insight

AAM Corporate Credit View: May 2011

May 4, 2011

More Buyers than Sellers – Is it Really that Simple?

There was a strong bid for Corporate bonds last month, as evidenced by the 42 basis points (bps) of excess return for the Barclays Corporate index in April and 146 bps year-to-date. The Option Adjusted Spread (OAS) of the index is 18 bps tighter this year, driven by tightening in Financial and BBB rated credits (Exhibit 1). This type of rally is what we expected this year. With the economy continuing to improve, we expected risk appetite to increase.

Exhibit 1

| Excess Returns, Year-to-Date (bps) | |||

| AA | A | BBB | |

| Industrial | 12 | 68 | 171 |

| Utility | 19 | 54 | 175 |

| Finance | 96 | 220 | 368 |

Source: Barclays

We have been supportive of Corporate credit for some time, for both fundamental and technical reasons. The majority of our monthly thought leadership pieces have focused on the fundamentals, and rightly so given their importance. This month, we are focusing on marketplace technicals. With QE2 expiring next month, investors have been focusing on the technical side of the Treasury market and the potential spill-over the expiration may have on other markets. Accordingly, it is important to understand what has (and has not) changed in the Corporate market from a demand and supply perspective. With the economy on firmer ground today relative to this time last year and the Fed’s communicated support, we are not expecting markets to react negatively when QE2 expires. We believe unless the fundamental outlook materially deteriorates, the demand for Corporate credit and limited supply will keep the sector from underperforming Treasuries.

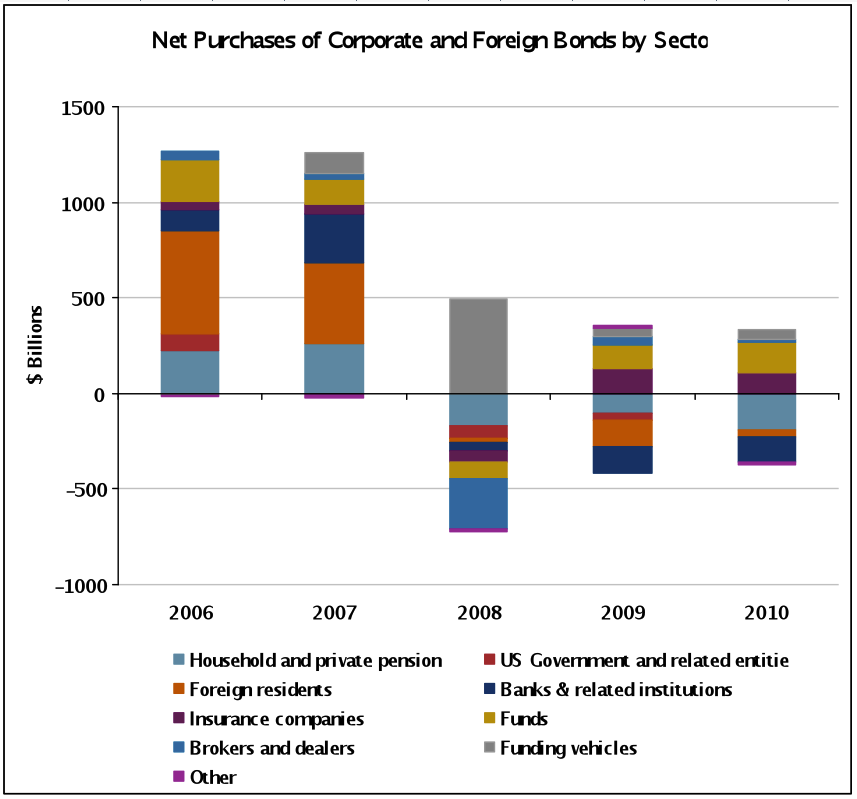

After a broad sell-off in 2008, demand has resumed for Corporate bonds albeit not to the levels witnessed in 2006-2007. Insurance companies, mainly Life companies, and Mutual Funds have been the predominant buyers of Corporate bonds over the last couple years (Exhibit 2). A lot of attention is placed on the continual buying of Corporate credit by mutual funds and the belief, according to investor surveys conducted by Wall Street firms, that many institutional investors are overweight Corporate bonds relative to their respective indices. This creates the perception that the market is biased to underperform. As Exhibit 2 shows, there are other investors that buy Corporate bonds. The household, foreign, banking and government sectors are also important constituents, and could resume net buying once they complete their deleveraging. The Corporate/Foreign bond sector has not grown since the peak in 2007, when it was $11.4 trillion up from $6.2 trillion in 2002. That said, relative to the total, this sector has moved from 20% of total Credit Market Debt in 2002 to 22% at year-end 2010.

Exhibit 2

Source: Federal Reserve, AAM

Note: Funding vehicles is defined by the Fed as nonbank financial holding companies, custodial accounts for reinvested collateral of securities lending operations, Federal Reserve lending facilities, and funds associated with the Public-Private Investment Program (PPIP); Foreign debt is defined as amounts borrowed by foreign financial and nonfinancial entities in U.S. markets only

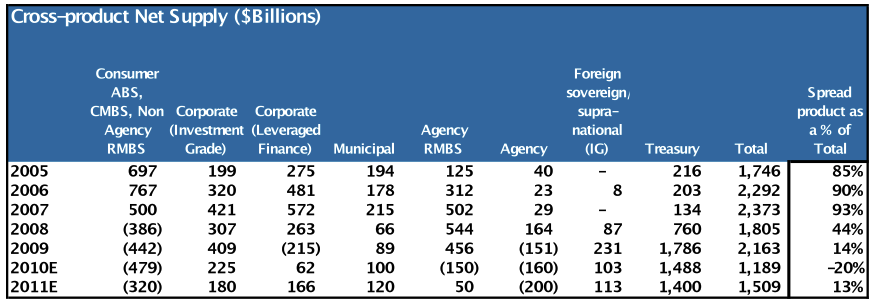

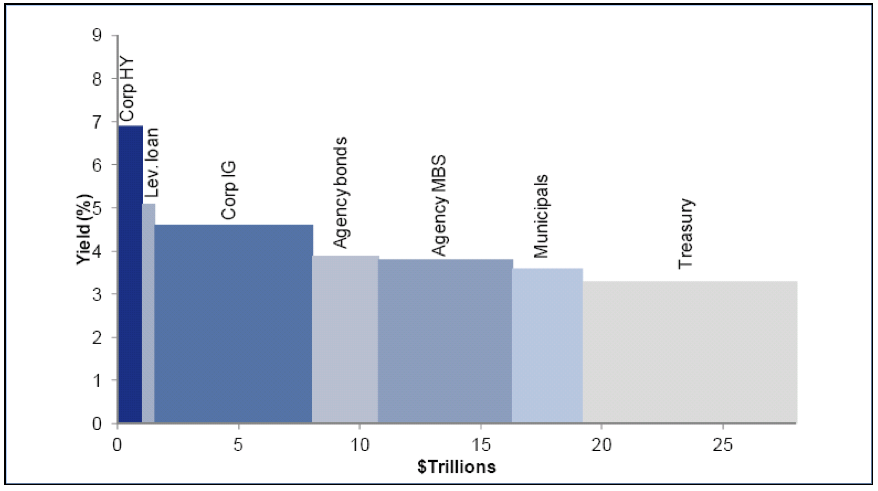

Importantly, the low interest rate environment and lack of supply in sectors outside of Corporate bonds supports the demand for the asset class (Exhibits 3 & 4).

Exhibit 3

Source: Bank of America Merrill Lynch Global Research

Note: For Leveraged Finance net supply, calls/tenders are subtracted from gross supply only for 2009-2011; Spread product defined as first five columns

Exhibit 4

Source: Goldman Sachs Credit Strategy, SIFMA, Bloomberg, S&P LCD

Note: This chart shows the size of all fixed income assets and the yields comparable to 10-year treasury, with exceptions of HY and leveraged loans.

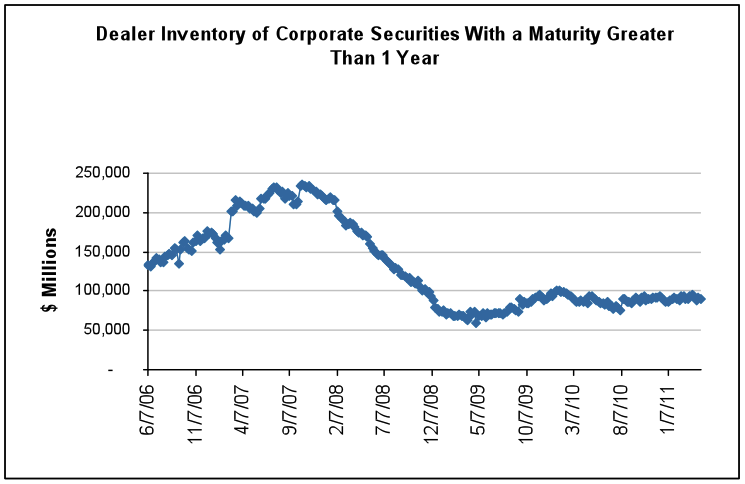

Lastly, secondary market liquidity is lower than it was before the financial crisis, as evidenced by the inventories held by broker dealers (Exhibit 5). A number of factors have conspired to constrain dealer inventories over the past several years. Most notable has been the dwindling field of dealers with balance sheet capacity (e.g., Bear Stearns, Lehman Brothers, Merrill Lynch). While numerous boutiques have sprung up in their wake, these start-ups have limited capital and balance sheet capacity. At the same time, the remaining large dealers were made painfully aware of their over-reliance on wholesale funding to finance large inventories in the run-up to 2008. Subsequently, dealers have been engaged in a multi-year de-leveraging process which has reduced average gross leverage from a high of well over 30 times (x) to around 20x today. Lastly, the pending debut of the Basel III capital regime beginning in 2013 will put pressure on dealers to run lower inventory in a number of ways. First, the market risk associated with inventories will be more heavily weighted in capital calculations. Additionally, Basel III moves away from a purely ratings based risk weighting, resulting in higher capital charges for a range of structured products (e.g., Residential Mortgage Backed Securities (RMBS), Commercial Mortgage Backed Securities (CMBS), Collateralized Loan Obligations (CLO)). Finally, European banks will be subject to a 3% minimum gross leverage ratio, which will meaningfully constrain the ability to grow their balance sheets (U.S. banks are already subject to a minimum leverage ratio).

Reduced supply, especially of spread product, in both the new issue and secondary market along with investor demand that is likely to grow at the margin as deleveraging slows, bodes well for the demand for Corporate bonds. This is supportive for Corporate spreads and firms that are nimble and can take advantage of all segments of the marketplace.

Exhibit 5

Source: Bloomberg

Source: Bloomberg

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.