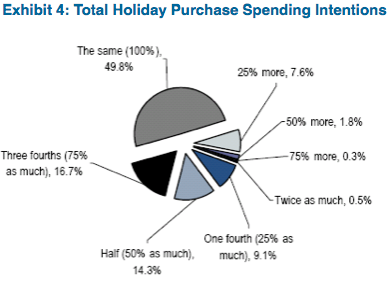

Exhibit 4 shows the results of a survey conducted by the Citigroup retail group. The survey was an online holiday survey which included more than one thousand responses for consumers between the ages of 18 and 65. About half of the respondents plan to spend the same as last year. That’s up from 45% last year and 41% the year before. And 10.2% said they would spend more in 2011 which was the same as last year. The survey reveals a slightly more optimistic consumer. Other interesting observations were: more consumers are looking for discounts, more consumers will shop online this year, and consumers are most concerned with the economy this year versus job status/income last year.

Summary

In summary, we see no reason for retail sales this holiday season to be much different from the average year over year growth of 2.6%. The tone of the typical consumer and the drivers of their spending patterns are a bit weaker now than when compared to last year. A lack of exciting items along with discount hungry shoppers will make it difficult for retailers to push up prices without sacrificing significant volume. Having said that, we believe retail sales will end up slightly better than the average helped by some important trends in the retail industry. Forced by the perils of the latest economic recession, retailers have become much smarter and more conservative. This has been helped through the addition of better inventory and supply chain systems. We expect e-commerce to continue to grow and become a larger proportion of total sales. We believe it will continue to help drive overall retail sales in the future. Finally, our regression analysis based on ‘back to school” sales returned a holiday sales number closer to last year’s 4.6%.

Credit Selection

We continue to be very selective when considering opportunities in the retail space. The economy remains very sensitive while news flow concerning the European debt crisis has kept global capital markets incredibly volatile. In addition, the retail landscape continues to evolve and competition has never been more cutthroat. We favor those credits that either benefit from a positive secular trend (e.g., CVS) or have proven their ability to succeed in a particular niche (e.g., Home Depot, Nordstrom). For higher quality focused investors, Wal-Mart and Target continue to be very strong operators. Both have taken market share away from traditional grocery stores and middle-market department stores.

Michael J. Ashley

Vice President, Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.