insight

AAM Investment Accounting Update for Year End 2012

January 3, 2013

FASB

Financial Instruments

On May 26, 2010, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) related to Financial Instruments (Accounting for Financial Instruments and Revisions to the Accounting for Derivative Instruments and Hedging Activities). Since then, FASB has been obtaining comments from U.S. stakeholders and working with the International Accounting Standards Board (IASB) to achieve convergence with IFRS 9 – Financial Instruments. FASB has grouped this project into three topics: (1) Classification and Measurement, (2) Credit Impairment and (3) Hedge Accounting. Below are status updates for each of these topics as of year end 2012:

Classification and Measurement – Unannounced Effective Date

Below is a summary of the current and proposed financial instrument classifications:

| Current Classifications | Proposed Classifications |

| Trading | Fair Value Net Income (FVNI) |

| Available-for-sale | Fair Value Through Other Comprehensive Income (FVOCI) |

| Held-to-maturity | Amortized Cost |

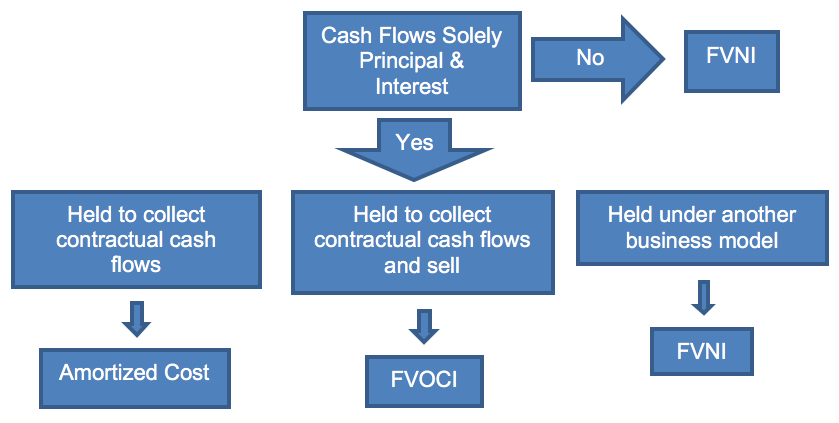

Under the proposed ASU, one should first consider the characteristics of the cash flows associated with the financial instrument. An instrument can be classified as Fair Value Through Other Comprehensive Income (FVOCI) or Amortized Cost if the expected contractual cash flows relate solely to the receipt of principal and interest on the principal amount outstanding. Interest is defined as consideration for the time value of money and the embedded credit risk of the instrument. If the instrument does not meet this test, it must be classified as Fair Value New Income (FVNI). If it does meet this test, the instrument should then be classified under one of the following business models:

- Instrument is being held to collect contractual cash flows

- Instrument is being held to collect contractual cash flows and sell

- Other

Classification and Measurement Decision Tree

There are several notable differences between current classification and measurement guidance and the proposed ASU:

- Entities no longer have the option to classify any instrument as FVNI (Fair Value Option)

- Reclassifications are permitted, under certain circumstances

- Hybrid financial assets (convertible bonds) shall be measured in their entirety; bifurcation of host and embedded derivative is no longer permitted

Credit Impairment – Unannounced Effective Date

On December 20, 2012, FASB issued a proposed ASU related to the recognition of credit losses (Financial Instruments – Credit Losses).

Prior to this proposed ASU, FASB and the IASB considered a three-bucket impairment model. Assets with insignificant credit deterioration were included in Bucket 1. Assets with more than insignificant credits deterioration or assets where it is possible that the contractual cash flows may not be collected were included in Buckets 2 and 3. An allowance for Bucket 1 assets included credit losses that the entity expected to incur over the next 12 months. The Bucket 2 and 3 allowances included the expected credit losses to be incurred over the entire life of the assets.

The newly proposed ASU eliminates the three-bucket model and simply requires entities to establish an allowance for credit losses that are expected to be incurred over the lifetime of the assets. At each reporting period, the allowance should represent management’s current estimate of the expected credit losses. The movement in this allowance would be recognized in income. Therefore, this model allows for an immediate “reversal” of credit losses recognized on assets that have an improvement in expected cash flows.

The proposed ASU also changes the way interest income is recognized on securities where the entity does not expect to receive substantially all of the principal or substantially all of the interest.

If it is not probable that substantially all of the principal will be received, the entity should stop recognizing interest; all cash receipts should be applied to the carrying value of the security until it reaches zero. Any additional cash received should be applied to the allowance, thereby causing the recognition of income.

If it is probable that substantially all of the principal will be received, but not substantially all of the interest, the entity can only recognize interest income as the related cash payments are received.

The proposed ASU also notes that an allowance for expected credit losses shall be established upon the acquisition of a purchased credit-impaired asset. The portion of the purchased discount related to the expected credit loss can not be recognized as interest income. For example, if a 100 par value security is purchased at $70, with expected credit losses of $10, the entity can only record $20 of accretion ($30 discount less $10 credit loss).

The ASU includes expanded disclosures related to the following:

- Credit-quality information

- How management monitors the credit quality of debt securities

- Assessment of the quantitative and qualitative risks arising from the credit quality of the debt securities

- Allowance for Expected Credit Losses

- Method and information used to develop the allowance

- Description of any economic circumstances impacting or changing the allowance from one period to the next

- Roll forward of the amortized cost of debt securities

- Reconciliation between fair value and amortized cost for FVOCI debt securities

- Information related to securities that are past due

- Information related to securities where the entity is not accruing interest

- Information related to purchased credit-impaired securities

- Bifurcation of purchase discount between expected credit losses and other factors

- Information related to collateralized financial assets

Hedge Accounting

FASB obtained comments in April 2011, but has not begun the re-deliberations.

Disclosures about Liquidity Risk and Interest Rate Risk

On June 27, 2012 FASB issued a proposed ASU, Disclosures about Liquidity Risk and Interest Rate Risk. The proposed ASU requires insurance companies to make the following liquidity risk and interest rate risk disclosures:

Liquidity Risk Disclosures

- Liquidity gap maturity analysis – Financial asset and financial liability classes are grouped by expected maturity in a tabular analysis.

- Available liquid funds – Unencumbered cash and liquid assets shall be presented in a tabular format.

Interest Rate Risk Disclosures

- Re-pricing gap analysis – The financial asset and financial liability classes’ weighted-average yield and duration along with an analysis showing how the financial asset and financial liability classes would re-price over certain time intervals.

- Interest rate sensitivity analysis – The impact on the entities net income and equity under various scenarios:

- Parallel shifts

- Up 100 basis points

- Up 200 basis points

- Parallel shifts

- Down 100 basis points

- Down 200 basis points

- Flattening shifts

- Increase short-end by 100 basis points

- Decrease short-end by 100 basis points

- Steepening shifts

- Decrease short-end by 100 basis points

- Increase short-end by 100 basis points

The disclosures are required in interim and annual periods for public insurance companies and annually for private insurance companies.

NAIC

Notes to the Financial Statements

For many of the notes to the financial statements, the NAIC is requiring that a specific presentation format be used. The standard formats are illustrated in the Annual Statement Instructions and allow the NAIC to electronically capture the data for further analysis.

Fair Value Note 20(A)2 – Level 3 Rollforward – The purchases, sales, issues and settlements previously were reported net. Now each item should be disclosed individually.

Fair Value Note 20(C) – Insurance companies must disclose the fair value of all investments, segregated by the fair value hierarchy (Level 1, 2, or 3) and grouped by asset type. This disclosure is similar to Note 20(A)1, which requires insurance companies to disclose the fair value of securities carried at fair value, segregated by the fair value hierarchy (Level 1, 2, or 3) and grouped by asset type.

Subprime Note 21(G) – There is now a specific format noted for investments with subprime exposure, which includes Actual Cost, BACV, Fair Value, OTTI.

Schedule D Reports

Security Classifications

The guidelines for classifying securities between the U.S. Government classification and the U.S. Special Revenue and Special Assessment Obligations and all Non-Guaranteed Obligations of Agencies and Authorities of Governments and Their Political Subdivisions (Special Revenue) classification has changed. Securities issued by agencies noted on the “U.S. Government Full Faith and Credit – Filing Exempt” list should be classified as U.S. Government and securities issued by agencies noted on the “Filing Exempt Other U.S. Government Obligations if issued and either fully guaranteed or insured by” list should be classified as Special Revenue. These lists can be found in Part 2, Section 4 of the 2012 Purposes and Procedures Manuals of the NAIC Securities Valuation Office. Here are some of the notable changes:

| Previous Classification | Current Classification | |

| FNMA or FHLMC Agency Debt | U.S. Government | Special Revenue |

| Multi-class GNMA MBS | Special Revenue | U.S. Government |

Maturity Date Column

The Maturity Date column now includes the final stated legal maturity date for all securities. Previously, this column included the maturity date that generated the lowest yield (call date) for securities purchased at a premium.

New Electronic Columns

Three new electronic columns were added. These additions are related to the Maturity Date Column change noted above.

- Effective Maturity Date – maturity date (stated legal maturity date or call date) used for yield-to-worst amortization method, as required by SSAP 26

- Call Date – call date used in relation to the effective maturity date noted above

- Call Price – call price associated with the call date used in relation to the effective maturity date noted above

Electronic Fair Value Hierarchy/Method Used to Obtain the Fair Value

Fair Value Hierarchy has been added to this electronic column. Previously this column only included the Method Used to Obtain the Fair Value:

“a” – rate determined by pricing service

“b” – rate determined by stock exchange

“c” – rate determined by broker or custodian

“d” – rate determined by insurer

“e” – rate published in the NAIC Valuation of Securities

Now this electronic column should include both the Fair Value Hierarchy and the Method Used to Obtain the Fair Value. For example “2a” in this column would represent a Level 2 security, where the fair value was obtained from a pricing service.

NAIC Ratings

SSAP No. 43R Loan-Backed and Structured Security Ratings

A three page flow chart has been added to the General Investments section of the Annual Statement Instructions. The flow chart illustrates the process of determining NAIC designations for SSAP 43R securities and can be a helpful reference.

“S” Subscript – Effective January 2013

Some securities may be considered bonds per the scope of SSAP 26. However, the Securities Valuation Office (SVO) classifies them as preferred or common equity. The SVO’s reclassification is a response to features that cause the securities to resemble the risk profile of equity versus debt. Debt securities that are mandatorily convertible into common equity or debt securities where the issuer can defer interest payments for an extended period are examples of these “Non-Payment Risks.” The SVO will include an “S” subscript to the NAIC designations of these securities, which will indicate that the security contains “non-payment risk” and will indicate that the security’s designation has been “notched.”

Risk Retention Groups (RRGs)

Some RRGs prepare a Property and Casualty (P&C) Annual Statement using Generally Accepted Accounting Principles (GAAP). A section has been added to the P&C Annual Statement Instructions, which provides related guidance to RRGs.

Ongoing…

NAIC Designation Recalibration Project

The Valuation of Securities Task Force (VOS) continues to work on the Recalibration Project, which may result in additional NAIC designations for corporate and municipal securities that are more in-line with historical default rates.

RBC Bond Factors

The C-1 Factor Review Subgroup continues to review the RBC bond factors, but changes are on the horizon.

Written by:

Joseph A. Borgmann, CPA

Director of Investment Accounting

joe.borgmann@aamcompany.com

For more information, contact:

Colin T. Dowdall, CFA, Director of Marketing and Business Development

colin.dowdall@aamcompany.com

30 North LaSalle Street

Suite 3500

Chicago, IL 60602

312.263.2900

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.