THIRD QUARTER CORPORATE CREDIT UPDATE

Market Performance

The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) has performed well year-to-date (YTD) as of the end of the third quarter, as yields remain compelling vs. alternatives domestically and overseas. The IG market generated an excess return versus a duration neutral Treasury of 1.9%, but due to rising Treasury yields, the total return YTD was -1.3%. Hence, Corporate bonds have underperformed riskier markets, with the S&P Index returning 16% and the High Yield market 4.5% (per Bloomberg Barclays).

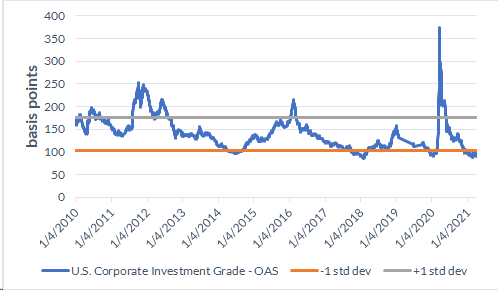

The option adjusted spread (OAS) of the IG market tightened 15 basis points (bps) in the first nine months of the year, with long maturities and ‘BBB’ rated bonds outperforming (per Bloomberg Barclays Index). Notably, spreads have been resilient despite increased equity and Treasury market volatility. With an OAS well inside its historic mean, the IG market is statistically rich (Exhibit 1), reflecting much stronger credit fundamentals, technical demand driven by low rates globally and ample liquidity, and possibly implied Fed support going forward for IG rated issuers in the event of a liquidity crisis given the establishment of the SMCCF.

Exhibit 1: Corporate IG OAS is Statistically Rich

Fundamentals

After assessing financial results for the universe of IG issuers, we have observed that credit fundamentals are stronger now than they were before the pandemic. Third quarter earnings season has started, and our expectation is for companies to continue to beat estimates. We believe there is the potential for more cautious undertones to management outlooks given more muted economic growth due in part to supply chain constraints, increasing commodity prices, Covid outbreaks, labor shortages and/or a rising US Dollar. Fundamental performance this year has been very strong, with many firms returning or exceeding pre-Covid revenue levels while enhancing margins and reducing debt leverage.

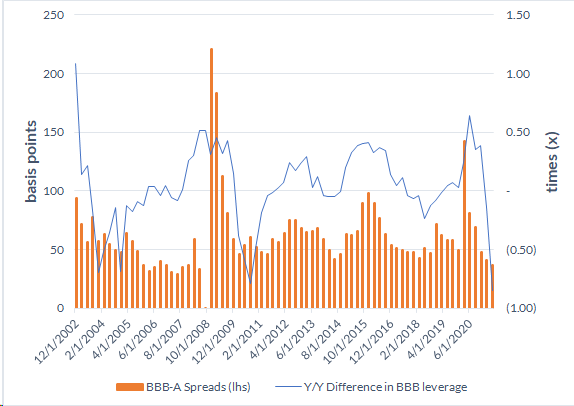

Debt leverage of ‘BBB’ rated non-financial issuers has improved substantially this year, especially for cyclical and commodity related firms per the data we have analyzed of over 350 issuers. Windfall profits due to high commodity prices was a major contributor to this. This improvement is notable given their more volatile cash flows, putting firms in a stronger position. Accordingly, we are not surprised to see the risk premium for ‘BBB’ rated issuers (“BBB-A Spreads” in Exhibit 2) approach a multi-decade low. That said, we do not expect debt leverage to improve in 2022, with free cash flow used largely for payments to shareholders, increased capital spending, and/or acquisitions.

Exhibit 2: BBB Risk Premiums have Fallen as BBB Leverage Improves

Liquidity

We believe there is ample liquidity in the system and financial conditions remain historically loose. Markets are open, and asset managers and banks are eager to lend. U.S. domiciled banks have stockpiled $3.7 trillion in cash and securities since year-end 2020, as loan growth has been anemic due to excess liquidity and for larger corporations, supply chain bottlenecks and access to more attractive capital markets. In contrast, the burgeoning private debt market exceeded $1 trillion in assets (new capital and unrealized value) according to Prequin. The public markets have remained active despite a record year in 2020, with $2 trillion of cash on balance sheet for IG firms at mid-2021 compared to $1.7 trillion at year-end 2019 (Source: AAM, Factset; 380 IG firms, excluding financials captives and utilities). Lastly, as shown in Exhibit 3, households have more than $2 trillion of excess cash as compared to balances in 2019.

More cash could be coming, as legislators debate the next round of fiscal spending and potential tax policy changes. Once that occurs and Covid-disruptions dissipate, we would expect companies and households to feel more comfortable spending and investing their cash, which should remain supportive for the economy and markets.

Exhibit 3: Households have Considerable Excess Savings

Market Outlook

As we examine sectors that have outperformed this year, we note that most of the performance has been driven by cyclical industries and those negatively impacted by the pandemic last year. Today, we see more value in defensive sectors, financials, and ‘BBB’s generally. We expect spreads to remain range bound in the fourth quarter 2021, as the Federal Reserve starts to taper its asset purchases. The new issue market is likely to slow in the fourth quarter, providing technical support.

While supply chain and Covid-related disruptions are expected to continue in 2022, we expect credit fundamentals to remain healthy, with companies benefitting from: (1) a financially stronger consumer, (2) technology enhancements, (3) pricing power due to right sizing of supply, and/or (4) demand fully recovering from Covid-related influences among others. For financial companies, the upward pressure on rates would likely be a tailwind next year while the low absolute level is not expected to be burdensome for other industries like housing.

That said, we acknowledge there are downside risks to growth due to demand destruction and the erosion of purchasing power and to various industries if secular change occurs at a faster rate than expected. Moreover, we believe there are risks to margins in the near to intermediate term as inflationary pressures linger with the potential for structural shifts as companies seek more manufacturing and distribution related control as well as investing in ESG related initiatives, which may not enhance productivity. This margin pressure would be a disappointment to the equity market which is expecting continued margin improvement. Lastly, external shocks such as a China invasion of Taiwan are not priced into markets today and would likely be a negative market event given increased uncertainty and risk. With rich asset valuations, we believe the opportunity cost of enhanced liquidity is not as onerous.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.