insight

AAM Corporate Credit View: December 2010

November 1, 2010

How Contagious is It?

The Corporate market experienced a modest pullback in late November driven by credit spread widening associated with concerns surrounding Europe, wiping out the positive excess returns for the month. We reduced our European credit positions prior to the widening, namely regulated entities in the region (Exhibit 1).

Exhibit 1

Source: Barclay’s; Note: 10-year bonds

We have witnessed European governments not only raising costs for the banks, but non-financial companies as well. For example, in regard to the utility sector, Germany proposed a nuclear fuel tax and Spain postponed its scheduled tariff increase and embarked on a wholesale review of the electricity sector’s costs. Moreover, the Greek government imposed special contributions on Greek profitable entities calculated on their total net income for the fiscal year 2009 based on a progressive scale up to 10% of their total net income. Regulated entities are particularly vulnerable not only due to revenue pressure, but also because they have high operating leverage and are very large employers. Therefore, as revenues are pressured by miscellaneous levies and the sour economy, costs are not easily adjusted to protect profit margins. In addition, credits that benefit from ratings uplift due to sovereign support are experiencing credit rating downgrades as sovereign ratings are downgraded and/or notching is widened (between the sovereign and credit), with support being viewed as less likely given governments’ reduced financial flexibility. Our optimism earlier this year has clearly waned regarding Europe. We await important events this week such as the European Central Bank’s Long-term Refinancing Option (LTRO) full allotment decision and Portugal and Spain debt issuance, but appreciate the market’s concern, which is chiefly how the underlying structural problems will be addressed.

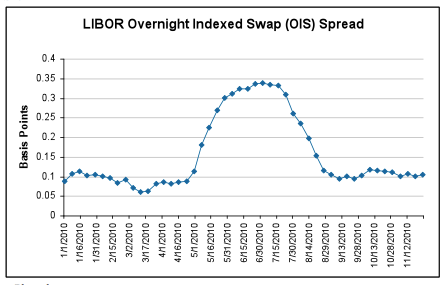

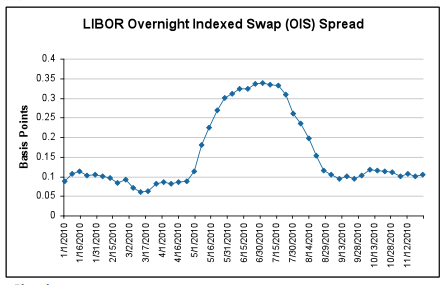

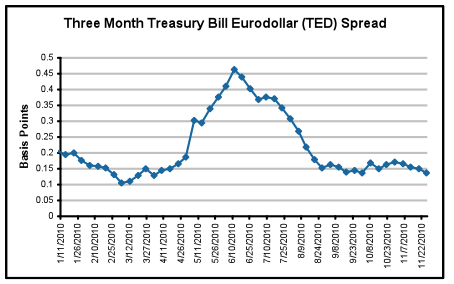

Except for the banking sector and select European utility and telecom credits, we have not witnessed broad based spread widening or systemic risk increasing in the Corporate market. While the stock market has sold off modestly, three-month Treasury-bill Eurodollar (TED) and LIBOR Overnight Indexed Swap (OIS) spreads have remained low (Exhibits 2 and 3). We would expect this to continue unless the market’s fears concerning Spain or other large sovereigns (e.g., Italy) are stoked.

Exhibit 2

Source: Bloomberg

Exhibit 3

Source: Bloomberg

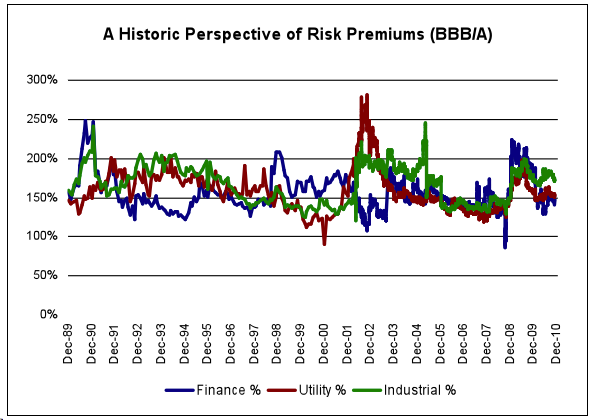

We remain constructive on Corporate credit, but at current spread levels, credit selection is paramount. Spreads for high quality credits are tight, yields are low, and while BBB Industrials are attractive given the stabilization of the U.S. economy (see Exhibit 4), we are investing carefully given our expectation for continued high spread volatility.

Exhibit 4

Source: Barclays

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.