insight

A Bail-In or a Bail-Out? New Risks on the Horizon in the Banking Sector

April 9, 2013

The US banking sector is currently characterized by good credit fundamentals and supportive technicals. A key risk offsetting this credit strength is the prospect of a new bank resolution regime (Orderly Liquidation Authority) imposed by regulators. Of particular interest to bank creditors is the possibility that a resolution regime imposes mandatory bail-in requirements on bank capital structures and mandates minimum levels of bank bond issuance. This article will examine the potential form of such a regime, direct implications for bank bond investors and a review of how we are positioning insurance portfolios in advance of a formal proposal from regulators.

What is Orderly Liquidation Authority?

Orderly Liquidation Authority (“OLA”) was created by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Act”). OLA authorizes the creation of a resolution regime for the purpose of receivership and orderly liquidation of a failing financial institution(s) whose collapse would endanger the US economy. The Act explicitly prohibits the use of taxpayer funds to prevent such liquidation, and instead mandates liquidation of any institution placed into receivership. The Act delegates responsibility for creation and administration of a resolution regime to the US financial regulators.

At its heart, OLA is meant to provide regulators the means to wind-down systemically important financial institutions that are in danger of failing in a disorderly manner such that the broader economy is damaged (i.e., another Lehman). The goal of OLA is to maintain the stability of the financial system while removing the perceived moral hazard that was created by the government bail-outs that occurred during the 2008 global financial crisis (TARP /AIG bail-out).

OLA Details? (You’ll have to be patient…)

When OLA became the law of the land in July 2010, it authorized financial regulators (Federal Reserve, SEC, FDIC, and the Federal Insurance Office) to create a detailed resolution regime which would be proposed to the Secretary of the Treasury. Nearly three years later, we continue to wait for a proposal. However, over the past year, regulators have begun to float trial balloons in the form of public speeches and investor outreach meetings, leading us to believe that a Notice of Proposed Rulemaking (NPR) is likely to be issued later this year.

While many details of the emerging OLA regime remain to be disclosed (formulated?), key aspects that have been shared include the regulators’ preference for single-entry receivership at the bank holding company level and the use of capital structure bail-in (write-down of the capital structure) as an alternative to tax-payer funded bail-outs.

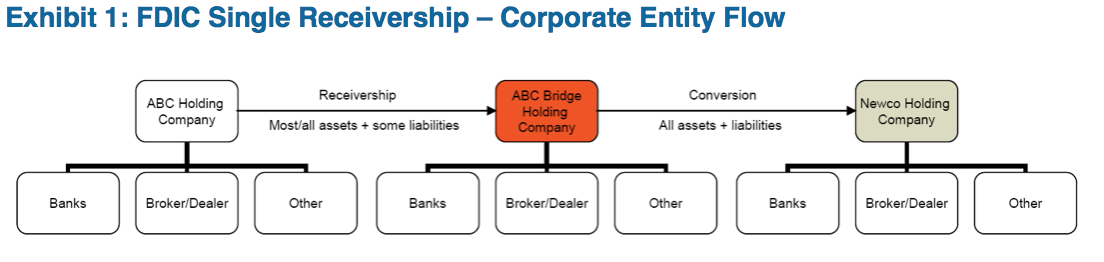

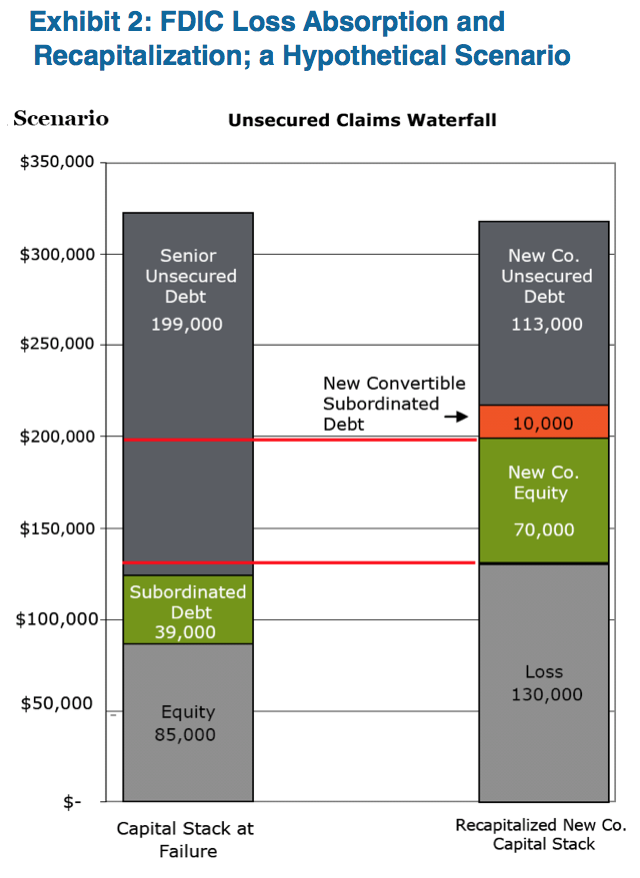

Single-entry receivership is the concept of taking control of a failing financial institution at the bank holding company level while allowing the operating subsidiaries to continue normal operations. Under this approach, the capital structure of the holding company is impaired, potentially all the way up to senior unsecured creditor level, in order to re-capitalize the operating subsidiaries (See Exhibits 1 and 2). Interim subsidiary operations would be funded by a secured line of credit from the Treasury. And importantly, the process would benefit from a bankruptcy stay, preventing creditors and trading counterparties from accelerating bank liabilities or seizing collateral.

The secured liquidity and bankruptcy stay are critical aspects of the single-entry process. The liquidity facility allows the distressed institution to continue operations (market making/collateral posting) in the normal course of business. At the same time, preventing counterparties from breaking derivatives contracts (no default/change of control) or creditors from declaring default (bankruptcy stay) allows the institution to continue as a “going concern.” These assumptions are theoretical, however, and it remains to be seen whether an institution taken into receivership would be able to maintain franchise value or whether it would face a rapid loss of business.

Unanswered Questions Regarding OLA

Key uncertainties that remain to be determined in any prospective OLA regime include:

- Which institutions will be subject to OLA? – At a minimum, we expect the four large money center banks (Bank of America, Citigroup, JPMorgan, and Wells Fargo), the two largest broker/dealers (Goldman Sachs, Morgan Stanley) and the two largest custody banks (Bank of New York, State Street) to be included. Of particular interest is whether the next tier of banks fall within the scope of OLA (US Bancorp, PNC Financial, SunTrust) or even all banks regulated by the Fed (those exceeding $50 billion in assets).

- What is the trigger for OLA? – Understanding the criteria that regulators would use to implement the OLA regime with a subject financial institution and the discretion they have in implementing the regime will be critical to analyzing the sector going forward. Minimum capitalization levels have been used as triggers for contingent capital instruments issued in the European Union (i.e., Conversion/write-down triggered when Tier I capital falls below 7%), but clarity on solvency/liquidity driven triggers will be needed as well (After all, Lehman was “well capitalized” when it failed in September 2008).

- Which parts of the capital structure will be subject to bail-in? – Other jurisdictions that are contemplating resolution regimes (United Kingdom, Switzerland, Germany and the European Union) have taken different approaches to bail-in. Some countries have designated certain levels of the capital structure as being subject to impairment if a financial institution approaches failure (i.e., Swiss Contingent Convertible Notes or the UK’s Primary Loss Absorbing Capital) while others have stated that the entire capital structure is subject to “hair-cut” (Germany/Denmark). Which approach the US takes will have material implications for both cross-sector and intra-capital structure relative value.

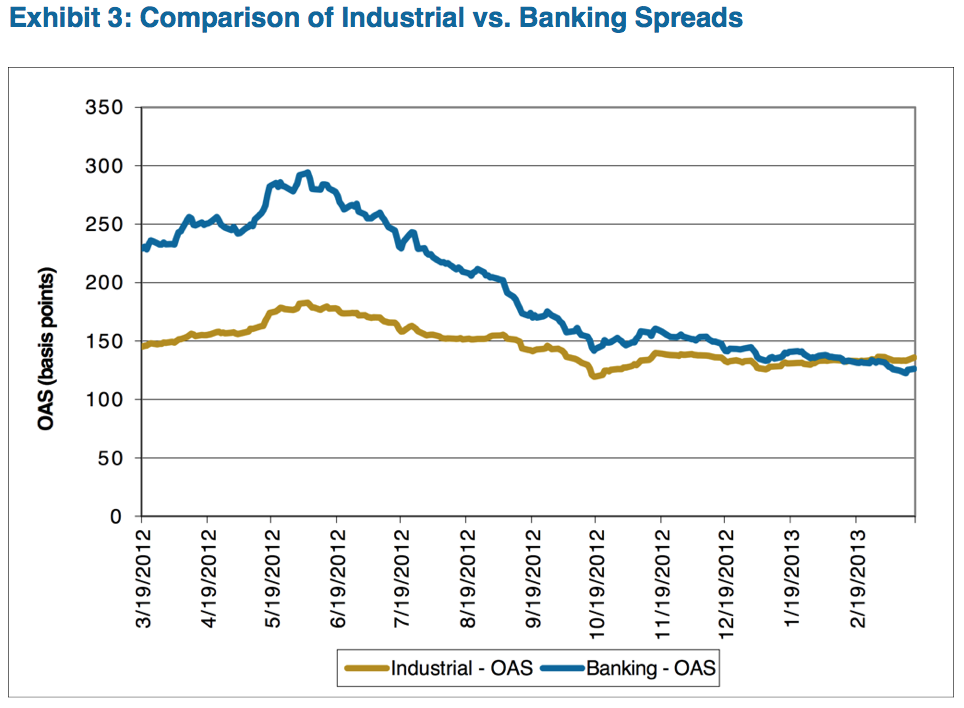

As envisioned, bail-in of bank bonds would transform that portion of the capital structure from a funding instrument into a capital instrument. While subordinated bonds, hybrids and preferred securities have always fallen on a spectrum between funding and capital, the imposition of bail-in on senior unsecured would be a fundamental change. Bank bond spreads have tightened to parity vs. comparable quality industrials over the past six months, after trading wide the previous five years (Exhibit 3). The main risk to bank bond investors from the imposition of a bail-in regime is that the market adds a risk premium to all bonds in the sector to reflect the changed regulatory event risk, which would result in widening bond spreads.

Further, moving the decision to bail-in the capital structure into the scope of regulator discretion (and the associated bankruptcy stay) would also raise uncertainty surrounding a credit as it fell into distress. This raises the probability of investors running for the exit at the first sign of trouble; an issue that we are uncertain the regulators fully appreciate. Bank bonds have clearly been more volatile than the Barclays Corporate Index since the 2008 financial crisis, but the prospect of bail-in would likely prolong and possibly exacerbate this phenomenon.

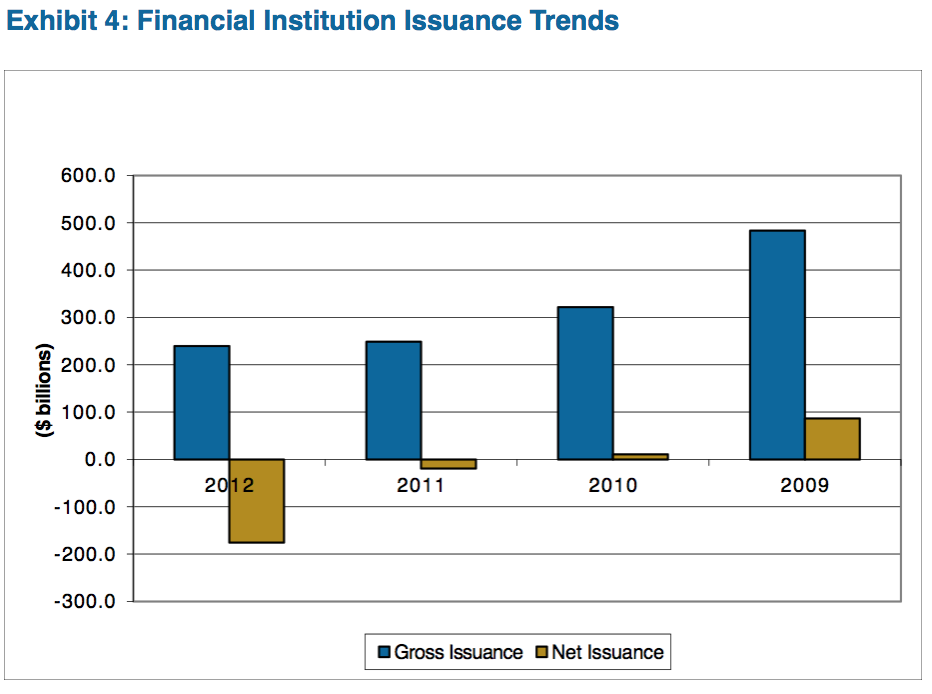

Related to the risk associated with imposing bail-in, regulators have also pondered imposing minimum bank holding company debt levels. A minimum debt requirement would assure that a bank’s capital structure is of sufficient size to absorb the impairment necessary to re-capitalize its operating subsidiaries in a bail-in scenario. A key factor in the outperformance of bank bonds over the past three years has been the technical benefit from a shrinking overall universe of bank bonds as maturing issues were funded by deposits rather than refinanced (Exhibit 4). The prospect of increased issuance (as well as increased holding company debt leverage) imposed by OLA would likely set a floor for bank bond spreads, if not resulting in outright spread widening.

How Are We Positioning for OLA

Although many of the critical details will not be available until the Fed releases its Notice of Proposed Rulemaking, there are a number of ways to position clients within the bank sector. This positioning is based on the assumption that an OLA regime including some form of bail-in is a certainty. We cannot justify dis-investing in the sector on the basis of the possibility of a bail-in regime which raises the possibility of spread widening. However, there are three concrete steps we can take:

- Avoid holding company subordinated debt – This insulates our portfolios against the possibility that bail-in applies only to subordinated portion of the capital structure, as well as the possibility that additional issuance is mandated.

- Favor bank level issuance over holding company issuance – Under single-entry receivership, only holding company bonds should be eligible for bail-in (in order to avoid broader financial system dislocation). As such, even bank level subordinated paper should be insulated from bail-in under an OLA regime, offering a reasonable relative value alternative to holding company senior unsecured bonds.

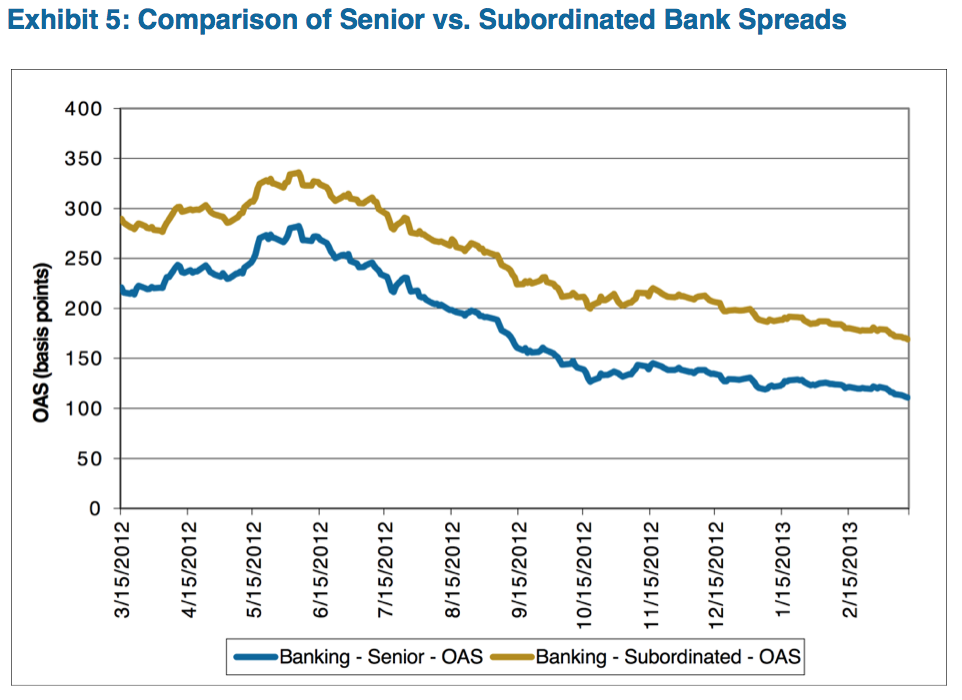

- Avoid bank capital securities – It has become clear that the junior portion of the capital structure is viewed as “bail-in eligible” by regulators, even before Dodd-Frank Act introduced the concept of OLA (recall Citigroup’s 2009 exchange). However, it appears that capital securities still trade based on cost of funds (as opposed to cost of capital) as demonstrated by the clear correlation between senior unsecured and subordinated debt.

Conclusion

The expected announcement of OLA details is the most prominent domestic event risk for the bank sector over the near-term. However, until a formal proposal is released by the regulators, the ultimate impact of OLA on bank fundamentals and relative value is tough to discern. It is also possible the bank spreads already reflect the potential negative impacts of OLA, and the formal proposal will serve as a catalyst for further tightening. We continue to position our clients in holding company senior unsecured and bank level subordinated bonds which we believe offer the best combination of relative value and defensiveness within the sector. Ultimately, we believe strong underlying fundamentals and the likelihood of an extended adoption period should offset credit impact of OLA, but investors should be prepared for the possibility of near-term volatility.

N. Sebastian Bacchus, CFA

Vice President, Corporate Credit

For more information, contact:

Colin T. Dowdall, CFA

Director of Marketing and Business Development

colin.dowdall@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.