insight

Will the Volatility Last?

March 7, 2016

The start of the year ushered in a heightened level of spread volatility. Markets reacted to lower commodity prices and an increased risk of a global recession. The Investment Grade Corporate market experienced spread widening of 50 basis points at the wide point in mid-February. Defensive industries have outperformed, with non commodity sectors contributing more to the market widening this year.

Is It Over?

As of early March, the market has recovered about half of that widening due to the bounce in commodities and more favorable economic data. The economic data points we follow have signaled a slight improvement from the deterioration we have seen since September 2015. Market anxiety remains in regards to China, “Brexit,” and the trajectory of commodity prices. AAM entered the year expecting volatility to be higher and economic growth to be lower than expected but not negative. We have been communicating that we believe we have been in the late stage of the credit cycle since mid-2014. After reviewing fourth quarter results and listening to earnings calls during which management teams provides their guidance for the year and discuss capital allocation, we do not believe the cycle has turned, and thus, do not expect Investment Grade credit spreads to meaningfully tighten.

Fundamentally, credit risk is elevated. At a market or median level and excluding commodity related sectors, revenue and EBITDA growth rates remain abysmal. There are certainly exceptions at an industry level. We highlight sectors such as Pharmaceuticals that are expected to grow nicely this year. That sector is one we expect will continue to be active with mergers and acquisitions, and we anticipate attractively priced new debt issues to be the result.

During earnings calls, we did not hear management teams become more balance sheet focused unless they were in the midst of deleveraging from a prior transaction or in a stressed sector like Energy. We heard much of the same – cash flow and capital allocated to share repurchase programs, increased dividends, and the pursuit of M&A opportunities. With the cost of debt still well below the cost of equity, we don’t anticipate a change. Until markets reprice risk, we expect to remain in this trading range, more likely resetting higher as economic risk increases given the tightening of financial conditions.

Is There Value in the Investment Grade Market Today?

Yes. We entered the year, expecting the corporate OAS to trade within a range of 145-215 basis points (“The Future Ain’t What It Used to Be” – AAM 2016 Investment Outlook), and we remain on the wider end of that range. We highlight the following opportunities:

1. New debt issuance from:

a. issuers funding M&A transactions that we project will add value to the enterprise

i.Examples include credits in the Beverage and Pharmaceutical industries (Anheuser-Busch InBev N.V. (ABIBB), Molson Coors Brewing Company (TAP), Teva Pharmaceutical Industries Limited (TEVA), Pfizer, Inc. (PFE), Mylan N.V. (MYL))

b. high quality companies financing share repurchase programs

i. Examples include companies with stable cash flows and a sensitivity to credit quality because of their need to fund working capital (Lowe’s Companies, Inc. (LOW), Wal-Mart Stores, Inc. (WMT), 3M Company (MMM), Walt Disney Company (DIS))

c. high quality credits in sectors that have cheapened with the increasing risk of recession and “lower for longer” interest rates

i. Examples include Autos, Retail, Insurance Brokers, Banks (subordinated)

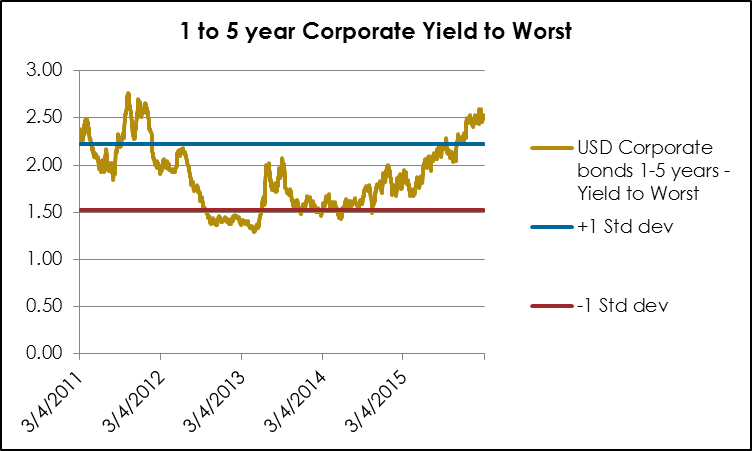

2. Secondary opportunities in credits with the financial flexibility to maintain investment grade ratings in a downside scenario. We also note the improvement in value on the short end of the corporate curve (1-5 years) relative to the last five years (Exhibit 1).

Exhibit 1:

Source: Barclays and AAM

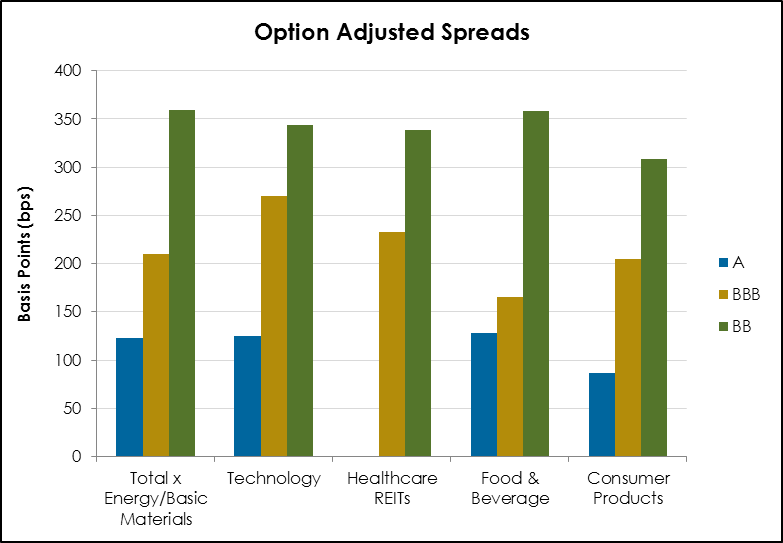

We do not see value everywhere; however, and are largely avoiding sectors and credits we believe are most vulnerable in a low growth environment. The Technology sector is one that has raised a lot of debt and now faces lower return prospects. We are avoiding credits rated BBB in that sector. Another is Healthcare REITs, a sector we have avoided because of concerns about rapid consolidation and competition amongst the largest operators, and given our view that not all of the operators will thrive once the sector stabilizes. We are also cautious about the aggressive push into operating businesses under RIDEA (REIT Investment Diversification and Empowerment Act) by the largest Healthcare REITs. Lastly, the Food and Consumer Products sectors are filled with household names that have failed to execute and are vulnerable to shareholder activist pressure or debt financed M&A to increase shareholder returns. Looking at various spreads in these sectors (Exhibit 2), we fail to find value in the single-A rated credits vs. Industrial peers. For BBB Tech and Healthcare REITs, we believe the rationalization that needs to occur will push spreads wider, towards BB levels.

Exhibit 2:

Source: Barclays (as of 2/29/16), AAM [Note: Total = Barclays Industrial sector]

For more information, contact:

Colin T. Dowdall, CFA

Director of Marketing and Business Development

colin.dowdall@aamcompany.com

John Olvany

Vice President of Business Development

john.olvany@aamcompany.com

Neelm Hameer

Vice President of Business Development

neelm.hameer@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.