insight

AAM Corporate Credit View: January 2010

January 6, 2010

Year 2009 closed as an exceptional year for the Corporate Bond sector with 2276 basis points (bps) of excess return per the Barclays Corporate Bond Index. This compares to 2008, which posted an excess return of -1988 bps. In terms of broad sector performance, Industrials and Utilities outperformed the Finance sector. Spreads remain wide of historical averages, reflecting the various uncertainties we face in the near term. Exhibit 1 depicts spreads for higher quality bonds in the three broad sectors.

Exhibit 1: A Rated Bonds (Z spread, bps)

| 5-year | 10-year | 30-year | |||||||

| 12/30/2009 | Average | std dev | 12/30/2009 | Average | std dev | 12/30/2009 | Average | std dev | |

| Utilities | 92 | 74 | 80 | 105 | 85 | 78 | 128 | 109 | 109 |

| Industrials | 71 | 67 | 69 | 93 | 82 | 70 | 126 | 110 | 110 |

| Finance | 148 | 130 | 169 | 171 | 142 | 164 | 204 | 163 | 163 |

Source: Barclays; Index data as of 5/31/1994 to 12/30/2009

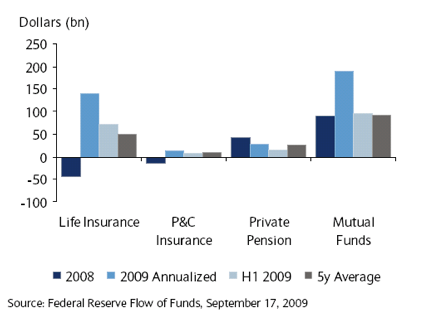

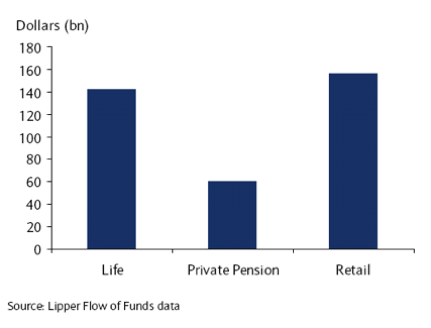

Spreads reflect the fundamental health and technical dynamics of the market. Compression in 2009 was due to an improvement in both, as the government stimulus and financial related initiatives shortened the tail risk in the market especially for Financials. Technical support returned to the market, as shown in the Exhibits 2 and 3, as funds flowed back into Corporate Credit.

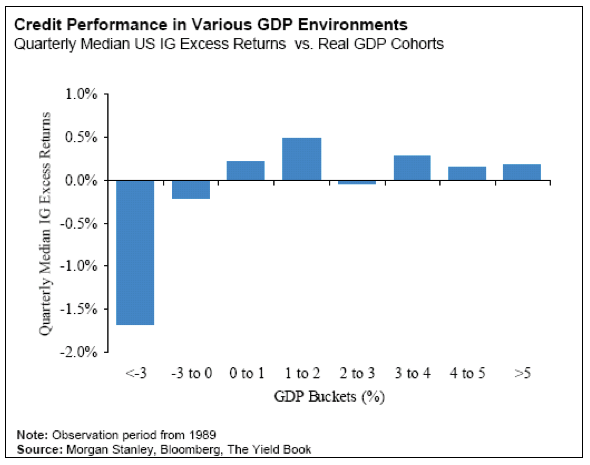

We enter 2010 with a different set of variables. Fundamentally, we continue to expect a muted economic recovery in the U.S. while other countries (“BRIC” – Brazil, Russia, India and China) grow more rapidly. The U.S. continues to face serious issues despite the improvements of late. Job creation and hiring must take place, foreclosures remain manageable, and real estate related loan modifications be successful, not to mention the government must continue to be involved and support the transition from the public to the private sector. As long as we remain on the path of recovery, a slow growth environment is not necessarily a negative for Corporate Credit (See Exhibit 4).

Exhibit 4: Credit Performance in Various GDP Environments

(Quarterly Median US IG Excess Returns vs. Real GDP Cohorts)

This “slow growth” environment should result in good old fashioned merger and acquisition activity, innovation to differentiate, and industry participant bifurcation where industries are cleansed of weak operators that benefited from the earlier days of easy money. We are seeing the latter in the Finance sector, as hundreds of small banks and other weak financial institutions like CIT have failed. Our approach for 2010 is not an unfettered “grab for yield” as many others are proposing, but a prudent “invest in growth,” which we believe will be a winning strategy over a longer period of time. Security selection remains critical, although we do not expect 2010 to be a year of high idiosyncratic risk like we have seen in previous years (e.g., LBO phenomenon). Therefore, both the industry and security calls are important.

Specifically, as it relates to industries, we continue to advocate sectors such as: (1) Banks and Insurance, including owning select subordinated securities of stronger banks given the right structure and economics, (2) commodity based cyclical industries and those related to them, and (3) defensive consumer based sectors like Food and Beverage, as opposed to Homebuilding/Building products. We are cautious on industries and companies that face growth obstacles over the near-to-intermediate term, making them more susceptible to shareholder friendly actions and event risk. At an industry level, this includes REITs, Media, Telecom, and Utilities. Specific industry and company related commentary that fall within these categories is included on page 3.

In summary, we expect the investment grade Corporate bond sector to post positive excess returns in 2010 driven by carry and spread tightening, as spread compression continues among industries and ratings.

| Supplemental Commentary |

|

Finance Insurance Insurance, like Banks, is a sector that continues to face challenges but we believe offers investors compensation for the risk. Like all Financial sectors, Insurance spreads continue to be wide of their historic average relative to other Industrial/Utility sectors. The OAS of the Barclays insurance segment of the Index was 250 bps at year-end 2009, or 155% and 180% of the Utility and Industrial sectors, respectively vs. historic averages of 115% and 119%, respectively. We can support the stronger credits in the Life and P&C sectors given the improvements that have been made, regulatory support shown, and the recovery that is underway at the macro and market levels. The U.S. life insurers raised approximately $10 billion of capital in 2009 to manage downward rating migration and capital pressure from investment asset write-downs. The U.S. P&C insurers experienced lower catastrophe losses and improved investment portfolios in 2009, but still face heavy competition and decreased premium levels. Reinsurers in the U.S. and Bermuda performed strongly in 2009, but the sector’s strong equity position and its ability to access the capital markets will be tested if a large catastrophe event occurs. The U.S. health insurance sector continues to be hurt by weak economic conditions and the ongoing uncertainty regarding health care reform. Commodity Related Sectors Metals & Mining In 2010, we expect commodity prices to remain off the lows of early 2009. We anticipate a general improvement in demand as consumption grows in emerging markets. The pace of recovery will depend on how certain challenged global end markets recover, including automotive and commercial construction. Many companies in the sector have improved their liquidity positions as debt and equity markets re-opened in 2009. Most of the larger more diversified companies entered 2009 with strong balance sheets, helping stem some of the pressure from free cash flow leakage. We also continue to expect consolidation of the industry in 2010, as the larger, more diversified companies buy the more specialized, lower rated companies. We expect issuance to be light/moderate in 2010 depending on M&A activity. Energy In 2010, we believe oil should be in the $65 – $70 per barrel range and natural gas should approximate $5 per thousand cubic feet. As a result, we have a positive view of the credit fundamentals for the independent and oil field service segments. We believe that in a $70 oil and $5 gas environment, the vast majority of the energy sector should be able to fund capital expenditures and dividends internally. However, we believe total debt will increase in the sector in 2010, due to debt-funded share repurchase activity and M&A related issuance. Additionally, refinancing activity in the Energy sector is expected to exceed $5 billion in 2010. We expect ConocoPhillips to be an active refinancer with more than $1.4 billion maturing in the second quarter of 2010. Consumer Defensive Food & Beverage In 2010, we expect the Food & Beverage industry to perform well fundamentally. Consumers continued to spend their dollars on food and beverage products despite the deep global recession. Having said that, we expect consumers to remain focused on price and there are numerous cases of “trading down” from premium brands. Diversification and economies of scale for investment grade companies in this sector help to alleviate pressure from changing consumer activity. Overall, we would expect a very minor pick-up in consumption as the global economy recovers. We are focused on those companies with strong brands that have (Anheuser-Busch Inbev), or are expected to (Kraft), engage in M&A activity and intend to capitalize on the new issuance that will be needed to fund those deals. We expect to see consolidation in this industry with the potential transaction between Kraft and Cadbury serving as the catalyst. We anticipate a moderate amount of issuance for the sector in 2010. Growth Obstacles Electric Utilities We have a negative view of the Electric Utility sector in 2010 given the defensive characteristics of the industry, the capital requirements necessary in the next several years and political threats (EPA pollutant rules, Cap and Trade legislation, etc). We believe that the credit profiles for much of the sector could deteriorate moderately as the sector in aggregate will be free cash flow negative. We expect that issuance in 2010 should be in the $50 billion range and would not be surprise if some issuers pre-funded their 2011 requirements given the low interest rate environment. |

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.