insight

Federal Policy Agenda to Influence Municipal Technicals over the Balance of the Year

April 21, 2021

Download PDFFIRST QUARTER MUNICIPAL BONDS UPDATE

Recap

During the first quarter of the year, Treasury rates moved aggressively higher amid improving economic growth and higher inflations expectations. Based on data from Bloomberg, 10 and 30yr rates moved higher by 83 and 77 basis points (bps), respectively, with the overall yield curve from 2 to 30yrs steepening by 73bps. Tax-exempt yields reported by Refinitiv Municipal Market Data (MMD) also moved higher by 29bps, but relative valuations to taxables improved dramatically. Very favorable demand technicals from heavy seasonal reinvestment flows, combined with a very manageable new issue calendar, provided the impetus for substantial outperformance. Ratios of municipal-to-Treasury yields in 10yrs reached a record low of 53.95% in Mid-February, before ending the quarter at a still very expensive 64.3%.

Taxable municipals also performed well during the quarter. In reviewing data compiled by AAM, ‘AAA’ muni spreads to Treasuries moved tighter by 5 to 14bps, with the 30yr part of the curve exhibiting the strongest performance. Improving supply technicals, along with persistent demand, were likely the primary catalysts for the spread tightening. New issuance has been down significantly from the peak of issuance that occurred during the June-to-October 2020 period. Based on data from the Bond Buyer, issuance of municipal-only cusips during that period averaged $16.6 billion per month as issuers rushed to execute deals before the November general elections. Since that time, taxable muni issuance has only averaged $7.8 billion per month. The overall higher rate environment has likely reduced the present value savings of taxable refinancings, which we expect was the primary driver of taxable municipal supply. Additionally, with the Democrats in control of both the executive and legislative branches, there is strong speculation that tax reform will be implemented this year, which is expected to include a restoration of tax-exempt advance refundings. As reported by the Bond Buyer, a bipartisan bill called Investing in Our Communities Act has already been introduced by Reps. Steve Stivers, R-Ohio, and Dutch Ruppersberger, D-Md., and the bill has 21 Democrat and Republican cosponsors. Ruppersberger and Stivers are co-chairs of the House Municipal Finance Caucus. With tax-exempt relative valuations near record levels, we believe the cost savings for executing tax-exempt advance refundings is substantial enough that issuers are expected to wait until this technique is restored to the tax-exempt market before resuming large scale refinancings.

Credit Tailwinds from Fiscal Stimulus

Policy initiatives are generally expected to be constructive for the municipal market. The first major initiative enacted by the Biden administration was the passing of the $1.9 trillion America Rescue Plan Act (ARP). The legislation provided $350 billion in direct aid to state and local governments. The stimulus was designed to help replace COVID-induced lost revenue, stabilize budgets and restore liquidity. The aid has been viewed as a major credit positive, with Standard and Poor’s subsequently revising their outlooks on the state and local government sectors to stable from negative. Moody’s also revised their outlook to stable from negative, citing the strong fiscal support and stronger-than-expected tax collections.

Outlook: Heavier Supply Expected During the Second Half of the Year

The next major agenda item for the Biden administration will be the American Jobs Plan, which was introduced at the end of the first quarter. The $2.2 trillion infrastructure package, along with tax-reform within the Made in America Tax Plan, are expected to contain provisions that will affect municipal supply technicals over the balance of the year. Although details are still forthcoming as to the financing structure of the infrastructure plan, news sources reported that the Chairman of the House Ways and Means Committee, Richard Neal, indicated that federally subsidized Build America Bonds will be part of the legislation. The direct-pay bonds, which were used as part of the infrastructure spending initiative under the Obama/Biden administration, were introduced with a federal subsidy of 35%. It is unclear at this time what the overall size of this program will be under Biden’s plan, but the original issuance totaled ~$182 billion of taxable municipal debt over two years, before the program expired in 2010.

The source of funding for the infrastructure is expected to come from tax-reform measures incorporated within the Made in America Tax Plan. The plan is expected to incorporate an increase in the corporate tax rate to 28% from 21%. The Biden administration estimates that the provisions within the legislation will generate a total of $2 trillion in tax revenue over 15yrs.

As mentioned earlier in this writing, this tax-reform legislation is also likely to include the restoration of tax-exempt refinancings. Unless we see a substantial weakening in relative valuations for tax-exempts before this legislation can be passed, we expect to see much higher issuance of tax-exempt debt during the second half of the year.

Another potential tax-reform measure that could be included in the legislation is the repeal of the $10,000 cap on state and local tax deductions (SALT). The cap has been largely felt in high-tax states and many of the representatives from these jurisdictions are making their support of the infrastructure package contingent on the inclusion of the SALT repeal in the infrastructure plan. With thin majorities in both the House and Senate, the Biden administration will have to strongly consider the repeal, even though the reported costs of its inclusion is estimated to be more than $600 billion, based on data from the Tax Policy Center. If the cap is removed, that would reduce the tax burden on wealthier investors and soften the retail demand for tax-exempts at a time when supply could dramatically accelerate due to the potential restoration of tax-exempt advance refundings.

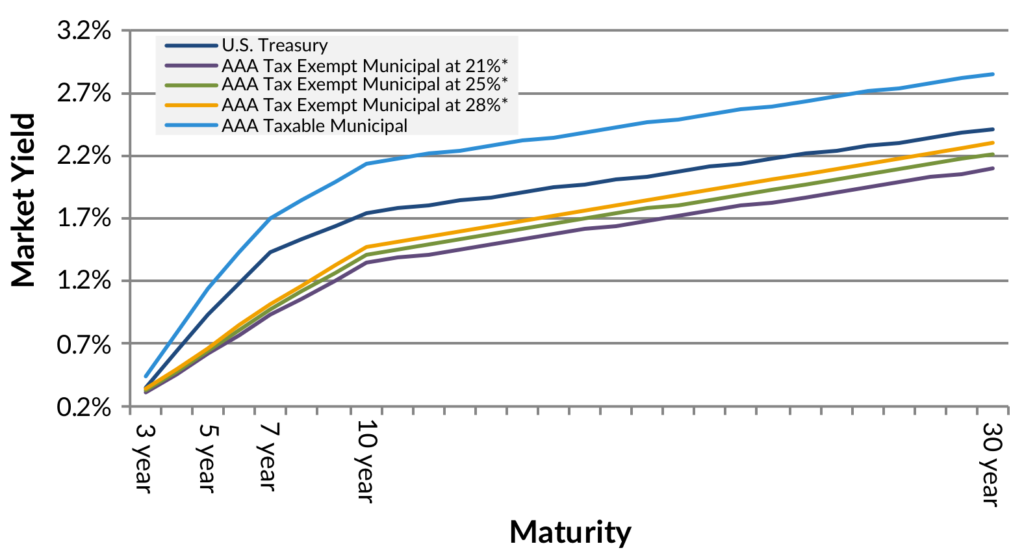

In terms of demand from institutional investors like insurance companies, the effects of the increase in corporate rates is not expected to materially increase their demand for tax-exempts, in our opinion. In the graph below (Exhibit 1), we highlight the yield curves between taxable municipals, Treasuries and tax-exempts, with yields tax-adjusted using corporate rates of 21% and 28%. We also included the tax-exempt yields tax-adjusted at a 25% corporate rate. At least one senator, Joe Manchin of West Virginia, has expressed a desire to cap the corporate tax increase to a rate of 25%. Under either event in the current yield environment, the additional yield carry of 10yr taxable munis to same-tenor tax-exempts stands at a very compelling 67 and 73bps at a 25% and 28% corporate rate, respectively. Consequently, we expect demand for taxable munis from institutional investors should remain firmly entrenched.

Exhibit 1: Market Yields as of 3/31/2021

While we expect taxable muni supply to move higher over the second half of the year, we continue to expect global and domestic demand for taxable munis will remain intact throughout the year. We also view current valuations for taxable municipals to be at fair value relative to historical spread relationships to the corporate market. Given the substantial yield advantage of taxable munis to tax-exempts, along with the potential for sizable technical imbalances to develop in the tax-exempt market, we continue to advocate a significant underweight to the tax-exempt sector in favor of taxable alternatives across the yield curve.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.