insight

Chameleons of the Fixed Income Market

July 2, 2007

Just as chameleons change their appearance to protect themselves against predators in the harsh environment, so too has the unsecured fixed income market adapted to risk from private equity firms. This has been accomplished though the addition of Change of Control (COC) covenants which protect investors against destructive leveraged buyouts (LBO’s). COC covenants, commonplace in the private placement world, have become much more popular among investment grade issuers over the past year. These covenants, which are designed to protect investors against a LBO, have been demanded by the market as private equity activity has picked up substantially.

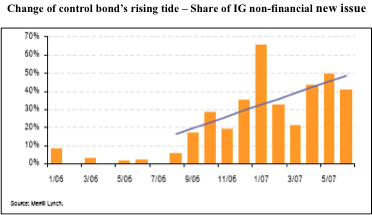

According to Goldman Sachs, “one year returns for buyout funds averaged 11.3% since 1999 compared with 4.9% for the S&P 500.” These relatively strong returns along with historically healthy corporate balance sheets, high cash balances, solid margins, and low funding costs make us believe that the LBO risk is not expected to diminish anytime soon. The increasing number of COC bonds in the market is detailed in the chart above and the expectation of more to come, makes the analysis of this new dynamic important.

Currently, there is an estimated $400 billion on the sidelines in private equity, equating to roughly $1.3 trillion of possible investing power. Sectors once considered LBO resistant, including financial services and utilities, are no longer considered bullet proof given the recent transactions with Sallie Mae and TXU Corp. (TXU), respectively. Sallie Mae is a leader in the financial services sector with debt of $108 billion and a financial leverage ratio of almost 25 times, pre-LBO. The regulated business of utilities has made those companies less inviting to private equity. LBO transactions have grown larger thanks, in part, to “club” deals, which involve multiple private equity firms. TXU, the largest LBO thus far at $45 billion, was arranged by a consortium of three investors. The pace may slow for these club deals due to the regulatory uncertainty and the difficulty of shared decision making.

Many investors and Wall Street firms have created tools to help predict the next LBO. There are some financial attributes of a company that are more conducive to a prospective LBO than others. One screen identifies underperforming share prices, low P/E multiples, moderate to low leverage, high cash flows, and high cash balances as key attributes of a company that may be more likely to draw interest from private equity buyers. While another, uses equity option implied volatility as a potential signal of LBO risk. While these quantitative variables are important to assess, it is also important to consider qualitative factors such as ownership structure, industry dynamics, and management and the composition of the Board of Directors. An examination of a particular company’s willingness or desire to maintain investment grade ratings is also a key factor when determining LBO risk. Unfortunately, even the best intentions by management for bondholders may be proven unimportant, as some transactions can be unfriendly.

While early identification of event risk is optimal, it is not assured; therefore, investors seek protection via COC language. When buying a COC bond, a bondholder is paying for a put option to protect against the downside. In general, the option is exercisable upon a COC event occurring and a downgrade to below investment grade by the rating agencies. The challenge is to determine if the market has assigned the correct cost to the put option. This is a critical task when performing a relative value analysis for a particular credit. Theoretically, the option should cost more if the perceived risk of an LBO for a particular credit is high when compared to other similar credits. For example, an investor should be willing to pay more for such put option for Macy’s (ticker M, market capitalization – $17.8 billion) than Wal-Mart (ticker WMT, market capitalization – $197 billion). The cost of the imbedded option translates into a spread or yield concession. The higher the price paid for an option, the less yield an investor will receive.

To determine the cost of the option entails comparing a COC bond of a particular credit to a non-COC bond of that same credit. After making adjustments to account for structural differences between the two issues, the difference in yield becomes the cost of the option or the yield concession. The next step in the process is to determine what the cost should be. To carry out this step, the probability of an LBO for a particular credit is determined along with the expected impact on spreads. The LBO scenario is then used to stress a particular bond issue without the put option. This analysis should help determine if the cost of the option is appropriate.

There are other less quantitative methods investors and traders use to value these options. One type of analysis is a historical comparison of the COC bond’s Z-spread, or spread to swaps, to credit default swaps (CDS) for a particular credit. CDS is a derivative instrument which does not protect the holder against an LBO. Theoretically, a departure from the average difference between the Z-spread and the CDS level could indicate a mispriced option.

While it is difficult to predict when the LBO risk will subside, there are some key developments which may slow the private equity bid for new investments. Private equity investors are dependent on the abundant liquidity in the financial system. Hence, a reduction in bank lending or the inability to raise debt in the high yield and leveraged loan markets for example would negatively affect this liquidity. Lower than expected returns on private equity investments may concern potential investors, affecting future capital raising prospects. Third, a substantial increase in lending rates could make borrowing costly if private equity investors are unable to compensate for it via a lower offer/price. Moreover, internal rate of returns (IRR) are very sensitive to cash flow margin and exit multiple assumptions. Therefore, a slowdown in the economy could heighten the risk related to anticipated exit multiples and/or margin improvement. Finally, changes in tax laws would also reduce the profitability of private equity firms and would therefore increase the difficulty with maintaining or improving investment returns for their funds. Currently, fund managers’ profits are taxed at the 15% capital gains rate versus the typical 35% corporate rate.

Financial markets do not operate in a vacuum. Markets evolve to accommodate change with the goal of sustaining liquidity to provide an efficient venue for the exchange of capital. A recent example of this is the growth of COC bonds brought on by more extensive LBO risk.

Investors, concerned about the damaging result of an LBO, are demanding protection in the form of covenants on newly issued bonds. Since the current environment remains positive for continued private equity activity, a careful analysis and understanding of COC bonds is important given the recent spate of issuance and the expectation of additional issuance of bonds with these covenants.

Michael J. Ashley

Vice President

Corporate Bonds

1 Kostin, David J., “Private Equity and GS LBO Model,” Goldman Sachs: United States: Portfolio Strategy, March 22, 2007, pg.8

2 Kostin, David J., “Private Equity and GS LBO Model,” Goldman Sachs: United States: Portfolio Strategy, March 22, 2007, pg.8

3 U.S. Department of Justice has launched an investigation into these types of deals to determine if competition and therefore pricing are being artificially deflated.

4 Marrinan, Edward B., “Credit Calls: Strategy Commentary,” JPMorgan: North American Credit Research, July 28, 2006, pg. 1

5 Jeffrey A. Rosenberg, “Quantitative Screens for LBO Risk”, Bank of America: Debt Research, Credit Strategy, June 1, 2007, pg. 3

6 Rooney, Mary, “Change of Control – When to Pay,” Merrill Lynch: The Credit Monitor, June 19, 2007, pg. 4

7 Forsythe, Michael, “Blackstone Sparks Lobbying ‘Battle Royale’ Over Taxes,” Bloomberg, June 25, 2007

Disclaimer: This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.