Market summary and outlook

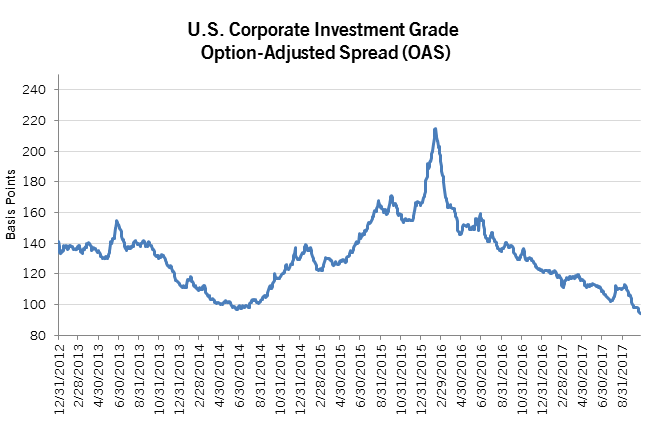

The Investment Grade (IG) Corporate bond market delivered a 1% total return in the third quarter 2017, with spreads tightening 7 basis points (bps). Risk assets outperformed with the S&P Index returning 5% in the third quarter, high yield 2%, and Emerging Markets 2% as well. Corporate bonds with longer maturities and BBB ratings outperformed using the IG Index per Bloomberg Barclays. This is a continuation of the performance witnessed in the first half of the year.

We continue to see strong demand from bond funds for investment grade securities, and foreign buying of USD IG debt remains a source of demand despite the less attractive yield advantage (net of hedging costs). New issue supply was higher than expected in the third quarter. Except for a brief period of spread widening in August related to rising geopolitical risk and falling expectations for tax reform, spreads have consistently moved tighter this year. We do not see warning signs related to the credit cycle. That said we are watching closely since (1) the growth in debt is concerning if economic growth starts to disappoint, and (2) risk premiums are low, which has historically masked bad decisions by management teams and financial lenders.

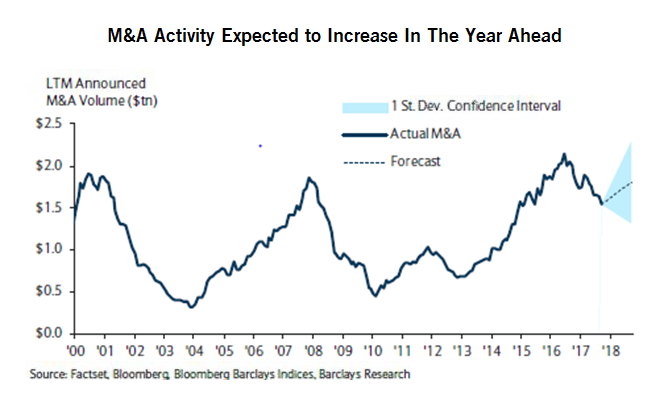

Despite lackluster valuations, we have a neutral opinion on the IG corporate sector, expecting technicals to remain supportive and fundamentals relatively stable over the near term given policy related uncertainty, improving overseas growth, and favorable lending conditions. Margin pressures such as rising labor costs and/or disappointing growth remain a risk given the elevated level of debt leverage and size of the credit market, BBB rated securities specifically. Moreover, we expect companies to resume M&A activity over the near term. Tactically, we are maintaining flexibility in portfolios given very tight spreads to add opportunistically when spreads widen.

Source: Bloomberg Barclays, AAM as of 10/24/2017

Source: Bloomberg Barclays, AAM as of 10/24/2017

Performance Summary Year-to-date

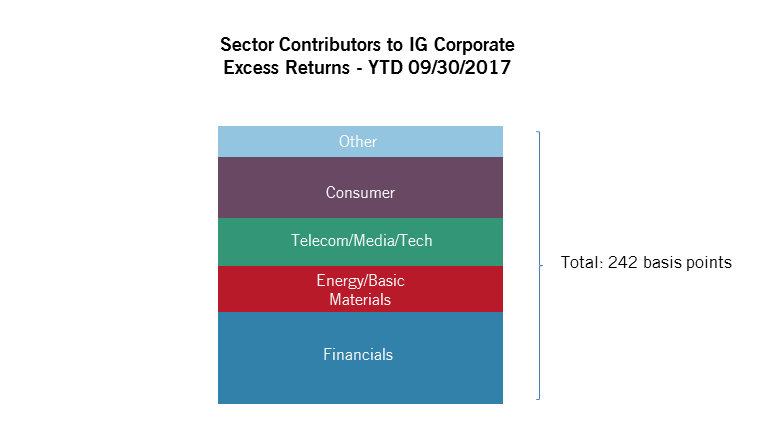

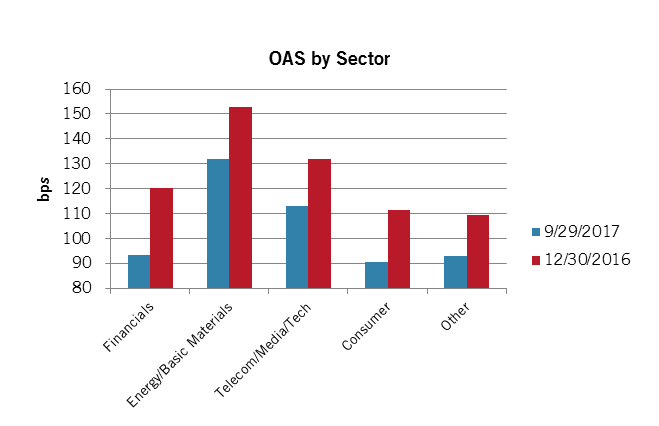

Spreads continued to tighten in the third quarter, with OAS 21 bps tighter year-to-date. Commodity and Financial sectors outperformed in the third quarter with spreads widening in the Cable, Media and Supermarket sectors. This widening was related to secular challenges and the event risk that results, with the best example being Amazon’s purchase of Whole Foods and what that means for grocers like Kroger. We have been investing with these themes in mind, reflected in recent presentations on electric vehicles and the cable/media sectors.

As shown below, all broad sectors have contributed to very strong performance in the Corporate market as of the end of the third quarter.

Source: Bloomberg Barclays Index (as of 9/30/2017), AAM

Source: Bloomberg Barclays Index (as of 9/30/2017), AAM

Credit fundamentals

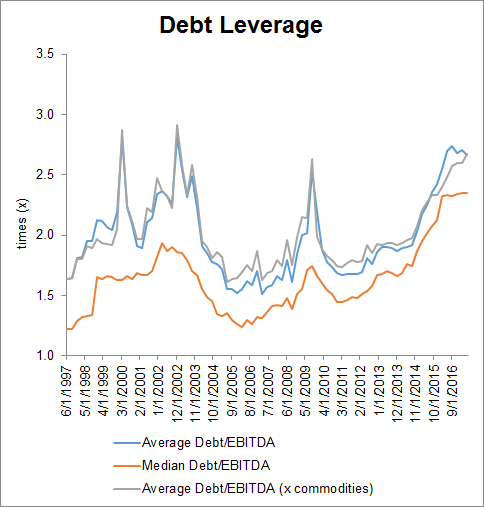

Credit metrics have been largely stable in 2017. Revenue growth has improved for most sectors versus last year driven largely by the strength in economies like Europe and China as well as higher commodity prices. We are not seeing debt leverage come down meaningfully, and it remains a concern of ours, but changes related to tax reform may incentivize companies to have less debt in their capital structure. One headwind for leverage is our expectation that M&A will increase, typical when volatility is low and sentiment is high.

Source: Factset, AAM as of 6/30/2017 (Data reflects IG issuers, excluding Financials, Utilities)

Source: Factset, AAM as of 6/30/2017 (Data reflects IG issuers, excluding Financials, Utilities)

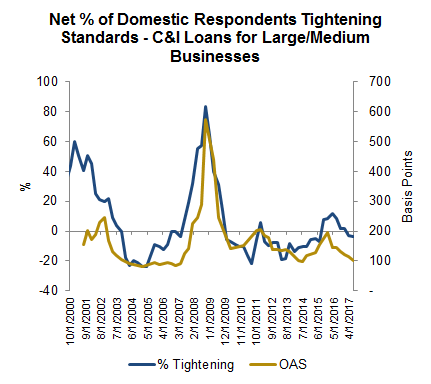

Credit Sector indicators

We track indicators statistically proven to forecast spread widening. One is the Senior Loan Officer Survey. As banks tighten lending standards, it tightens the credit markets. We were concerned in 2014 when we saw that trend, but that reversed in 2016. Thus far in 2017, lending standards have remained favorable. This message is consistent when we look at the survey data provided by the non-banking sector, namely the Credit Managers Index. That Index has also registered data consistent with an “expansionary” cycle. Lastly, the other indicator that has proven to be a reliable indicator is the shape of the Treasury yield curve. That is flattening, but remains upward sloping, which is good for the credit market. However, it is something we are watching closely as Treasury yields have become more volatile given the uncertainty surrounding the Federal Reserve Chair appointment, QE in Europe as well as stimulus provided by tax reform.

Technical Support

While the Federal Reserve may be on a path to raise rates, the ECB and BOJ remain accommodative. The ECB surprised investors this week by extending its corporate bond buying program. Monthly purchases from the ECB and BOJ will continue to take liquidly out of the system even with the Fed compressing its balance sheet. This strong technical keeps us investing in corporate credit despite lackluster valuations. We remain watchful of signs of inflation, which would change this dynamic.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.