insight

AAM Corporate Credit View: April 2010

April 1, 2010

In Like a Lamb?

Spring is starting off on a good note with Corporate bond option adjusted spreads (OAS) 23 basis points (bps) tighter per the Barclays Corporate Index, generating 128 bps of excess returns for the month and returning year-to-date excess returns to positive territory (114 bps). Finance outperformed Industrials and Utilities, generating 193 bps of excess returns in March (171 bps year-to-date) vs. 94 bps (80 bps YTD) and 81 bps (93 bps YTD) respectively. This is consistent with our 2010 forecast for the three broad sectors. Sub-sector performance is proving itself as well with Metals & Mining posting a strong 212 bps of return in March (99 bps YTD), Energy- Oil Field Services 78 bps (152 bps YTD), Banking 180 bps (112 bps YTD), and Life Insurance 431 bps (439 bps YTD). Unlike 2009, in which all sectors gapped tighter, credit selection has been more important thus far, and we expect this to continue. For example, in terms of investment opportunities over the course of 2010, the Kraft new 10-year issue has tightened more than 55 bps and the Telefonica 10-year 60 bps from purchase amidst the Greek fears. We continue to believe there are attractive opportunities within the Corporate sector and that it will outperform Treasuries in 2010.

Events and news in March were largely positive. First, Greece was able to issue debt and get a back-stop from certain EU countries and the International Monetary Fund (IMF), if it is unable to borrow from the markets. The European Central Bank (ECB) also helped Greece by extending the acceptance of collateral rated at least BBB- instead of its plan to reinstate the former A- threshold in 2011. Greece sovereign debt is rated A2/BBB+/BBB+. Second, domestic economic news was better than expected especially relating to the consumer, which appears to be spending at a faster rate than many had anticipated. If the consumer continues to show strength and the ISM non-manufacturing index extends its recovery, our unemployment forecast may prove too conservative. Third, after taking a brief hiatus in February, liquidity in the market re-emerged despite the continued fall in primary dealer positions in Corporate bonds with maturities greater than 1 year. Aside from money market funds, AMG Mutual fund flows were positive for both debt and equities. High yield debt and bank loans were in great demand, new issues regardless of credit quality were very well received in both the investment grade and high yield markets, and finally the talk of LBOs had the Street and investors dusting off models used to determine feasibility.

Last, but not least, at the government level, the Administration was able to get its Healthcare bill passed under reconciliation rules. It appears more likely that a Financial Reform bill will get passed as well with the Republicans in a difficult position given the broad voter angst against the banks and Wall Street. The Fed kept its rate language unchanged, signaling to the market that low rates are here to stay for the near term. Finally, the Treasury auctions received more tepid demand in March, bringing into the forefront the discussion and forecasting of Treasury yields and what that means from an investment standpoint– specifically, what markets will outperform in an inflationary environment.

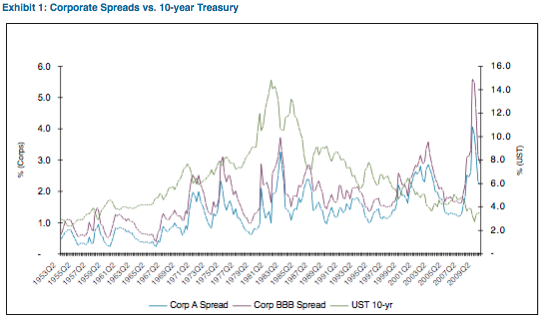

As it relates to Corporate bonds, we look to Exhibit 1 to remind us that spreads are not highly correlated to rates, but to data that may or may not move Treasury rates.

Note: Corporate spreads calculated using yields vs. the 10-yr Treasury

Given that the industrial capacity utilization rate is only 72.7%, well below the historical average of 81%, we are not concerned with near term inflationary pressures. That said, our industry and credit analysis takes into account the prospect of rising rates over the intermediate term in various economic environments. While commodity based industries may perform well in not only the current environment but that environment as well, others are likely to underperform as higher rates stymie the rate of consumer borrowing and thus, spending for example. Hence, we continue to prefer “investing in growth,” namely manufacturing and commodity based industries, those that are non-discretionary in the consumer space, and certain Finance sectors versus a blind grab for spread product/yield as many investors are advocating.

1 AAM Corporate Credit View, January 6, 2010

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.