post

AAM Comments on the Federal Reserve’s Rate Cut

March 3, 2020

In a surprise move, the Federal Reserve this morning cut the Federal Funds target range by 50 basis points to 1.00% – 1.25%. Although the markets had been pricing in rate cuts from the Fed to help ease concerns from investors due to the spread of the coronavirus, most economists believed the Fed would wait until their scheduled meetings to take action. Today’s action from the Fed was the first emergency move since the 2008 financial crisis.

So why did the Fed cut rates? During a press conference following the rate cut, Fed chairman Jerome Powell said “the action was taken to keep the U.S. economy strong in the face of new risks to the economic outlook”. The move was surprising given that as recently as last week, some Fed officials thought it was too soon to respond to the virus. Today’s vote to lower rates was unanimous.

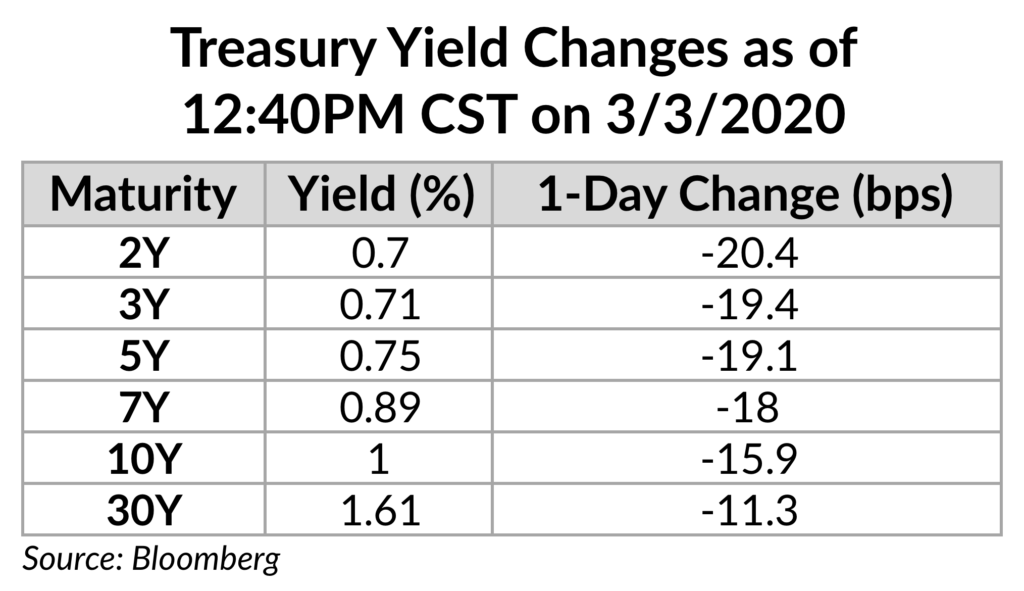

Investors appear skeptical that today’s action from the Fed will be effective. Equity markets briefly moved higher following the rate cut but are currently in the red. Treasury yields have moved significantly lower across the curve.

Bottom Line:

Global economic activity is being pressured due to supply-chain disruptions and challenges in end-market demand and it’s unclear on how lower rates will help. The Fed is hoping that by cutting rates, they will help support consumer and business sentiment and ease financial conditions.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.