insight

AAM Corporate Credit View: August 2009

August 3, 2009

Given current earnings and economic news, it is now more difficult to argue that we have not hit bottom. We believe the recovery is in its early phase, and the technical support to the Corporate bond market is unabated. We have been advocating an overweight to Corporate Credit since late 2008, and continue to believe spreads will grind tighter. The excess returns over Treasuries for the Barclay’s Corporate Credit Index were 3.84% for July and 17.37% year-to-date.

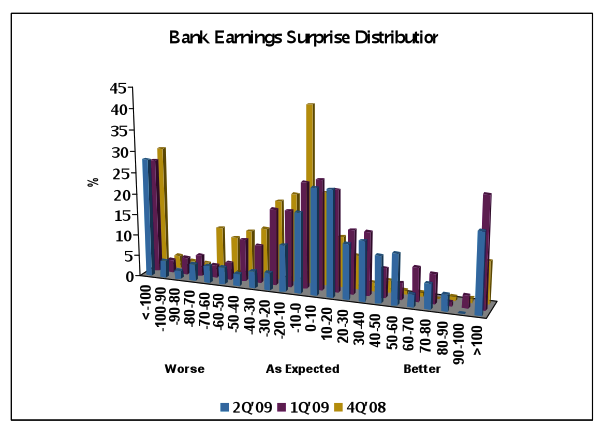

In last month’s letter, we cited three areas we would be watching in the near term, two of which were the trajectory and magnitude of losses at the banks relative to expectations. The majority of the large domestic banks have reported second quarter earnings. The main take-away from the quarter is that while results were very weak, they were not weaker than expected. In fact, the percentage of “earnings surprises” continues to creep higher since the low point in the 4Q’08 (Exhibit 1). Historically, asset quality deterioration at the banks tends to persist for two quarters after unemployment peaks. Consequently, we expect asset quality deterioration to continue well into 2010, and loan loss provisioning to remain at elevated levels into the foreseeable future. Earnings performance will be weak commensurate with reserve builds, and “noisy” quarters will be the norm rather than the exception going into the first half of 2010. Further regulatory interventions should not be surprising for small banks and even certain regional banks.

Exhibit 1

Importantly, as bad as this sounds, this is what the market (and AAM) is expecting. CIT was a recent test, as the deterioration has been contained, keeping the risk idiosyncratic instead of systemic. We expect this cleansing process to take place in all industries to various degrees. In Moody’s latest default report (7/8/09), the global speculative-grade default rate was at 10.1% at the end of June. In April, Moody’s had expected this to peak at 14.8% in the fourth quarter this year. This peak estimate has been revised down over the last two months and is now expected to be 12.8%. The twelve month forward estimate has also been reduced from over 10% to 6%.

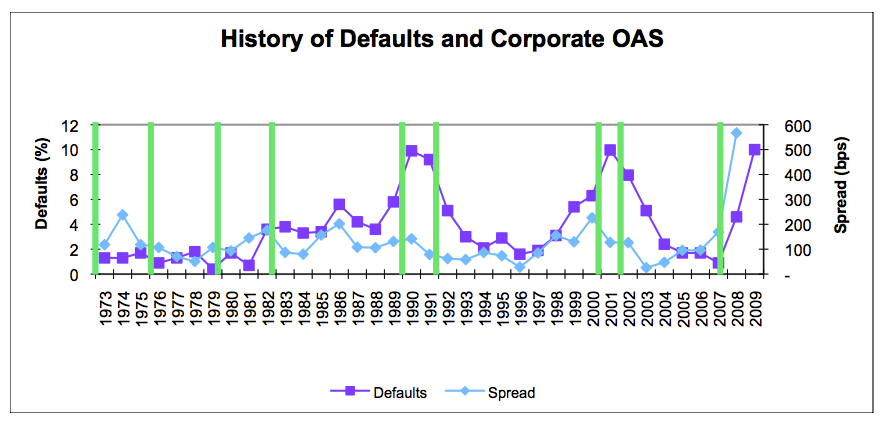

As you see in Exhibit 2, since 1973, spreads typically peak a year prior to defaults peaking, and the relationship is statistically significant. This is intuitive since investors need to measure risk in order to assign return expectations. Despite soft fundamentals, we expect spreads to continue to tighten, as uncertainties moderate surrounding rating downgrades and ultimately defaults. We continue to favor high quality credits especially certain high quality Financial senior bonds (e.g., GE, Barclays), which are 50-100 bps wide of Industrial/Utility equivalents.

Exhibit 2

Source: AAM, Moody’s, Barclays

AAM refers to Asset Allocation & Management Company, LLC, an SEC registered investment advisor specializing in insurance investment management. This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM , any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.