insight

AAM Corporate Credit View: August 2011

August 9, 2011

Leadership

The Corporate credit market turned up in July, posting 33 basis points (bps) of excess return per the Barclays Corporate Index. The sovereign issues abroad and at home affected sentiment and performance. Negatively, Financials widened, as investors were concerned about capital adequacy due to European peripheral exposure and the prospect for ratings downgrades, including U.S. Treasuries. Conversely, they looked to highly rated, defensive Industrials and Utilities as substitutes (Exhibit 1). Regarding the supply side of the market, new issue volume was low, and dealer inventories continued to decline.

Exhibit 1: High Quality Credit Outperformed in July

| Total | AAA | AA | A | BBB | |

| Corporate | 33 | 97 | 21 | 25 | 45 |

| Industrial | 71 | 114 | 108 | 69 | 62 |

| Utility | 83 | 178 | 98 | 69 | |

| Finance | -39 | 81 | -27 | -48 | -34 |

Source: Barclays (July month-to-date excess returns in basis points)

August is not starting off well, as markets are concerned about the recent slowdown in economic activity, both here and abroad. The Corporate market per Barclays moved from being up 108 bps of excess return year-to-date as of July 29 to down 16 bps as of August 8 due mainly to spread widening in Banks, Finance, Life Insurance, and deep cyclical Industrials. A question we face in the near term is how the consumer will react to the steep drop in the equity market over the last week. Last year, we witnessed consumers (regardless of income level) pulling back after similar questions were raised. Falling oil prices will provide a stimulus for the second half, but that may be insufficient if the velocity of consumer spending slows.

Our outlook for the economy continues to one of cautious optimism (i.e., very low GDP growth), notwithstanding the increasing concerns of a recession. The deleveraging of the consumer takes time. Unemployment will remain high and the economy will be vulnerable to external shocks until the housing market rebounds and the private sector is confident about growth prospects. We continue to be concerned about structural credit problems in Europe and their impact on the global financial markets. Given our economic outlook, we have been prioritizing growth in our corporate bond recommendations, looking to companies that benefit from: dominant market positions, emerging market exposure, higher income earners, productivity enhancements, flexible balance sheets, new product innovation, and strong management. In the Finance sector, we look to companies with high quality assets, liquid balance sheets, strong capital positions, astute management, and exposure to strengthening economies and customers (commercial, industrial, or consumer). Security selection is imperative in this environment. Before making changes to our investment thesis, we await more information in the very near term about the following: (1) consumer sentiment and spending, (2) earnings for 2011-2012, and (3) the Eurozone. We are particularly wary of lower rated credits that have outperformed, but are poised to move meaningfully wider if there is confirmation of a slow down (Exhibit 2).

Exhibit 2

| Excess Returns (bps) | |||

| Sector | Month-to-date | Year-to-date | |

| Corporate | (120) | (16) | |

| Industrial | (96) | 28 | |

| Utility | (30) | 153 | |

| Finance | (182) | (132) | |

| Option Adjusted Spread (bps) | |||

| Sector — Rating | 8/8/11 | Maximum since 2010 | Difference |

| Industrial — A | 107 | 121 | 14 |

| Industrial — BBB | 189 | 216 | 27 |

| Utility — A | 109 | 134 | 25 |

| Utility — BBB | 170 | 211 | 41 |

| Finance — A | 246 | 275 | 29 |

| Finance — BBB | 299 | 409 | 110 |

Source: Barclays (as of August 8, 2011)

For the approximate 61% of U.S. companies that have reported as of August 9, earnings have been better than expected. Second quarter earnings reports have surprised the market with EPS and Sales growth of 19.5% and 13.1%, respectively. This is quite an achievement given the negative economic data releases and stock market moves this quarter and the wrangling that has gone on in Washington and Europe. On earnings calls, management teams are highlighting the many headwinds they are facing: weak consumers, debt ceiling uncertainty, Japan related disruptions, commodity inflation, rising food and fuel costs, and strained government spending both in Europe and the U.S.. Companies are largely benefiting from the strength of emerging markets, cost cuts due to productivity enhancements and/or market share growth. After the last month, we can’t help but draw a distinction between management in the public vs. private sector.

As credit analysts, we understand that management is a key factor in determining whether a credit will outperform or underperform its peers. Shareholder activism has increased (e.g., McGraw Hill, Clorox) as well as mergers and acquisitions, asset divestitures, and spin-offs (e.g., Kraft, Conoco Philips). Restructurings and re-capitalizations to increase shareholder returns are bound to increase when economic growth is anemic. Therefore, when assigning our fundamental risk scores to credits, we rate the quality of management and its track record (operational achievements), including its attitude towards bondholders (capital management). The following are samples of credits that rank high or low in this regard:

AAM Management Team Rating: HIGH

Barclays plc

The tandem of CEO Bob Diamond and his now retired predecessor, John Varley, along with CFO Chris Lucas and Investment Bank co-heads, Jerry Del Missier and Rich Ricci, have been one of the more effective (and unheralded) management teams in the global money center space over the past five years. In contrast to UK peers (RBS, Lloyds, Northern Rock), the bank was early to raise capital (including large amounts of common equity) in advance of the worst of the financial crisis. In addition, then-President Diamond moved aggressively to reduce risky balance sheet exposures to both structured finance and leveraged loans beginning in the second half of 2007. As a result, Barclays was the only UK bank that did not require government capital investments and liquidity support during the second half of 2008. Furthermore, the bank’s foresight in raising capital, and the excellent cooperation between then CEO Varley and then President Diamond, left the bank ideally positioned to acquire the U.S. assets of bankrupt Lehman Brothers Holdings at a fire sale price in late 2008.

Since that time, the bank has built upon its Lehman acquisition to grow market share in U.S. banking and capital markets businesses, while maintaining its strong position in Europe. The bank’s foresight in cleaning up its UK retail credit exposures (particularly in BarclaysCard) in 2006 has also aided in the faster than its peers recovery in asset quality in the UK retail loan portfolio.

Chubb Corporation

Chubb Corporation is one of the best managed companies in the property/casualty sector. The company is highly disciplined in its underwriting and investment exposures. It is consistently profitable and regularly outperforms its industry peers. The company has produced a five-year average total return on capital in excess of 13%. Chubb’s consistency and strength in earnings largely reflects the company’s success in integrating underwriting, actuarial and claims functions, which has in turn enabled it to maintain underwriting and pricing discipline and to adapt to changing market conditions.

Apache

We believe Apache Corp. is a uniquely strong credit in the energy sector due to the strength of its long serving management team consisting of Steve Farris, Rod Eichler, Roger Plank (son of founder, Raymond Plank) and Tom Chambers. Collectively, this group has served Apache for more than 80 years. Unlike nearly all of its peers, Apache consistently delivers positive free cash flow regardless of the commodity environment due to its focus on rate of return and its firm grasp on costs. Apache has been free cash flow positive in nine of the last ten years as its EBITDA margins have remained near 70% every year. Apache management further distinguishes itself through its ability to grow organically and to successfully integrate large acquisitions, while maintaining a strong and remarkably stable credit profile (debt/cap of 20%-30%, debt/EBITDA of 0.5x-1.0x and debt/BOE of $2.60-$4.50 for the past decade). These factors have contributed to Apache’s shareholder returns exceeding their peers by 40% and 300% in the last 5 and 10 years, respectively. Additionally, Apache’s strong credit profile and shareholder returns allow for easy access to the capital markets.

The ability of Apache to quickly tap the capital markets, combined with the respect for Farris and his colleagues by their peers, along with the group’s reputation for being willing and able to close a transaction quickly, provide Apache access to lucrative deals others don’t get to see (i.e., the Forties transaction in 2001, the Permian, Egypt and Western Canada transactions in 2010). As a result, management’s strategy of delivering top rates of return, while maintaining financial discipline becomes circuitous.

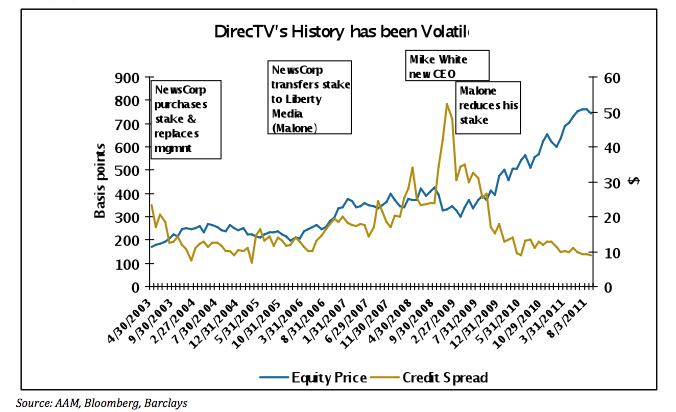

DirecTV

DirecTV (DTV) is a good example of the connection between strong management and investor results. DTV differentiates itself from its competitors based on technological leadership, a strategy that has been the soul of the company since it was founded in 1994 by Hughes Communications. It has gone through close to a decade of management distractions relating to ownership. The latest positive development was mid-year 2010 when Dr. John Malone (Liberty Media) reduced his voting interest from 24.3% to 3% and resigned as Chairman of the Board along with the other Board members from Liberty Media after the FCC imposed restrictions on Liberty Global and its ownership of two of three pay TV providers in Puerto Rico. Malone pressured Rupert Murdoch to sell him NewsCorp’s stake in DTV through a greenmail type tactic, a stake which Murdoch purchased from GM in 2003 after DTV’s merger with EchoStar fell through.

Murdoch’s team was responsible for taking DTV to the next level, as the technology oriented company lacked operational focus. Their marketing strategy in particular has been a success, targeting the upper end of the market (particularly men with families) with superior sports packages, premium content (HD, 3D) and user interface. The current management team is essentially the same as when Chase Carey of NewsCorp took over, except for Chase Carey himself, who went back to NewsCorp after Peter Chernin left in 2009. The new CEO, Mike White, came from Pepsi, a company that is no stranger to the consumer. Not only is this ownership clarity important from a management/operational perspective, it is important from a financial policy perspective, a particular concern for bondholders (including ourselves) given Malone’s history of taking investment grade companies to high yield. The rating agencies appreciated this too, with Moody’s upgrading to Baa2 from Baa3 after Malone reduced his stake. The improvement in credit spreads and the equity price is a good indication of management’s performance (Exhibit 3).

Exhibit 3

Source: AAM, Bloomberg, Barclays

Dow Chemical

We upgraded Dow’s management score in 2010, after witnessing management’s actions both strategic and financial. After almost losing its investment grade ratings in 2008, we believe management understands the importance of a strong balance sheet and low cost of funding. The transformation to a less cyclical chemical giant took shape with the acquisition of Rohm & Haas and subsequent non-core, commodity based asset sales including Morton Salt and Styron. In the near term, we believe that additional debt reduction would most likely come by additional asset sales and/or through a settlement with Kuwait over the failed joint venture transaction (expected by the end of 2011). We continue to believe that ratings, in the intermediate to long term, can return to single-A due to steps management has taken. Management continues to maintain that higher ratings will provide strategic advantages to the company, namely lower cost of capital and opportunity to grow through acquisitions. Aside from balance sheet restoration, Dow has exceeded its own operational goals and should continue to improve as a premier, global chemical producer with emphasis on less volatile specialty chemical products.

CEO Andrew Liveris (Second Quarter 2011 earnings call):

“You can count on us being a strong, aggressive balance-sheet manager to aggressively release and have more flexibility on the balance sheet. That’s been our single focus, and with $35 billion of cash coming from operations in the next several years, you can count on us to be a liberator and lower debt.”

AAM Management Team Rating: WEAK

Suntrust Banks Inc.

CEO James Wells has continued a tradition of underperformance and weaker than peer credit metrics over a protracted period. The bank’s strong competitive position in its core market (Georgia) has allowed it to avoid improving operating efficiency which has resulted in below-peer return on assets and profitability. The ill-timed expansion into Florida retail banking through mergers and acquisitions has saddled the bank with a still material portfolio of high LTV mortgages and home equity loans. While credit costs are moderating, we note that the bank continues to maintain a loan loss reserve-to-non-performing assets ratio well below 1:1. While it can be pointed out that reserves were sufficient to meet the losses experienced in 2009, we note that it has run a reserve-to-NPA (Non-Performing Assets) ratio well below its peers, leaving the bank considerably exposed in the event that housing prices continue to fall, and less well positioned than its peers should the economy fall back into recession. We believe that the bank will face increasing competition from stronger, larger and better run competitors encroaching on surrounding markets, and believe that the bank may ultimately find itself pressured to sell. However, management has traditionally resisted such considerations and appears to still view itself as an acquirer.

Allstate Corp.

Illustrating its market standing, Allstate Corp. fell to the 9th most admired Property & Casualty company in 2011 from 5th in 2010 (Fortune Magazine) and could be ranked lower after a series of disappointing financial results and questionable management decisions. The company is facing increasing competitive pressure in its personal lines business, losing market share in both its auto insurance and home insurance businesses, and experiencing rising combined ratios. The company responded by acquiring auto insurer, Esurance, and the insurance agency, Answer Financial, for $1 billion. On July 18, 2011, the president of Allstate’s main businesses stepped down following one and a half years of what the Allstate CEO referred to as “inadequate results”.

Allstate has reported earnings that missed Wall Street analyst consensus estimates in 12 of the past 14 quarters. Since the Allstate CEO was hired in January 2007, Allstate shares have declined approximately 55% (compared to a gain of 8% in Travelers Companies stock over the same time). Earlier this year, Allstate announced its decision to exit both the bank and broker/dealer distribution channels, de-emphasize spread based businesses and focus on Allstate career agency distribution and mortality and morbidity products. The company reported a $21 million loss on the dissolution of Allstate Bank when the agreement to sell it to Discover Bank was terminated.

Encana

For some time the market provided a premium to Encana bonds due to the perceived quality of its management. However, after a series of questionable strategic decisions, delays and disappointments, we believe that premium is no longer justified. Recall that in May 2008, management approved a proposal to split Encana into two highly focused energy companies – one a natural gas company with North American natural gas assets and the other a fully integrated oil company with oil sands properties and refineries. Less than six months later, this company-altering strategy was postponed. Less than twelve months later, the company proceeded with plans to complete the spin-off of the oil related assets, which would be known as Cenovus. Cenovus has generated returns of 67% since then compared with Encana’s 7%.

In February 2011, management announced that PetroChina would pay $5.4 billion (in Canadian dollars) to acquire a 50 percent interest in Encana’s Cutbank Ridge business assets in British Columbia and Alberta, with the intention of using the proceeds to meet a substantial free cash flow shortfall in 2011. However, not six months later, Encana announced that negotiations ended with PetroChina pertaining to the Cutbank Ridge joint venture. Equally concerning, is management’s efforts to increase capital expenditures (resulting in the free cash flow shortfall in 2011) to become more “oily” less than three years after spinning off Cenovus. This lack of strategy and forethought combined with volatile cash flows and limited capital discipline make us question Encana’s management. Given Encana’s share performance relative to its peers (-50%, -22% and -25% in the last 1-year, 3-year and 5-year’s, respectively) some type of shareholder friendly (bondholder unfriendly) activity is likely soon.

Dell

After relinquishing the CEO role in 2004, Michael Dell returned in 2007. Since that time, the company has cut costs and built out an indirect distribution channel, focusing more on the non-PC enterprise side of the market (servers, storage, software and services) and minimizing PC related overhead. Specifically, management has set a target of doubling the enterprise business by 2014. Management entered the PC retail distribution market as it was slowing, was late to enter the enterprise market, and late to expand into Asia. While Dell’s initial vision proved successful, the company has struggled to differentiate itself competitively. Its global market share has fallen to #3 in PCs, and it lacks leading market positions in its other product categories as well. In terms of managing expectations, the company has missed its revenue guidance seven of the last twelve quarters. Its assumptions underlying its revenue guidance this year are among the most optimistic in the technology sector since it has been expecting a strong increase in public sector spending (approximately 25% of revenues) and back-to-school sales. Not only are both not likely, Dell is late with its tablet offering, has a presence in the mid-tier server market which is being squeezed by the low and high end, and is likely to see the commercial PC refresh cycle slow (normalize).

We believe management will be forced to pursue sizeable mergers and acquisitions to meet its goals. Unfortunately, 60-70% of its cash resides overseas and since its stock trades below its peers based on virtually all valuation metrics (Exhibit 4), it will likely need to raise debt to fund this activity. Exemplifying management’s lack of foresight, in June of last year, Michael Dell acknowledged he had contemplated taking the company private, an option discussed further by the CFO in November. This caused spreads to widen close to 100 bps, tightening over the course of this year as the company has worked to dismiss such an option. At current spreads, we do not believe bondholders are being compensated for this credit and event risk.

Exhibit 4: Dell Does not Stack Up Well vs. Its Peers

| Dell Inc. | Bloomberg Peers | S&P 500 | |||||

| Current | 1 Yr. Ago | 5 Yr. Avg. | Current | Pctl | Current | Pctl | |

| Price/T12M EPS | 9.44 | 13.51 | 15.44 | 12.17 | 27% | 13.98 | 10% |

| PEG Ratio | 0.12 | n/a | 0.88 | 0.27 | 20% | 0.63 | 8% |

| Price/T12M Sales | 0.51 | 0.44 | 0.65 | 0.64 | 38% | 1.27 | 10% |

| Price/T12M Cashflow | 7.49 | 7.07 | 12.11 | 8.15 | 39% | 8.89 | 29% |

| EV/T12M EBITDA | 4.69 | 5.66 | 8.34 | 6.48 | 29% | n/a | 7% |

Source: Bloomberg, as of 8/1/2011 (Pctl = percentile)

Clorox

Clorox management has been put in a very difficult position post the $80 per share offer from Carl Icahn announced on July 19 ,2011. Ultimately, we believe bondholders will suffer. The chance of a “white knight” riding in to buy the company for a significant premium to the current offer seems unlikely. Over the last year, Clorox has lowered its 2011 guidance twice in addition to offering disappointing 2012 guidance. The company has limited exposure to emerging markets, is in low growth categories (high exposure to private label), and is more exposed than most of its consumer product competitors to Wal-Mart (customer base at that retailer is hurting), which accounts for 27% of sales. Market share trends have not been encouraging. Even lower average pricing did not improve share in 2010. In a slow growing economic environment Clorox’s product categories will have a difficult time expanding.

We believe management’s poor strategic decisions and operational performance has resulted in this action from Icahn. It can be debated whether or not Carl Icahn is really interested in buying the company or rather starting a process to restructure and revalue the company. Regardless, Clorox management will need to do something to placate investors. This could include stock repurchases, a large one-time dividend, or perhaps a strategic acquisition. All of those options would most likely result in additional debt and lower ratings. Moreover, management may be forced to sell to Icahn at a higher price or to another private equity firm. A highly leveraged deal would result in much lower ratings, perhaps in the single-B category, as suggested by Standard & Poor’s.

Summary

While bottom up analysis is critical, performance – operationally and financially – will also be affected by macroeconomic and political/regulatory factors. It is critical to analyze both to measure risk appropriately. We have to question whether management in the public sector understands this connection, particularly as we approach an election year. Uncertainties delay decisions, negatively affecting all parties. This uncertainty needs to diminish for management in the private sector to feel confident and add jobs. Our investment thesis is not predicated on this happening in the near term. In Corporates, we are investing in companies with strong management teams that can identify market opportunities, positioning them for growth in the intermediate to longer term. We expect our portfolios to benefit from our more selective credit and sector positioning.

Written by:

Elizabeth G. Henderson, CFA

Director of Corporate Credit

and the AAM Credit Research Team

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.