insight

AAM Corporate Credit View: September 2012

September 7, 2012

Back to Work

- Corporate Bond Markets Outperformed Treasuries in August

- European Headlines Will be Plentiful, Leading to Higher Volatility

- Stimulus in China is Likely by Year-End

- Companies are Cautious, But Consumers are Still Spending

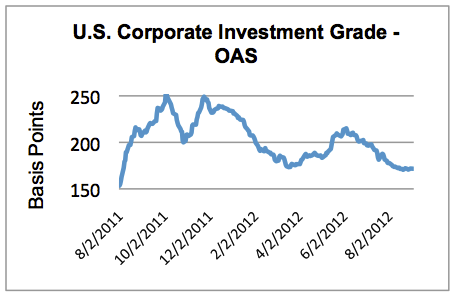

Investment Grade Corporate Bond Spreads Continue to Tighten in August

Investment grade corporate bond performance in August was strong with Finance outperforming Industrials. The Investment Grade Corporate OAS tightened six basis points (bps) per Barclays. The market earned 0.42% over Treasuries in August, increasing the year-to-date excess return to 4.80% per Barclays (Exhibit 1). “BBB” rated securities have earned 4.87% over Treasuries and 5.09% over “A” rated securities year-to-date (0.54% and 0.38%, respectively, in August). From an industry perspective, Life Insurance outperformed in August (2.03% excess return) and Metals & Mining underperformed -0.99%). The domestic high yield market also performed well, earning 1.15% over Treasuries in August. In Europe, the Corporate market had a good month as well, earning 1.20% of excess return in August according to Barclays.

Exhibit 1

Source: Barclays Capital, AAM

New issuance in all markets was healthy, and for most deals in the domestic investment grade market, new issue concessions were nonexistent. We expect September to be an active month for new issuance with over $80 billion of supply expected. The market continues to be in our Fair value range, but the risk is skewed to the downside. We would not be surprised if spreads widened this month due to heightened volatility and new issue supply.

How Has AAM Been Investing in Corporates?

We believe the market has largely priced in: (1) the policy actions expected from the Federal Reserve, European Central Bank, and People’s Bank of China, (2) positive headlines from Europe (i.e., a supportive German Constitutional Court, Greece remaining in the Euro, Spain receiving support from the Troika), and (3) an avoidance of the fiscal cliff in the United States. If the market is right, business and consumer confidence is likely to rise, supporting and possibly propelling GDP growth. While our base case reflects market sentiment, we believe the risk and uncertainty surrounding these events is high and will lead to increased volatility. Current spread levels are not compensating investors for heightened volatility. We are defensively positioned for our clients, owning more Corporates versus our benchmarks while avoiding Europe and more cyclical and/or fundamentally weak credits. From a rating perspective, we prefer higher quality BBB rated Industrials/Utilities and domestic Financials versus A rated Industrial/Utilities due to the historically wide spread differential and the importance of income in this environment. We believe it remains prudent to avoid Europe until real fundamental solutions are presented and are not investing in more volatile, weak BBB rated credits due to the lack of value for their deteriorating fundamentals.

European Headlines Will Be Active – Status Quo Most Likely, But Tail Risk Remains

September is a critical month with the Federal Reserve and European Central Bank expected to announce programs to help stimulate their respective economies. Mario Draghi, President of the European Central Bank, pleased the markets this morning with his announcement that the Securities Market Program (SMP) will be used to purchase government bonds with maturities of one to three years. The amount will be unlimited, but the countries that participate must enter into the rescue fund and comply with such conditions. The ECB has used this program very little in the past due to the objections by the Germans. They objected to this plan as well, and were the sole objectors of the 23 member Governing Council.

Liquidity may be further increased via the European Stability Mechanism (ESM), assuming the German Constitutional Court rules that Germany’s participation in the European Stability Mechanism (ESM) is legal. This announcement is expected on September 12. We are also waiting for ratification of the ESM by other countries, which are likely post September 12. Finland has been most resistant to further bail-outs and to the ESM. A unanimous vote is needed by the European Union countries to move forward. Importantly, the Dutch election is also September 12 and one such outcome could return a coalition against aggressive austerity and in favor of a Greek exit.

While the ECB’s actions are a near term positive solution for liquidity, we do not view this unconstrained monetization as a long-term solution. Fiscal unification is required as well as structural reform and growth initiatives for countries in the periphery. Without growth, deficit and debt reduction cannot be achieved without debt repudiation, a very painful process. Lastly, unification of European Union (EU) bank regulation is also being discussed, although it is unlikely that it will be in place this year. The European Commissioner for Economic and Monetary Affairs and the Euro, Olli Rehn, favors giving the EU supervisory power for all euro area banks as this framework is the only one that would allow the euro area to recapitalize banks directly. It is expected that once this is in place, the ESM will be able to recapitalize the banks similar to what the U.S. Federal Reserve did with T.A.R.P.

In addition, we expect to learn more about Spain’s banking system and how much capital is needed of the €100 billion of aid pledged. Four of its regions have approached the sovereign for emergency liquidity support and bank deposits (for the country) continue to drain. Prime Minister Rajoy has not officially asked for a bailout from the Troika, but this is expected over the near term. The terms are important, since Spain has been diligent with its austerity and in the minds of the Spaniards, is not able to implement further austerity. Germany has been slowing economically and cannot afford to have a break-up of the Euro. Therefore, we believe the Germans will capitulate, allowing Spain to enter the program without materially harsher measures.

And, don’t forget Greece! Prime Minister Samaras has asked key euro policy makers to discuss relaxing its conditions of the last bail out agreement to give Greece another two years to meet its commitments. This month, the Troika will be examining Greece’s fiscal and economic progress and releasing its report by the end of October. Although the report is expected to disappoint, it is not a foregone conclusion that Greece will leave the Eurozone with a 30% probability (per Intrade) being assigned to its departure this year.

From a ratings perspective, Moody’s left Spain’s rating on review, waiting for more details from the German court and Spain’s funding requirements. It also placed the EU’s triple-A rating on negative outlook, reminding investors of the correlation between the four largest member states’ (Germany, France, Netherlands, UK) ratings and the EU’s rating.

China – Expect More Policy Action Over the Near Term

We continue to see evidence of a slowing economy, exemplified by the latest manufacturing report. Policy action so far has not gotten sufficient traction; therefore, more is expected to maintain growth. Specifically, the market expects China to cut its reserve ratio by 150 basis bps by year-end. Inflation concerns should be tempered by recent reports, although policy action may be delayed due to the transition in leadership in November. While growth has come down and the overall contribution to world GDP is quite large, companies are revising their spending plans in the country, a near term consequence. For instance, Metals and Mining companies are extending their capital spending plans because of lower commodity prices and higher costs and Media companies are cutting their revenue forecasts due to a lower growth rate for advertising. In addition, large, global conglomerates such as Caterpillar (CAT) have suffered. CAT is cutting production in China and will export to other parts of the world to get inventory in that region to a more comfortable position.

In summary, we believe the government will remain supportive with policy action later this year, but are more cautious and concerned with the secondary affects on the Corporate sector since China has been a significant contributor to many companies’ financial results.

Sector Fundamental Reviews

We thought it would be worthwhile to revisit our fundamental sector views due to the slowing economic growth worldwide. Second quarter results highlighted managements’ uncertainty and caution with few increasing 2012 estimates. Pricing was more difficult, higher input costs and a stronger dollar affected margins, and emerging market growth was weaker than expected. We are seeing an increase in share repurchase activity, a logical step given the cash on the balance sheet and political and economic uncertainty, suppressing organic investment and acquisition activity.

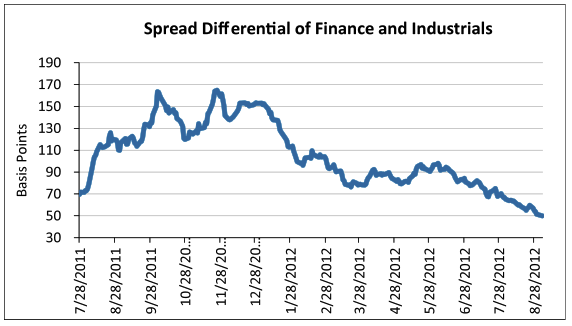

Finance – Fundamentals Remain on Track, But Spreads Have Compressed

Banks – Improving Asset Quality and Loan Growth, But Revenue Growth is Anemic and Event Risk is Rising

Finance bonds have performed very well this year, compressing with Industrials (Exhibit 2), due to continued fundamental improvement and technical support as net supply is expected to be meaningfully down this year. Domestic banks largely met expectations in the second quarter. Bank fundamentals have been on a steady improving trend for twelve quarters driven by improving asset quality, as the banks have steadily repaired their balance sheets. Falling credit costs have been the key driver of profitability, which has in turn driven balance sheet repair in the form of growing capital and continued run-off of non-core loan portfolios (commercial real estate, home equity). Modest loan growth has continued with banks expecting commercial and industrial lending growth of 2%, rolling out more credit card and installment lending to consumers, and being more active in auto and student lending. Banks are taking advantage of the deleveraging required by European banks, as well as becoming more aggressive with leveraged buyout and syndicated lending. We continue to believe it’s not banks’ willingness to lend, but companies’ unwillingness to add debt that has held back loan growth.

Exhibit 2

Source: Barclays Capital, AAM

However, we are beginning to see a counter-trend of top-line revenue pressure due to the protracted low interest rate environment. While modest loan growth has somewhat offset compressing interest margins, net interest income has fallen in seven of the last nine quarters. Additionally, the money center banks’ non-interest income has been pressured by weak capital markets revenues over the past two years as the Eurozone crisis has driven down volumes and Basel III has led to the exit of select capital market businesses. The result has been deteriorating efficiency ratios (non-interest expense/net revenues) despite continued expense reduction initiatives and pressure on the absolute level of bank profitability despite improving pre-tax margins.

While the improving asset quality and capital growth trends have been fundamentally positive for bank creditworthiness, the sector has struggled to generate adequate returns for shareholders. The combination of higher capital requirements under Basel III, low interest rates and weak economic growth are causing banks to struggle to achieve adequate return on equity and return on assets. As a result, the credit positive of steady balance sheet improvement is offset by our concerns that event risk may be rising as management faces pressure from equity holders (not to mention the specter of macro-political risk in the forms of the Eurozone crisis and the U.S. fiscal cliff).

REITs – Fundamentals Continue to Improve and Management Remains Prudent

The industry remains fundamentally healthy with management remaining disciplined towards acquisitions and development despite very strong liquidity. Broadly, occupancy and rental rates are increasing in Retail and Multi-family while Office remains challenged. Financial metrics have improved post financial crisis especially liquidity.

Insurance – Companies are Navigating Well in this Environment

Earnings were stronger than expected for Life companies with interest rate swaps and less liquid, higher yielding assets (e.g., commercial real estate, private placements) helping to mitigate the effects of falling interest rates. Property and Casualty company results were as expected. The sector that disappointed was Health due to higher medical expenses. Although, we see this as a short term phenomenon, as the companies will work again to increase rates to offset this cost. We expect associated headlines in 2013.

Cyclical Industrials – Consumers are Still Spending While Businesses are Being Affected by Deleveraging in Europe and Slowing Growth in Asia

Energy – International Oil Remains the Bright Spot While Uncertainty is an Overhang for the Services Sector

Oil prices have increased with the markets and the quantitative easing sentiment. Based on fundamentals and a slowing world economy, we project a twelve month price of $85 per barrel. We expect demand to increase by 500,000 barrels per day, supply to increase by 850,000 per day and the market to shift its focus on slower growth from China and declining demand from the U.S. and Europe. Supply is more of the unknown variable due to the political unrest in the Middle East and will keep oil prices higher than fundamentals support.

Similarly, natural gas prices remain low with the supply glut domestically. Strong productivity of 105 million cubic feet per day per rig is nearly 50% greater than 2011 and at the highest level in more than a decade. However, the natural gas rig count has declined by 46%, which will eventually impact supply. The potential for increased demand for natural gas in the next three years as coal burning electric plants are retired and replaced by natural gas burning electric plants should not be meaningful until 2014 at the earliest. Moreover, given the significant coal to natural gas switching that has already taken place in 2012, we believe the influence of coal closures will be less than previously expected. Our forecast remains $3 per MMBtu (million British thermal units) over the next twelve months.

As it relates to companies, those with international oil exposure are outperforming their domestically focused peers. Weak natural gas prices and escalating service costs in the first half of 2012 have resulted in a decline in North America spending plans. We are examining whether those reduced capital expenditure plans for North America will spill over to the international market, putting pressure on contract drillers.

Media – Advertising Growth Remains Solid, But Signs of a Weak Economy are Emerging

Away from commodities and moving on to advertising, growth estimates have been revised down for advertising especially in Europe (Exhibit 3). Europe’s growth was revised down from 2.3% to 0.8% by MagnaGlobal. Most of the revision was due to sharp revisions in ad spending in Greece, Spain (12% lower), Portugal and Italy (5% lower). Carat was the latest to make revisions, taking Europe from 1.5% to 0.2% and Asia from 8.7% to 6.8%. This will affect companies differently, depending on their geographic exposure. As evidence, after affirming guidance on June 14, WPP recently revised its revenue projection for 2012 down from over 4% to 3.5% due slower growth in Southern Europe and North America. WPP’s Chairman has been very vocal regarding his concerns for the economy in 2013 and thus, advertising due to the political uncertainties. It is worthwhile to note that in the U.S., advertising is expected to be about flat with 2011 levels if one were to strip out political and Olympic advertising. Therefore, the expectations are certainly not high in terms of a base for growth in 2013.

Exhibit 3: Global Advertising Growth Projected for 2012

| Research Unit | New 2012 Projection | Old 2012 Projection | Date of Revision |

| Zenith Optimedia | 4.3% | 4.8% | 6/18/2012 |

| MagnaGlobal | 4.8% | 5.0% | 6/18/2012 |

| GroupM | 5.1% | 6.4% | 6/19/2012 |

| Carat | 5.0% | 6.0% | 8/23/2012 |

| Average | 4.8% | 5.4% |

Source: Bloomberg

Another sign of a weak economy was the increase in direct response advertising. Direct response advertising grew 8% year-over-year in the second quarter, the fastest growth since first quarter 2008. This type of advertising is emblematic of a weak economy because these advertisers are buying excess inventory on short-notice at a sizeable discount to standard rates. Apart from this, advertising was solid in the second quarter especially given the weakness in cable network ratings. Auto spending has contributed nicely this year, and should be maintained through the second half unless the consumer turns more cautious.

Retail – The Consumer is Still Spending

The two bright spots in the quarter were the resiliency of the consumer and the continued strengthening of the housing market. Back-to-school sale estimates were raised and overall retail results were better than expected, foreshadowing a strong holiday season. Retailers benefited from promotional activity and higher overall volume despite softer pricing, as consumers are still in the hunt for good deals. Even more positive was that the results were strong across the spectrum of retailers with both discount and luxury performing well. Inventories are in a comfortable position as retailers still remain somewhat defensive in this environment. In addition, retailers have improved they way they manage their inventory resulting in better turnarounds and more efficient demand feedback.

Rails – Growth is Tepid, But Pricing is Firm

The recovery in the housing market is benefitting not only the retailers but the Rails as well with volume increases in lumber and other building related products. Besides housing products, the Rails are taking advantage of the changing utility landscape, moving crude oil and other petroleum products and fracking materials across the U.S. That said, growth is slowing somewhat with rail car loadings about flat to 2011 levels over the last couple of months. Rails have benefited more from price, given the economic advantage they offer their customers over other modes of transport. Volume should generally follow the relative strength of the economy.

Utilities – Fundamentals Reflect Economic Conditions in the U.S.

Electric Utilities – Regulatory News was the Highlight

It was a quiet quarter fundamentally. Domestic electricity consumption was modest, much like economic growth. Utilities benefited from the hot summer as residents used more energy while being hurt from the slowing manufacturing sector, as commercial and industry energy consumption slowed.

The real news for the sector was regulatory related. In a 2-1 decision, the Court of Appeals for the D.C. Circuit vacated the United States Environmental Protection Agency’s Cross-State Air Pollution Rule (“CSAPR” or the “Transport Rule”), the EPA’s attempt to “fix” the Clean Air Interstate Rule to regulate downwind state air pollution under the Clean Air Act. The court found that the EPA exceeded its statutory authority, the so-called “good neighbor” provisions of the Clean Air Act, by potentially requiring an upwind state to reduce emissions in excess of its contribution to a downwind states exceedance of air quality standards. Additionally, the Court of Appeals for the D.C. Circuit struck the EPA’s decision to require that each state comply with a federal implementation plan to implement the emission reductions mandated by the Transport Rule rather than allowing each state to determine how best to achieve the reductions within the state[note]Jane E. Montgomery, Kathleen C. Bassi, and David M. Loring, “D.C. Circuit Vacates CSAPR, Instructs USEPA to Continue Administering CAIR,” Environmental Update, August 22, 2012, accessed September 4, 2012, http://www.schiffhardin.com/File%20Library/Publications%20(File%20Based)/HTML/env_aug22_12index2.html[/note].

Very importantly, utilities are still on the hook for meeting the Maximum Achievable Control Technology or MACT standard, which is scheduled to become effective in 2015. On May 3, 2011, the EPA proposed national emission standards for hazardous air pollutants from both new and existing coal electric generating units. The proposed rule would create national standards that require all coal electric generating units to achieve the maximum degree of reductions in emissions of hazardous air pollutants.

Pipelines – Fundamentals Remain Positive While Technical Risk May Increase Over the Intermediate Term

We believe the fundamentals for the pipeline segment are positive. Volumes of oil, refined products, natural gas and natural gas shipments are largely determined by domestic GDP. Our forecast for domestic GDP is 1%-2% for 2012, so we think volume growth should increase slightly. Notably, volumes of natural gas liquids should probably increase faster than GDP growth given the heightened demand from the chemical sector. We believe another positive fundamental is the expanding number of resource basins, which will lead to greater size and cash flow generating capability. The Eagle Ford basin in South Texas, the Bakken Shale in North Dakota and the Utica Shale in Ohio will provide many domestic growth opportunities. Offsetting these positive fundamental drivers is the levered business model, which relies on external funding to refinance maturing debt and in periods of capital market uncertainty, causes spreads to be more volatile. Moreover, as companies begin to exploit these relatively new resource basins, we expect capital spending and debt issuance to increase.

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Michael Ashley

Vice President

Sebastian Bacchus, CFA

Vice President

Bob Bennett, CFA

Vice President

Patrick McGeever

Vice President

Hugh McCaffrey, CFA

Vice President

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.