2022 Review

The OAS of the Bloomberg Corporate Index1 widened 73 bps to a high of 165 in October given a very volatile interest rate environment and heightened uncertainty. However, the tone has been more positive since that point, as investors expect the Federal Reserve to slow the pace of interest rate increases and navigate a soft landing. That has supported markets, with the OAS tightening into the low 130s by mid-December.2

Cash balances that had grown during 2020 contracted, as companies repurchased shares and funded acquisitions. Most sectors experienced contracting EBITDA margins from historically high levels due to inflation, foreign exchange and/or covid related issues. Debt leverage has been stable, and interest coverage remains high. Capital spending has been very strong in 2022, as companies invested in their businesses in anticipation of high nominal GDP growth, infrastructure related stimulus and ESG projects among others. Commodity related firms generally outperformed in 2022 due to elevated prices.

2023 Outlook Summary

Credit fundamentals are expected to continue to weaken in 2023, as slowing top line growth and continued inflation – albeit less than 2022 – pressures EBITDA. With higher interest rates, slowing money supply growth and tighter lending standards, we expect demand to fall for investment and borrowing. AAM’s view is that the U.S. economy enters a shallow recession likely in the middle of 2023. We expect interest rate volatility to remain high based on the uncertainty of the Federal Reserve’s ability to successfully manage inflation without damaging the labor market and driving the U.S. economy into a deeper than expected recession. The risks to the downside are high. This is our base case, which results in the Corporate index OAS4 widening to 155, possibly in the first half of the year.

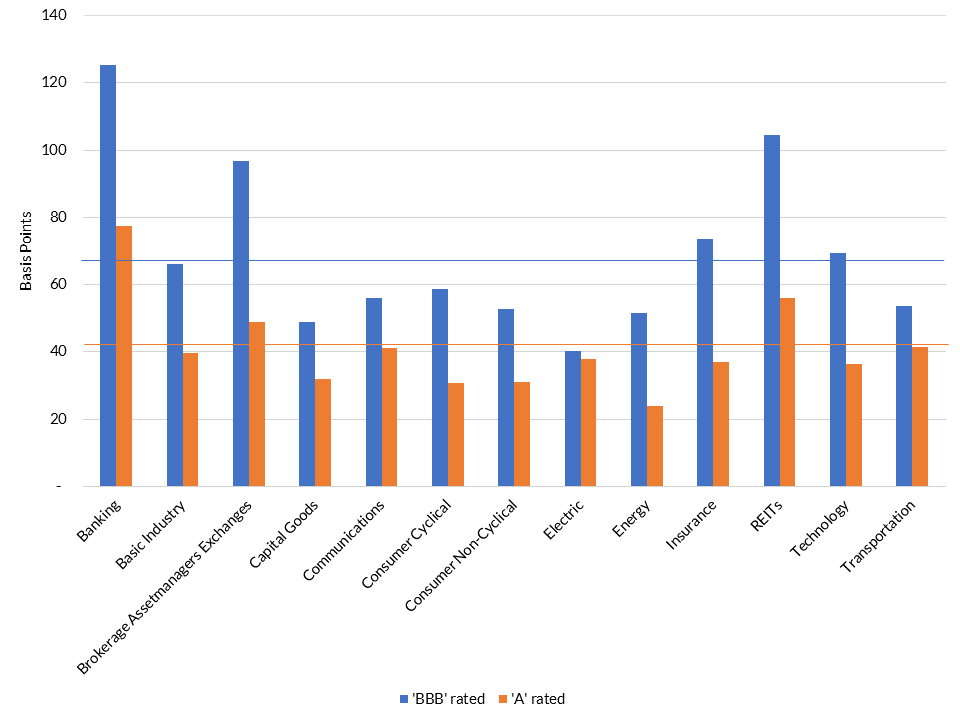

We favor credits/sectors with stable cash flows and less debt leverage. That list includes Railroads, Aerospace/Defense, Wirelines, Midstream, Pharmaceuticals, Health Insurance and Utilities. Sectors that we believe are unattractive due to fundamental reasons include: Cable, Media, Tower REITs, and Office REITs. While we expect weaker commodity prices in 2023, commodity related firms are entering this potential recession with stronger credit fundamentals than past cycles. Financials underperformed in 2022 (see exhibit 1) due to interest rate volatility and for banks, greater-than-expected debt supply. While we expect spread volatility to remain high in this sector, we expect less issuance from the largest domestic banks in 2023.

One potential area of imbalance relates to the number of leveraged companies that may be inappropriately capitalized if we are entering a period of higher interest rates and lower growth. We note the exponential increase in private debt borrowing over the last decade, which is largely outside of regulators’ purview. The ‘CCC’ segment of the Bloomberg High Yield5 market has been reflecting distress with an OAS near or exceeding 1000 bps since mid-2022. While defaults are expected to rise next year, this could become more problematic than markets expect. As we forecast fundamental performance for our sectors, we are considering this bear case scenario as well.

After a very favorable period in 2021, rating actions have become more negative due to liquidity and operating performance challenges.6 Moody’s default forecast increases to 5% in twelve months7, slightly exceeding the long-term average. If our bear case materializes and segments of the private corporate sector are over-leveraged, we would expect lower recovery and higher default rates in this cycle.

Exhibit 1: Relative Sector Performance in 2022

Sector Outlooks

Basic Materials

The outlook for the Basic Materials sector revolves around commodity prices, which weakened considerably in the second half of 2022. We expect the weak commodity pricing backdrop to persist at least into early 2023. One big caveat is the potential for the economy in China to surprise on the upside from further relaxation of Covid restrictions.

Despite a weak commodities backdrop, the Metals and Mining sector performed relatively well in the second half of 2022. A significant recession in 2023 would put further pressure on fundamentals for metals and mining companies, making it difficult to repeat this relative performance.

The Chemical sector is a mix of upstream companies that are more exposed to weak commodity prices and downstream specialty chemical companies that benefit from lower raw material costs. Supply chain destocking has put severe pressure on the upstream producers, and we would avoid investing in these companies until there is clarity that demand along the supply chain has stabilized. The specialty chemical companies are still vulnerable to weakening demand, but margin benefits from lower input costs provide a relatively more stable outlook.

We also view agriculture-related chemical credits as a relatively safe place within the chemical sector. Demand destruction has finally put pressure on fertilizer prices, but the spring planting season should offer some stability.

The stability of the Paper sector offers an opportunity for outperformance. It should be noted that this view applies to the domestic producers as South American based paper companies could underperform in a risk-off scenario. Containerboard and boxboard grades within the paper sector are highly consolidated and have historically exhibited rational pricing behavior. Historically, this has led to strong and consistent free cash flow generation. We are likely to see pricing declines across most paper grades, but the deterioration is expected to be more muted than other commodities such as those in the chemical or metals and mining spaces.

Capital Goods and Transportation

Service issues have improved throughout the year as hiring has progressed and supply chain issues have improved. Railroads continue to offer an attractive economic advantage and productivity opportunity for shippers which helps maintain pricing power. Longer term, we expect the industry to gain market share and continue to improve on its technology. Large-scale M&A is limited, and we expect the industry to remain very capital intensive. We expect a similar amount of issuance this year and would take advantage of new issue given relatively illiquid secondary issues. We would expect this higher quality sector to widen less than the index given our expectation of a risk-off scenario in the first part of 2023.

We expect global defense spending to increase given the continued conflict in Ukraine and other geopolitical tensions. In addition, we expect the commercial aircraft business to remain in recovery mode into 2023 with the biggest opportunity on the international front. We see some opportunity for fundamental improvement in the Aerospace & Defense sector with less pressure from the supply chain and inflation. Large-scale M&A is limited although small to medium size transactions requiring debt funding are expected. We expect issuance to look like last year, especially as Boeing is expected to stay out of the new issue market and continue to pay down its existing debt load.

Communications and Technology

We expect incumbent Telecommunications companies to gain share next year as weaker competitors are forced to slow fiber deployments and aggressive marketing campaigns due to higher interest rates and weaker economies. Confronting slower growth and higher interest rates, we expect most operators to continue to reduce debt leverage, which limits new debt issuance. We also expect continued price increases and cost reduction efforts, as operators look to offset the effects of inflation. From a relative value perspective, we see more value in European telecom USD spreads and less value in the Canadian. We expect the domestic telecom operators to perform in line with the market.

Low interest rates for over a decade supported highly leveraged new entrants, like Dish Network in the wireless industry. We expect Dish to be challenged next year in terms of its capital spending plans and building its pipeline given its stressed financial condition. While this is a positive for wireless competitors, it is likely to be a material disappointment to investors in the wireless Tower REITs. We believe spreads do not reflect this risk, not to mention this sector is a perpetual issuer given its REIT structure and thus, should be viewed as higher beta vs. the broad market.

The Media sector underperformed in 2022 after a year of outperformance in 2021, as this sector benefited from COVID-related stimulus and behaviors. Higher financing costs and the expectation of economic weakness affect the economics for content investment and advertisers. Media has been a sector we have felt had too much capacity from a content perspective given very low interest rates and the incentives from equity investors rewarding growth irrespective of returns. In 2023, we expect rationalization to begin. We believe NBC and Paramount’s networks will face disproportionate drops in advertising revenue. This should increase risks for investors, leading to wider spreads. Additionally, we expect 2023 to be a year of higher event risk in Media and Cable, as Disney addresses its stake in Hulu and Fox with FanDuel and News Corp. We also expect Comcast, AMC and Paramount to be looking for deals to maximize the value of their media assets, as the rationalization process begins.

Despite its stable cash flows, we expect the IG Cable sector to underperform. Capital spending will be elevated since cable operators need to invest in DOCSIS 4.0 to protect their core broadband business, and we expect companies to repurchase their stocks, which have underperformed this year. Smaller cable systems may be up for sale as they confront falling profits in the face of costly broadband investment.

Technology benefited from a refresh during the pandemic driving record revenue growth to inventory digestion in late 2022. In 2023, we expect more of a diet to work off that inventory glut lasting into the second quarter of 2023, further workforce reductions, lower capital spending, and a deceleration of revenue growth. We expect weaker demand to persist, driven by a cutback in global IT spending as enterprise and commercial customers shrink IT budgets and slow investments amid macroeconomic weakness. In addition, consumers continue to shift their spending priorities, facing higher costs elsewhere. Margin pressures should be evident across semiconductors, hardware, software, and IT Services. When considering the relative value and the cyclicality of Technology, we are more constructive this time around compared to prior tech cycles in 2015 and 2018, given the ongoing digital transformation and long-term secular trends underpinning tech’s diversification into healthcare, autos, industrials, and communications. However, valuations start from a rich level, with the sector outperforming the Corporate index in 2022. Technology is a defensive sector, but it will take a few more quarters to adjust to normalized demand and a low GDP growth environment, driving our underweight for the sector, at least for the first half of 2023. We see more downside for credits with higher exposure to consumer spending on PCs, smartphones, and other electronics, and small-to-medium businesses, as these areas will be more impacted by a deeper-than-expected recession.

Consumer

The Pharmaceutical sector showed its resiliency during a very chaotic 2022. The sector is relatively immune to macroeconomic and supply chain issues. Demand is consistent despite changes in economic growth. Longer term, we would expect new drug discovery, improved technology, increased longevity, and the use of medicine over other forms of health care solutions will continue to make this a fundamentally solid sector. Margins and leverage are among the strongest in the investment grade index. The sector is highly rated with characteristically tight spreads. Large-to-mega sized M&A deals are not unusual given strong fundamentals and the need to replace upcoming patent expirations. We expect this to pick up in 2023. Historically, we have preferred investing in this sector via new issue especially after a transaction has been announced given the new issue concessions. We also like the additional spread going down into the high-triple-B rated credits. We expect outperformance for the sector as we move into 2023 with another anticipated period of uncertainty and spread volatility.

For the Auto sector, Northern American light vehicle production continues to be stuck in what historically has been considered a recessionary range. With one month to go in the year, production looks to be trending around 14 million units (SAAR) for 2022. This would be the third year in a row of production substantially below the pre-pandemic trend of over 17 million units. While defining “normal” is somewhat difficult, it is reasonable to assume that the industry has underproduced by a few million units since the start of the pandemic.

With a potential recession looming, there is a debate whether demand will fall below the already low production level. The OEMs insist that demand still exceeds supply, and this view is supported by the ongoing extremely low dealer inventories and incentives. Inventories have trended higher over the past few months but remain well below historical levels. At the same time, manufacturers continue to benefit from strong pricing power and have not yet had to rely on aggressive incentives to sell every vehicle they can make.

The outlook for suppliers is mixed with conditions improving domestically while the supply chain situation in Europe remains uncertain. In North America, after two years of difficult conditions, suppliers are finally expressing a relatively positive tone. While the OEMs benefitted from a strong pricing environment, the suppliers were challenged with soft volumes, high raw material prices, supply chain disruptions and intermittent labor availability. Many of these headwinds are subsiding and with lower raw materials and improving operational efficiencies, the outlook for the suppliers has improved. If the OEMs can follow through on higher production targets, the outlook for the suppliers would be even more positive.

In addition to the uncertain supply/demand balance, the auto industry has other potential headwinds to watch. One is the upcoming expiration of the UAW contract. Union negotiations are always contentious but there are now additional stresses brought on by the EV transformation and inflation. Another concern resides in the OEM’s finance subsidiaries, which have been a significant source of cash over the past two years. While finance portfolios are currently still in decent shape, declining residuals and rising delinquencies are likely to stress portfolio performance 2023.

Energy

Fundamentals in the Energy sector are expected to be robust again in 2023, but valuations reflect this expectation. The Energy sector in general is fairly valued. We believe the best opportunities are in the Midstream sector, which is the largest subsector in the energy space. We are avoiding the two smallest components of the sector, Refining and Oil Field Services due to unattractive valuations and limited opportunities. The Independent and Integrated components are fairly valued but should benefit from continued strong commodity prices and capital discipline.

The Integrated subsector of the Energy sector is considered low-beta because of high quality constituents such as Exxon Mobil, Chevron, Shell and Total Energies. Nearly every constituent is expected to have a strong 2023 due to elevated commodity prices and robust diesel and gasoline prices. We expect the majority of free cash flow to go towards share repurchases and increased dividends rather than absolute debt reduction like in the previous two year. The subsector has historically traded 30bps-40bps inside of Industrials, consistent with where it is currently trading.

The Independent subsector of the Energy sector is considered high-beta because of the sensitivity to commodity price fluctuations, unrestrained capital spending last decade and rating downgrades. Following crises in 2016, 2018 and 2020, companies within this sector radically changed their business models to one based on being free cash flow positive in a $50 oil and $2.50 natural gas environment. We expect constituents such as ConocoPhillips, Canadian Natural Resources and Hess to be significantly free cash flow positive in 2023 due to high commodity prices and continued capital discipline. Given volatile oil prices over the past decade, the subsector has traded in a wide range of 25bps to 75bps wide of Industrials. Currently, it is near the tight end of that range given the robust outlook in 2023.

The Midstream subsector of the Energy sector is considered high-beta because of relatively levered balance sheets, high distributions and low investment-grade ratings. Fundamentals are expected to be mixed in 2023. Volumes of oil and natural gas transported on interstate pipelines throughout the US, which are fee-based and often contracted, are expected to be near all-time highs in 2023. However, those constituents that transport natural gas liquids such as propane, ethane, butane and natural gasoline are likely to face headwinds in the first half of 2023. Volumes of those commodities, which are largely used as a feedstock in the Chemical sector, may be subdued due to the challenges that sector is facing. Moreover, the cash flows from transporting those volumes are generally not contracted and are exposed to commodity volatility. The midstream sector has historically traded 45bps to 70 bps wide of Industrials and currently it is near the tight end of that range.

The Oil Field Services subsector is the smallest in the Energy sector. It really only has three constituents – Baker Hughes, Halliburton and SLB (formerly known as Schlumberger). This high-beta sector relies entirely on the capital spending from National Oil Companies and the constituents of the independent and integrated subsectors, which are still about 40% below the average spent from 2010-2015. Cash flows and credit profiles for the oil field service companies should continue to improve in 2023 provided the expected healthy double-digit increase in spending by their clients, but this dynamic is already reflected in spreads. The subsector has historically traded between 20bps and 60bps wide of Industrials, which compares with the 17bps differential currently.

The Refining subsector is a high beta sector due to the volatile nature of its constituents’ cash flows and credit profiles. Companies in this subsector generate revenues by selling gasoline, diesel and jet fuel, which are tied to economic conditions, inventories and increasingly government policy. Its input costs which include crude oil, natural gas and electricity are also highly volatile. The largest constituents in this sector include Marathon Petroleum, Phillips66 and Valero, all of which had banner years in 2022. Demand for their products remained very high due to a healthy domestic economy and uniquely high demand from Europe. Sanctions placed on Russian refineries limited gasoline and diesel from there; several strikes at European refineries further reduced supply and those European refineries that were operating were dealing with surging natural gas costs, making US exports to Europe cost competitive. It is unlikely all of these conditions will remain in place in 2023 and we expect the refining sector to weaken. Historically, the sector has traded 25bps to 50bps wide of Industrials compared to the current 15bps differential.

Utilities

After many years of relatively smooth sailing, the Utility sector faced a perfect storm of challenges in 2022. Some of these challenges were not necessarily new, including high capex spending, high debt issuance and the associated pressure on credit metrics. These ongoing issues were compounded by new pressures brought on by inflation. This has led to significant increases in consumers’ monthly bills, which have generally trended below inflation for the past decade. While the regulatory environment continues to be relatively stable, both utility companies and regulators continue to be under pressure to keep monthly bills low. In some cases, as an example, regulators are lengthening the period for fuel recovery from 12 months to up to 36 months.

Despite its reputation as a defensive sector, utilities did not outperform the overall corporate index YTD. While much of this can be attributed to the relatively long duration of the utility sector, it can also be attributed to the perfect storm of challenges the industry faced in 2022. This helps explain why the z-scores for the industry screen attractive across the curve. The positive z-scores keep us comfortable selectively adding names in the sector, but the headwinds facing the industry keep us from officially moving to attractive.

Financials

REITs are expected to face headwinds next year as the weakening economic environment combined with inflationary expense pressures and rising capital costs weigh on real estate fundamentals. Despite wide valuations to the corporate index and other financials, we believe elevated market volatility combined with these macro headwinds will limit the performance of the sector through 1H23. Across the various subsectors, office REITs are likely to face the most headwinds and valuation pressure as the need for office space remains uncertain and asset disposals encounter setbacks. We believe office REIT balance sheets will be tested once again and for ratings to be pressured, particularly if economic conditions prove more severe. Away from office REITs, apartment REITs are best positioned to weather the upcoming headwinds given the higher credit quality of most issuers and the defensive characteristics of housing. Raising interest rates are also expected to increase the barriers to homeownership, supporting already strong occupancy rates and NOI growth in the subsector. Retail REITs are entering 2023 in a position of strength after bouncing back from the pandemic. However, as consumers begin to feel the squeeze from inflation and weaker economic conditions, regional malls and shopping centers tied to luxury and discretionary spending are expected to come under pressure. Open-air, grocery-anchored shopping centers are best positioned to weather the macro uncertainty and valuation pressures. Healthcare REITs represent a mixed picture as life-science and medical offices building trends are expected to remain stable, while skilled nursing and senior housing operators remain vulnerable to rising costs, labor shortages, and prospective residents’ ability to afford the product.

We maintain a preference for US banks with an emphasis on the global systemically important banks (G-SIBs) given wide valuations to the Corporate index, lower supply estimates, and strong sector fundamentals. Bank performance has been hurt by unusually high debt issuance over the past year, but we expect net issuance for the US G-SIBs to decrease in 2023, reflecting a mix of strong regulatory positions and slowing balance sheet growth. In contrast to the G-SIBs, we expect regional bank net issuance to increase in 2023 driven by the finalization of TLAC rules for regional banks and rising deposit outflows.

Fundamentals across the US bank sector are expected to remain healthy over the next year, with earnings supported by rising interest rates and continued loan growth, capital levels preserved through discipline and lower risk appetite, and normalizing asset quality trends backed by strong reserve balances. Liquidity levels are expected to decline as deposit costs increase and the impacts of quantitative tightening (QT) accelerate system. This may prompt some banks to utilize more wholesale funding, including senior bank issuance, with regional banks facing more pressure.

Outside the US, we expect Yankee banks to be subject to greater macro headwinds as economic conditions worsen and financing conditions tighten across most regions. These headwinds are broadly priced into valuations, but additional risks related to corporate defaults, high government leverage, weak property sectors, and energy supply present downside. Additionally, despite elevated USD funding costs, Yankee bank issuance is expected to remain strong in 2023, as banks look to supplement funding and deposit outflows in their local markets and manage regulatory buffers.

Insurance will walk a tightrope in 2023, as the sector balances brighter prospects from the surge in interest rates with an increasing probability of recession. New money yields have stemmed a decade-long decline in net investment yields, and we expect higher interest rates to be a tailwind in 2023. In the case of a recession, insurance begins the year with robust levels of capital and has largely de-risked investment portfolios from the credit issues seen in 2008/09. Commercial P&C insurers have benefited from a hard market the past few years but will need to keep the momentum going in 2023, as cost inflation works its way into reserves. The impact of inflation has been clear on short-tail personal lines with industry losses setting up a hard market in 2023 to reach rate adequacy. We expect competition to remain rational as the industry continues to price higher for rising risks and severity, and insurance brokers to benefit. After another year of record sales for the life insurance sector, we expect a return to normal. The sector should benefit from higher rates while COVID-mortality claims are less of a headwind in 2023. Investors will be digesting the upcoming GAAP accounting changes for LDTI, which will introduce more volatility in earnings, and sector spreads. Despite higher rates, the expectation of a mild recession and ensuing investment losses have led to underperformance in the sector in 2022. With these risks largely priced in, we start the year by moving our view on valuation from unattractive to fair. Health insurers continue to look favorable in 2023, with premiums adjusted for inflation annually, and another year of benefitting at the expense of providers, with contracts typically negotiated on three-year terms. We expect medical cost trends to remain manageable even with utilization continuing to recover to pre-pandemic levels. In the case of a mild recession, consensus forecasts for unemployment rates next year, remain supportive of growth.

1 Bloomberg Barclays Corporate Index

2 Bloomberg Barclays Corporate Index

3 Capital IQ for non-financial, non-utility mainly IG Companies

4 Bloomberg Barclays Corporate Index

5 Bloomberg Barclays Corporate Index

6 S&P “Liquidity Concerns and Rising Rates Influence Potential Downgrades” Dec 08, 2022

7 Moody’s “November 2022 Default Report” 12/14/2022

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.