SECOND QUARTER CORPORATE CREDIT UPDATE

Market Performance – Constructive Economic and Inflation Data Drives Performance

The Investment Grade (IG) Corporate bond market had a less volatile second quarter with the option adjusted spread (OAS) fluctuating in a range of 123-148 basis points (bps), closing 7 bps tighter vs. year-end 2022. With this spread movement, the IG market generated an excess return versus a duration-neutral Treasury of 1.3% for the second quarter. It returned 1.6% year-to-date (YTD)1. When including the underlying Treasuries, the IG market returned -0.3% in the second quarter and 3%2 YTD, as Treasury yields increased in the second quarter with better-than-expected economic data. This compares to the S&P Index which returned 17% YTD and the High Yield market 5%3.

Investors became more comfortable adding risk in the second quarter, as it became more apparent that US economic growth remained above 1% and inflation was in check, limiting the risk of outsized moves by the Federal Reserve (Fed) and/or a near term recession. Financials outperformed after a volatile first quarter, and Industrial BBBs outperformed higher quality. The short end of the curve outperformed from a spread tightening perspective given the strong performance in Financials, a shorter duration sector.

Market Outlook – Second Half Likely Less Volatile With the Focus on 2024

The second quarter earnings season has started. We expect earnings growth to be negative once again this quarter driven largely by commodity prices and continued normalization post pandemic. However, while earnings growth and margins are expected to contract for the average IG company this quarter, EBITDA growth should remain healthy in the mid-to-low single digit range. We expect modest margin compression to continue as firms are losing their pricing power and wage inflation remains a headwind, but interest coverage for the average IG company should remain ample even with higher rates for longer. We expect the Fed to pause after this week, but with a strong labor market likely to continue for longer than the Fed expected, we don’t expect rates to move lower in the near term. This outlook is constructive for the economy and markets near term, increasing the likelihood that market volatility remains low in the second half of 2023.

Looking into 2024, one can easily ask how revenue for companies in the S&P 500 Index can grow 5%4 on average when nominal GDP is around 3%5 and there is a risk of a recession in the first half of the year. We believe this reflects improved performance from sectors that have been in their own recession this year, as supply and/or demand normalizes post pandemic. One example is the technology sector. Revenue growth for that sector is expected to be 4 percentage points less than nominal GDP growth this year (2% vs. 6%) while exceeding nominal GDP growth by 6 percentage points next year (9% vs. 3%)6. Technology companies are recovering from the inventory disruption related to a pull-forward in consumer demand and the semiconductor chip shortage. We expect this sector to bottom later this year, as it works down bloated inventory and demand recovers.

An example of a sector that is normalizing yet has downside risk to estimates in 2024 is the auto sector. After suffering from supply chain disruptions, we see new challenges on the horizon related to the low-end consumer, increased supply of electric vehicles, and a likely UAW strike. Moreover, if interest rates remain elevated next year, we are likely to see downward pressure on sales growth added to that list. Currently, the sector is expected to perform in line with nominal GDP growth next year.

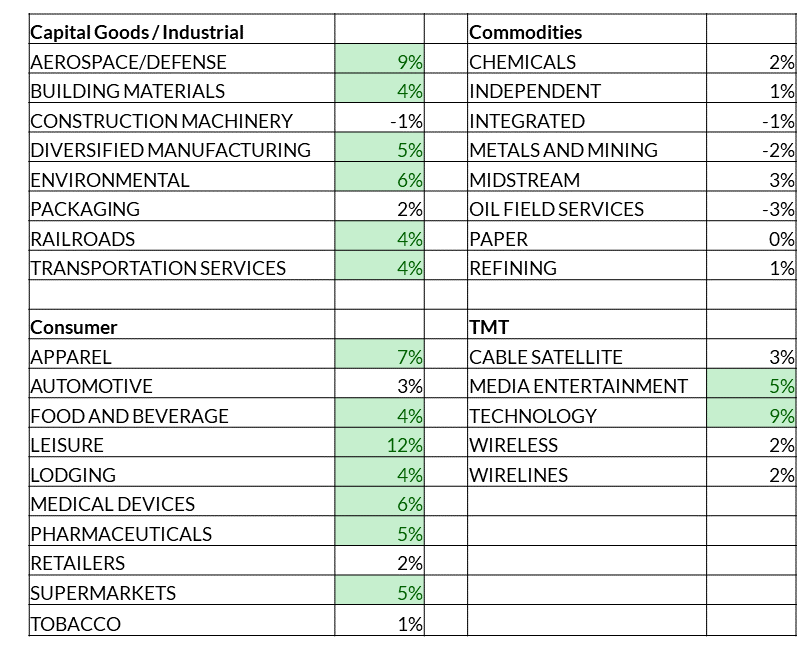

As you can see in Table 1, sectors projected to generate more than 3% revenue growth are generally exposed to the consumer, which continues to have excess savings and benefit from a strong labor market, and the industrial side of the economy, which like technology and media, is normalizing post-pandemic as well as benefitting from government related spending.

Table 1: 2024 Projected Revenue Growth7

The Finance sector is one that is likely to remain under the spotlight in 2024. Bank earnings have not surprised to the downside thus far in the quarter, limiting near term risk. We expect this cycle to take a while, as bank liquidity remains challenged and we expect asset quality to slowly deteriorate as economic growth remains slow and secular challenged sectors like commercial real estate (CRE) start to impact banks’ ability to lend. Therefore, credit is likely to remain tight. While this could very well tip the economy into a recession and certainly has in the past, we think it’s more likely to negatively affect leveraged borrowers that took advantage of very low rates for possibly too long. Using CRE as an example, this means selectively investing in the Banking and Insurance sectors given their exposures to this asset class.

1 Bloomberg Barclays Corporate Index

2 Bloomberg Barclays Corporate Index

3 Bloomberg Barclays High Yield Index

4 Factset “Earnings Insights” 7/21/2023

5 Bloomberg consensus estimates

6 Factset “Earnings Insights” 7/21/2023

7 AAM; CapIQ using ~350 IG non-financial, non-utility companies; Bloomberg

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.