insight

Santa’s Sleigh May Be a Little Light This Year – Our Analysis of the Most Important Drivers

November 19, 2015

Hoverboards and Michael Jordan shoes. I can’t get through a conversation with my kids without one or both of these topics coming up. I have to admit, being a huge Back to the Future fan and growing up in Chicago during the Bull’s domination of the 90’s, I am excited about this holiday season. This is always a very important time of year for the retailers, as up to 40% of annual revenues are realized during this season. Based on our figures from the U.S. Census Bureau (retail, excluding auto and gas), retail sales for 2014 were up 4.4%. We believe that retail sales for this year will be up between 3.25% and 3.75%. The following report explores some of the more important drivers of our analysis.

The Consumer is Strong

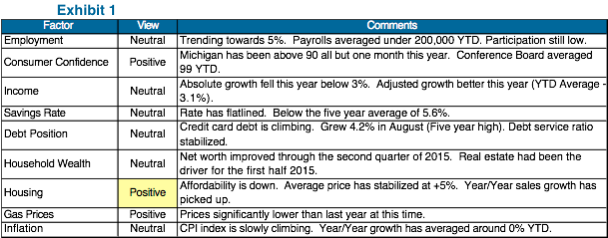

We believe the most important driver of retail sales is the strength of the consumer. The following table summarizes our analysis of nine different factors which drive the willingness to spend. We make an assessment of the individual factors in terms of how we think they may impact future spending.

Note: Highlight notes a change from 2014.

The overall picture is about the same as last year. Positive developments include falling gas prices and stronger consumer confidence data. Home prices and sales look steady and we continue to see more spending on home improvement. Homeowners spend more aggressively when their homes transition to an investment from a cost. Stagnant income growth coupled with rising personal debt could impact spending. Currently, credit card performance has been solid, so we would not expect rising credit card balances to slow spending. In addition, GDP in the U.S. remains volatile throughout the year with expectations to flat line through 2017, signifying a pretty benign economic environment.

Big Ticket Item Spend Could Slow Holiday Shopping

Once again, a significant amount of consumer spending this year has been on big ticket items, including new cars and home appliances. The fear is that spending on these sorts of items could impact holiday season shopping for various discretionary items. Auto sales continue to consistently come in higher than expected with the last two months above a SAAR (Seasonally Adjusted Annual Rate) of 18 million, which hasn’t happened in more than 10 years. Most analysts point to easy access of funding and attractive incentives to explain this sort of growth. In addition, there are also secular trends driving demand including the increasing age of used cars and number of cars owned per household. Years of pent up demand from curtailed spending, high average appliance age (approximately 10 years), an improved housing picture, and a better job environment are giving consumers greater confidence to spend on their homes. We continue to see strong buying in the large appliance sector.

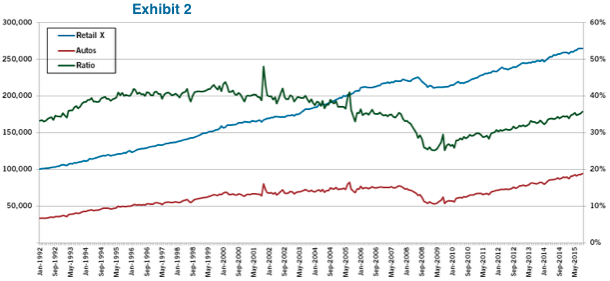

We took a closer look at the history of auto sales and potential impact on consumer spending. To do this, we used information from the monthly retail trade data completed by the U.S. Census Bureau. We segmented the Motor Vehicle & Parts Dealers portion of spending and compared it to retail spending (Exhibit 2). What we observe is that retail spending (not including autos) is growing faster than auto spending. The green line is the ratio of auto versus retail spending. That ratio has been growing and is currently at 36%, well below the maximum of 48%. Based on this information, it appears there is still opportunity for auto sales to grow without impacting retail spending.

Big ticket items include technology as well. This year, there are a number of new/innovative electronic devices available for the holiday. These include the iPhone 6s, 4K Ultra TV’s, drones, fitness trackers, 3D printers, and connected home technology. The Consumer Electronics Association expects tech spending this holiday to be up 2.3% to $34.2 billion.

Statistical Analysis – Predicting a Slow Down

Looking back on data over the last twenty two years reveals a significant correlation (81%) between “Back to School” retail sales (August and September) and “Holiday” sales (November and December). To complete this analysis, we used the U.S. Census Bureau’s monthly retail trade data, which includes a variety of retail businesses. We exclude Motor Vehicle & Parts Dealers and Gasoline Stations from our analysis because sales in those segments have been more heavily impacted by factors outside the control of consumers. In 2014, “Back to School” sales of 4.0% led to “Holiday” sales of 4.4%. Our model predicts “Holiday” sales of 3.2% when using 3.0% for the “Back to School” sales observed in 2015. Holiday sales of 3.2% would be below the 23 year average of 4.2%.

Seasonal Hiring Looks Similar to Last Year

The National Retail Federation predicts that between 700,000 and 750,000 seasonal workers will be hired this year[note]Retail Employment and Seasonal Hiring. ”National Retail Federation, derived from Bureau of Labor data.https://nrf.com/resources/holiday-headquarters/retail-employment-and-seasonal-hiring, accessed November 17, 2015.[/note]. This compares to 714,000 hired last year and 765,000 hired in 2013. Companies, including Macy’s, Kohl’s, and Walmart seem to be adding holiday staff in a somewhat conservative manner. We continue to see hiring shifts to distribution warehouses which support online shopping. E-commerce giant, Amazon is hiring 100,000 seasonal employees which is up significantly from 80,000 last year. In addition, shipping giants FedEx and UPS are predicting a similar holiday season to 2014. UPS expects to ship 10% more packages between Thanksgiving and New Year’s (3Q Earnings Transcript). UPS expects their peak day to be December 22, when they expect to ship about 36 million packages, twice the normal amount in a day (3Q Earnings Transcript).

Higher Inventory Should Lead to Better Discounts

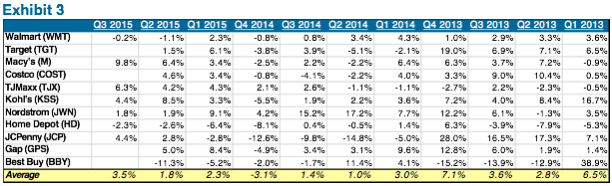

Technology working closely with demographic and social change has altered the way traditional retailers are selling/marketing their products. One of the outcomes has been a much more efficient and better informed shopper. Shoppers will continue to deal hunt, forcing retailers to sharpen their prices and start promoting earlier. This year, we believe that retailers are in a less favorable inventory position versus last year. We took a look at the inventory-to-sales spread (inventory – sales growth (year/year)) for a variety of retailers since 2013. In a perfect world, we would want to see this at zero as inventory build keeps the same pace as sales.

A positive figure might result in price discounting by retailers, as they are stuck with too much inventory. As shown in Exhibit 3, the average inventory-to-sales spread seems to have picked up somewhat since the second quarter of 2015. While it is too early to determine the pace in the third quarter, so far, it looks as if inventories are up substantially, as sales have been disappointing. Lower tourism and luxury spending seem to be a building theme in the locations that are geared toward higher income spenders. The problem can be partly blamed on weaker emerging stock markets and a stronger U.S. dollar versus other currencies.

As a result, we expect retailers will need to be aggressive with discounts this season. We expect retail margins to be somewhat stable as costs, especially commodities, have generally decreased.

Online Shopping Blazes Ahead – Department Stores Have a Big Opportunity

A solid e-commerce strategy has become a “must have” for all major retailers. Even with the incredible advancements in this area, most shoppers still want to visit an actual store. Retailers must continue to update their stores to remain relevant amongst a huge host of competition. Omni-channel retailing has merged the inventory and distribution of physical stores with the online business. In short, it has simplified and enhanced the entire buying process. According to the U.S. Census Bureau, e-commerce now accounts for 7.2% of total retail sales. Year over year growth since 2010 has averaged 15% on a quarterly basis. According to the National Retail Federation, the average shopper said that 46% of their shopping will be completed online[note]Retail Employment and Seasonal Hiring.”National Retail Federation, derived from Bureau of Labor data.https://nrf.com/resources/holiday-headquarters/retail-employment-and-seasonal-hiring, accessed November 17, 2015.[/note]. In addition, mobile devices are now much easier to use and play a bigger role in shopping for consumers. One important outcome of e-commerce has been quicker delivery. The much talked about Millennials are helping shape the evolution of retail. It’s interesting to note that about 16% of this group expects to use the “same day delivery” option this holiday compared to just fewer than 8% for the rest of the population.

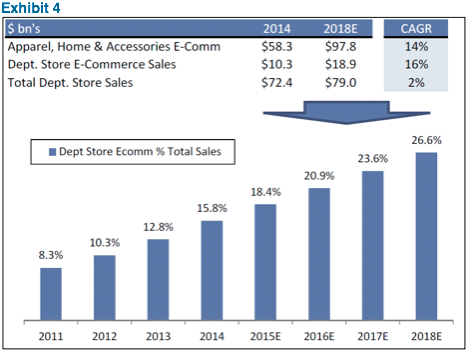

One area of particular interest is in the department store segment of retail. This has been especially newsworthy given the very high profile e-commerce push at Walmart. E-commerce is a big opportunity for large department store retailers given lower online penetration and slower same-store-sales growth at brick and mortar stores. Exhibit 4 gives a good sense of the upside when compared to other retail segments. One example of the growth opportunity is in the consumer electronics segment which doubled its online penetration to almost 24% in only four years[note]Steven Grambling, CFA, Alison Levens, Chistopher Prykull, CFA,. “Bricks and Click reboot: Adoption accelerates, margin trajectory grows murkier,” Goldman Sachs Equity Research – Americas: Retail: Broadlines, October 22, 2015 (6).[/note].

In general, we would expect margins to compress as a larger percentage of the business is moved online. Also, capex spending would shift more towards e-commerce spending and less to net new builds.

Trade Group Surveys Expect Lower Growth in 2015

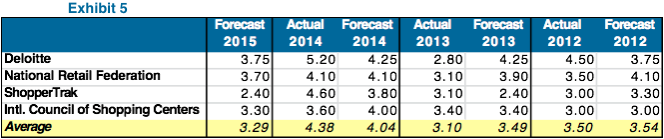

We have included a summary of the four trade groups which publish their views on upcoming holiday sales (Exhibit 5). While each of them uses a different data set to base their expectations, the more important aspect is the change in growth year–over-year. In addition, we thought it would be interesting to look at how accurate each group has been over the past three years. The International Council of Shopping Centers (ICSC) seems to be the most accurate.

Weather and Calendar Remain Relevant

Weather and the changing calendar are always important factors for holiday spending. Last year, November was colder and December was warmer than normal. We saw a lot of snow in November and a very limited amount in December. According to Weather Trends International (WTI), this holiday season is expected to be milder with temperatures warmer and precipitation lower than normal[note]Denise Chai, CFA, Lorraine Hutchinson, CFA, Robert F. Ohmes, CFA, “Holiday ’15: Santa’s sleigh faces uphill ride,” Bank of America Merrill Lynch, Equity. Oct. 21 2015, 7.[/note]. Of course, better weather makes travel easier for consumers. Having said that, consumers are less likely to buy winter focused products when the weather is unseasonably warm. A more severe winter might actually be a good thing especially given the growing popularity of online shopping.

The days between Thanksgiving and Christmas are key shopping days. This year, those days total 28 (26 is the minimum, 32 is the maximum) versus 27 last year. In addition, there are eight total weekend days to shop, the same as last year. One more day will probably not make a significant difference. We would not expect this to be a factor in our estimate for 2015 sales.

Conclusion

We believe 2015 will be a decent year for holiday spending coming in slightly below last year’s growth. Overall, the typical consumer is in a better economic position than recent years. We believe mediocre job growth and inflation adjusted wages will limit the upside to spending. We would expect retailers to be challenged somewhat with higher inventory positions this year, especially if tourism related spending does not return to normal levels. In addition, we believe consumers will continue to purchase big ticket items, which may negatively affect other areas of consumer spending. Seasonal hiring outlooks and subdued predictions from various trade group organizations support our prediction of a slower holiday season in 2015. The calendar will look very similar to last year while the weather is expected to be harsh but not quite as bad as last year.

Michael Ashley

Principal and Senior Analyst, Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.