Key Ideas:

– The surplus impact of a stress scenario in financial markets is usually the chief constraint on insurer exposure to risk assets

– After a decade of neutral-to-euphoric markets, the period from 2020-2022 has reacquainted a new generation of investors with the psychology of market stress

– There are important differences between a recessionary stress case and a stagflationary one. Both deserve consideration in setting portfolio risk tolerance and ensuring proper diversification

“Everyone has a plan until they get punched in the face.”

– Mike Tyson

Forewarned is Forearmed

2022 wasn’t just a negative year for financial markets, it was a strange one. Recent years have conditioned investors to the phenomenon of the “recessionary selloff”, where equities and credit fall in value while high-grade and government-backed bonds rally in a flight to quality. But in 2022 there was nowhere to hide, and we experienced the first “stagflationary selloff” in decades. Bonds sold off, credit spreads rose, stocks sold off, almost everything sold off. In this paper we’ll look at what we can learn from the re-emergence of this long-dormant flavor of market risk, and the implications for how insurers should approach asset allocation strategy.

AAM has long taken care to emphasize the potential loss to surplus from a financial market stress case in developing asset allocation strategies. The essence of this concept is intuitive: notwithstanding long stretches of relatively consistent gains, markets periodically face interludes of declining profits, heightened risk aversion, and declining (sometimes rapidly declining) asset prices. While predicting the exact timing and duration of these periods is a fool’s errand (who in February 2020 accurately predicted equities were about to have their largest 1mo drawdown ever? For that matter, who in March 2020 predicted they were about to have their largest 12mo rise ever?), we can have strong confidence that these events will occur, and develop a plausible range of severities derived from historical experience and current conditions. The worst-case outcome for an investor is to have excessive exposure to risk assets in a sharp decline and be forced to sell at depressed prices, locking in the loss and missing out on the recovery. Thus, “what level of risk asset exposure will maximize long-term returns while keeping stress case losses within tolerable limits” is a perennially relevant question for insurance investors, on which 2022 provided a valuable new perspective.

Expect the Unexpected

“They couldn’t hit an elephant at this distance.”

– Gen. John Sedgwick, last words

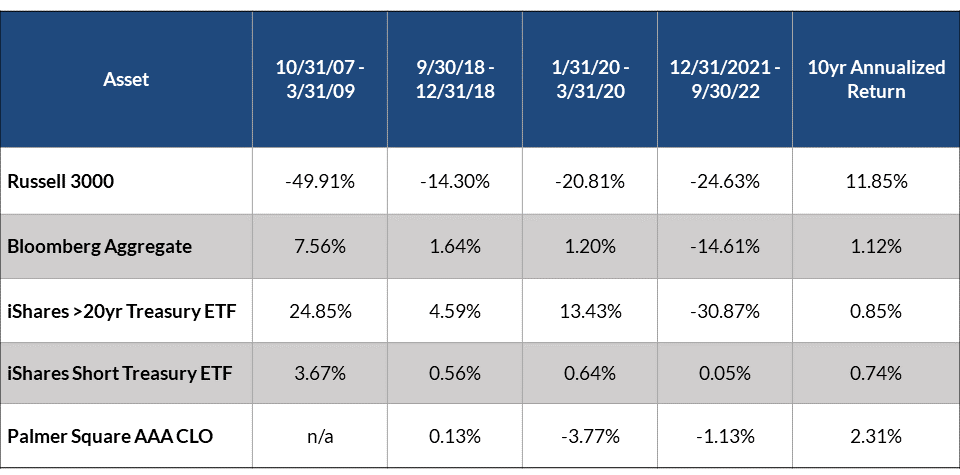

The table below outlines returns on several major asset classes across the largest periods of market stress from the past 20 years. These include US equities, US fixed income, long Treasury bonds, short Treasury bonds (effectively cash), and AAA-rated floating-rate collateralized loan obligations (CLO’s; structured securities backed by portfolios of bank loans to businesses). See if you can spot which scenario is unlike the others:

The first three columns were all classic recessionary selloffs, when for various reasons investor risk appetites fell sharply and they fled into canonical safe haven assets: high grade bonds, especially long Treasuries. While Treasuries deliver indifferent returns during more normal market environments (note the 10yr average returns), diversified high-grade fixed income has performed better over time while also offering comfortingly low correlation when trouble hits; from 12/31/92 – 1/31/23 the correlation of monthly returns between the Russell 3000 and Bloomberg Aggregate was just 10.5%. This diversification benefit from holding a broad mix of bonds and stocks has for years been the closest thing to a free lunch in financial markets.

Or so it seemed until 2022. As the 4th column above shows, both stocks and bonds – essentially the entire complex of financial assets – sold off in unison. The only thing worse to own than stocks was long Treasuries, the very thing that 2008 and 2020 had taught investors to buy in a crisis! The only relative winners were short Treasuries and floating-rate assets like CLO’s.

These latter bear examining for a moment, as they’ve historically been a small fraction of insurer assets, but if rate volatility is here to stay then interest in them is likely to rise:

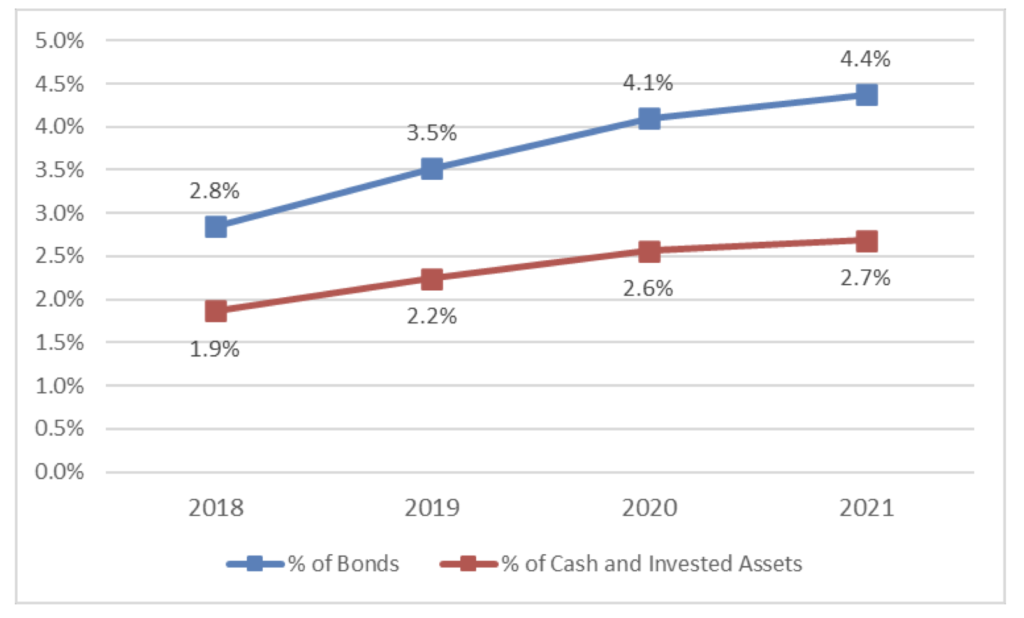

CLO Exposure as a Percentage of Cash and Invested Assets and Bond Investments 2018-2021

If anything, the graph above overstates the median insurer’s CLO holdings, as most are held by a small number of massive companies; 79% of the industry’s holdings were owned by insurers with assets >$10 billion as of 12/31/21. Although holdings likely increased further in 2022, small and medium-sized insurers may have little familiarity with the sector and may be under the impression they can’t access it due to being unable to hold 144a securities (not to worry, there’s a solution to this issue). While it may be some time before CLO’s outperform as dramatically as in 2022, heightened awareness of this sector’s value as a diversifier will be a net benefit for the industry.

So what was so different about 2022? The short answer is that it matters why a market selloff is happening, not all stress cases are alike. Scenarios like 2008 and 2020 were rooted in demand shocks from the collapse of the housing bubble, and the sudden onset of Covid and resulting lockdowns, respectively. These were deflationary situations where demand/spending (which drives corporate profits) fell sharply. 2022 was different; the core problem was spiking inflation due to a variety of supply constraints caused by Covid-related fiscal largesse and productivity disruptions, soaring energy prices, and geopolitics-driven trade disruptions. High inflation means rising interest rates, and so bonds got hammered even as rising economic uncertainty, spiking borrowing costs, and tepid GDP crumbled the foundations of elevated post-Covid equity valuations. In a word: stagflation, a phenomenon not really seen in the US since the 1970’s.

Hormesis

“Hormesis” is a charming word denoting the growth that comes after stress, like the way a muscle will hypertrophy after being damaged from weightlifting. It’s a critical mechanism by which mature organisms continue to grow and develop throughout their lives. So what lessons did 2022 highlight to experienced insurance investors? First, to restate my point from before: stress cases will occur. Everything has a selloff sooner or later. Investment strategies must anticipate this and prepare for it. It’s never “different this time”. Second, diversification doesn’t begin and end with holding both bonds and stocks. While cash never suffers a capital loss, it’s not a viable long-term allocation for entities that need to earn income over time, which leaves floating-rate exposure as the best available shield against interest rate volatility. After many years of indifferent returns during the prolonged low-rate environment, floating-rate CLO’s dramatically proved their worth in 2022, resulting in a 10yr average return for high grade CLO’s more than double that of the broad Bloomberg Aggregate. The utility of prudent exposure to assets that can buffer the 1-2 punch of a stagflationary selloff is clear. Third, it’s critical for investors to know what you’re optimizing for. Statutory accounting offers insurers the enormous benefit of shielding surplus from mark-to-market volatility on IG bonds, but many also closely track the economic impact of rising rates on their portfolios. This can affect AM Best BCAR, the ability to trade the portfolio without generating realized losses, and the ability to raise liquidity for operational needs. A properly laddered portfolio duration structure can help mitigate this, but 2022 has illustrated that interest rate risk is no less material to the economic value of surplus than market risk is for stocks. Deciding how relevant this is compared to growth of statutory surplus (from which perspective higher rates are largely beneficial, offering better reinvestment opportunities with negligible downside) is something each insurer should consider carefully.

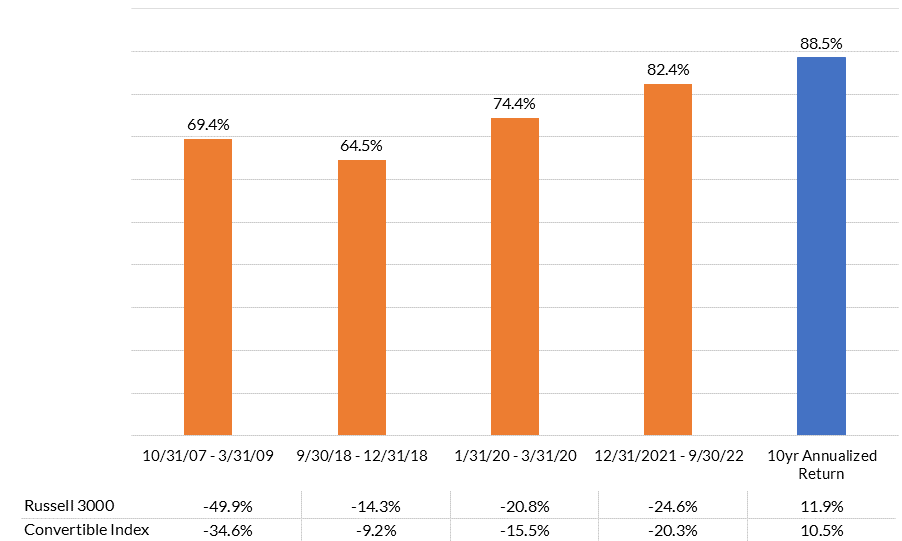

Among those considerations should be an allocation to convertible bonds, which combines corporate debt with a warrant that is exercisable into the equity of the issuer. These securities offer holders participation in equity market rallies, while benefiting from a bond price floor in times of market stress. The additional regulatory benefit to insurers is that convertibles are regarded as bonds for reporting and capital modeling purposes. Such statutory accounting recognition for convertible bonds limits the surplus volatility of an asset highly correlated with equities.

Convertible Participation in Equity Market Returns

Source: Bloomberg, ICE Bond Indices

During times of stress, particularly in recessionary selloffs where bonds rally, convertible bond floors reduce this asset class’s participation in market declines. During the three recessionary selloffs in focus, convertible bonds declined by less than three-quarters of the drops seen in equity markets. Even across last year’s widespread selloff, convertible bonds managed to limit their equity market downside participation to 82%. Active management within the sector may further seek to position portfolios to confine market downside or partake in equity upside. Convertibles’ asymmetric risk/return profile versus equities is illustrated by the 10-year history of the index, which has participated in 88% of annualized US stock market upside, with less correlation during times of stress.

Remember to Breathe

Just as stress scenarios are inevitable, so too are recoveries. By prudently managing risky exposures during boom times, and especially by limiting mark-to-market exposure to levels that can be held through a selloff, we can sleep more comfortably in the knowledge that we don’t need to guess exactly when and where trouble will strike. By incorporating assets that outperform under different kinds of economic stress, we don’t need to guess how trouble will strike either. Guessing near-term economic outcomes is the province of gambling; as investors we seek to sustainably balance risk and return across a whole range of scenarios, identifying attractive opportunities within each while recognizing that uncertainty, sharp reversals, and unpredictable shocks are inevitable features of markets, but ones that can be weathered successfully through prudent preparation.

Note: All historical investment data sourced from Bloomberg

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.