FIRST QUARTER CORPORATE CREDIT UPDATE

Market Performance – Spreads Widen Due to Banking Sector Concerns

The Investment Grade (IG) Corporate bond market had a volatile first quarter with the option adjusted spread (OAS) fluctuating in a range of 114-163 bps, while only closing 8 basis points (bps) wider vs. year-end. With this spread movement, the IG market generated an excess return versus a duration-neutral Treasury of 0.2% for the first quarter1. Year-to-date (YTD), when including the underlying Treasuries, the IG market returned 3.5%2 as Treasury yields fell. This compares to the S&P Index which returned 7.5% YTD, and the High Yield market 3.6%3.

Concerns after the failure of two regional banks led to lower Treasury yields and wider financial spreads. The short end of the corporate market underperformed given the disproportionate share of Finance sector bonds in the short end. Industrial ‘A’ and ‘BBB’ spreads were essentially unchanged with cyclical sectors underperforming more defensive ones, as concerns related to economic growth resurfaced. Utilities underperformed likely due to credit profiles that are stretched relative to Industrial peers and elevated issuance to fund capital projects.

Market Outlook – Spread Volatility Expected to Continue While the Fed is Tightening

Rapidly higher yields, a stronger U.S. dollar, and a contraction in liquidity has increased uncertainty. While the probability of a recession in the U.S. remains elevated (65% per Bloomberg) and consensus forecast is for a shallow one, the pressure on banks increases the likelihood that liquidity will contract more than we had anticipated at the start of the year, deepening or lengthening the recession. As we have seen in prior cycles, this can lead to asset quality problems as banks no longer have the capacity to retain marginal borrowers. While people may point to the shadow banking sector as a replacement, we would point to the higher costs of operation today from a business and funding perspective4.

Consequently, the level of uncertainty remains high. This uncertainty coupled with a Fed that relies on backward looking data increases the likelihood that spreads remain volatile. Our expectation is for the OAS to fluctuate between 110 and 160 bps in 2023, with 160+ bps more likely to occur if the probability increases for a hard landing and/or an external shock materializes.

Fundamentals – Slowing Expected with Risks in Leveraged Markets

According to Factset, analysts are projecting earnings growth of 1% and revenue growth of 2% for the S&P 500 in 20235. Energy and Materials are the two sectors dragging down those forecasts with other sectors expected to grow revenues 3-5%. Energy and Material related companies benefited greatly from the rise in commodity prices in 2022, and many companies used that enhanced cash flow to improve their credit profiles. Therefore, while growth may decline in 2023, free cash flow in those sectors should remain strong.

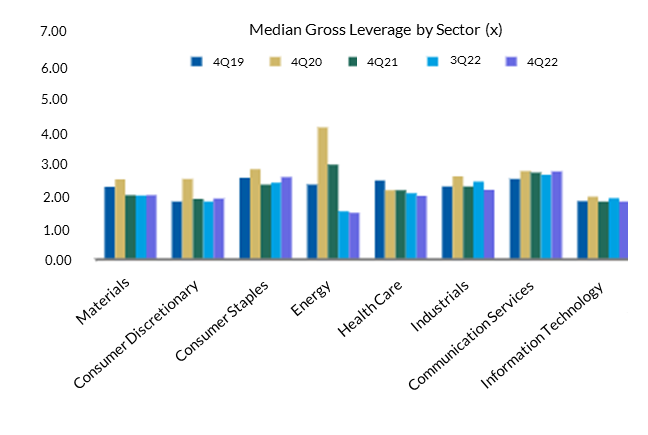

You can see in Exhibit 1 that sectors have largely reduced debt leverage since the peak in 2020 with deep cyclical sectors having reduced it the most. Defensive sectors have maintained debt leverage (Debt/EBITDA) in the 2-3x area, which is comfortably investment grade. This improvement helps cushion the potential impact on credit profiles if economic growth is weaker than expected. Compared to other markets with greater refinancing needs, the IG market has 14% of its debt due before 20256. The majority of IG companies have cash and other sources of liquidity to cover the debt maturing over the next couple years7. We are comfortable with the fundamentals and refinancing risk in the corporate sector as a whole.

Exhibit 1

That said, we do not expect all sectors will escape ratings downgrades. We continue to believe the areas that are at risk for negative rating actions include: (1) credits over-exposed to office related commercial real estate such as banks and REITS and (2) highly leveraged credits given the expectation for elevated interest rates over the intermediate term and relatively low economic growth.

In regards to more leveraged borrowers, spreads rallied at the start of the year with the expectation for the Federal Reserve to lower rates, which would be supportive fundamentally for these borrowers. As economic growth surprised to the upside, rates increased and spreads for leveraged companies widened. This was magnified in March after the bank failures. S&P commented in a recent report8 that the global corporate default tally of 37 issuers year-to-date is the highest since 2016 and 2009. Distressed exchanges are responsible for nearly half of them, which is more supportive for the economy vs. bankruptcies as these companies remain viable. This activity is likely to continue given the difficulties borrowers have operating in this environment, which means losses will very likely be realized by lenders and equity holders.

The bank failures in March placed a spotlight on liquidity and potential asset quality problems. When liquidity is strained, banks are unable to provide stability to markets and/or support for the economy. We expect bank lending standards will tighten more over the next six months after already having tightened. One market that is most vulnerable is office. It has both cyclical and secular challenges, with loss estimates ranging from $82B to $413B9. We expect losses to materialize over time, dampening growth prospects for the U.S. economy. However, at this time, we are not expecting this to be a systemic issue.

1 Bloomberg Barclays Corporate Index

2 Bloomberg Barclays Corporate Index

3 Bloomberg Barclays High Yield Index

4 AAM Podcast with Leah Savageau https://lnkd.in/gsaHvTww

5 Factset “Earnings Insight” 4/21/2023

6 Morgan Stanley “Scaling Maturity Walls” 4/4/2023

7 20% cash/debt metric cited in Morgan Stanley’s “The Best Is Behind Us – 4Q22 IG Fundamentals” 3/22/2023

8 S&P “Distressed Exchanges Spur a Sharp Rise in Corporate Defaults” 4/13/2023

9 $82B estimate from: JP Morgan “Commercial Real Estate Overview” 3/24/2023; $413B estimate from: Arpit Gupta, Vrinda Mittal, Stijn Van Nieuwerburgh from NYU Stern “Work From Home and the Office Real Estate Apocalypse” 11/27/2022

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.