insight

AAM Corporate Credit View: June 2010

June 7, 2010

Out Like a Lion

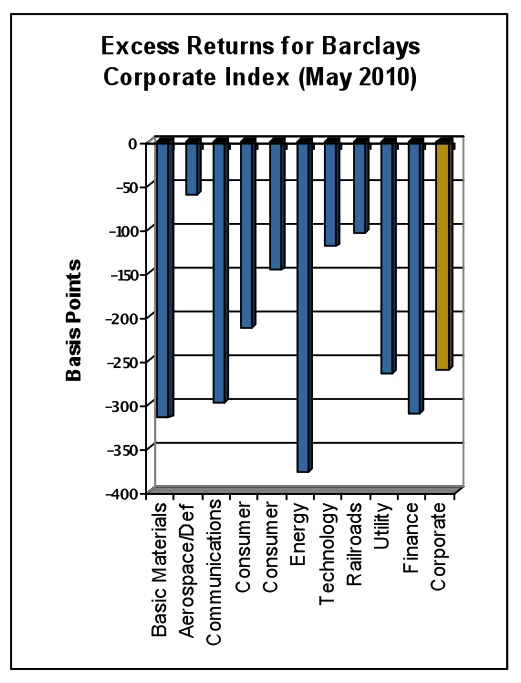

May brought a steep reversal of the spread tightening over the previous few months. After 44 basis points of spread widening in May, excess returns turned negative for the year (-99 basis points excess return year-to-date and -260 basis points in May for the Barclays Corporate Index). The widening occurred in all three sectors, Industrials, Utilities, and Finance although defensive sectors generally outperformed, as shown in Table 1 (e.g., Aerospace/Defense, Railroads, Consumer Noncyclical sectors).

In addition to widening credit spreads, Treasury yields rallied among other signs of increased risk, reflecting three primary concerns:

Economic uncertainty in Europe – The market seems to be taking a “prove it” stance towards the Eurozone periphery countries, also known as PIIGS (Portugal, Italy, Ireland, Greece, Spain), and other European countries, as government liquidity and austerity measures are not resulting in positive market reaction. Fears of a public to private transition for GDP growth worldwide and the uncertainties relating to fiscal deficits and debt burdens are high, and the Eurozone periphery countries represent proof and consequence. In addition, there continue to be questions surrounding the stability of the banking sector in Europe. The contagion to the domestic economy is a concern if this weakness continues. While U.S.

exports are a small component of GDP growth, there are many indirect economic consequences if this region deteriorates economically. For instance, a weaker Euro would likely cause the Chinese export market to weaken, resulting in slower Chinese and emerging market growth, which would negatively affect U.S. growth. The indicators that we will be watching closely include: confidence, manufacturing, auto and retail sales, railcar loads, and various European GDP and banking related reports. The economic fragility coupled with limited monetary and fiscal alternatives remain our primary concerns, if the U.S. does enter another recession.

Stock market correction – In addition to many other consequences, a continued decline in the stock market has the potential to weaken consumer and business confidence, which is essential for our economy to continue to grow. As the government stimulus is withdrawn and the early drivers of GDP growth wane (e.g., inventory reduction), U.S. GDP growth will become increasingly more reliant on traditional sources of growth – fixed investment and the consumer. So far in 2010, the consumer has been stronger than expected as reflected in the latest confidence report. Consumer confidence has increased largely due to the expectations factor, highlighting the vulnerability of the consumer in light of high unemployment and a weak housing market. If expectations from the consumer and business leaders deteriorate, it puts the progress in these areas at risk. There are many other direct and indirect effects that would negatively impact not only GDP but individual company results (e.g., annuity writers).

Financial regulatory reform – The primary risk facing bank credit investors is the possibility of rating downgrades associated with a reduced ability on the part of the government to provide extraordinary support in the future. For a handful of “systemically important” institutions, the ratings currently reflect a level of implicit and explicit support from the U.S. government. Should regulators be legislatively prohibited from providing extraordinary support to struggling financial institutions (as they did during the 2008 liquidity crisis), the rating agencies have signaled that they could potentially downgrade a number of large banks from the A category to BBB. While the rating agencies appear to be taking a measured approach to assessing the impact of financial regulatory reform, rating downgrades remain a possibility in the intermediate-term. From a bank Balance Sheet perspective, unlike three years ago, banks are very liquid and have deleveraged, leaving them better able to manage a downgrade to the BBB rating level. However, this is significant not only because it increases funding costs, but it also reduces the availability of funds (Commercial Paper, Repurchase Agreements). This has a negative impact at an economic level because it constricts lending and therefore, the velocity of funds, which is already low. At this point, we remain comfortable with the financial sector from a fundamental standpoint (improving asset quality/strong capital and liquidity), but raise the concern more at an economic level.

Entering 2010 vigilantly, we had advocated a defensive position in credit. We have been concerned about the economic fragility around the world and the limitations governments face due to the burdensome debt obligations and strained fiscal balances. Although we have witnessed improving company fundamentals, the possibility of an exogenous shock to the economic system puts the sector at risk of underperformance in the near term. Our cautious approach to the sector has reduced the volatility of our portfolios and puts us in good position to take advantage of spread widening in the high quality sectors over the next few quarters.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.