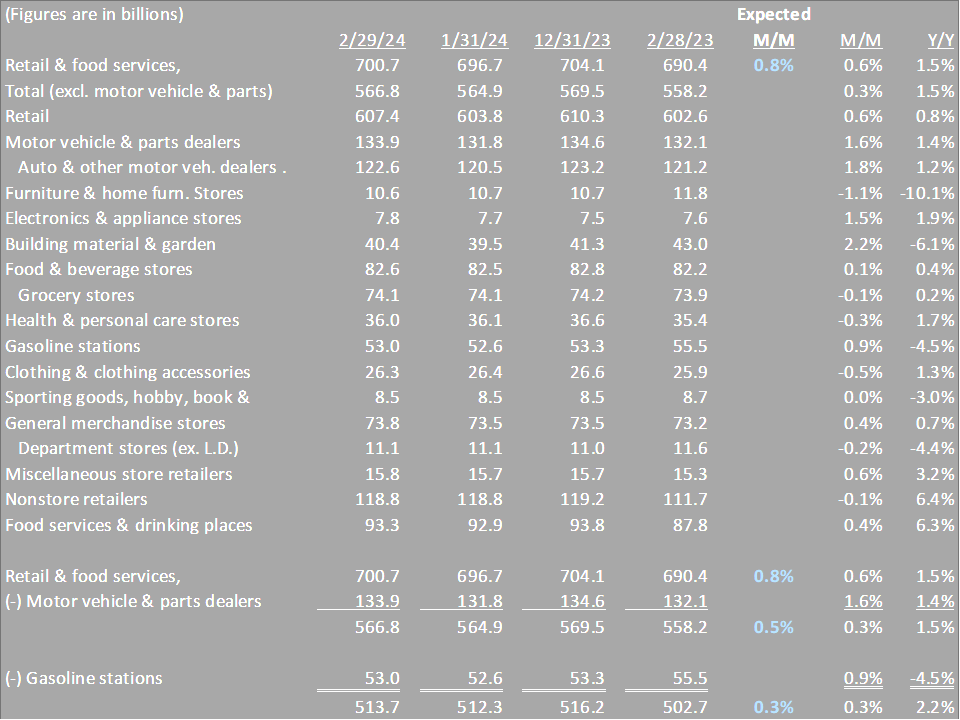

On March 14th, the U.S. Census Bureau released its Advance Monthly Sales for Retail and Food Services report for February. February was the second month in a row of disappointing retail sales. In addition, January results were revised down from an already lower than expected number. The table below details the sales by category and time period. February increased by 1.5% y/y and was up 0.6% m/m. The expectation was for February to be up by 0.8% versus last month. Total retail sales growth of +0.3% m/m, after removing motor vehicle and gasoline station sales, came in-line with the consensus. We continue to see a pattern of slowing in many of the more discretionary categories including furniture, electronics & appliances, building materials, and sporting goods. Online and restaurant spending continue to generate mid-single-digit growth on a y/y basis. This is especially significant as these two categories account for almost 30% of total retail sales.

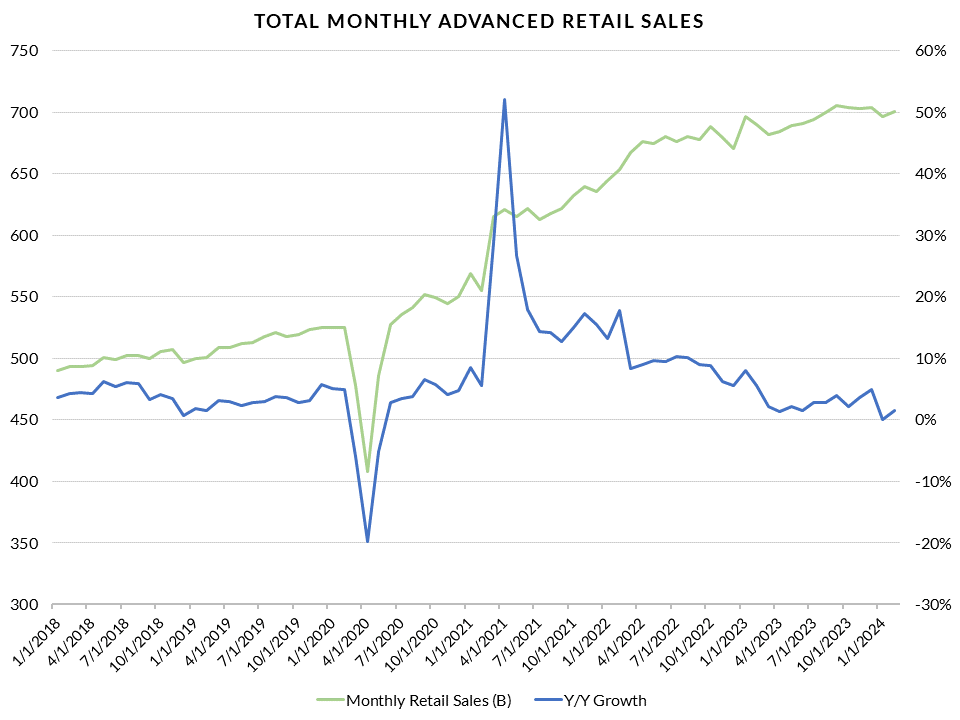

We think the slowing over the last few months is due to a combination of three things. First, we expect that the consumer can’t keep up with the growth of spending we saw in 2021 and 2022. The average monthly growth of those two years was 14.4%. During those years excess savings and consumer confidence was high. While our positive view of the consumer remains intact we expect the unique tailwinds that led to robust post-covid spending will erode. In other words, we are returning to a more “normal” spending pattern. The graph below illustrates this point. Second, inflation has come down and the Advanced Retail Sales results do not account for the change in the price of goods. CPI escalated throughout 2021 and 2022 to a peak of 9.1% on 6/30/22. We have been just above 3% for the last few months. Finally, we have been through a string of solid holiday spending seasons which are typically more emotionally driven spending months. Perhaps, consumers pulled forward some of their spending budget from the beginning of 2024. The 2023 holiday season which came in at +3.9% versus last year. Holiday sales in 2022 were +5.6% which trailed two consecutive years of above 11% growth. The ten years before covid averaged +3.8% per year.

All data presented in this paper was sourced from the United States Census Bureau.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.