insight

AAM Corporate Credit View: July 2010

July 7, 2010

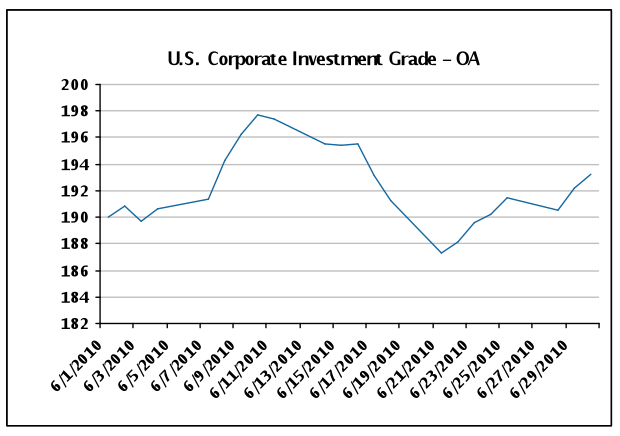

June was another volatile month for Corporate credit (Exhibit 1). Spreads ended the month modestly wider, generating -9 basis points (bps) of excess returns for the Barclays Corporate Index driven mainly by the underperformance of the Energy sector (-249 bps excess return).

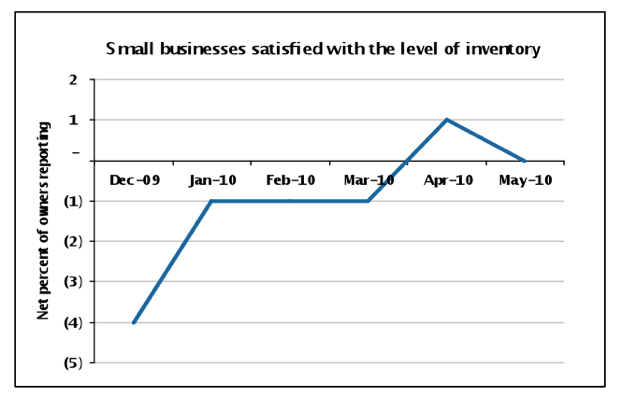

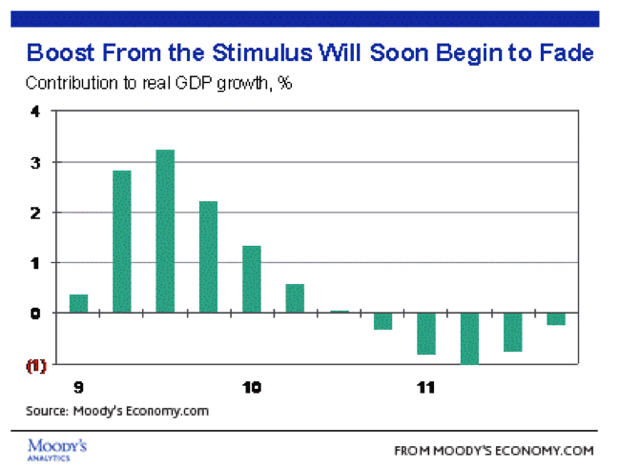

June failed to produce sufficient positive signs to allay concerns regarding the sustainability or strength of the domestic economic recovery. Early indicators are pointing to a slowdown in growth in the second half of the year. The question is how slow? We had believed growth would be modest this year, less than 3%, and vulnerable to a public to private sector handoff as stimulus spending waned (Exhibit 2). Since May, manufacturing has continued to expand, albeit at a slower pace, and private sector employment has disappointed, as private employers turn more cautious. We believe we may be at a point where inventory restocking has stalled and employers are willing to replace but not build (Exhibit 3). Small business owners, as reflected by the National Federation of Independent Business (NFIB) survey, and large business CEOs, as reflected by the Business Roundtable survey, are concerned with the overall global economy, legislative policy, and new regulations and rules. Managers do not feel comfortable hiring new workers or spending capital when they are uncertain of the return on investment. Therefore, jobs remain very difficult to source. We have been expecting jobless claims to fall below 400,000, a level that typically coincides with the end to payroll employment losses, and are still waiting. The jobs report released on July 2, 2010 was very weak, considering household employment declined sharply and both the workweek and average hourly earnings declined.

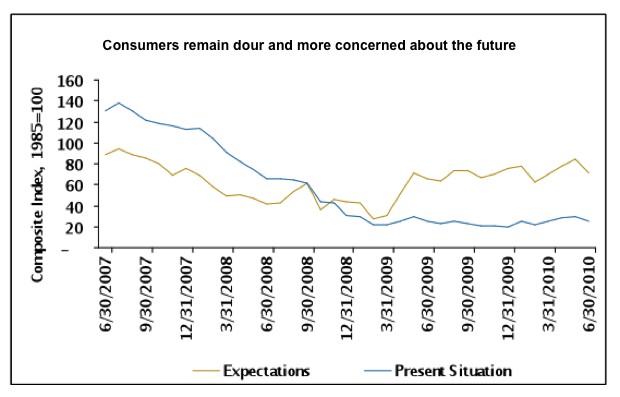

The high level of unemployed workers is being reflected in lower consumer confidence. The June Conference Board Index (Exhibit 4) reading disappointed (52.9 vs. a revised 62.7 in May) with a 16% drop in the expectations part of the index, a source of concern given the reliance on the consumer to solidify the recovery. As reflected in the present situation portion of the index, consumers recognize the obstacles they and their government face.

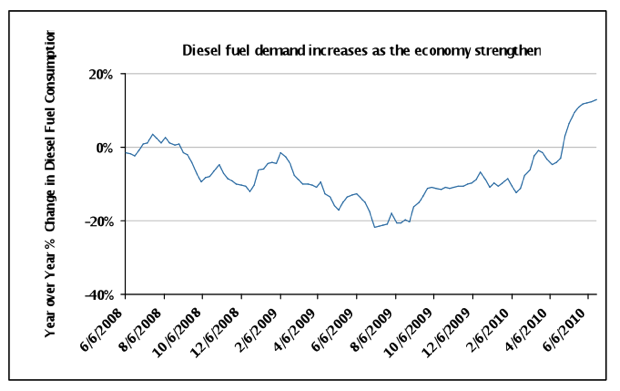

Firm and industry level data has been encouraging, albeit reflecting decisions that may have been made earlier in the year or quarter. For instance, data points such as rail carloads, intermodal traffic, rig count, energy consumption (Exhibit 5), advertising, retail sales on the Industrial side and return on assets, net interest margin and asset quality on the Banking side have all shown improvement from 2009 levels. Acknowledging the time lag that exists from when a decision is made at the consumer and/or business level to when the information is made available to the public via a statistic or index figure, we will continue to analyze this data and incorporate management commentary and forecasts to make changes to our base case. That said, recent economic data suggests the risk of growth coming in below consensus forecasts has increased.

Our investment mantra earlier this year of “investing in growth” instead of “reaching for yield” reflected our view that investors could benefit from investing in high quality companies in defensive industries. We believed and continue to believe that a “slow growth” environment should result in merger and acquisition activity, innovation to differentiate, and industry participant bifurcation where industries are cleansed of weak operators that benefitted from the earlier days of

easy money. We are early in this process, but are seeing signs of potential catalysts for the latter (i.e., widening divergence of balance sheets and access to capital for strong vs. weak firms).

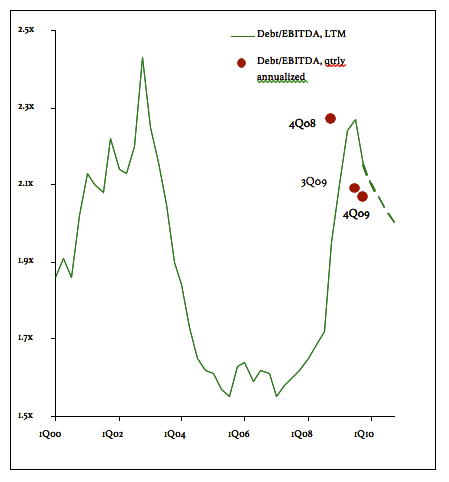

At this point, we believe fundamental improvement has taken place in many facets of the economy, including investment grade company balance sheets (Exhibit 6), and a recovery, even one that is lackluster, is still on track. However, the recent jobs report shows that the labor market has yet to reach the point where it is self sustaining, making our base case forecasts at the credit level vulnerable to downward revisions. The degree of these revisions could affect our opinion on the Corporate credit market, but at this point we continue to expect positive excess returns for those credits that are higher quality and more defensive (e.g., food, beverage, pharmaceutical, aerospace/defense, rails), in addition to high quality banks and believe there are opportunities in the energy sector.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.