insight

AAM Corporate Credit View: February 2011

February 7, 2011

2011 Outlook

We believe the Corporate market faces less uncertainty relative to this time last year, and that is reflected in tighter spreads. The OAS of the Barclays Index was 150 basis points (bps) on January 31, 2011 vs. 171 bps at the end of January last year. Company balance sheets are strong and revenue growth has resumed, allowing profit margins to expand. Banks are loosening lending standards as their credit provisions slow. The consumer is spending again despite stubbornly high unemployment and a weak housing market. Sovereign related risks remain high in Europe and the Middle East, and China and other emerging markets are growing at record paces, two issues that are unchanged from last year. Importantly, domestic political and regulatory uncertainty should be lower this year after a busy legislative year in 2010 and Republicans reclaimed the House of Representatives. Overall, we are optimistic about the Corporate market and expect positive excess returns again in 2011. We expect spread tightening, as financial credits and BBB rated credits compress with A rated Industrial and Utility credits.

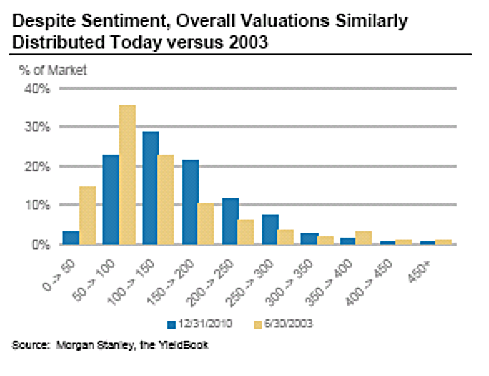

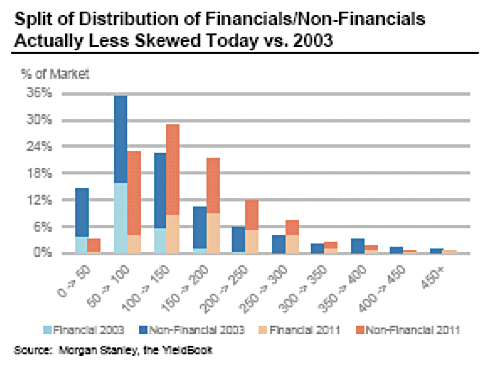

Besides Finance which is at its historic average, Utility and Industrial sector spreads are inside their historic averages, but well above their historic minimums (two to over three times). As shown in Exhibits 1 and 2, spreads are similarly distributed relative to the last economic recovery in 2003, albeit the Finance sector is today what the Industrial and Utility sectors were in the 2001/2002 recession (i.e., the catalyst). Similar to 2003, the U.S. economy and credit fundamentals are improving, and growth is expected to be strong from Asia and emerging markets. However, the consumer is weaker, the financial system is weaker and growth in Europe is expected to a fraction of what it was in 2003. Surprisingly, equity volatility as measured by the VIX (The Chicago Board Options Exchange Volatility Index) is lower today than in 2003.

Exhibit 1 and 2

- Sovereign risk relating to not only the peripheral European countries but in all parts of the globe, as countries either face rising inflation or fiscal challenges. In particular:

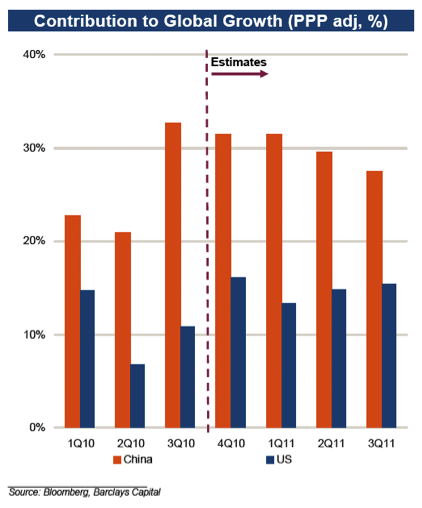

- China is an important source of global growth (see Exhibit 3), and the government has made it clear that growth is its top priority while fighting inflation is only the third priority.

- Europe will go through another round of stress testing its banks, using more stringent criteria. Moody’s estimates the global speculative default rate could increase from an estimated 2% in 2011 to 6% if significant sovereign and financial problems develop[note]Moody’s December Default Report, January 6, 2011.[/note]. Additionally, the austerity measures and weak economies drain credit fundamentals of companies exposed to consumers in that region.

- The U.S. faces its own challenges this year as municipalities look to fill a $125 billion budget gap for fiscal year 2012[note]Center on Budget and Policy Priorities[/note]. It is difficult to quantify the potential consequences, directly and indirectly, to jobs and growth as municipalities cut spending and some raise taxes.

Exhibit 3

- Increased event risk, as companies continue to operate in an economy that is recovering with high unemployment in the U.S. and Europe and face more difficult year-over-year comparisons with 2010 vs. 2009. Productivity improvements are more difficult today and with raw material costs, healthcare and capacity increasing, inflation is likely to increase. For companies serving consumers, this may result in margin erosion as consumers balk at picking up the tab and/or price competition ensues. We expect companies to become more active with mergers and acquisitions to exploit revenue and cost synergies and spend their cash on dividends and share buybacks.

- Rising raw material costs and labor costs abroad and their affects on company margins, leading to increased event risk (see Risk #2). Due to firms’ limited pricing power and high unemployment, we are not yet concerned about inflation in the U.S., but in emerging markets. As we are witnessing in the Middle East, this increases political instability, which increases market volatility, commodity prices volatility, etc.

- Weaker than expected economic growth in the U.S. and/or Europe, including sustained high unemployment and/or a weaker than expected housing market. This would put pressure on the Federal Reserve to keep rates low and continue to stimulate the economy, an increasingly difficult decision.

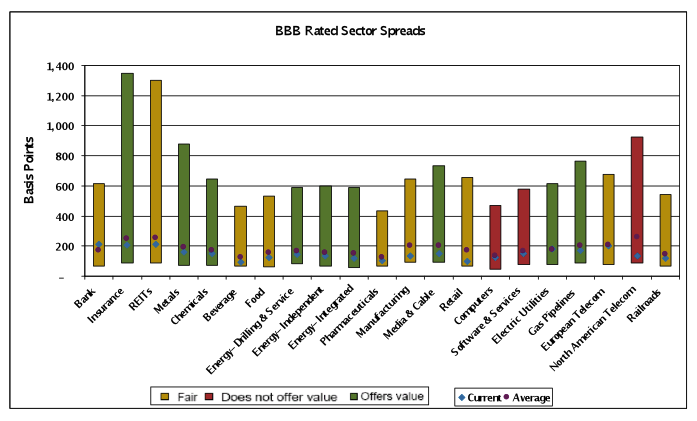

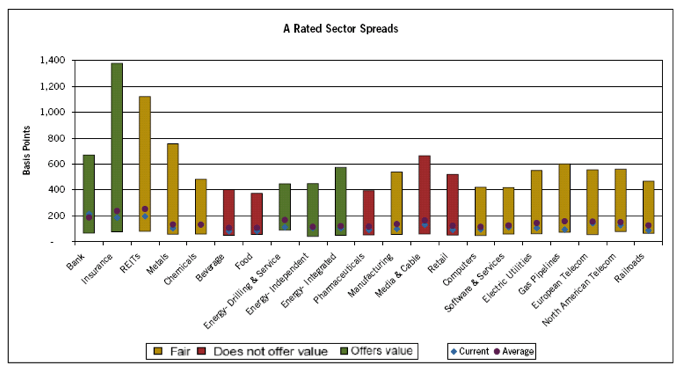

Our industry recommendations reflect these themes in addition to others that are relevant for various credits and industries. Similar to 2010, we expect excess returns to be driven from spread tightening in the Finance sector and BBB rated credits and income generated (“carry”). That said, while we believe there is value in credits rated in the BBB category, in some cases, BBBs are well inside their historic averages vs. credits in the A rating category (Exhibits 4 & 5). This highlights the need for bottom up credit research, as it will be more difficult to outperform using only a top down approach. In summary, we expect outperformance will be driven by the Finance and Utility sectors, and select Industrial sectors.

Exhibit 4

Source: Credit Suisse LUCI Index, 08/02/02 – 1/31/11, 7 – 10 year maturities Note: The bars represent the minimum to maximum spread range for the period.

Source: Credit Suisse LUCI Index, 08/02/02 – 1/31/11, 7 – 10 year maturities Note: The bars represent the minimum to maximum spread range for the period.

Exhibit 5

Source: Credit Suisse LUCI Index, 08/02/02 – 1/31/11, 7 – 10 year maturities Note: The bars represent the minimum to maximum spread range for the period.

Source: Credit Suisse LUCI Index, 08/02/02 – 1/31/11, 7 – 10 year maturities Note: The bars represent the minimum to maximum spread range for the period.

Finance

Banks – We continue to expect this sector to outperform, as fundamentals are improving and, in contrast to last year, regulatory risk has decreased. Profitability should continue to improve as the cost of credit falls. Sector credit quality also continues to be supported by strong capital levels in the wake of recapitalization that began in 2009 and continued in 2010. Liquidity remains robust as deposits exceed loan books for most of the sector, and while loan books appear to have stabilized, loan growth is expected to be modest during 2011. As a result, new issuance is expected to modest relative to the high levels of the past. Accordingly, net debt outstanding for the sector is expected to contract. That said, Finance related issuance is expected to comprise a little over half of the gross Corporate bond issuance for 2011, evenly split between Yankee and domestic banks. Despite this modestly negative technical, we expect bank spread tightening will continue, as volatility decreases and fundamentals improve. We believe bank spreads should compress meaningfully with credits with similar risk profiles.

Insurance – Our preference has moved from Property & Casualty to Life operators from both a fundamental and valuation standpoint. Investment portfolios have strengthened post the economic and financial market recovery. Property & Casualty companies face pricing pressure and have a much higher exposure to municipal bonds (average 30% with some having up to 80%), an asset class that has a high degree of headline risk given the fundamental uncertainties.

REITs – Fundamentals are improving in this sector, benefitting from an improving economy and aggressive capital raising efforts to deleverage and recapitalize. Strong investment grade rated REITs, especially those exposed to central business district (CBD) office and residential (apartment) properties, are well positioned to take advantage of the continued economic improvement and the consolidation that we expect. We are more cautious on the retail REITs. Compared with a stabilization in CBD and apartment REITs, retail rental rates continue to decrease and with high unemployment and a debt laden consumer, retail occupancy rates are not expected to improve dramatically.

Industrials

Energy – We are maintaining our constructive view of oil in 2011 as fundamentals have actually improved from last year when we established our intermediate forecast of $90 per barrel. We are also keeping our subdued outlook for natural gas as prices remain stubbornly below $5 per thousand cubic feet, despite domestic consumption reaching all time highs in 2010. These views on commodity prices contribute to our preference for credits levered to oil in 2011 as was the case in 2010. We believe Integrateds (companies with exploration & production and refining & marketing) and Independents (companies with only exploration & production) levered to oil are likely to report similar results in the upcoming year with more cash flow devoted to capital expenditures and dividends. We anticipate Independents that focus more on natural gas will experience flat margins and cash flow. However, we anticipate more of their cash flow will be directed toward shareholder friendly endeavors rather than capital expenditures as their shares have underperformed oil-levered peers. We have a favorable view of the oil service sector in 2011 for several reasons. First, capital spending by the Integrateds and Independents, the lifeblood of the Service Sector, is expected to increase by 10% in 2011. Secondly, activity in the oil patch is becoming more service intense (i.e., longer lateral drilling, more hydraulic fracturing, deeper offshore, etc.), which results in greater revenue and margins for service companies. Also, the consequences of civil unrest are less for service companies relative to Independents and Integrateds. Lastly, we are cautious on contract drillers due to excess supply created by the moratorium or the non-existent permitting process in the Gulf of Mexico and a substantial number of new rigs entering the marketplace in 2011 and 2012.

Metals/Mining – We expect this sector to outperform in 2011, as most commodity prices remain strong and margins benefit from improved cost structures. Demand across the globe for base metals, especially in China, will remain the main driver of prices. Going forward, we expect a big increase in capital spending, which will be funded with strong cash flow. Debt reduction will become a lower priority and acquisition activity should pick up given strong balance sheets, low rates, and significant growth opportunities. We favor the more diversified companies in lieu of single focused commodity companies, which have more volatile cash flows and hence, more risk in a down market.

Cable/Media – We have become more constructive on this sector, and expect BBB rated Cable credits in particular to outperform. The economy and consumer confidence are strengthening, which is supportive for advertising revenues and consumer spending on telecommunications and entertainment related products and services. The content companies (e.g., Liberty Media-Starz, Time Warner) understand that “cord cutting” (e.g., using Hulu, Netflix, Apple TV to get programming over the Internet) could be damaging to their business models, a risk they had not accurately modeled when entering these agreements. Therefore, they are taking a tougher stance in these negotiations and are being more thoughtful about what rights are being sold into what windows. Conversely, content companies are working more closely with the cable operators to give customers more control over the accessibility of the programming (e.g., video on demand, “TV everywhere”). It’s in the content companies’ best interest to maintain the health of the existing distribution system. We believe the fear of ad skipping has reduced and the fear of cord cutting has increased. Time shifted TV viewing continues to be modest at less than 10% of time spent per Nielsen. We continue to believe this is a risk, at least for programming that is not time sensitive (e.g., dramas), but believe the slow progression will allow the content companies to deal with the issue. Lastly, shareholder pressure has decreased, exemplified by the higher stock prices, due to the reduced uncertainty relating to aforementioned factors. Moreover, acquisitions has been very modest given wide bid/ask spreads and the lack of opportunities. We expect event risk to remain high, but companies are better positioned today with higher cash balances and stock prices. While we expect leverage to increase as company’s are currently underleveraged, we do not believe current management teams are looking to materially increase leverage in a prospective rising rate and uncertain technological and competitive environment. We prefer more diverse media companies (e.g., NewsCorp), chiefly those with strong production studios as the value of content is rising with the proliferation of new technology and devices (e.g., iPad), driving increased media usage and spending.

Cable credit spreads are wide of other BBBs with similar risk profiles, including media credits. They have underperformed over the last few months given the cord cutting concerns and the expectation for new issue supply. Cable operators will be more frequent issuers than media companies given their higher leverage and capital needs, but cash flows should be more stable.

Consumer Products – We expect this sector to underperform and exhibit a heightened level of event risk in 2011. The very large household names, such as Pepsi and Proctor & Gamble, are still doing fine from a fundamental perspective. Having said that, spreads in these bonds are tight and will underperform as the higher yielding credits compress. Smaller sized companies will struggle with higher input costs, intense competition, and a growing and more concentrated retail marketplace. Innovation and consolidation would help offset low growth prospects. We have already seen leveraged buyout (LBO) rumors stir in the market and watched a diversified company (e.g., Fortune Brands) breakup its assets in an effort to extract better value for shareholders. In this sector we like those companies who have completed large debt financed acquisitions and are aiming for higher credit ratings (e.g., Anheuser Busch, Kraft).

Utilities

Electrics – We expect 2011 to be a transformative year for the electric utility sector as the industry gets clarity on several regulatory issues that have stalled strategic initiatives. The Environmental Protection Agency (EPA) will issue its proposed rules for hazardous air pollutants in March with the final rules scheduled for later this year. Additionally, the EPA has indicated that it expects to issue clean water proposals in March with final rules expected in mid-2012.

The implications to the industry are enormous as utilities will decide on retiring and or upgrading coal fired plants (up to 15% of coal plant capacity could be retired), which could lead to regulatory driven demand for natural gas plants. This comes on the heels of many efficient natural gas fired plants supplanting older inefficient coal plants in the past year due to natural gas/coal economics.

As we suggested earlier, outside of financials, we expect excess returns to be driven from BBB rated credits, which does not bode well for the higher rated, regulated first mortgage bonds of the electric utility sector. Additionally, our lackluster view of natural gas, the marginal fuel in most major competitive power markets, suggests that unregulated power providers probably will have another rather weak year.

Pipes – We have a favorable view of the BBB-rated Utility sector, largely due to our expectation of a reasonably positive year from the Pipelines/MLP (Master Limited Partnership) sub-sector, which currently trades wide of its historical average. We see several factors contributing to the strength in the sector for the upcoming year. First, for non-fee based MLP businesses, performance generally tracks the U.S. economy, which we expect to grow by 3% in 2011. Secondly, several recently completed multi-billion dollar projects (Fayetteville Express, Gulf Crossing, Midcontinent Express) will begin to generate substantial cash flows this year. Thirdly, the massive build out of the past five years will slow and more capital will be devoted to maintenance projects. This should allow credit profiles to stabilize or improve in 2011.

Technicals

We believe Technicals will remain supportive for spreads. We are expecting new issuance to be down slightly versus 2010, with Financials dominating the calendar. Yankee issuers are also expected to be prevalent. Gross new issuance for 2011 is expected to be down about 14% to $565 billion. Financials are expected to be unchanged at about $310 billion while Industrials are expected to be down 31% to $205 and Utilities (Electrics and Natural Gas) unchanged at $50 billion. Within Financials, Yankee Banks are expected to be about 52% of the total, issuing about $160 billion in new debt. Within Industrials, increases are expected only from Capital Goods (+33%) and Technology (+13%). Capital spending is forecasted to be relatively unchanged, merger and acquisition activity should be higher, debt tenders and opportunistic interest rate related issuance should be lower, and some sectors are benefiting from the bonus depreciation provision in the recent tax bill, reducing their issuance needs (lower cash taxes increases free cash flow). Merger and acquisition activity will be the wildcard this year with respect to changes in the issuance estimates. We expect companies will continue to raise dividends and repurchase shares, reducing their large cash coffers. The secondary market has been active as well despite a more difficult market in which to buy bonds, as dealers hold less inventory due to more stringent regulatory requirements.

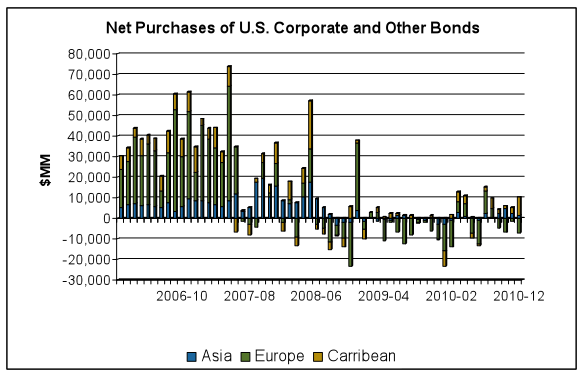

Investor demand continues to be robust for Corporate bonds. International demand is increasing but remains quite low relative to past periods (Exhibit 6). Asian demand in particular has increased for high quality, longer duration Corporate bonds. Retail investors have been selling Municipal bonds, possibly decreasing any selling pressure on Corporates as a fixed income asset class in the face of rising rates and an increased appetite for risk. Investors have been concerned about an asset allocation shift from fixed income into equities which could place pressure on Corporate spreads. However, we have yet to see this transpire. The tight supply of bonds and the demand from insurance companies, foreign investors and traditional buyers should limit the impact on spreads. Another risk in the near term is a shift from Corporates into Municipals; however, the lack of supply in that Municipal market limits the downside.

Exhibit 6  Source: Department of the Treasury

Source: Department of the Treasury

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.