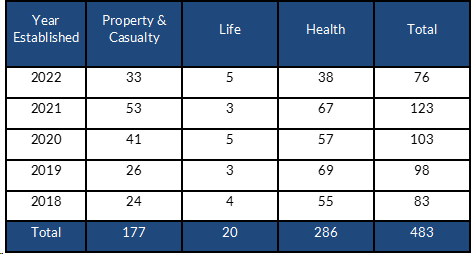

The insurance space is not always known to many outside of the industry for being innovative, but over the years the industry continues to evolve. There are individuals in the industry that consistently have new ideas of how to underwrite risk or they see an underserved market of policy holders which they feel they can underwrite profitably. Some examples from the past are Government risk pools serving municipalities in the 70s and 80s, Healthcare Co-ops after the passage of the affordable care act, and more recently InsureTech startups who look to leverage technology to streamline operations and the underwriting process. Looking at annual statutory filings, over the last 5 years there have been 483 insurance companies founded in the Property & Casualty, Life, and Health sectors so there are consistently new companies being formed1.

AAM has assisted a number of startups over the years as they implement these innovative ideas and grow in the market place. Although each startup is unique, they all have similar challenges. AAM has the tools and experience helping startups with their investment portfolio as they navigate the early stages and grow into mature companies. This paper details some of the services we provide and how we can help start-ups as they navigate their growth process.

During the early stages, there are a number of elements that startups have to consider on the investment side of their business. Common items are creating an investment policy, setting up a custody account to hold the company’s investments, and performing the statutory accounting for their investments. When creating an investment policy, it is not only important to make sure that the policy conforms with the investment code of company’s state of domicile, but it also should also reflect the company’s risk tolerances and have appropriate risk parameters for the company’s line of business. We can help a startup navigate this process and provide recommendations that reflect industry standards. As for selecting a custodian, AAM has relationships with over 20 different custodians through our client base. As part of our service offering, we frequently assist clients with custodial searches and solicit blind fee proposals to ensure competitive pricing. The custodial industry continues to evolve and it’s critical for startup companies to engage with the best custodial service providers. Another essential service is investment accounting. AAM uses Clearwater Analytics’ reporting portal and has an experienced internal team of accountants on staff to help clients with accounting questions and filings. An experienced investment accounting staff is a great resource for startups as they are preparing annual filings or their auditors have questions on their investment statements.

As companies mature, managing liquidity, reevaluating duration targets, and conducting peer analyses can be helpful exercises. To start, liquidity management and capital preservation are key during this phase. It takes time for a startup’s underwriting track record to season and exhibit stable cashflow patterns. Expenses tend to run high during this phase. It is important to have good communication with your asset manager as they can strive to structure the portfolio’s cashflows to meet operating needs and minimize liquidations to fund expenses. This was crucial during 2022 and 2023 when interest rates rose sharply and bond prices declined resulting in significant unrealized losses. Selling securities at a loss during this phase and taking a hit to surplus reduces capital better used for funding growth. Other exercises include re-evaluating fixed income portfolio duration targets and performing peer analyses. AAM can help with these projects and is a good resource as questions arise during this phase. As underwriting patterns develop, the company should re-evaluate their duration target to confirm whether it still aligns with company’s liabilities and capital structure. AAM’s model uses the company’s reserves and capital structure to determine an appropriate duration target for the portfolio. As a company matures, it could potentially extend the duration target of its investment grade fixed income portfolio and generate more investment income. Peer analysis can also be conducted to benchmark a company to its industry segment. AAM’s peer analysis uses annual statutory filings which compares various operating ratios and statistics versus a group of similar companies with similar characteristics. This process can be used for startups to see how they stack up against other startups or versus more established companies in their line of business.

As startups mature and underwriting and cashflow patterns develop, they may have the ability to transition a portion of their investment portfolio into higher returning surplus strategies. AAM’s asset allocation model can assist in that process. The model uses the company’s current capital structure, operating metrics, and historical investment returns to determine an appropriate allocation to surplus strategies such as equities, convertible bonds, high yield and bank loans. The model provides a reference point for potential asset allocation strategies based on statistics. Each company’s risk tolerance is unique and should be considered prior to implementation.

As in the past, the insurance industry will continue to evolve and there will be new ideas of how to underwrite risk that will draw capital and become startups. AAM’s experience and service offerings can help these startups with their investment portfolios and help them navigate the growth process as they become successful insurance carriers.

1 Source: S&P Global Capital IQ

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.