Convertible securities are a unique asset class that complement traditional insurance company investment portfolios. In a simple sense, convertible debt combines corporate debt with a warrant that is exercisable into the equity of the issuer. Convertible security valuation is influenced by factors affecting the corporate debt instrument as well as factors relating to the conversion option – share price, volatility, time to expiration and the level of interest rates. Particularly, balanced convertibles have an asymmetrical risk/return profile – participating in equity market rallies, while benefiting from a bond price floor in times of equity market stress. As such, a diversified portfolio of balanced convertibles can be attractive assets for insurance companies. AAM has been partnering with Zazove Associates, LLC (Zazove) for over 30 years in managing portfolios of convertible securities with such profiles for insurance clients.

A Compelling Segment for Total Return

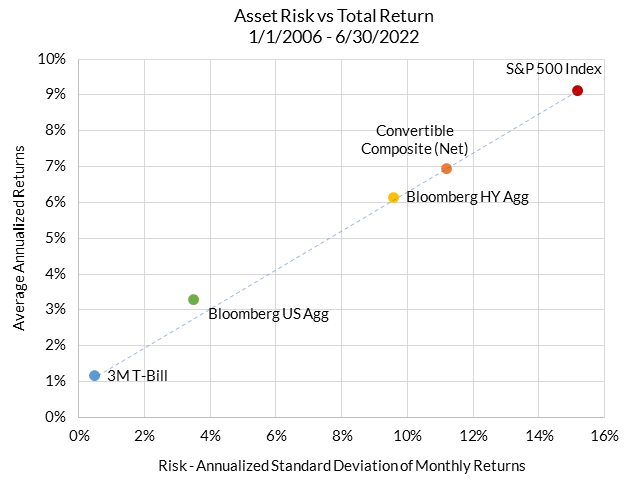

Total return for convertible securities has historically exceeded investment grade and high yield bonds, generating competitive risk-adjusted total return compared with equity markets. Data from January of 2006 to June 2022 shows that Zazove’s actively-managed Institutional Blend composite consisting of balanced convertible portfolios has produced an annualized net-of-fees total return of 7.0%1. The S&P 500 over this time had an annualized total return of 9.1%. Comparing asset class returns per unit of risk (annualized standard deviation of monthly returns), convertible bonds exhibit risk-adjusted returns of 0.62, similar to the S&P 500 at 0.602.

Exhibit 1

Source: Bloomberg Finance L.P., Zazove Associates LLC

Traditional portfolios of fixed income and equity securities that seek to optimize risk/return attributes can benefit from the inclusion of convertible bonds, an asset class with favorable performance and offering diversification benefits. We believe investment strategies focused on asset growth, yet attentive to managing market risk, should evaluate convertible bonds for inclusion based on these factors.

Benefits for Insurance Companies

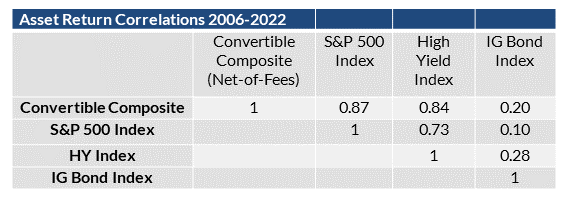

As entities subject to statutory accounting principles, insurance companies that invest in convertible bonds benefit from favorable accounting treatment. NAIC statutory accounting guidance treats convertible securities as typical bonds on company balance sheets, subject to SSAP 26. Insurers, in effect, receive bond accounting and capital treatment for an asset class that exhibits a return profile with a high degree of correlation to equity markets and little correlation to the U.S. high-grade bond market.

Exhibit 2

Source: Bloomberg Finance L.P., Zazove Associates, LLC

Carrying Value & Rating Impact

A closer look into the accounting and regulatory considerations reveals additional benefits of investing in convertible bonds. Within regulatory capital models, capital requirements are linked to the convertible debt instrument’s credit rating – beneficial relative to lofty required capital levels for equity holdings. Furthermore, for property & casualty insurance companies, investment grade-rated convertibles are carried on balance sheet at amortized cost with no surplus adjustment due to market movements. For life insurance companies, this treatment extends to all convertibles rated NAIC 5 (equivalent to CCC quality) or better. In both cases, these accounting principles measurably buffer surplus from market volatility for statutory accounting filers.

AVR/IMR Treatment

Furthermore, statutory accounting guidance offers additional benefits to life insurance companies investing in convertibles. When determining whether to book a gain or loss through the Asset Valuation Reserve (AVR) or the Interest Maintenance Reserve (IMR), life companies are required to measure the conversion value at the point of purchase and sale. As a result, any gains are most often recognized in the current period, while losses are amortized to maturity through the IMR.

GAAP Considerations

Insurance companies preparing GAAP financial statements are afforded an interesting choice in accounting treatment with potential benefits. Convertible investors can carry the assets on a bifurcated basis – treating the bond and conversion feature as separate assets. The bond component may be held as an Available-for-Sale asset, generating a competitive level of investment income while changes in valuation of the more volatile derivative component would be booked through realized gains/losses.

Statutory Accounting Return

Given the preferential treatment of convertible securities on insurance company statutory balance sheets, it is worthwhile to examine their investment performance in statutory accounting terms. Standardized total return measures incorporate price changes and income receipts. For equities, which are carried at fair value for statutory reporting, the total return measure is directly linked to the impact on statutory surplus. However, the accounting treatment applicable to convertibles calls for a different approach in determining statutory accounting return.

We can approximate statutory return by considering several factors which are relevant for statutory accounting treatment. These factors include bond rating category, book-adjusted carrying value, statutory investment income including amortization and accretion, and the realization of gains and losses.

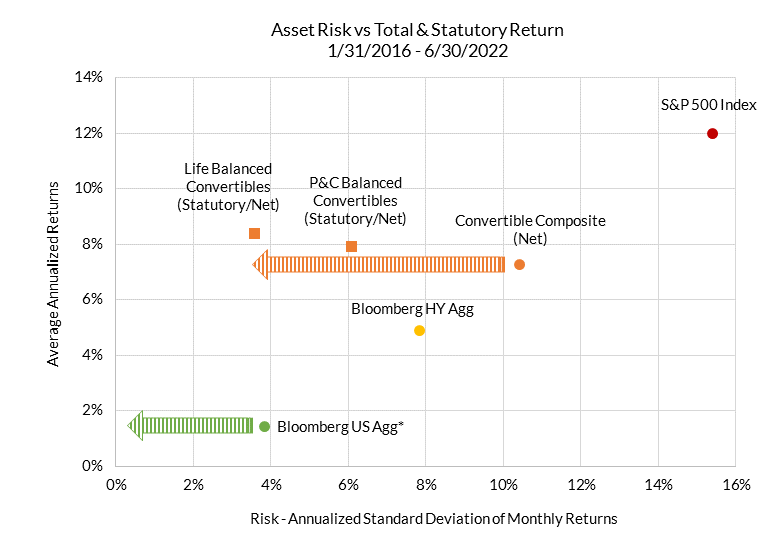

P&C Insurers

Applying this methodology to two property & casualty insurance client portfolios that are part of the above referenced Zazove-managed convertible composite, the statutory return net-of-fees is in line with the standard total return calculation for the trailing 6.5-year measurement period. This is intuitive as the economic and accounting benefit of holding an asset should be consistent over time regardless of the calculation method. What is notable is the decline in standard deviation of returns. This analysis indicates that the carrying value volatility exhibited by these two convertible portfolios is 61% lower than the S&P 500 return volatility.

Life Insurers

Looking at a life insurance company, this approach indicates an even more favorable result as the majority of convertible bond holdings are held at amortized cost. In fact, over the illustrative time period, the surplus volatility borne by the sample life company was 77% lower than would have been experienced in an S&P 500 index fund. With returns dramatically outpacing investment grade bonds, this company was able to generate a compelling return on invested statutory capital with limited surplus volatility.

Exhibit 3

*Investment grade bonds would also exhibit limited statutory carrying value volatility, with statutory return being driven by income fluctuation versus price return. Effect is not modeled.

Represents monthly return data for 1/1/2016 to 6/30/2022 with Convertible Composite and sample account returns shown net-of-fees.

Source: Bloomberg Finance L.P., Zazove Associates LLC, Clearwater Analytics

Bottom Line

We believe convertible bonds managed per the Zazove Institutional Blend strategy can be an attractive asset class for investors looking for equity market participation while balancing downside risk. The additional benefits afforded by statutory accounting principles and regulatory capital treatment produce significantly lower statutory capital volatility and strain for an asset that is strongly correlated with equity markets. Insurance companies looking for equity market exposure in a capital-efficient manner should consider this strategy to seek to enhance investment results. AAM and Zazove have brought the benefits of actively managed, balanced convertible strategies to insurance clients for over thirty years. If you are interested in learning more, please contact your AAM portfolio management team or email us at marketing@aamcompany.com.

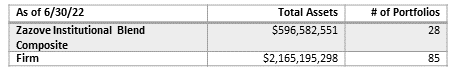

1. Source for S&P 500 Index returns is Bloomberg Finance L.P., source for Institutional Blend convertible composite data is Zazove Associates, LLC. 2006 reflects first full year of available data for the convertible composite. Data as of 1/1/2006 to 6/30/2022. Composite return data is net-of-fees assuming a $50 million portfolio with the preferred fixed fee rate structure offered to the AAM portfolios. Past performance is not indicative of future results.

2: Id.

Disclosures

S&P 500 Index is the SPX Index, Bloomberg HY Agg is the Bloomberg US Corporate High Yield Bond Index, Bloomberg US Agg is the Bloomberg US Aggregate Bond Index, 3M T-Bill is the Bloomberg U.S. Treasury Bellwethers: 3 Month Total Return Index.

Convertible composite is the Zazove Institutional Blend Composite.

AAM and Zazove’s relationship consists of a fee sharing arrangement.

Bloomberg Index Services Limited. BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Bloomberg does not approve or endorse this material or guarantee the accuracy or completeness of any information herein, nor does Bloomberg make any warranty, express or implied, as to the results to be obtained therefrom, and, to the maximum extent allowed by law, Bloomberg shall not have any liability or responsibility for injury or damages arising in connection therewith.

Notes to Performance: Zazove Institutional Blend Composite

1. Zazove Associates, LLC, a Delaware limited liability company (“Advisor”), claims compliance with the Global Investment Performance Standards (GIPS) and has prepared and presented this report in compliance with the GIPS standards. Advisor has not been independently verified. Valuations are computed and performance is reported in U.S. dollars. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. Advisor is a registered investment advisor and the successor to Zazove Associates, Inc., an Illinois corporation that transferred its investment advisory business on January 1, 1995 to Advisor. Zazove Associates, Inc. is the managing member of Advisor.

2. The composite was created as of September 1, 2005 and includes all fee-paying discretionary portfolios over $5,000,000 managed for Qualified Institutional Buyers under the Zazove Institutional Investment Grade Blend Convertible Strategy, which mandates an investment grade average credit quality for at least 75% of the portfolio and allows for purchases of securities rated less than BB-. Portfolios managed under this strategy are allowed to have certain exposures to convertible preferred stocks and foreign securities and provide for certain diversification requirements with regard to industry, issuer and security. This investment strategy creates and manages a diversified portfolio of convertible securities through an investment process anchored by Advisor’s proprietary valuation model, which seeks to identify statistically undervalued convertible securities with attractive risk/reward characteristics.

3. Portfolios that have significant additions of capital are excluded from the calculations for a month on the following basis: (i) if the cash balance at the beginning of the month is greater than 15% of the portfolio’s market value and is the result of an addition of capital by investor, (ii) if, as a result of an intra-month addition of capital by investor, average capital for a month is greater than 25% of the portfolio’s market value at the close of the prior month, or (iii) if, as a result of an intra-month addition of capital by investor, average capital for a month is greater than 15% of the portfolio’s market value at the close of the prior month and the ending cash balance is greater than 15% of the portfolio’s market value. A portfolio is excluded from the calculations for a month in which the account is considered non-discretionary as a result of specific instructions by investor (e.g., account liquidation, trading freeze, sell instructions). Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request.

4. Composite dispersion for any period is calculated by the standard deviation of asset-weighted portfolio returns and only includes portfolios represented in the composite for every month during the period. Number of portfolios, composite assets and firm assets are determined at the close of the period.

5. Composite returns are presented both before management fees (gross returns) and after management fees (net returns). In both cases, returns are before custodial fees, but after trading expenses and non-reclaimable withholding taxes. Net returns assume a 0.75% management fee, which is Asset Allocation and Management Company’s (AAM) basic fee schedule for a $50 million portfolio managed under the Zazove Investment Grade Blend strategy.

6. A complete list and description of firm composites is available upon request. Zazove Associates, LLC’s policies for valuing investments, calculating performance, and preparing GIPS Reports are available upon request.

7. Historical performance data reflects actual past performance and is not a guarantee of future performance.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.