No matter the conditions, a liability account on a balance sheet can’t go negative, right? “Not so fast” it seems according to the NAIC. The Interest Maintenance Reserve (IMR) – the accounting mechanism enacted in 1992 to smooth the impact of interest-rate driven gains/losses on a life company’s financial statements – may become an exception to the rule.

As the world paused in 2020, insureds remained covered by companies able to book income even as the Fed cut its policy rate. Realized gains taken before or during Covid-19 were amortized into the income statement over multiple years via the IMR. As detailed in an AAM November 2022 report, Turning Interest Rate Losses into Book Yield Gains: Capitalizing on the Interest Maintenance Reserve, after realizing only a portion of a gain upon disposal, the balance (the gain yet to flow into income) remains in the IMR as a liability, to be released as income over a period of years determined by the bond’s remaining time to maturity at sale.

Today, entering the second half of 2023, interest rate volatility remains front and center for investors, the Fed and the NAIC. The dramatic shift higher in rates has led to significant unrealized losses for long duration bonds acquired in 2020 and 2021, and for life insurers transacting at current prices, the realization of hefty losses where sales have funded policy benefits or the purchase of new assets. In contrast to how realized gains gradually impact an insurer surplus via the IMR, the unprecedented pace of realized IMR losses has the NAIC questioning the appropriate treatment of IMR balances approaching the zero bound this year.

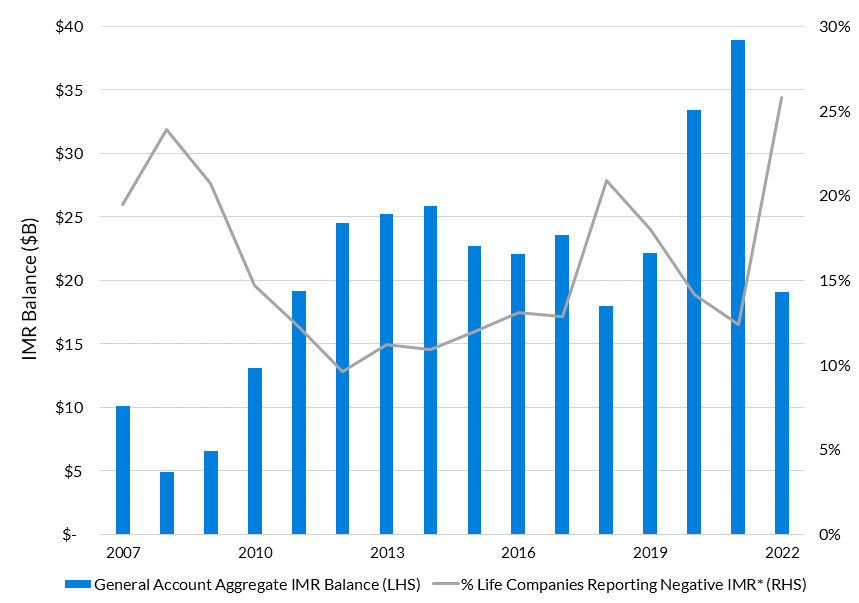

Almost $20B in IMR has been wiped from the industry since its peak in 2021, largely due to companies realizing over $14B of bond losses in 2022. Additionally, S&P estimates one in every four life companies reported negative IMR balances at year-end, exceeding the previous high set in 20081. Following a recommendation from the American Council of Life Insurers (ACLI) in October, the NAIC’s Statutory Accounting Principles Working Group (SAPWG) is addressing the potential downside impact of such meaningful realized losses to financial metrics in 2023.

Exhibit 1: Life Industry Annual IMR Balances

Absorbing Both Sides: IMR as a Balance Sheet Cushion

Under current guidance, a negative IMR results in immediate dilution of surplus due to its treatment as a disallowed asset2. Following the ACLI recommendation, the SAPWG published a March report describing a temporary proposal that admits IMR balances below zero to help life insurers remove “double counting of losses.” Recording a negative IMR would entail companies reporting negative balances against general account assets as contra-liability accounts in statutory filings. If adopted, the proposed rule will buffer the impact on insurer income and surplus in high rate environments just as it does when smoothing realized gains resulting from low rates.

The proposal does come with barriers, however. The latest NAIC publication in May limits eligibility to life companies of a minimum quality and permits those firms to admit a negative IMR balance equaling up to 5% of 2023 surplus3.

Exhibit 2 – SAPWG Language

“Reporting entities with an RBC greater than 300% are permitted to admit net negative (disallowed) IMR, as defined in paragraph 9b, up to 5% of the reporting entity’s general account capital and surplus…adjusted to exclude any net positive goodwill, EDP equipment and operating system software, net deferred tax assets and admitted net negative IMR.”

Permitting further interest-rate driven realized losses may benefit insurer asset-liability matching during asset-adequacy tests. Lower or negative IMR balances can increase admitted assets and allow insurers to present fewer reserve deficiencies, ultimately improving risk-based capital (RBC). While the amount admitted will be introduced on balance sheets, if enacted, the longer-run net effect to surplus will ultimately be zero, as the IMR is, at its core, a timing mechanism.

Managing Risks Through the Cycle

Looking at insurer holdings, the allowance of a negative IMR may provide life insurance companies with the chance to reposition credit exposures, revisit asset allocation, and pursue opportunistic investments with more flexibility.

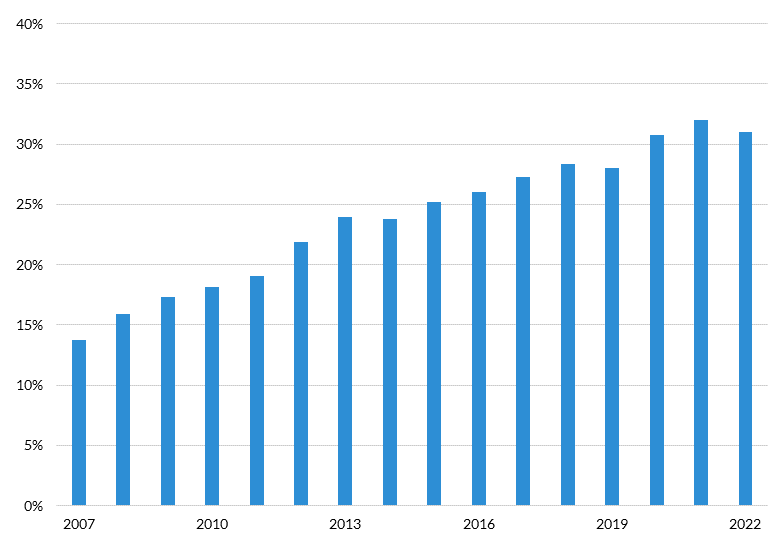

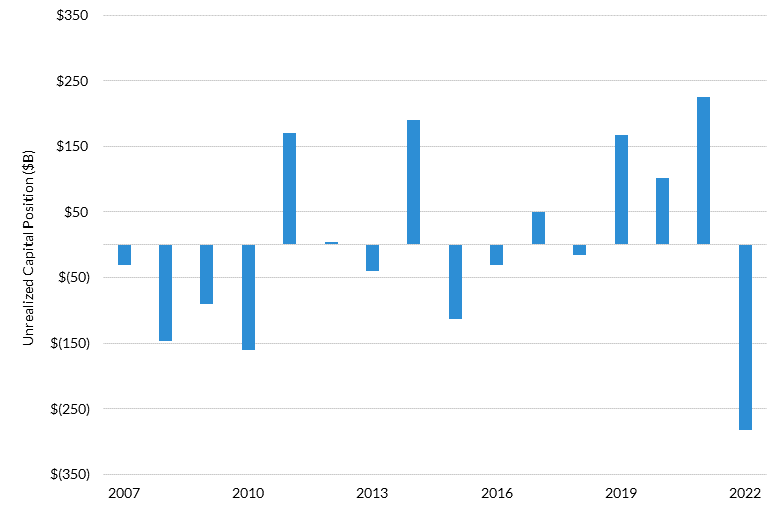

As illustrated in Exhibit 3, life insurance companies have doubled NAIC 2 exposure since 2007, with this quality grade representing 31% of bond holdings at the end of 20224. At the same time, rising interest rates and still isolated credit events have contributed to a nearly $500 billion change in the industry’s net unrealized loss in bond portfolios, year-over-year (Exhibit 4). For companies fearful of weakening corporate and consumer credit in a slowing economic environment, ‘up in quality’ trades may be more compelling should the IMR proposal be adopted.

Exhibit 3: Life Industry NAIC 2 Bond Exposure

Exhibit 4: Life Industry Year-End Unrealized Gain/Loss

While the NAIC has yet to finalize any guidance, the SAPWG proposal appears to be headed towards adoption in 2023. We expect that the enhanced financial flexibility afforded to qualifying life companies will prompt a greater level of trading activity and rising industry book yields.

1 Source: S&P Capital IQ 2023 Insurance Investments Market Report

*Excludes Separate Account Balances

2 Source: 11/17/2022 Guidance Letter from NAIC to Life Actuarial (A) Task Force

3 Source: NAIC INT 23-01T

4 Source: S&P Capital IQ Life Insurance Investment Analysis

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.