We all know Warren Buffett as perhaps the most astute investor of our time. His success within the financial markets is legendary. But do you know what the Oracle of Omaha chose if he were stranded on a desert island and could pick only a single indicator to help him navigate through the financial markets? Rail traffic. This paper will examine the logic behind this unexpected and atypical perspective.

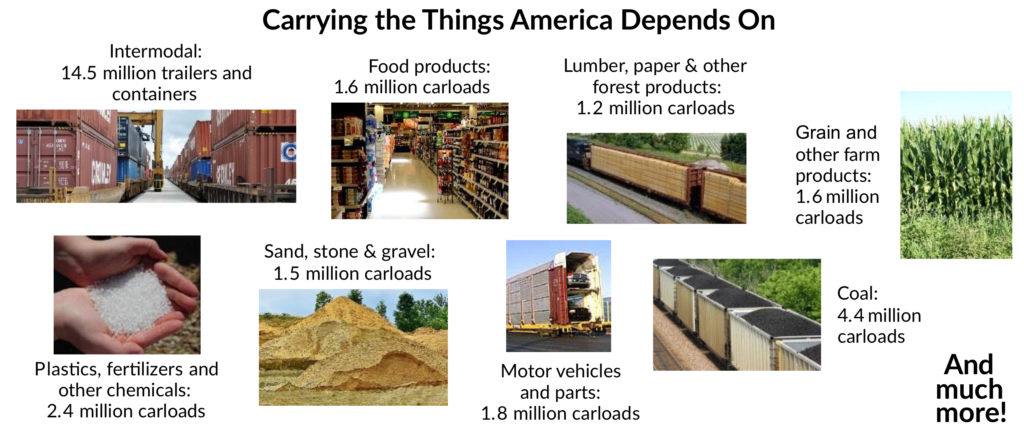

Why are railroads important?

The U.S. freight railroad system comprises about 140,000 miles of track and consists of hundreds of railroads. The largest are called “Class I” and include CSX, Norfolk Southern, and Burlington Northern Santa Fe (BNSF). Most of what you touch, eat, and interact with on a daily basis most likely, at one point or another, traveled on one of these railroads.

Exhibit 1

Railroads ship both raw materials used in the production of finished products as well as the finished products themselves. And rail supports a wide variety of industries including automotive, agriculture, energy, and construction. Shipping goods via rail is an attractive alternative for several reasons including economic efficiencies (rail can move one ton of freight more than 470 miles on one gallon of fuel), reliability, and access to international markets. Railroads account for about one-third of U.S. exports by volume. These industry characteristics make for an interesting way to gauge the pulse of the economy.

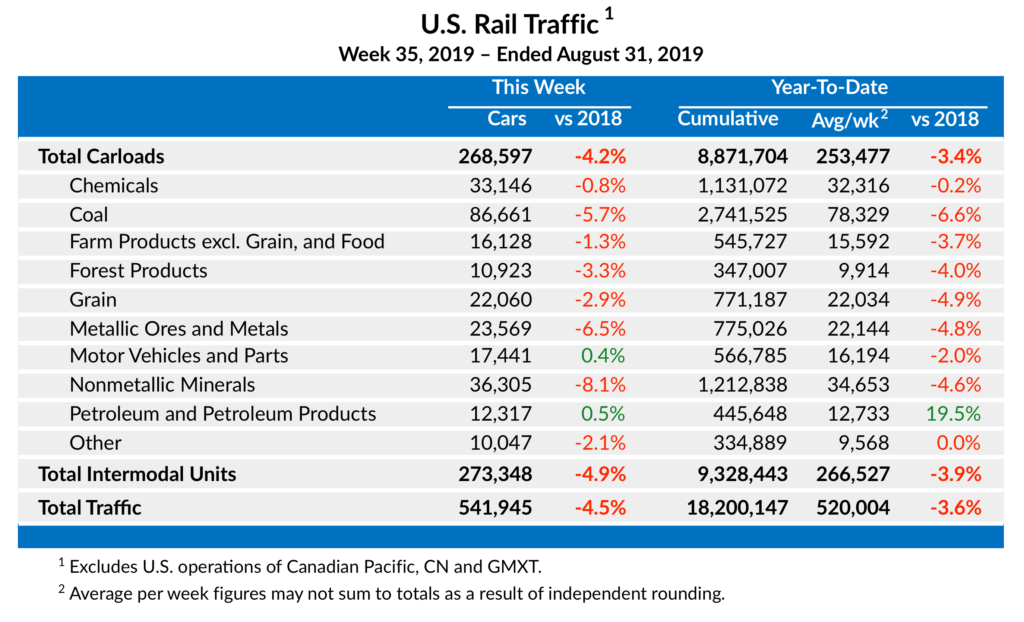

The data

Rail traffic data is released weekly by the Association of American Railroads (AAR) and is broken down by number of railcars per each category including intermodal. Intermodal is defined as the long-haul movement of shipping containers and trailers by rail combined with a truck or ship at either end of the journey. The following is a snapshot of the AAR report:

Exhibit 2

A breakdown of each category offers additional background on how each is viewed as an economic indicator:

Chemicals (6%) – Consists mostly of industrial chemicals, plastics and synthetic fibers, and fertilizers. This category includes thousands of products and serves as a good proxy for general growth especially in manufacturing.

Coal (15%) – About 8% of U.S. coal is exported, double from 2017. Low natural gas prices and advanced renewables are replacing coal as a source of generation for electricity, which means it is less reliable as an economic indicator

Farm Products (3%) – Includes feed for livestock and a very wide variety of food for human consumption. Refrigerated rail cars have come a long way in moving perishable products to rail and away from trucks.

Forest Products (2%) – Consists of lumber and paper products. Transport of lumber is highly correlated to housing starts, a key economic indicator.

Grain (4%) – The United States is the world’s largest grain producer. The market is somewhat unpredictable given difficulty in forecasting crop size due in part to weather and soil conditions.

Metallic Ores (4%) – Includes iron ore, steel scrap, and coke. Impacted by the health of the steel industry and manufacturing (i.e., appliances).

Motor Vehicles (3%) – Rails are involved in several stages of the auto production process including materials for steel, parts, and finished vehicles. A single train can move 750 vehicles at once.

Nonmetallic Minerals (7%) – Includes materials for a wide variety of construction projects including crushed stone, sand, and gravel. Analysts estimate that about 80% of crushed stone is used as a construction material mostly for road construction.

Petroleum (2%) – Crude oil volume for rail is impacted by pipeline capacity and oil prices. Domestic production in shale oil, especially in North Dakota and Texas has created opportunities for the rail industry.

Intermodal (51%) – Rail has invested a tremendous amount of resources into this business. Customers can move twice the freight for the same price paid 30 years ago. Intermodal has helped address the difficulty of hiring long haul truckers. In addition, this segment has a large international component.

Is this a good indicator?

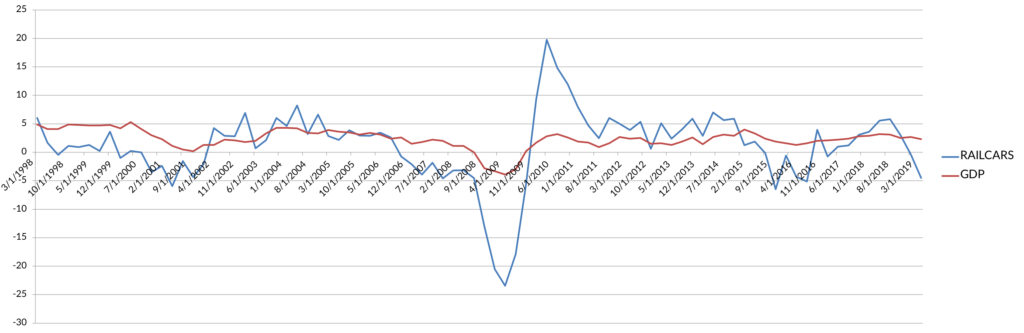

We recognize for an indicator to be reliable, it needs to be statistically credible. We analyzed the different subsets of the rail carloading data to measure their significance as a predictor of economic data points, including GDP growth. We found that the best combination was total traffic, excluding grain and coal. We removed grain and coal because volumes in those categories often change based on factors outside the scope of economic growth. For example, coal volumes change based on the price of natural gas and grain volumes can be severely impacted by unexpected weather patterns.

Using data going back to 1997, we find a correlation of 66%; R squared of 43% and a statistically significant relationship as noted by the t stat. Given this data we characterize the relationship as having a relatively strong correlation.

The exhibit below illustrates the relationship of the two variables, which is helpful since GDP data is released with more of a time lag than the railcar loading data.

Exhibit 3: Rail carloading growth vs. GDP growth (Y/Y)

Future trends

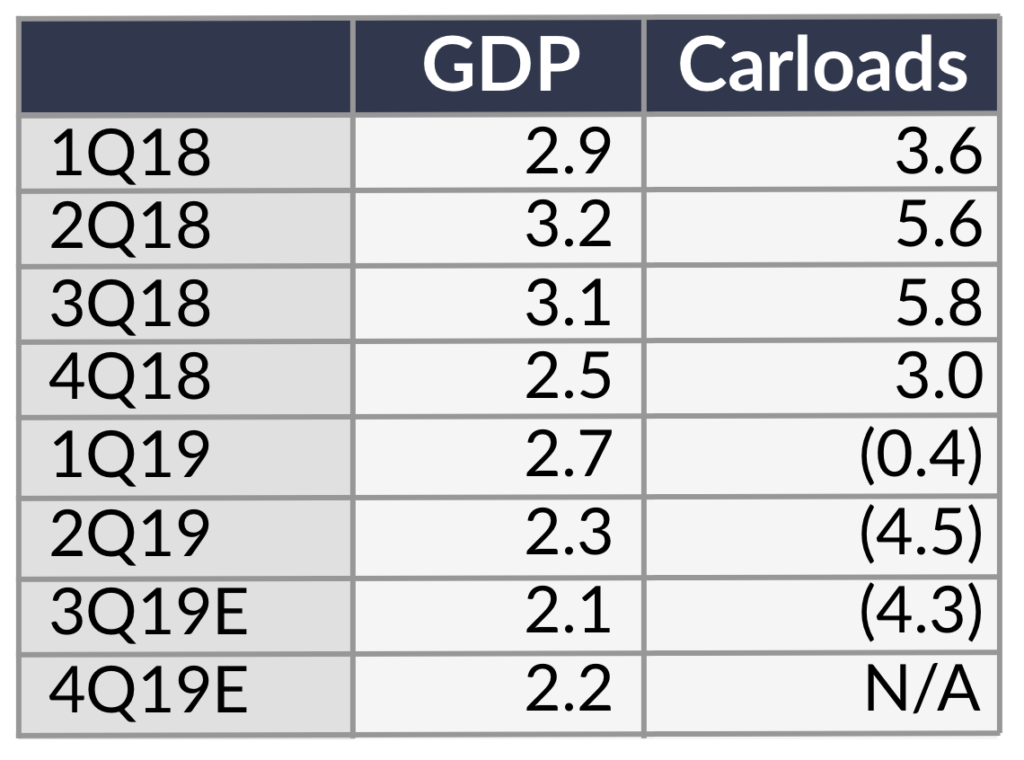

At this point in the third quarter we have nine data points (Note: each quarter has a total of 13). So far, railcar loadings QTD are down 4.3% compared to last year. If the trend continues for the remainder of the quarter, the change year over year would look similar to 2Q19 which was down 4.5%. Based on our analysis, we would expect GDP to trend lower or stabilize around 2.0%. Currently, the estimate for Year over Year growth for 3Q19 GDP is +2.1%, and for 4Q19 GDP is +2.2%. Economists seem to agree!

Exhibit 4: Rail carloading growth vs. GDP growth (Y/Y)

Will we see the impact of the “trade war” in rail traffic?

The quick and easy answer to that question is, yes. The US/China trade dispute continues to evolve and freight railroads play a very important role in international trade. The Association of American Railroads estimates that at least 42% of the carloads and intermodal units railroads carry are directly associated with international trade. In addition, 35% of rail revenue is accounted for by international trade. Of that amount about 36% was from intermodal containers with the remainder from other carload traffic.

On August 1st, the office of the US Trade Representative announced a new round of additional tariffs. The proposed “List 4” tariffs are more retail and consumer oriented. The effective date of September 1st for this third phase of tariffs gave companies little opportunity (one month) to stock up on Chinese goods before prices increased. Therefore we would not expect to see a “pull ahead” of ordered goods like we did at the end of 2018 when the timeline was not as compressed. That said, we expect car loadings to be impacted by negative sentiment, lower import/export volume, and permanent supply chain reorganization. The exhibit below shows the estimated cost of the tariffs per household as estimated by JP Morgan. We would expect the impact to the consumer to come through in the weekly rail traffic numbers and eventually impact GDP.

Exhibit 5: Estimated Cost of Tariffs on Households

Summary

Rail traffic may not have been at the top of your list of indicators, but, given its statistical relevance, we believe it deserves some attention when forming a strategic opinion on the economy. It’s interesting to note that not so long after that comment from Warren Buffett, Berkshire Hathaway purchased Burlington Northern Santa Fe for about $44 billion (February of 2010). Talk about putting your money where your mouth is!

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.