insight

Big Changes Coming to S&P Insurer RBC Model – Convertible Bonds Still Shine

June 12, 2023

Download PDFThe Standard & Poor’s (S&P) Insurer Risk-Based Capital Adequacy model is undergoing significant changes, including major adjustments to the factors applied to bond holdings. This model is an important tool used to assess the financial strength and solvency of insurance companies rated by S&P. The updates being made to the model reflect evolving market dynamics and aim to provide a more accurate assessment of risk exposure.

Key changes affecting insurer bond holdings will include recalibration of the confidence intervals used to generate capital factors to 99.5%, 99.8%, 99.95%, and 99.99% (previously 97.2%, 99.4%, 99.7%, and 99.9%), addition of more bond sector groups with differentiated factors, improving the process for identifying which ratings bucket to put bonds in (certain bonds were treated punitively in the past if not rated by S&P, even if highly rated by a different agency), and introducing greater consistency into the process for assigning ratings to RMBS and CMBS.

S&P’s capital adequacy model features much more granular treatment of bonds than either NAIC RBC or AM Best BCAR. It uses complex grids of capital factors based on bond sectors, ratings, and maturity buckets, so it can be tricky to generalize too broadly about these charges. Despite this extra granularity, the S&P model does resemble the others in that convertible bonds continue to represent a highly efficient vehicle for gaining exposure to equity-like returns relative to the capital charges applied to them.

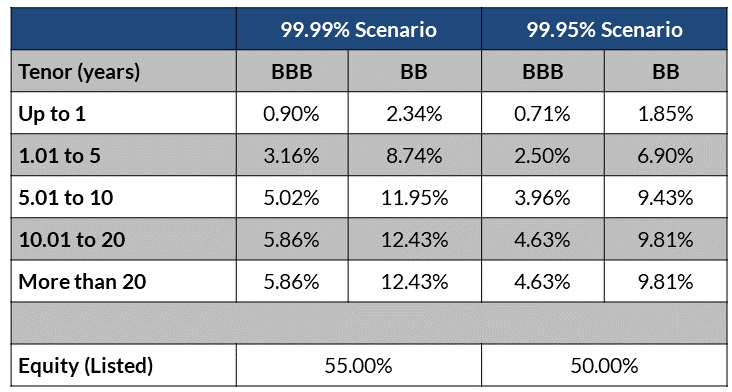

To illustrate, the table below shows proposed capital charges from S&P’s Illustrative Insurer Risk-Based Capital Model (recently released to assist insurers in evaluating the impact of the proposed process changes) for BBB/BB corporate bonds and equity at the 99.99% and 99.95% confidence intervals:

Source: S&P

As you can see, a portfolio of predominantly 1-5yr corporate bonds rated in the BBB/BB range (which describes a representative convertible portfolio) receives a capital charge of about 6% on average under the most aggressive 99.99% scenario, while the charge for equity holdings is nearly 10x as large at 55%. For an asset that has returned about 70% as much as US equity over the past 20 years, having a capital charge of only ~10% as much offers an obvious strategy for RBC-efficient investing. Simply put, for any given allocation to equity, an insurer could instead hold a significantly larger allocation to convertibles (potentially several times larger) with a higher overall expected portfolio return, and a material reduction in required capital.

Convertible bonds remain a natural fit for insurers: they receive Schedule D Part 1 bond treatment, issues rated BBB or better are carried at amortized cost rather than market value, they typically capture a large fraction of equity market rallies and a lower proportion of equity market declines, and they represent an established, well-understood corner of the investable universe. Their remarkable RBC efficiency is just the cherry on top. This will remain true under the proposed alterations to S&P’s Insurer Risk Based Capital Adequacy model, perhaps even more so than under other common RBC models.

For more information about S&P’s proposed changes to its capital model, or to provide feedback on the proposal prior to June 30, insurers can visit this link:

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.