AAM’s investment philosophy is anchored in the recognition that insurance portfolios seek a yield-oriented approach within a risk-controlled framework that seeks to minimize credit impairments. We believe that this can deliver competitive total returns over a market cycle. This philosophy includes a portfolio duration driven by the client’s liabilities, a laddered cash flow profile across maturities, and a focus on managing call risk. AAM has maintained this investment philosophy throughout our history and with this philosophy we have been able to produce strong returns with lower volatility, even during times of market volatility.*

Our experienced research group and traders have the ability to analyze and access all fixed income markets which allows us to make meaningful allocations to structured and credit markets to effectively implement trades across portfolios. For the purpose of this paper we will be looking at the period from March, 2022 to September, 2023 and the volatility that resulted as the world emerged from the pandemic.

Backdrop – A Volatile Market

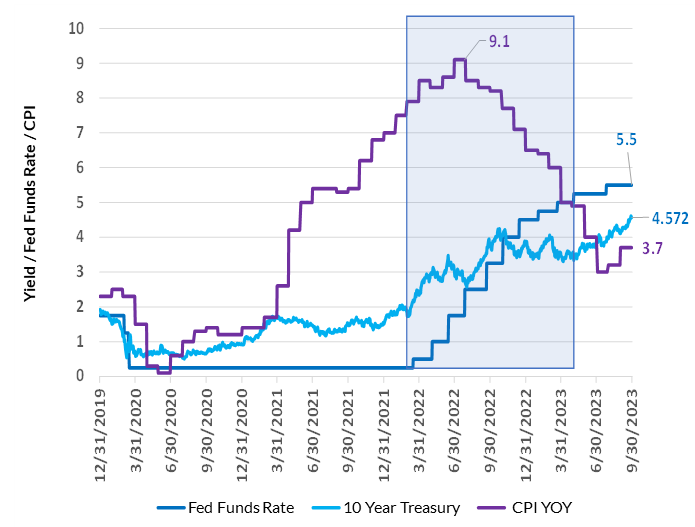

Following unprecedented government stimulus and supply chain disruptions in response to Covid-19, inflation peaked at 9.1% in July, 2022. In an effort to reign-in inflation, beginning in March, 2022 the Federal Reserve started tightening short-term interest rates which caused Treasury market volatility to spike to levels not seen in over a decade. As demonstrated in Exhibit 1, from March, 2022 through September, 2023, the Fed Funds and 10 Year Treasury rates increased sharply.

Exhibit 1: Fed Funds, CPI, 10 Year Treasury

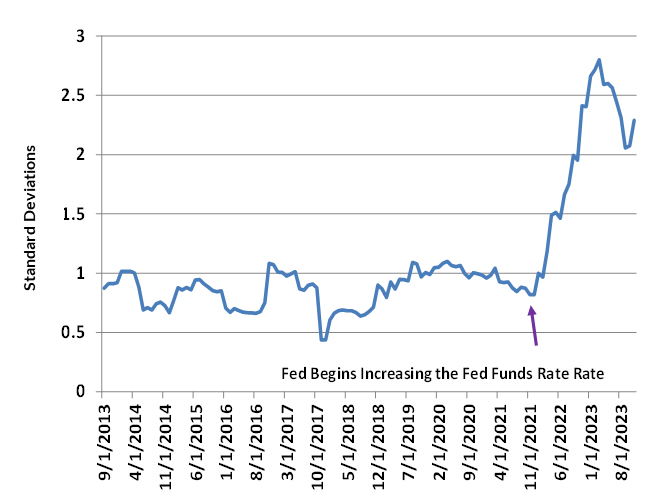

During this period, money managers were confronted by a spike in short term interest rates causing a doubling in market volatility. Managers who were unprepared for this spike suffered both an increase in the volatility of their returns relative to benchmarks and underperformance versus their peers. Exhibit 2 displays the dramatic increase in the volatility of returns of the Bloomberg Aggregate Index.

Exhibit 2: Bloomberg Aggregate Index

Trailing 12 Month Total Return Standard Deviation

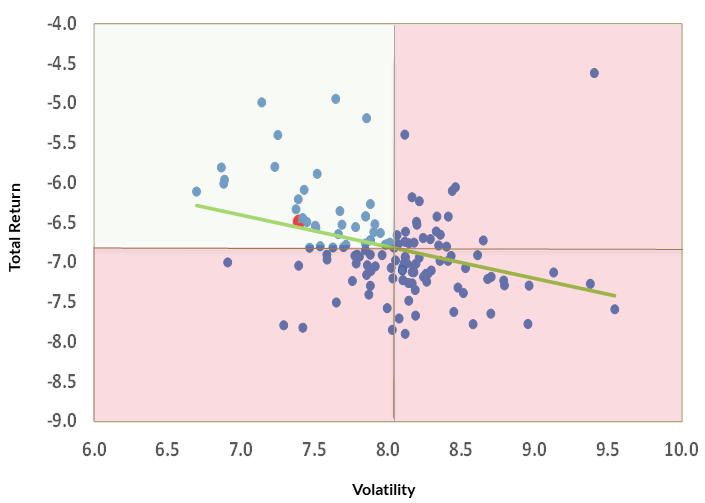

Also during this period of total return volatility, the dispersion across Core Aggregate Fixed Income managers also increased. As shown in Exhibit 3, for the period March, 2022 through September, 2023, total return dispersion across managers ranged from -4.62% to -7.89%. Total return volatility was even greater with a range from 6.7 to 9.5. Risk-return profiles finishing in the upper left quadrant, highlighted in the below exhibit in green, lends itself to a more replicable, stable strategy achieving competitive returns with lower volatility; as did AAM. At AAM we seek to find high quality, higher yielding alternatives to Treasuries, with stable cash flows, despite elevated market volatility, striving to create an enhanced portfolio yield with lower return volatility.

Exhibit 3: Risk Return March 2022 – September 2023

Sector Diversification – Adding Yield, Diversifying Away from Treasuries

Due to the explosive expansion of government debt, the Treasury share as a percent of the Bloomberg Aggregate Index now stands at approximately 41% as of 09/30/2023.

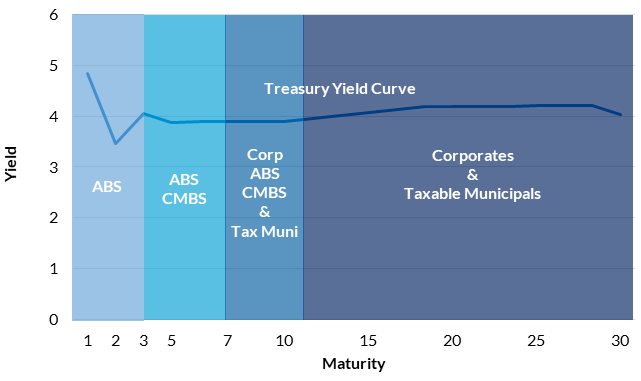

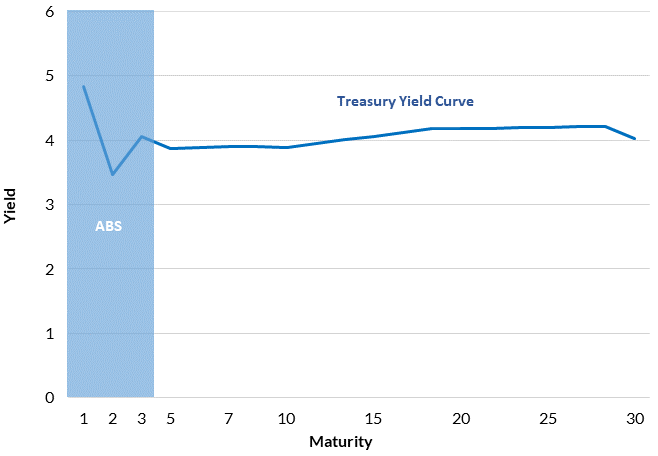

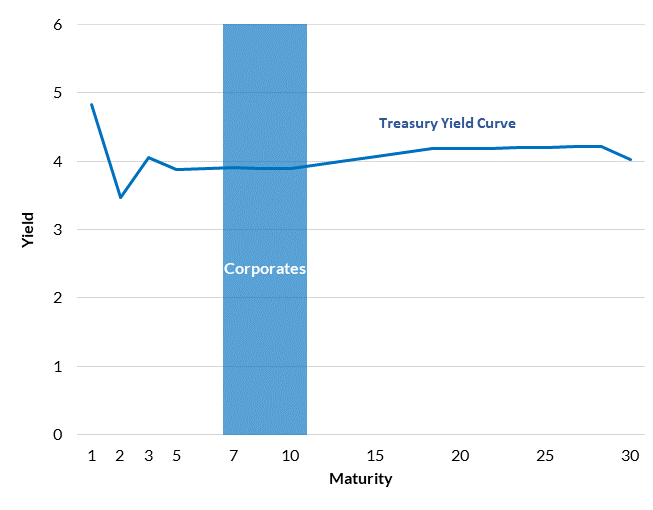

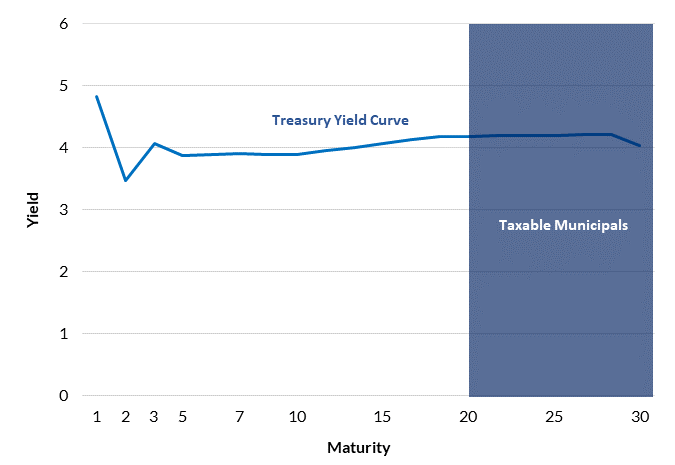

The process of adding excess returns generally begins with sector diversification by substituting Treasuries with other sectors in order to generate low volatility, competitive returns. As seen in Exhibit 4, alternative sectors can be sourced to take advantage of incremental yield on specific tenors of the yield curve. Implemented properly, these sectors can generate total return with lower volatility, while maintaining high quality without imprudent concentrations in any one sector.

Exhibit 4: Yield Curve Diversification and Sector Selection

When it comes to sector diversification, corporate securities tend to be the first choice for many managers due to ease of access, size and surveillance. Although corporate securities are important in generating excess returns, the Bloomberg Investment Grade Corporate Sector harbors lower quality securities with approximately 92% of the index rated Single A+ through BBB- (Bloomberg). To diversify and compliment the yield of Corporate bonds, the Asset-Backed Security (ABS), Commercial Mortgage-Backed Security (CMBS), and Taxable Municipal markets can be used to add excess return in specific parts of the yield curve while utilizing corporates where they perform best. In this way AAM strives to construct lower volatility, higher yielding, well diversified portfolios with stable cashflows.

Over the next few pages we will review various sectors along different tenors of the yield curve highlighting specific attributes which can make them attractive for enhancing portfolio construction.

Sector – ABS

The 1-3 Year Yield Curve Tenor: The Asset-Backed Sector

On the short end of the yield curve, ABS with 1 to 3-year maturities are comprised of structured securities/cashflows, primarily backed by Credit Card and Auto receivables. These securities are highly rated, generally AAA, due to credit enhancement/principal protection and they tend to have competitive yields with low volatility. Collateral performance is continually surveilled by our structured product analysts.

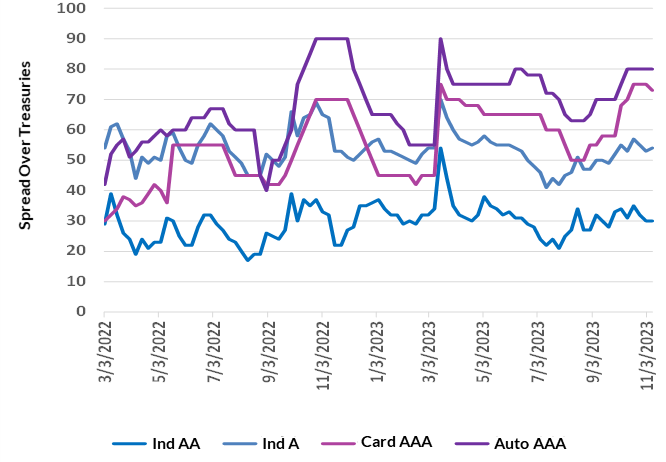

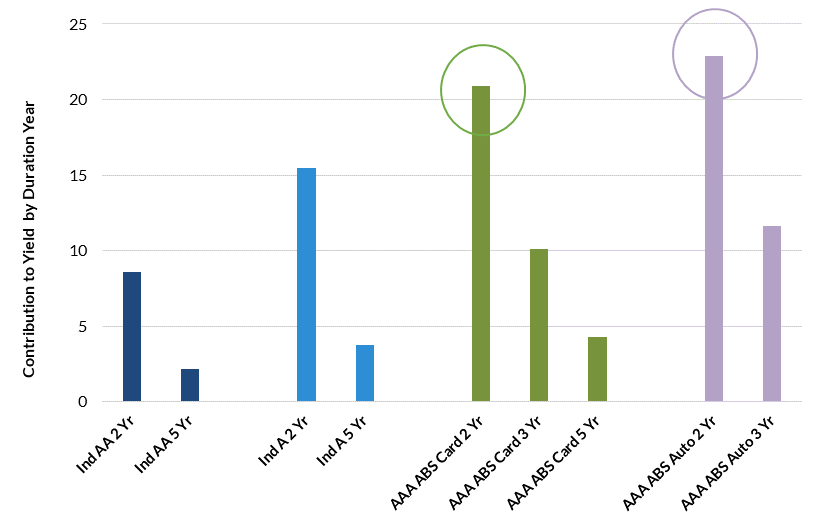

As can be seen in Exhibit 5, AAA rated Card and Auto spreads can offer higher yields when compared with highly rated Corporate Industrials.

Exhibit 5: Asset-Backed Sector Spreads

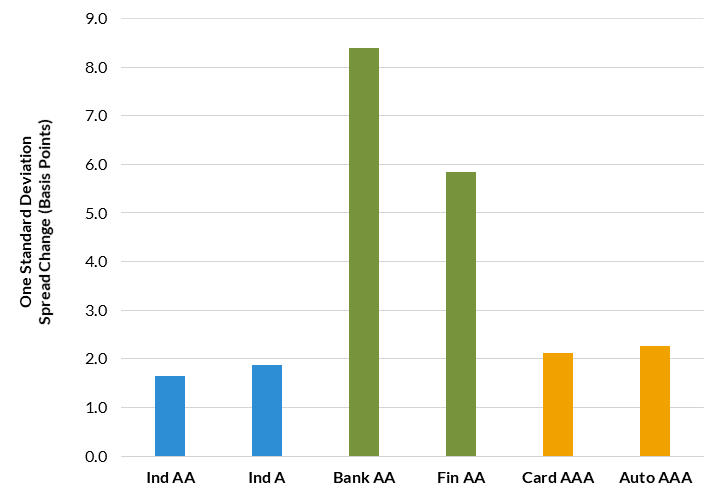

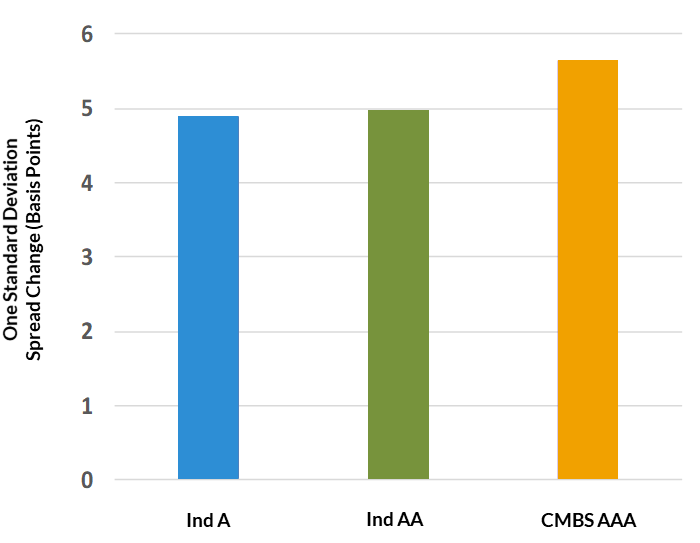

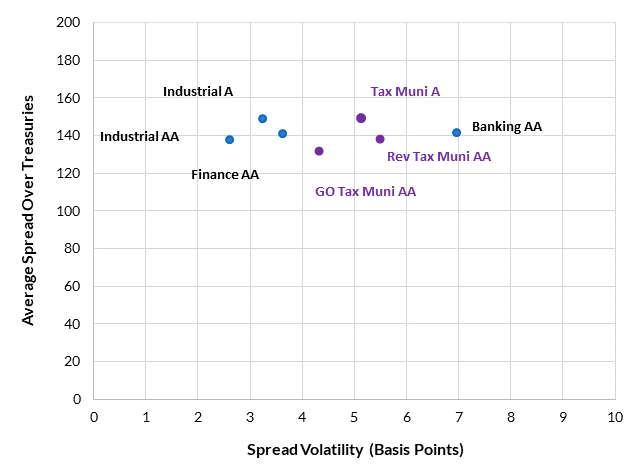

Due to the high-quality of ABS, it can be a sound substitute for Treasury and A/AA rated Corporates. Below, in Exhibit 6, we illustrate the standard deviation of various Industrial, Finance and ABS spreads. Despite having competitive yields, ABS spread volatility is not materially different than Industrial AA and A rated paper, but is lower than AA rated Bank and Finance paper.

Exhibit 6: Selected Sector Spreads Volatility

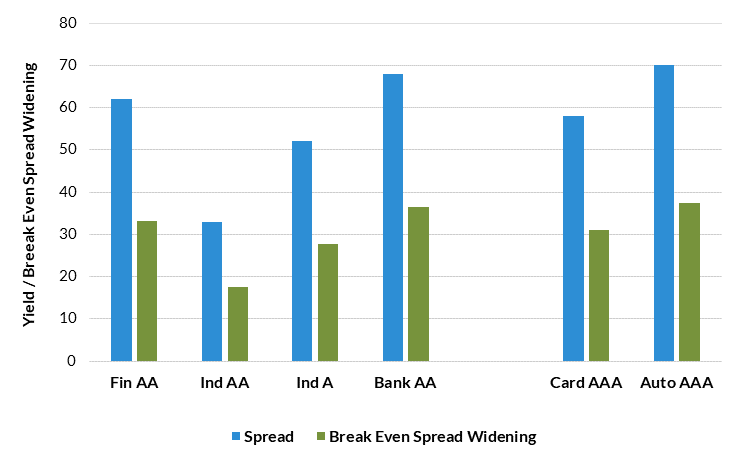

The short end of the yield curve offers a great deal of relative value. In Exhibit 7 we see the Break-Even Spread Widening for selected 2 Year corporate and asset-backed sectors. Over a 12-month time horizon, Credit Card and Auto ABS can take a 30-basis point increase in spreads before underperforming Treasuries. They also tend to perform well against other lower quality Corporate sectors.

Exhibit 7: Break Even Spread Widening: 09/30/2023

Most importantly, in Exhibit 8, we find on the short end of the yield curve ABS can have a significant advantage: The ABS yield per unit of duration year is often the most attractive in the index. With an average spread of 0.41% and a standard deviation of returns of 0.12%, ABS is often an attractive low volatility alternative to the Treasury and lower rated Corporate sectors.

Exhibit 8: Contribution to Yield by Duration Year: 09/30/2023

Sector – CMBS

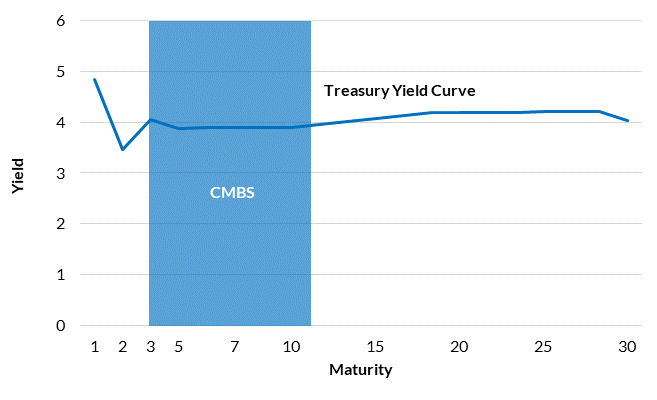

The 3-10 Year Yield Curve Tenors: The Commercial Mortgage-Backed Sector

Commercial Mortgage-Backed securities tend to be issued in the 3 to 10-year maturity bin and AAM is active in both the Government Agency-backed and Non-Agency Commercial Conduit arenas; dependent on market conditions. Although representing only 1.6% of the Bloomberg Aggregate Index, our overweight – approximately 9%, is a compliment to, and diversification from, Corporate and Treasury cashflows. These securities are structured, as their cashflows are segmented into small tranches creating subordination (principal protection) to achieve desired ratings and risk. Approximately 70% of the CMBS sector is rated AAA. These securities can be a good compliment to a portfolio as their cashflows are backed by a diversified pool of commercial properties including retail, multi-family dwellings, office, industrial, and other property types not found elsewhere in the index.

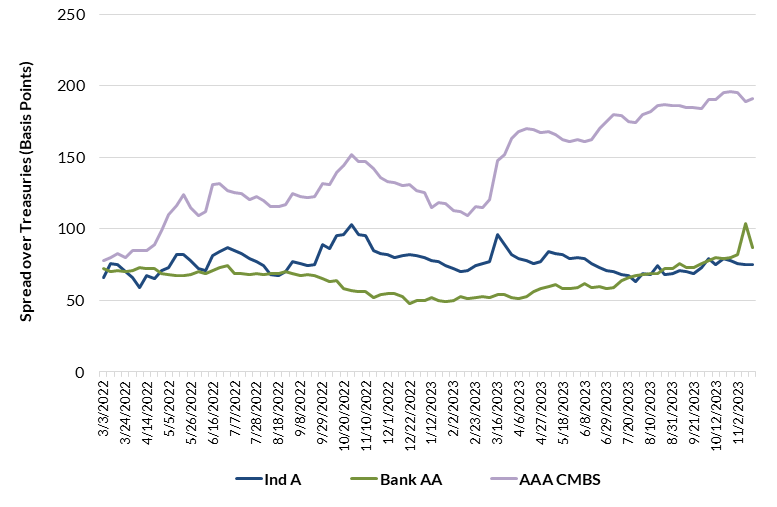

Exhibit 9: Selected Sector Spreads

In Exhibit 9, on the 5 Year yield curve tenor, we find CMBS having an average spread over Treasuries of 191 basis points. These competitive yields and total return prospects can make CMBS a tactical substitute for the Treasury and Corporate Sectors. Furthermore, as can be seen in Exhibit 10, relative to Corporates, CMBS has a similar volatility profile. The small difference in standard deviation due to spread changes can make the CMBS sector a compelling choice for yield enhancement and sector diversification, while maintaining high quality.

Exhibit 10: Selected Sector Spread Changes

Sector – Corporates

The 7-10 Year Yield Curve Tenor: The Corporate Sector

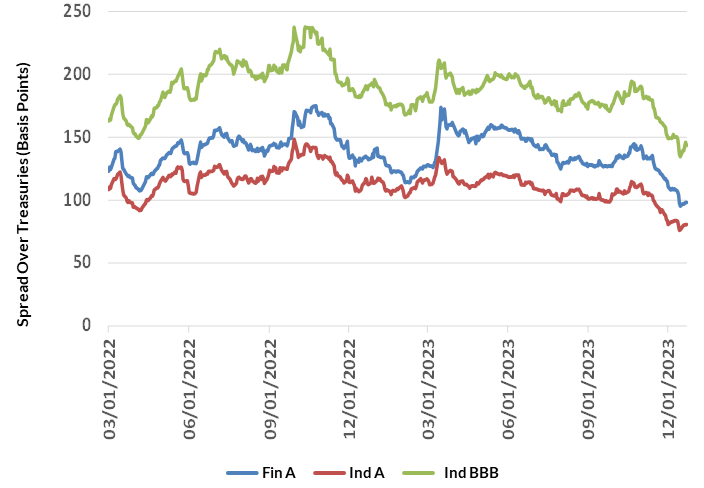

Comprising approximately 25% of the Bloomberg Aggregate Index, the Corporate Sector represents $6.3 Trillion of the $25 trillion Index. Given its large size, the corporate sector is often used as a Treasury substitute for yield enhancement. In Exhibit 11, we find the Corporate Sector offers a generous yield advantage compared to Treasuries, albeit, with the caveat: a disciplined approach to credit analysis is required to take advantage of these opportunities. Although available anywhere along the yield curve, due to the steepness of A and BBB rated credit curves, we explore the advantages of owning corporates in the 7-10-year tenor.

Exhibit 11: Selected Sector Spreads

The Bloomberg Corporate sector, with approximately 43% of securities rated “BBB”, has an average quality of “A-“. Due to the lower quality, the Corporate sector employs steeper credit curves as investors demand to be paid for taking on additional maturity risk. With the passing of time, this nuance provides enhanced total return opportunities due to “yield curve roll-down”.

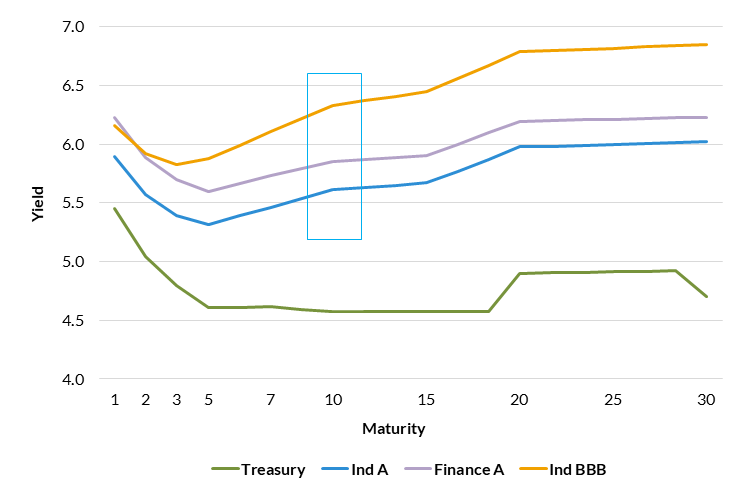

As can be seen in Exhibits 12 and 13, corporate securities can be useful in generating excess returns in the 7 – 10-year yield curve tenor. In Exhibit 12, this enhanced slope is captured in the blue box. The yield difference between the 7 to 10-year yield curve tenors for the Industrial A, BBB and Finance A paper is 15, 12 and 23 basis points respectively.

Exhibit 12: Selected Yield Curves as of 09/30/2023

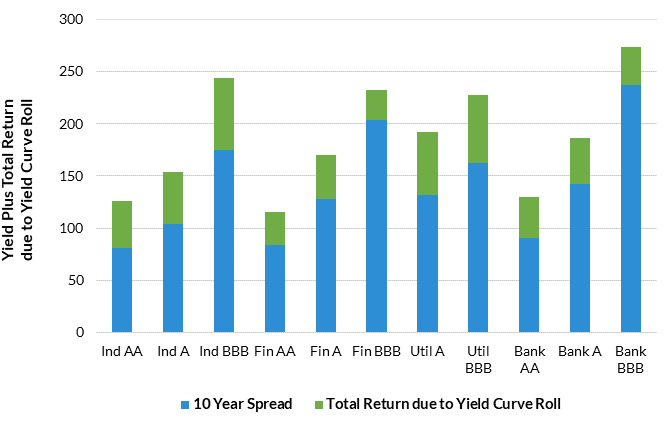

To demonstrate, in Exhibit 13 demonstrates yield curve roll down as illustrated by the Green Bar Segment. This yield curve “steepness” allows 10 Year Corporate securities to generate additional total return due to “yield curve roll-down” over and above their enhanced spread above Treasuries represented by the blue bar segments.

Exhibit 13: Yield and Total Return due to Yield Curve Roll

Sector – Taxable Municipals

The 30 Year Yield Curve Tenor: The Taxable Municipal Sector

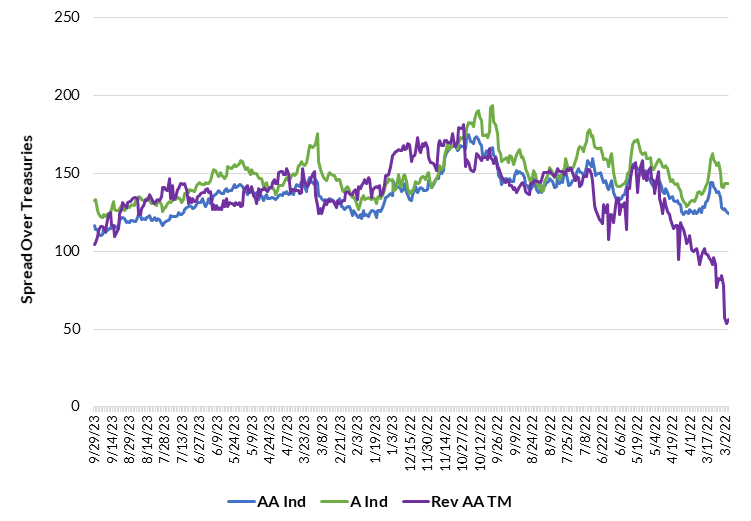

Taxable Municipals are often underutilized and under surveilled and is a relatively small segment with only $554 billion in outstanding debt. This sector brings a high quality, Aa2 rating, with competitive yields and similar volatility allowing for diversification away from Treasuries and Corporates. And, although available all along the yield curve, given the only other issuance comes from the Treasury and Corporate markets, they can be especially useful 20 years and out.

Exhibit 14: Selected Sector Spreads

In Exhibit 14, on the 30-year yield curve tenor, relative to selected corporate sectors, we find competitive Taxable Municipal yields/spreads. Given their government backing from taxes and revenues, Taxable Municipals are a competitive and sound cashflow substitute for Corporates and Treasuries. As demonstrated below in Exhibit 15, in a complement to their competitive yields, Taxable Municipals also have relatively low spread volatility. Although a bit higher, their spread volatility is competitive with Industrial paper. Once again, this Treasury/Corporate sector substitute can allow for diversification of risk and increased portfolio quality while reducing overall portfolio volatility.

Exhibit 15: Selected Sector Spread Changes

Conclusion: Where is AAM Positioned?

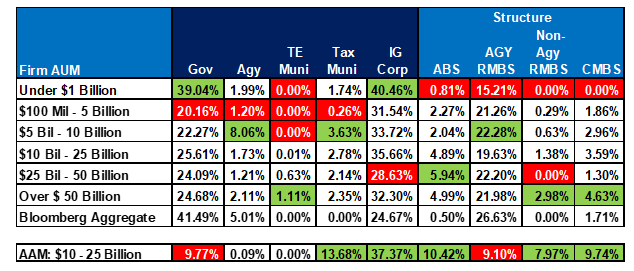

Exhibit 16: AAM Sector Weights

As can be seen in Exhibit 16, highlighted in Green, our competitive returns come from exploiting both sector and yield curve opportunities in Taxable Municipals, Corporates, ABS, and CMBS.

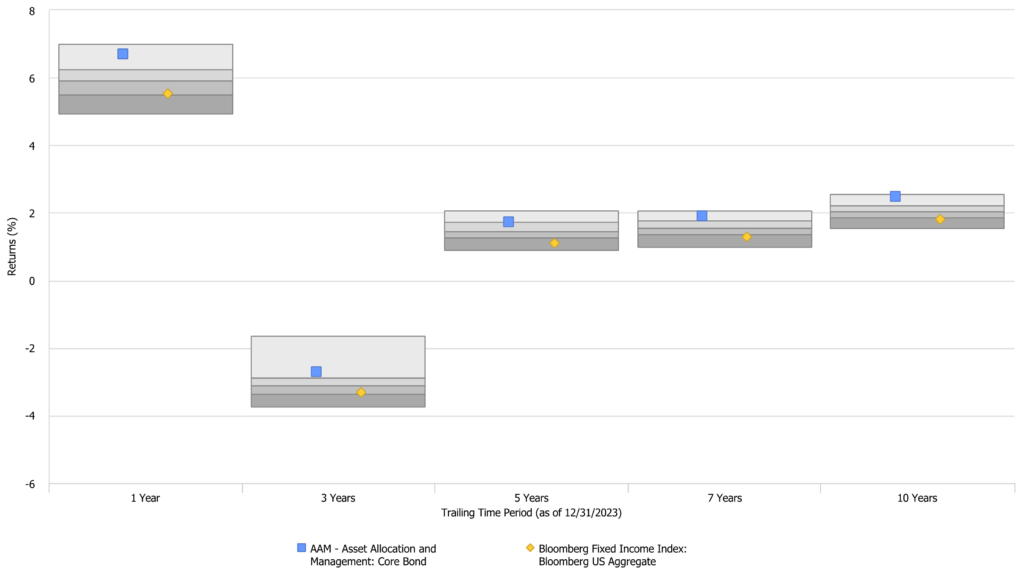

Exhibit 17 displays our 1, 3, 5, 7- and 10-Year track record. Our strategy provides time tested, returns replicable in volatile markets.

Exhibit 17: Total Return

AAM vs. the eVestment Core Aggregate Universe

In summary, at AAM we strive to invest in high quality, higher yielding alternatives to Treasuries, with stable cash flows, despite elevated market volatility, in an effort to create a more diversified portfolio with enhanced yield and lower return volatility.

*Past performance not indicative of future results.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.