post

AAM Newsletter: Fourth Quarter 2015

December 15, 2015

Welcome

By John L. Schaefer, CFA

President

[toc] As we head into the holiday season, AAM is marking the end to a successful year. We have made substantial new investments in our business, including:

- An exciting upgrade to our client reporting and technology platform through the Clearwater Analytics partnership. Clearwater is the gold standard in providing risk analytics, performance reporting, and investment accounting to insurers.

- Launching a new private placement offering through our relationship with Advantus Capital Management. Advantus is one of the premier providers of private placement portfolio management with deep infrastructure including legal and compliance support.

Please mark your calendars for the 2016 AAM Investment Conference which will be held on May 16th and 17th at University of Chicago’s Gleacher Center. This year, we will be providing interactive small group break-out sessions to enhance both networking and educational opportunities.

All of us at AAM wish you safe and restful holidays.

Market Update

By Reed J. Nuttall, CFA

Chief Investment Officer

The Federal Reserve is expected to announce an increase to the Fed Funds rate to 0.25% on December 16, 2015. We expect that announcement to be followed up with guidance that the Fed will be cautious as it approaches future hikes, taking a “wait and see” approach to the economy in the first quarter of 2016. The employment picture is looking better, with the non farm payroll number averaging 220,000 new jobs a month for the past year. This strength in employment gives the Fed room to move up from the zero interest rate policy of the past 5 years. However, this hike also contributes to a strong dollar which puts future manufacturing job gains in doubt.

We are in the late stage of the credit cycle, as leverage, M&A activity, share buyback and dividend payments have increased at a time when earnings growth is slowing. We expect this to continue to be a headwind for spreads and an impetus for rating downgrades. Slowing growth in China has affected the commodity markets, and spreads have widened in those sectors. Market technicals have improved but debt funded M&A and share buybacks and overall refinancing activity should keep issuance levels high. Positively, fundamentals are good in the U.S. (housing, auto, consumer). Although spreads have widened, this is a time to remain defensive and selective. As lending standards tighten, commodity prices remain volatile, and global growth remains stubbornly low, we are growing increasingly more cautious.

We are in the late stage of the credit cycle, as leverage, M&A activity, share buyback and dividend payments have increased at a time when earnings growth is slowing

Within these constraints, we favor high quality Corporate bonds, using this low rate environment to move up in quality. We think the liquidity and quality offered by short ABS securities make them attractive. We are underweight Agency MBS as the strong demand from the Fed has created a supply/demand imbalance within this market. Both CMBS and Taxable Municipals have offered excellent returns this year and we currently view them as fair. Given the uncertainties across markets, we have increased our allocation to Treasuries while waiting for a more constructive re-entry point for both Agency MBS and lower quality corporate bonds. Tax-exempt municipals have performed very well this year; we continue to overweight the sector.

AAM Hosts Webcast to Discuss the Opportunity in Convertible Bonds

On Tuesday, October 20, 2015, Portfolio Managers Tim Senechalle and Allison Balestrino hosted a webcast to discuss the opportunity in Convertible Bonds. With many equity valuation measures suggesting caution, and underlying economic fundamentals sending mixed messages, AAM recommends that insurers consider Convertible Bonds which balance the potential upside with downside risk management.

To learn more, please click the link below to read about the asset class.

The Investment Opportunity in Convertible Bonds for Insurance Companies

AAM Partners with Clearwater Analytics for Investment Accounting

Following a thorough review of AAM’s technology platform, the Board of Directors has approved a partnership with Clearwater Analytics, a leading provider of web-based investment accounting solutions for insurers, as the firm’s investment accounting, reporting, and analytics solution.

In discussing the value of the technology, John Schaefer, President, described the system as “the gold standard for insurers.” The flexibility and access to data will enhance the user experience.

The system will provide the following:

- An automated investment accounting and reporting solution

- Integrated portfolio performance and risk analytics

- Timely investment policy compliance monitoring

- A user-friendly, web-based solution

- Customized, automated, and specialized reporting capabilities

The Clearwater Analytics platform will be rolled out to clients starting in January 2016.

AAM Announces Strategic Private Placements Relationship with Advantus Capital Management

AAM has entered into a strategic relationship with Advantus Capital Management to distribute a separate account Private Placement Fixed Income investment strategy to existing clients and prospective clients.

Private Placements have the potential for enhanced yields over comparable public bonds, and can increase diversification with access to fixed income securities not available in the public bond market. Advantus has been active in the market for over 30 years, and adheres to a well-established, credit-focused investment approach. Advantus provides the expertise and infrastructure to support a strategy that invests across the investment grade credit spectrum.

The Private Placement strategy has been a staple in Life insurance portfolios for decades due to the enhanced income and ability to absorb reduced liquidity. However, there has been increased interest from Property & Casualty and Health insurers looking for diversified sources of income. Advantus has the flexibility to tailor portfolios to meet custom duration targets, including shorter liability Property & Casualty and Health insurers.

The Perfect Storm: Fixed Income Portfolio Management in a Reduced Liquidity Environment

AAM believes that one of the most significant investment risks for insurance company investors is the potential for a liquidity crunch due to the reduced inventory capacity of broker/dealers. The primary reasons for reduced inventory are new regulations including Basel III capital guidelines and the Dodd-Frank Act.

At the same time that the bond market liquidity has been challenged, the bond buyer universe has experienced a transformation. Insurance companies and pensions have remained large buyers, but their proportion of the market has dropped as ETFs and foreign buyers have increased. Further, the investment management community has experienced rapid consolidation as the largest fixed income managers have continued to grow market share.

With both reduced liquidity and a transformed bond buyer universe, AAM believes that there is a benefit to being a smaller, nimble manager. To learn more, please click here:

The Perfect Storm? Fixed Income Portfolio Management in a Reduced Liquidity Environment

Employee Spotlight: Neelm Hameer,

Vice President of Business Development

How did you get into working in Insurance Investment Management Sales?

I joined AAM eight years ago as a Marketing Analyst. I wore many hats in the role and was able to learn the ins and outs of the insurance industry as well as the sales and marketing process. Transitioning into insurance investment management sales was a natural fit.

What do you like best about working in Business Development?

The best part about the job is that every new client/prospect varies from the last, so each experience is different. It forces you to think creatively and really do a deep dive in order to understand the company to tailor the best solution. In the process you tend to develop a strong working relationship with the individuals involved which adds a personal touch.

What’s your favorite thing to do when you’re not at work?

I am currently in the midst of planning my own wedding. As you would expect from any bride, my free time is dedicated to the big day!

What hobbies or interests do you have?

I enjoy volunteering in various community projects. In my most recent project, I taught English as a second language to the elderly.

What’s the last book you read?

I Am Malala. The book is about a young girl from Northern Pakistan who not only survived being shot in the face by the Taliban because she spoke out against the political regime in support of education for females in the region, but continues speaking out around the world today.

It’s an inspirational read for me particularly because of my cultural background.

What’s your favorite vacation place and why?

I love to travel internationally. I enjoy learning the history and exploring the cultures of different countries.

What’s one thing people would be surprised to know about you?

I love to play basketball. Growing up with an older brother, I ended up being the default substitute any time he and his friends would play a game of basketball. Over the years, I picked up on a few skills and became quite good. I even beat a bunch of boys in a game of HORSE!

AAM Thought Leadership Articles

AAM produces a number of Thought Leadership articles throughout the year on such topics as sector analysis, market conditions, and investment accounting updates. Below is a list of the Thought Leadership produced recently with direct links to the articles.

AAM Municipal Market Perspective: Headline Risk Returns to the Municipal Market – Puerto Rico Debt Likely to Face Restructuring

The second quarter ended with Puerto Rico once again making the headlines. On June 29, 2015, the governor of the Read more…

AAM Corporate Credit View: Fallen Angels Expected to Increase

Volatility increased this quarter with investment grade credit spreads widening 16 basis points versus Treasuries in the second quarter. The Read more…

Updated Edition – Multiplying Factors: An Analysis of the NAIC’s Proposed Changes to RBC Bond Risk

In early August, AAM received an updated report prepared by the American Academy of Actuaries featuring RBC factors slightly different from Read more…

The Investment Opportunity in Convertible Bonds for Insurance Companies

With equity market volatility increasing, insurers are taking a fresh look at risk asset allocations. We continue to believe that Read more…

The Perfect Storm? Fixed Income Portfolio Management in a Reduced Liquidity Environment

Since the extreme disruption of the global financial crisis in 2008 the world and the U.S. have experienced a deep Read more…

AAM Corporate Credit View: The End of the Credit Cycle?

Volatility remained high in all markets with investment grade credit spreads widening 23 basis points (bps) versus Treasuries in the Read more…

AAM Municipal Market Perspective: Tax-Exempts Performed Well in the Midst of Market Volatility

The municipal market remained resilient as it navigated through a number of issues during the quarter, including anticipation of potential Read more…

Santa’s Sleigh May Be a Little Lighter This Year – Our Analysis of the Most Important Drivers

Hoverboards and Michael Jordan shoes. I can’t get through a conversation with my kids without one or both of these Read more…

AAM in the Community

For the last nine years, AAM has forged a very successful partnership with the United Way. Beyond raising nearly $100,000 in financial support for the organization, AAM has participated in the United Way Volunteerism Program.

Two important United Way community volunteer initiatives this winter included:

- In October 2015, AAM kicked off its annual United Way campaign by partnering with the Chicago Child Care Society. Employees donated toys, diapers, and warm clothes to the Chicago Child Care Society as part of our fourth annual holiday toy drive.

- In November 2015, twenty-one AAM employees, and a group of students from Urban Prep Academy, packed boxes of non-perishable food items for senior citizens at the Mac Warehouse for Catholic Charities. The group packed over 900 boxes (photos below), bringing the AAM total to over 6,000 boxes packed for senior citizens over the last five year period.

AAM Hosts Urban Prep Academy Students

This year, AAM participated in the Urban Prep Academy’s “Discovering Our City 2015” program by hosting a group of students at AAM (Urban Prep is a non-profit organization that operates a network of free open-enrollment public all-male college preparatory high schools in Chicago). The program is designed to expose students to company/organization workplaces and to meet the people who work in them. It also creates awareness among the employees of important issues facing the city’s youth.

The students were given a tour of the AAM office and various job functions, introduced to the employees, and then followed up with mock interviews to help the young men prepare for their college/universities admissions interviews. The students were also able to ask about working at an investment management firm over lunch with the presenters/interviewers.

John Schaefer, AAM President, speaking to the Urban Prep Academy student volunteers prior to packing non-perishable food boxes for seniors at the MAC Warehouse for Catholic Charities.

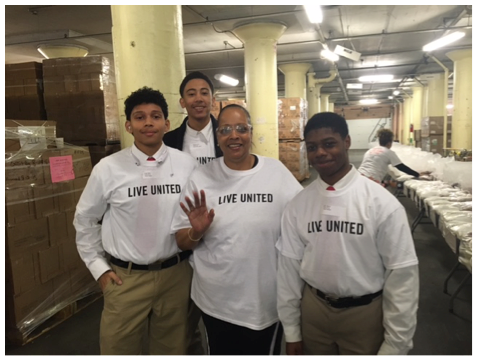

Denise Madison, AAM Office Manager, with a few of the Urban Prep Academy student volunteers at the MAC Warehouse.

Upcoming Conferences

AAM will be attending and/or participating in the following industry conferences.

[event-list start-date=”3/1/2016″ end-date=”7/1/2016″]

Feedback

If you have any comments about how we can improve the AAM Quarterly Newsletter, please let us know at: marketing@aamcompany.com

For more information about AAM or any of the information in the AAM Newsletter, please contact:

Colin Dowdall, CFA, Director of Marketing and Business Development

John Olvany, Vice President of Business Development

Neelm Hameer, Vice President of Business Development

30 North LaSalle Street

Suite 3500

Chicago, IL 60602

312.263.2900

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.