insight

Cautious Consumers Likely to Dampen Retail Holiday Sales

November 26, 2013

Another year is behind us and we find ourselves in the midst of the holiday shopping season. Holiday merchandise seems to creep into stores earlier every year. According to the National Retail Federation (NRF), about 40% of shoppers begin their holiday shopping before Halloween. This is a very important time of year for the retailers as up to 40% of their annual revenues are realized during the holiday season. The retail industry has performed reasonably well this year despite concerns in Washington (government shut down, budget woes, and unrest in Syria) and continued low economic growth. Various analysts and trade organizations predict that holiday sales will be up anywhere from 2% to 4%. We believe that sales for this year will come in at the low end of that range. The following report explores some of the more important drivers of our analysis.

The Consumer’s Financial Position Remains Questionable

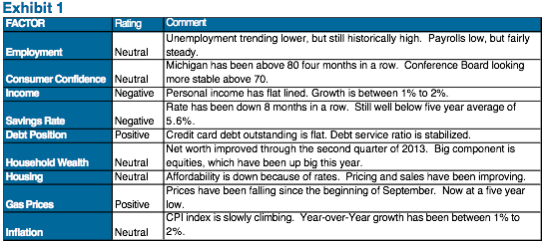

Probably the most important driver of retail sales is linked to the strength of the consumer. The table in Exhibit 1 summarizes our analysis of nine different factors which help us think about the typical consumer’s economic position. We make an assessment of the individual factors in terms of how they may impact spending.

These factors are slightly more positive than last year. Positive developments include falling gas prices and better housing data. Low income growth, a falling labor participation rate, and headlines out of Washington create uncertainty and hurt spending. In addition, GDP in the U.S. has tapered off throughout the year and is not expected to be significantly better in 2014.

Big Ticket Items Could Take Away From the Shopping List

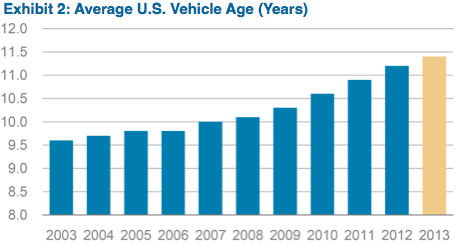

This year, a significant amount of consumer spending has been on big ticket items, including new cars and housing related items. Auto sales have been stronger than expected because of more available funding and secular trends including the increasing age of used cars, shown in Exhibit 2.

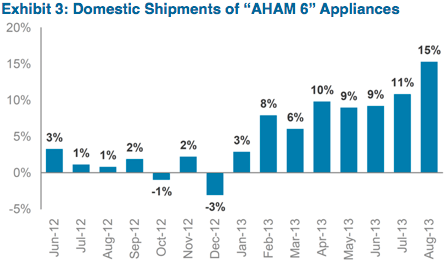

Another indicator to watch is the “AHAM 6” (Association of Home Appliance Manufacturers) which measures shipments of six major home appliances (washers & dryers, dishwashers, refrigerators, freezers, ovens, and ranges). As shown in Exhibit 3, growth has been impressive in 2013.

Years of pent up demand from lack of spending and improving housing prices are giving consumers greater confidence to spend on their homes. There is the risk that a greater piece of the spending pie will be used to buy these types of big ticket items, leaving a smaller portion for typical Christmas items including apparel and electronics.

Statistical Analysis – Purely Quantitative But Supports Slower Sales

Looking back on data over the last twenty years, reveals a significant correlation (81%) between “Back to School” retail sales (August and September) and “Holiday” sales (November and December). To complete this analysis, we used the U.S. Census Bureau’s monthly retail trade data which includes a variety of retail businesses. The model predicts “Holiday” sales of 1.6% when using 1.9% for the “Back to School” sales observed in 2013. We also used adjusted data which predicted “Holiday” sales of 2.2%. This would be significantly lower than the average, which was 3.6% (4.1% adjusted) over those twenty years.

Seasonal Hiring Resembles Last Year

The National Retail Federation predicts that between 720,000 and 780,000 seasonal workers will be hired this year[note]“Holiday Survival Kit 2013,” National Retail Federation. Page 7, accessed November18, 2013, http://www.nrf.com/modules.php?name=Dashboard&id=55[/note]. This compares to 720,490 hired last year and is above the pre-recession numbers which were closing in on 700,000 several years in a row. One important trend stems from the growing online business. Companies are shifting hiring in stores to adding staff in call centers or distribution warehouses. E-commerce giant, Amazon, is hiring 70,000 seasonal employees which is up 40% from last year.

Worse Inventory May Lead to Pricing and Margin Pressures

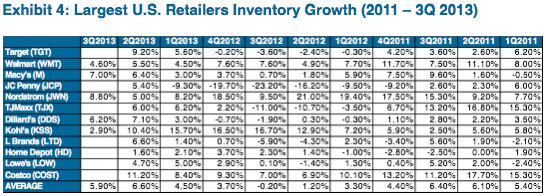

Consumer shopping patterns are not expected to be much different this year. Consumers are much smarter these days given much more efficient ways to comparison shop. Shoppers have turned into deal hunters which has forced retailers to deepen promotions and to start promoting earlier. This year, we believe that retailers are in a worse inventory position than last year. We take a look at inventory growth (year/year) in the second quarter and third quarter for the largest retailers in the U.S. over the past three years. As you can see in Exhibit 4, the average growth is significantly up from 2012 and about the same as 2011. We are still waiting on some financial results to get a more complete picture for the third quarter of 2013.

As a result, we expect retailers will need to be price competitive. We expect retail margins to be weaker going into the end of year as overall costs have increased. In particular, retailers experienced higher cotton prices earlier in the year when orders for holiday merchandise were made. In addition, there is a lack of fashion newness and limited “hot” toys this year which typically help margins.

Online Shopping Continues to Gain Importance

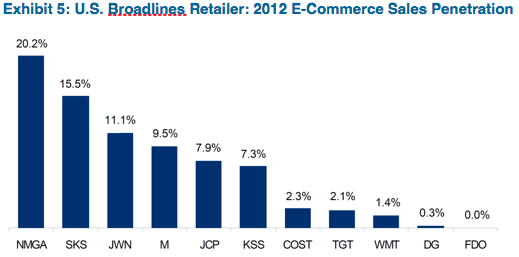

E-commerce continues to be a very important area of growth for the retail industry. Those brick and mortar retailers that have not adapted to the evolution of online shopping are loosing dollars. Retailers’ “Omni-channel” strategy has merged the inventory and distribution of physical stores with the online business. As shown in Exhibit 5, for some retailers, e-commerce has grown to a significant portion of their business, especially the major department stores. According to Shop.org, holiday sales are expected to be up 13% to 15% this year to as much as $82 billion[note]Deborah L. Weinswig, “Weinswig’s Holiday 2013 Outlook: Soft Holiday Sales Likely to Put our Retailers on the Naughty List,” Citi Research: Equities, Retailing – Broadlines (North America), October 24, 2013, 14[/note]. Mobile devices are getting easier to use and are playing a bigger role in shopping for consumers. According to eMarketer, 16% of e-commerce sales will be made on a mobile device this year.

Note: DG, SKS, TGT, and WMT are estimated

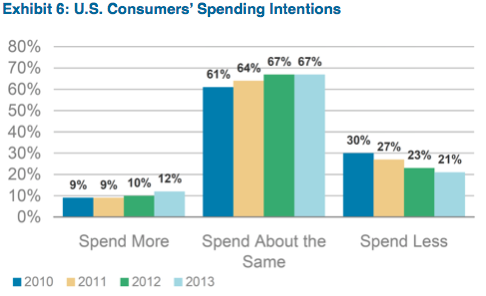

NPD Survey Is Positive for 2013 Holiday Sales

According to a recent survey by the NPD Group (Exhibit 6), consumers are expected to spend more this holiday season. This year, 79% of shoppers are expected to spend more or the same compared to 77% last year and 73% in 2011. The main purchase drivers for consumers are special sale prices, overall value for the price, and free shipping.

Weather…Good, Calendar…Bad

Weather and the changing calendar are always important factors for holiday spending. Last year, the vast majority of the country trended warmer which seemed to have an impact on seasonal items (e.g., coats, scarfs) which are more important to the department store segment. According to Weather Trends International (WTI), November and December of this year are expected to be significantly colder. This should be a positive so long as a heavier than normal amount of snow does not keep shoppers from driving. Having said that, WTI is predicting one of the heaviest snowfalls in the last three years, but still slightly below the average. Worse than expected weather might not be that bad, as we would expect some of that shopping to shift to increased online sales.

The days between Thanksgiving and Christmas are key shopping days. This year, those shopping days total 26 (minimum) versus 32 (maximum) last year. In addition, this year there is one fewer weekend between holidays. The shortened holiday shopping season could make it more difficult for retailers to forecast sales, which could lead to an earlier start to promotions. We expect the changing calendar will negatively affect the retailers.

Despite some challenges this year, the typical consumer remains resilient. Slowly, but surely, the consumer seems to be improving. Retailers seem to have built up a bigger than normal inventory which may prove costly given the lack of exciting product this season and an off-year in terms of the calendar. Also, spending on big ticket items may leave less money left over for typical Christmas presents. Growing popularity with online shopping and a better than normal weather forecast should help retail sales. Also, season hiring expectations appear to support moderate growth. We expect spending during this holiday to be decent probably up somewhere around 2% which is at the low end of forecasts.

Michael J. Ashley

Senior Research Analyst, Corporate Credit

For more information, contact:

Colin T. Dowdall, CFA

Director of Marketing and Business Development

colin.dowdall@aamcompany.com

John Olvany

Vice President of Business Development

john.olvany@aamcompany.com

Neelm Hameer

Vice President of Business Development

neelm.hameer@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.