insight

Multiplying Factors: An Analysis of the NAIC’s Proposed Changes to RBC Bond Risk – Updated Edition

August 12, 2015

A draft proposal to enhance the NAIC’s bond RBC (Risk-Based Capital) factors is currently being considered by the Investment RBC Working Group. AAM’s analysis suggests that these changes would meaningfully impact Life insurers’ Asset Risk calculations and ultimately their RBC ratios. While discussion of this proposal has been focused on Life insurers, AAM expects that a successful adoption for Life insurers will lead to a similar application for Property & Casualty and Health insurers. However, because asset risk is a substantially less material component of the RBC calculation for these other insurers, the impact is likely to be relatively muted. Please contact AAM for a complimentary customized report to estimate the hypothetical impact of these changes on your RBC ratios.

At their Summer 2014 National Meeting, the NAIC’s Investment RBC Working Group proposed an increase in the granularity of NAIC ratings on life insurer bond portfolios, to provide better transparency of credit risks in these portfolios, to improve the precision of RBC factors for each ratings category, and to discourage “regulatory arbitrage” that currently incentivizes insurers to over-invest in bonds at the lower end of each rating bucket (e.g., A3 bonds receive the same RBC treatment as Aaa bonds despite being six rating notches lower). This new ratings scheme has continued to be under discussion in subsequent meetings, and its eventual adoption looks increasingly likely. This change could potentially have a significant impact on RBC scores and correspondingly on insurer investment strategies. In this paper, we will examine the new ratings scheme being proposed and the hypothetical impact on the RBC score of a sample life insurer.

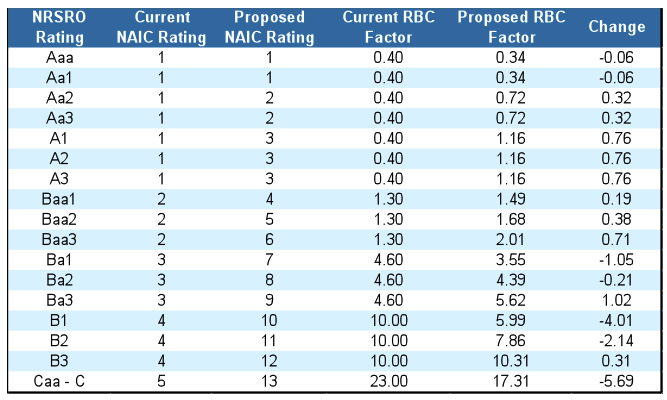

The following table illustrates the proposed changes. These factors were calculated through an analysis performed by the American Academy of Actuaries involving a 2,000-trial simulation of the capital required to pre-fund the greatest cumulative losses in each ratings category over a 10-year period, to a 95% confidence level. Default assumptions were based on a Moody’s default study encompassing 20 years of trailing default data. There was also discussion of using a “matrix” methodology to determine capital requirements, which would have added consideration of the lien position of each bond in determining its capital requirement, but this was ultimately not pursued due to prohibitively complex implementation. As you can see, the proposed system expands five NAIC ratings categories (the sixth category for securities in default remains the same) into 13 by increasing the granularity of NAIC ratings relative to NRSRO (Nationally Recognized Statistical Rating Organization) letter ratings. Under these changes, seven NRSRO ratings receive lower capital charges (five of them below investment grade), and ten receive higher charges. Because the increased capital charges are mostly on the investment-grade ratings, which include the majority of insurer bond holdings, we would generically expect these changes to increase the RBC required capital for most insurers.

Exhibit 1

Source: American Academy of Actuaries,” Model Construction and Development of RBC Factors for Fixed Income Securities for the NAIC’s Life Risk-Based Capital Formula,” August 3, 2015

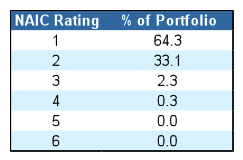

To test this hypothesis, we examined the portfolio of a sample life insurer. Like most insurers, this company holds primarily investment-grade bonds, but has a few sub-investment grade bonds in the portfolio as well, mostly in the BB range. Our analysis focused on corporate and municipal bond holdings (the NAIC has expressed an intention to use the same factors for municipal bonds as for corporates), and excluded structured bonds, which have their ratings determined by unit book value breakpoints rather than NRSRO ratings. Here are the relevant portfolio holdings divided into current NAIC ratings buckets:

Exhibit 2

Source: AAM

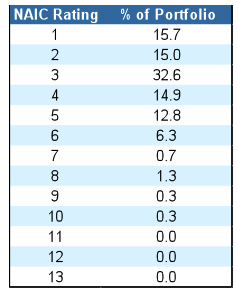

This distribution corresponded to RBC required capital of $1.26 million prior to the covariance adjustment. Placing the exact same bonds into the new NAIC buckets resulted in the following distribution:

Exhibit 3

Source: AAM

Using the proposed factors for these buckets produces RBC required capital of $1.86 million, a 48% increase. More than 100% of this increase came from the new factors applied to investment-grade bonds, whereas the required capital attributable to sub-IG bonds actually declined slightly. Note that A-rated bonds in particular require almost 3x as much capital under the new scheme as the old one.

Asset risk is a major RBC component for life insurance companies, so a 48% change should meaningfully impact RBC ratios. For our sample company we tested the effect of a 48% increase in their C-1o (Other Asset Risk) factor (assuming that structured securities would face similar changes as corporate and municipal securities under the new system, which is admittedly not certain at this time), and their RBC ACL ratio declined from a normalized 100 under the current ratings scheme down to an 85.8. This is clearly a material change, and we would expect it to lead to some reshuffling of investment portfolios to compensate.

In particular, at the margin it could lead to a decline in single-A rated bond holdings in favor of a “barbell” of bonds rated either Baa1 and below, or Aa1 and above. The factors no longer drop off as sharply as one goes down the credit scale, which makes the higher yields on lower-quality bonds more attractive per unit of required capital. Previously a Ba1 bond required 11.5x as much capital as an A3 bond, but on the new scale that ratio is 3.06x. Meanwhile, insurers will want to offset this credit risk with higher-quality bonds, and the new system puts a premium on Aaa and Aa1 bonds, suggesting that Government- and Agency-backed bonds may be used to offset credit risk taken elsewhere in portfolios. The NAIC cited the smoothing-out of large “cliffs” between ratings categories as one motivation for the new system, and that is certainly borne out in practice.

The above comments have been focused on life insurers, but what about Property & Casualty and Health companies? If the new system is adopted, it will probably be adopted for all insurers, both because the gains in transparency and precision would also apply to these other industry sectors, and also for the sake of avoiding confusion due to a lack of uniform practices. The important difference is that asset risk is a much smaller component of the RBC calculation for these other types of insurers (underwriting and reserving risk are much more material), and especially after the effects of the covariance adjustment, it is unlikely that the changes will have much impact on the overall ratios. We repeated our earlier test with a sample Property & Casualty company, putting their existing bond holdings into the new ratings buckets, and the RBC ACL ratio only declined from a normalized 100 down to 99.3, a much less material change than the life insurer experienced.

The NAIC’s Investment RBC Working Group continues to examine possible enhancements to RBC Asset Risk factors, and those described above may not be final. Additional analysis has been recommended regarding the challenges of implementing a new ratings regime, including resultant changes to form blanks, model laws, software systems, and financial statements. Considerable analysis has already gone into the issue; however, the mandate to recalibrate asset risk factors was issued back in 2011. We believe that it is likely the process is approaching a consensus. We will continue to monitor updates from the NAIC as they become available, and can help with modeling out the potential impacts of these changes on RBC ratios upon request.

Written by:

Pete Wirtala, CFA

Insurance Strategist

Additional sources: NAIC Summer 2014 Meeting (August 16 – 19, 2014) and Spring 2015 Meeting (March 28 – 29, 2015) Notes, SNL RBC Modeling Templates

For more information, contact:

Colin Dowdall, CFADirector of Marketing and Business Development

John Olvany, Vice President of Business Development

Neelm Hameer, Vice President of Business Development

30 North LaSalle Street

Suite 3500

Chicago, IL 60602

312.263.2900

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.